What Non Refundable Tax Credit

In the realm of financial planning and tax strategies, understanding the concept of non-refundable tax credits is crucial. These credits play a significant role in reducing one's tax liability, offering a potential financial advantage. However, it's important to note that not all tax credits are created equal, and some, like the non-refundable type, have specific characteristics and limitations.

This article aims to delve into the intricacies of non-refundable tax credits, exploring their definition, functionality, and real-world applications. By the end of this exploration, you'll have a comprehensive understanding of how these credits work and their potential impact on your financial landscape.

Understanding Non-Refundable Tax Credits

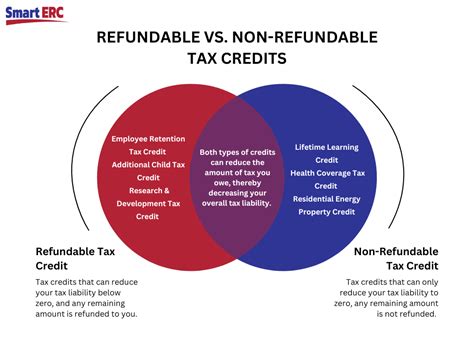

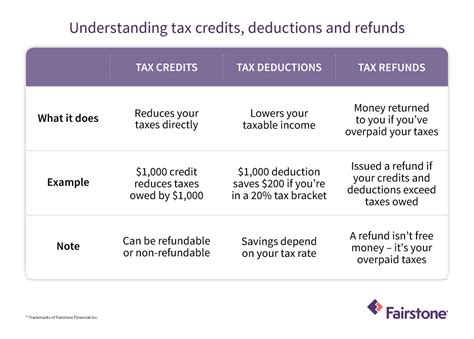

At its core, a non-refundable tax credit is a tax benefit that reduces the amount of tax you owe to the government. Unlike refundable credits, which can result in a refund even if your tax liability is zero, non-refundable credits are only applied to the tax you actually owe. In simpler terms, if your tax liability is $0, these credits won’t put money back in your pocket; they will simply reduce the tax you owe to zero.

For instance, consider the Child Tax Credit, a common non-refundable credit. If you have eligible children and qualify for this credit, it can reduce your tax liability by a certain amount for each child. However, if your tax liability is already zero, the credit won't provide you with a refund. Instead, it serves as a tool to further reduce your tax burden, potentially benefiting those with higher tax liabilities.

How Non-Refundable Credits Work

Non-refundable tax credits operate as a mechanism to offset your tax liability, often calculated as a specific dollar amount for each qualifying situation or individual. These credits are typically subtracted from the total tax you owe, effectively reducing your tax burden. For example, if you have a tax liability of 2,000 and qualify for a 1,000 non-refundable credit, your final tax liability would be $1,000.

It's important to note that these credits are not always available to everyone. Eligibility criteria vary based on the specific credit and may include factors such as income, marital status, or specific life events. Understanding these criteria is essential for determining whether you qualify for a particular non-refundable credit.

| Non-Refundable Credit | Eligibility Criteria |

|---|---|

| Child Tax Credit | Having eligible children under the age of 17 |

| Child and Dependent Care Credit | Qualifying dependent care expenses |

| Foreign Tax Credit | Tax paid or accrued to foreign countries or U.S. possessions |

Additionally, it's crucial to recognize that not all non-refundable credits are created equal. Some credits may have income limits or phase-out ranges, meaning they become less valuable or unavailable as your income increases. Others may have specific requirements, such as educational expenses or energy-efficient home improvements.

Maximizing the Benefits of Non-Refundable Credits

While non-refundable tax credits can provide significant savings, it’s important to understand how to maximize their benefits. One strategy is to combine multiple non-refundable credits to further reduce your tax liability. For example, if you qualify for both the Child Tax Credit and the Child and Dependent Care Credit, these credits can work together to provide a more substantial tax reduction.

Furthermore, planning ahead can be beneficial. For instance, if you know you'll have significant medical expenses in the upcoming year, you can strategically time these expenses to maximize the benefits of the Medical Expense Deduction, which, while not a credit, can reduce your taxable income and indirectly lower your tax liability.

Real-World Applications and Case Studies

To illustrate the impact of non-refundable tax credits, let’s explore a few real-world scenarios. These examples will showcase how these credits can benefit individuals and families, offering a clearer picture of their potential advantages.

Scenario 1: Family with Multiple Children

Imagine a family with three children under the age of 17. They have a combined income of 80,000 and are eligible for the Child Tax Credit. With each child providing a 2,000 credit, their total non-refundable credit amount is $6,000. This significantly reduces their tax liability, potentially bringing it down to zero or even creating a small refund.

Scenario 2: Self-Employed Individual with Business Expenses

Consider a self-employed individual who incurs substantial business expenses throughout the year. They qualify for the Self-Employment Tax Credit, which can reduce their tax liability by up to $2,500. By claiming this credit, they can effectively lower their tax burden, especially if their income is within the credit’s income limits.

Scenario 3: Elderly Couple with Medical Expenses

An elderly couple with significant medical expenses may benefit from the Medical Expense Deduction. While not a credit, this deduction can indirectly reduce their taxable income. If their medical expenses exceed 7.5% of their adjusted gross income, they can deduct the excess amount, potentially lowering their tax liability.

Future Implications and Tax Strategy

As tax laws and regulations evolve, it’s crucial to stay informed about potential changes to non-refundable tax credits. While these credits provide valuable benefits, their availability and specifics can change from year to year. Keeping abreast of these changes can ensure you’re maximizing your financial benefits and planning effectively.

Furthermore, it's essential to consider the broader implications of these credits on your overall financial strategy. Non-refundable tax credits can be a powerful tool in tax planning, but they should be part of a comprehensive financial plan that considers your income, expenses, and long-term goals. Working with a financial advisor or tax professional can help you integrate these credits into a well-rounded financial strategy.

In conclusion, non-refundable tax credits offer a valuable opportunity to reduce your tax liability, providing a potential financial windfall. By understanding their mechanics, eligibility criteria, and real-world applications, you can harness their power to your advantage. Stay informed, plan strategically, and leverage these credits to optimize your financial landscape.

What is the difference between refundable and non-refundable tax credits?

+Refundable tax credits can provide a refund even if your tax liability is zero, while non-refundable credits only reduce the tax you owe, without providing a refund.

Can non-refundable tax credits result in a refund?

+No, non-refundable tax credits cannot result in a refund. They are designed to reduce your tax liability, but they won’t provide a refund if your tax liability is already zero.

Are there any limitations to non-refundable tax credits?

+Yes, non-refundable tax credits often have eligibility criteria, income limits, or phase-out ranges. It’s important to understand these limitations to determine if you qualify for a specific credit.