St Joseph County Property Taxes

Property taxes in St. Joseph County, Indiana, are an important revenue source for local governments and a key component of the community's financial landscape. These taxes fund essential services and infrastructure, shaping the county's development and influencing residents' financial decisions. Understanding the intricacies of St. Joseph County's property tax system is crucial for homeowners, investors, and anyone interested in the local real estate market.

The Fundamentals of St. Joseph County Property Taxes

St. Joseph County, like many other counties in Indiana, follows a comprehensive property tax system. This system assesses the value of real estate properties and levies taxes based on their assessed values. The revenue generated from these taxes supports various public services, including schools, emergency services, local government operations, and infrastructure maintenance.

The property tax rate in St. Joseph County is determined by the taxing jurisdictions within the county, which can include the county government, townships, cities, and special taxing districts. Each of these entities has its own tax rate, and the total tax rate for a property is the sum of these individual rates.

Assessed Value and Tax Rates

The assessed value of a property is a critical factor in calculating property taxes. In St. Joseph County, the assessed value is typically a percentage of the property’s market value. This percentage, known as the assessment rate, can vary depending on the property’s classification (e.g., residential, commercial, agricultural) and the jurisdiction.

For instance, consider a residential property in St. Joseph County with a market value of $200,000. If the assessment rate for residential properties is 100%, the assessed value would be $200,000. This assessed value is then multiplied by the applicable tax rate to determine the property tax liability.

| Taxing Jurisdiction | Tax Rate (per $100 of Assessed Value) |

|---|---|

| St. Joseph County | $3.20 |

| Township (Example: Penn Township) | $1.80 |

| City (Example: South Bend) | $2.50 |

| Special District (Example: School District) | $2.00 |

| Total Tax Rate | $9.50 |

In this example, the total tax rate for the residential property is $9.50 per $100 of assessed value. If the property's assessed value is $200,000, the annual property tax would be calculated as follows:

Property Tax = Assessed Value x Total Tax Rate

Property Tax = $200,000 x $9.50 per $100 = $1,900

Therefore, the annual property tax for this specific property would be $1,900.

Property Tax Deductions and Exemptions

St. Joseph County offers various deductions and exemptions to reduce the tax burden for eligible property owners. These include homestead deductions, which provide a credit for homeowners who use their property as their primary residence, and exemptions for certain types of properties, such as those owned by non-profit organizations or dedicated to agricultural use.

For instance, the homestead deduction in St. Joseph County reduces the assessed value of a homeowner's primary residence by a certain amount, resulting in lower property taxes. The exact deduction amount can vary depending on the county's policies and the homeowner's income level.

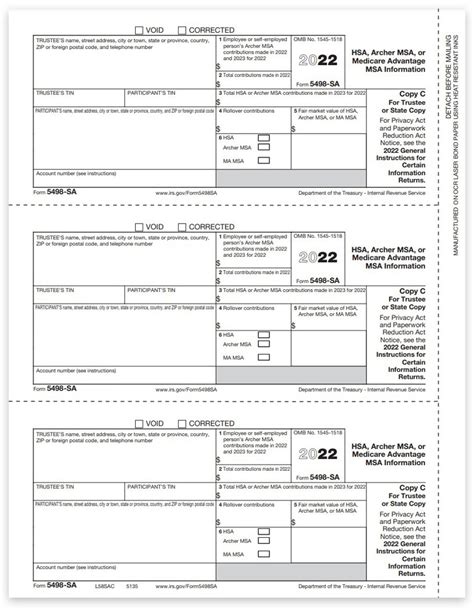

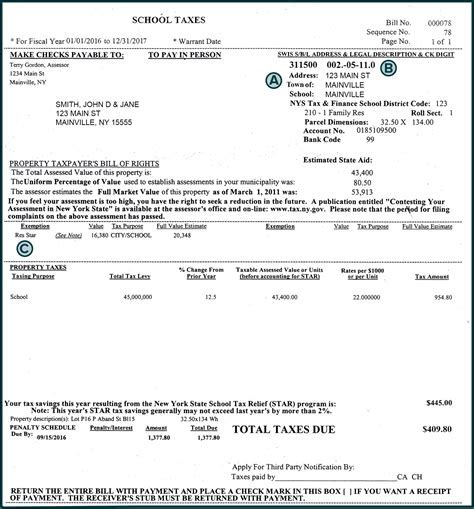

Understanding Property Tax Bills

Property tax bills in St. Joseph County provide a detailed breakdown of the taxes owed. These bills typically include information such as the property’s assessed value, the applicable tax rates, and any deductions or exemptions applied. Property owners receive these bills annually, and the due dates are usually set by the county’s treasurer’s office.

For instance, a property tax bill for the aforementioned residential property in St. Joseph County might look like this:

| Description | Amount |

|---|---|

| Assessed Value | $200,000 |

| County Tax Rate | $3.20 per $100 |

| Township Tax Rate (Penn Township) | $1.80 per $100 |

| City Tax Rate (South Bend) | $2.50 per $100 |

| School District Tax Rate | $2.00 per $100 |

| Homestead Deduction | $3,000 |

| Total Taxes Due | $1,900 |

Payment Options and Due Dates

Property owners in St. Joseph County have several payment options for their tax bills. These may include online payment portals, direct bank transfers, mail-in checks, or in-person payments at designated locations. The county’s treasurer’s office typically provides detailed instructions on the available payment methods and their respective due dates.

For instance, the due dates for property tax payments in St. Joseph County might be divided into two installments, with the first due in May and the second in November. Late payments may incur penalties and interest, so it's essential for property owners to stay informed about these deadlines.

The Impact of Property Taxes on the Community

Property taxes in St. Joseph County have a significant impact on the local economy and community development. They provide a stable source of revenue for essential services, ensuring the smooth operation of schools, public safety departments, and other vital public institutions. Additionally, property taxes play a crucial role in funding infrastructure projects, such as road maintenance, public transportation, and utility improvements.

From a homeowner's perspective, property taxes are an essential consideration when purchasing a property. They directly influence the cost of homeownership and can impact a homeowner's financial planning. Understanding the property tax system and staying informed about tax rates, deductions, and payment options is crucial for managing this aspect of homeownership effectively.

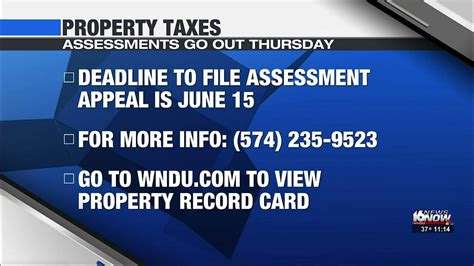

Property Tax Appeals and Challenges

In cases where property owners believe their assessed value is inaccurate or disagree with their tax bill, they have the right to appeal. St. Joseph County provides a property tax appeal process that allows homeowners to dispute their assessed value and, consequently, their tax liability. This process typically involves submitting documentation and evidence to support the appeal, followed by a review by the county’s assessor’s office.

For instance, if a homeowner believes their property's assessed value is too high, they might provide recent sales data of similar properties in the area to support their appeal. If the appeal is successful, the assessed value and subsequent tax liability could be adjusted downward.

FAQs

How are property tax rates determined in St. Joseph County?

+Property tax rates in St. Joseph County are set by the various taxing jurisdictions within the county, including the county government, townships, cities, and special taxing districts. Each entity has its own tax rate, and the total tax rate for a property is the sum of these individual rates.

What is the typical assessment rate for residential properties in St. Joseph County?

+The assessment rate for residential properties in St. Joseph County is typically 100%, meaning the assessed value is equal to the property’s market value. However, this rate can vary depending on the property’s classification and the jurisdiction.

Are there any deductions or exemptions available for property taxes in St. Joseph County?

+Yes, St. Joseph County offers various deductions and exemptions to reduce the tax burden for eligible property owners. These include homestead deductions for primary residences and exemptions for properties owned by non-profit organizations or dedicated to agricultural use.

How can I pay my property taxes in St. Joseph County?

+Property owners in St. Joseph County have several payment options, including online payment portals, direct bank transfers, mail-in checks, and in-person payments at designated locations. The county’s treasurer’s office provides detailed instructions on the available methods and their respective due dates.

What should I do if I disagree with my property’s assessed value or tax bill in St. Joseph County?

+If you believe your property’s assessed value is inaccurate or disagree with your tax bill, you can appeal through St. Joseph County’s property tax appeal process. This process involves submitting documentation and evidence to support your appeal, followed by a review by the county’s assessor’s office.