North Carolina Auto Sales Tax

Understanding the intricacies of vehicle sales tax is crucial, especially when it comes to North Carolina, a state known for its diverse landscapes and vibrant culture. The sales tax on vehicles in this region is a significant aspect of automotive commerce, impacting both buyers and sellers. Let's delve into the specifics of North Carolina's auto sales tax, exploring its rates, calculations, and the factors that influence it.

The Complex Landscape of North Carolina's Auto Sales Tax

North Carolina's auto sales tax is a key consideration for anyone purchasing a vehicle within the state. The tax is levied on the purchase price of the vehicle, and it's important to understand how it's calculated to ensure a smooth and informed transaction.

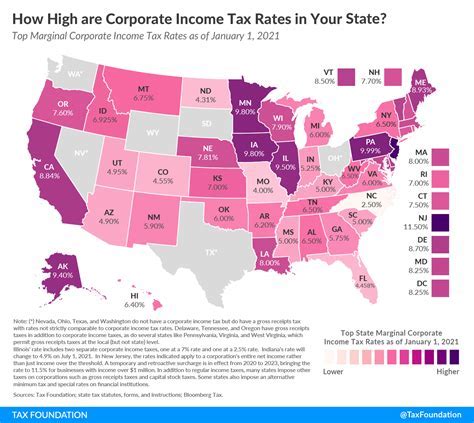

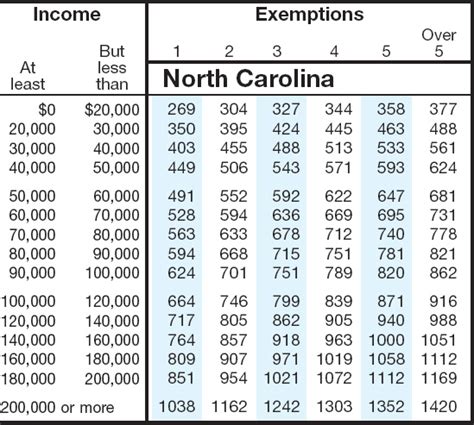

The sales tax rate in North Carolina varies depending on the county where the vehicle is purchased. While the state sales tax rate remains uniform at 4.75%, counties have the authority to impose an additional local tax, resulting in a total sales tax rate that can range from 5.25% to 7.50%.

For instance, in Charlotte, the largest city in North Carolina, the total sales tax rate stands at 7.25%, consisting of the state tax and an additional 2.5% local tax. In contrast, the city of Asheville has a lower total sales tax rate of 6.75%, with an additional 2% local tax on top of the state tax.

Calculating the Sales Tax

To calculate the sales tax on a vehicle purchase in North Carolina, you can use the following formula:

Total Sales Tax = Purchase Price x (Total Tax Rate / 100)

For example, if you're buying a car in Charlotte with a purchase price of $25,000, the sales tax calculation would be as follows:

Total Sales Tax = $25,000 x (7.25 / 100) = $1,812.50

So, in this scenario, the sales tax on the vehicle would amount to $1,812.50.

Factors Influencing Sales Tax

Several factors can impact the sales tax on a vehicle purchase in North Carolina. Here are some key considerations:

- Vehicle Type: The sales tax rate may vary based on the type of vehicle being purchased. For instance, some counties may have different tax rates for electric vehicles or hybrid cars.

- Registration Fees: In addition to sales tax, vehicle registration fees are also applicable in North Carolina. These fees vary depending on the vehicle's weight and age.

- Trade-Ins: If you're trading in your old vehicle as part of the purchase, the sales tax calculation can become more complex. It's advisable to consult with your dealer or tax professional to ensure accurate calculations.

- Discounts and Rebates: Any discounts, rebates, or incentives offered by the dealer or manufacturer can impact the final sales tax amount. These reductions are typically applied to the purchase price before calculating the tax.

Understanding these factors and their potential impact on the sales tax is crucial for making informed decisions when purchasing a vehicle in North Carolina.

The Impact of North Carolina's Auto Sales Tax on Consumers

North Carolina's auto sales tax can significantly influence the overall cost of purchasing a vehicle. While the state tax rate is consistent, the addition of local taxes creates a complex landscape for buyers.

For instance, a buyer in Charlotte would pay a higher sales tax rate than someone in Asheville, all else being equal. This variation in tax rates can result in substantial differences in the final cost of the vehicle.

Additionally, the impact of the sales tax extends beyond the initial purchase. It can also affect the resale value of the vehicle, as the tax amount is often passed on to the new buyer. This means that the sales tax paid on the original purchase could influence the selling price when it comes time to trade in or sell the vehicle.

Strategies for Minimizing Sales Tax Impact

While the sales tax is a mandatory cost, there are strategies that buyers can employ to minimize its impact:

- Research County Tax Rates: Before making a purchase, research the sales tax rates in different counties. This can help you identify areas with lower tax rates, potentially saving you money.

- Consider Trade-Ins Strategically: If you're trading in your old vehicle, evaluate the impact on the sales tax calculation. A higher trade-in value can reduce the purchase price, resulting in a lower sales tax amount.

- Explore Incentives and Rebates: Keep an eye out for dealer or manufacturer incentives and rebates. These can reduce the purchase price, leading to a lower sales tax liability.

- Timing Your Purchase: In some cases, timing your vehicle purchase can make a difference. Certain periods may offer tax breaks or incentives, so staying informed about these opportunities can be beneficial.

By implementing these strategies, buyers can potentially reduce the financial burden of North Carolina's auto sales tax.

North Carolina's Auto Sales Tax: A Complex Yet Navigable Landscape

Navigating North Carolina's auto sales tax landscape requires a thorough understanding of the rates, calculations, and influencing factors. While the state's diverse tax structure can make vehicle purchases more complex, informed buyers can make strategic decisions to minimize the impact of sales tax.

Whether it's researching county-specific tax rates, understanding the impact of trade-ins, or exploring incentives, there are various ways to navigate this complex tax landscape. By staying informed and making well-informed choices, buyers can ensure a smoother and more cost-effective vehicle purchase experience in North Carolina.

| County | Local Tax Rate | Total Tax Rate |

|---|---|---|

| Mecklenburg (Charlotte) | 2.5% | 7.25% |

| Buncombe (Asheville) | 2% | 6.75% |

| Wake (Raleigh) | 2.25% | 7% |

Frequently Asked Questions

How often do county tax rates change in North Carolina?

+

County tax rates can change periodically, typically with new legislation or budgetary decisions. It’s advisable to check for any recent changes before making a vehicle purchase to ensure accuracy in your tax calculations.

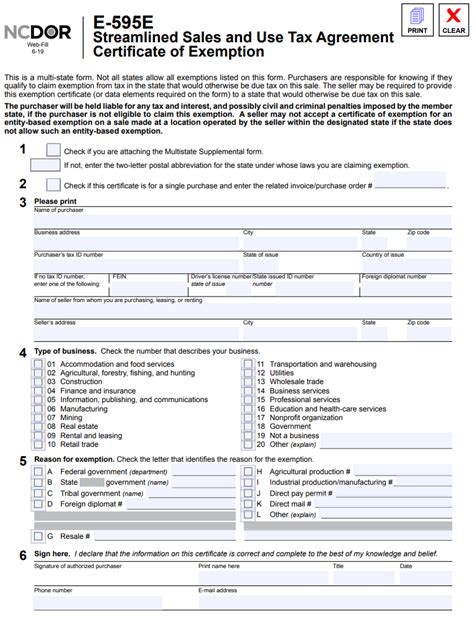

Are there any tax exemptions for certain types of vehicles in North Carolina?

+

Yes, North Carolina offers tax exemptions for specific types of vehicles, such as electric vehicles and hybrid cars. These exemptions can significantly reduce the sales tax liability. It’s important to research and understand the eligibility criteria for these exemptions.

Can I negotiate the sales tax rate with the dealer?

+

No, the sales tax rate is a legally mandated tax and cannot be negotiated with the dealer. However, you can negotiate the purchase price of the vehicle, which will indirectly impact the sales tax amount.

How is the sales tax calculated for leased vehicles in North Carolina?

+

For leased vehicles, the sales tax is typically calculated based on the capitalized cost of the lease. This cost is determined by factors such as the vehicle’s value, the lease term, and any additional fees or charges. It’s important to review the lease agreement carefully to understand the sales tax implications.

Are there any online resources to help calculate the sales tax for a vehicle purchase in North Carolina?

+

Yes, there are several online calculators and tools available that can assist in estimating the sales tax for a vehicle purchase in North Carolina. These resources take into account the purchase price, state tax rate, and any applicable local taxes. It’s always a good idea to use these tools to get an accurate estimate before finalizing the purchase.