Sales Tax Walnut Creek Ca

When it comes to understanding sales tax, it's crucial to be well-informed, especially for those residing in Walnut Creek, California. The sales tax rate in this charming city is a significant factor that affects both residents and businesses alike. With a unique blend of retail, dining, and entertainment options, Walnut Creek offers a vibrant lifestyle, and being aware of the sales tax rates ensures that consumers and businesses can make informed financial decisions.

Understanding the Sales Tax Landscape in Walnut Creek, CA

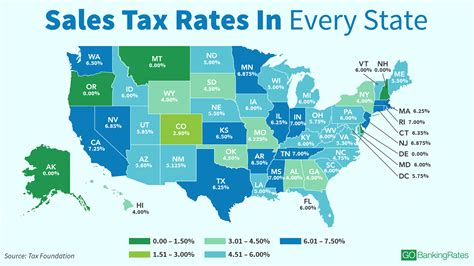

Sales tax in Walnut Creek, California, is a combination of state, county, and city rates, each contributing to the overall tax burden on consumers. As of the most recent information available, the total sales tax rate in Walnut Creek is 8.75%, which is slightly higher than the statewide average. This rate is subject to change, so it’s essential to stay updated for accurate financial planning.

The California state sales tax rate is a uniform 7.25% across the state. This base rate forms the foundation of the sales tax structure in California. However, local jurisdictions, including counties and cities, have the authority to levy additional sales taxes to support local services and infrastructure.

County Sales Tax in Contra Costa County

Walnut Creek is located in Contra Costa County, which adds a 0.50% sales tax rate on top of the state rate. This additional tax is used to fund various county-wide services and initiatives. It’s important for businesses operating in Walnut Creek to be aware of this county-specific rate to ensure accurate tax collection and remittance.

City Sales Tax in Walnut Creek

The city of Walnut Creek itself imposes an additional 1% sales tax, bringing the total sales tax rate within the city limits to 8.75%. This city-specific tax is a vital source of revenue for the local government, funding essential services and contributing to the overall economic development of the area.

| Sales Tax Component | Rate |

|---|---|

| California State Sales Tax | 7.25% |

| Contra Costa County Sales Tax | 0.50% |

| Walnut Creek City Sales Tax | 1% |

| Total Sales Tax in Walnut Creek | 8.75% |

Sales Tax Implications for Businesses and Consumers

For businesses, understanding the sales tax landscape is crucial for several reasons. Firstly, accurate tax collection and remittance are essential to maintain compliance with state and local tax laws. Failure to do so can result in penalties and legal consequences. Secondly, businesses need to consider the impact of sales tax on their pricing strategies. Including sales tax in the final price of goods and services can affect consumer behavior and purchasing decisions.

From a consumer perspective, being aware of the sales tax rate is important for budgeting and financial planning. Consumers can make more informed decisions about their purchases, especially when comparing prices across different jurisdictions. Additionally, understanding sales tax rates can help consumers advocate for fair taxation and support initiatives that benefit the community.

Sales Tax Exemptions and Special Considerations

It’s worth noting that certain goods and services in California are exempt from sales tax. These exemptions can vary based on state and local regulations. For instance, some essential items like groceries, prescription medications, and certain medical devices are often exempt from sales tax. Businesses and consumers should be aware of these exemptions to ensure they are not overcharged.

Additionally, there may be special considerations for online sales and remote sellers. California has specific regulations for collecting sales tax from out-of-state sellers, and businesses should stay updated on these rules to avoid non-compliance issues.

Sales Tax Registration and Compliance

Businesses operating in Walnut Creek, CA, are required to obtain a seller’s permit from the California Department of Tax and Fee Administration (CDTFA). This permit authorizes businesses to collect and remit sales tax on behalf of the state and local government. The application process typically involves providing business details, estimated sales volumes, and other relevant information.

Once registered, businesses must collect sales tax at the point of sale and remit it to the CDTFA on a regular basis. The frequency of remittance can vary based on the business's sales volume and other factors. Late or incorrect remittances can result in penalties and interest charges, so it's crucial for businesses to stay organized and compliant.

To ensure compliance, businesses can utilize sales tax software or work with tax professionals who specialize in sales tax regulations. These tools and experts can help businesses accurately calculate, collect, and remit sales tax, reducing the risk of errors and penalties.

Sales Tax Audits and Penalties

The CDTFA conducts audits to ensure businesses are compliant with sales tax laws. These audits can be random or triggered by suspicious activity. During an audit, the CDTFA may review a business’s records, including sales receipts, invoices, and tax returns. Businesses should maintain accurate records and be prepared to provide documentation to support their tax filings.

If a business is found to be non-compliant, the CDTFA may impose penalties and interest charges. The severity of penalties can vary based on the nature and extent of the violation. In some cases, businesses may also be subject to criminal charges for intentional tax evasion.

The Future of Sales Tax in Walnut Creek and Beyond

The sales tax landscape is subject to change, and businesses and consumers in Walnut Creek should stay informed about potential future developments. Local governments may propose changes to sales tax rates to fund specific projects or address budget shortfalls. Additionally, the ongoing debate about online sales tax collection and remote seller regulations may have implications for both online and brick-and-mortar businesses.

Staying updated on these changes is crucial for businesses to adapt their pricing strategies and compliance processes accordingly. Consumers, too, can benefit from being aware of potential changes, as it may impact their purchasing decisions and overall financial planning.

In conclusion, understanding the sales tax rates in Walnut Creek, CA, is essential for both businesses and consumers. Accurate tax collection and compliance not only ensure legal and financial integrity but also contribute to the overall economic health of the community. By staying informed and proactive, businesses and consumers can navigate the sales tax landscape with confidence and contribute to the vibrant economic ecosystem of Walnut Creek.

How often do sales tax rates change in California?

+Sales tax rates in California can change annually, usually effective from the start of the calendar year. However, local jurisdictions may propose changes at any time, subject to approval through the legislative process.

Are there any special sales tax holidays in California?

+Yes, California does have sales tax holidays for certain types of purchases. For example, there are tax-free weekends for back-to-school shopping and energy-efficient appliance purchases. These holidays are typically announced in advance and provide significant savings for consumers.

How can businesses stay updated on sales tax regulations in Walnut Creek?

+Businesses can stay informed by regularly checking the California Department of Tax and Fee Administration’s website, subscribing to their newsletters, and consulting tax professionals or industry associations for the latest updates on sales tax regulations in Walnut Creek and beyond.