Property Taxes Montgomery County Md

Understanding property taxes is crucial for homeowners and prospective buyers alike. In Montgomery County, Maryland, the process of assessing and calculating property taxes is an intricate one. Let's delve into the specifics of this system, exploring the factors that influence tax rates, the assessment process, and the ways in which residents can navigate and potentially reduce their property tax obligations.

Unraveling the Complexity of Montgomery County’s Property Tax System

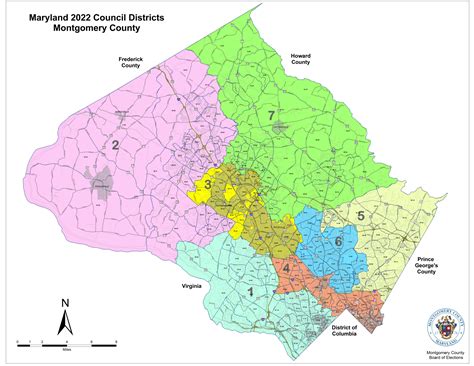

Montgomery County, a vibrant and diverse region in Maryland, boasts a unique property tax landscape. The county’s tax system is renowned for its complexity, influenced by a multitude of factors that contribute to the final tax bill. Here, we dissect the key elements that shape the property tax scenario, offering a comprehensive guide for residents and investors.

Factors Influencing Property Tax Rates

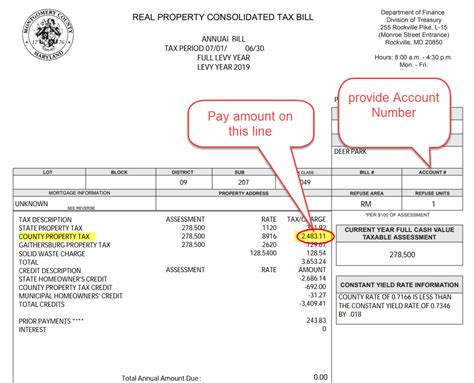

Property taxes in Montgomery County are determined by a combination of assessed value, tax rates, and various exemptions and credits. The assessed value of a property is a critical factor, representing the market value of the property as determined by the county’s Department of Finance. This value is then multiplied by the tax rate, which is set annually by the county government. The resulting figure is further modified by any applicable exemptions or credits, such as the Homestead Tax Credit, which provides a reduction for primary residences.

The tax rate itself is a product of multiple components. It includes the county tax rate, city or town tax rate (if applicable), and special tax districts that may have additional rates. These special districts, established for specific purposes like fire protection or sanitation, can add significant complexity to the tax calculation.

| Component | Description |

|---|---|

| Assessed Value | Market value of the property as determined by the county. |

| Tax Rate | Combined rate from county, city/town, and special districts. |

| Exemptions & Credits | Reductions based on factors like primary residence or senior status. |

The Assessment Process: A Step-by-Step Guide

The assessment process in Montgomery County is a meticulous undertaking. It begins with a physical inspection of the property, conducted by assessors from the Department of Finance. This inspection takes into account the property’s characteristics, including its size, condition, and any recent improvements or additions.

Following the inspection, the assessor determines the fair market value of the property, considering recent sales of similar properties in the area. This value is then adjusted for any unique features of the subject property. The assessed value is typically lower than the market value, as it is based on a formula that considers a property's income potential, replacement cost, and prevailing interest rates.

Once the assessed value is established, it is subject to a tax rate cap, which limits the increase in property taxes from one year to the next. This cap is designed to protect homeowners from sudden, drastic increases in their tax bills. However, it also means that the assessed value may lag behind the actual market value, especially in a rapidly appreciating real estate market.

Strategies for Navigating Property Taxes

Navigating Montgomery County’s property tax system can be challenging, but there are strategies to mitigate the financial burden. One effective approach is to appeal the assessed value if it seems inaccurate or if the property has unique features that may impact its value. The Department of Finance provides a formal appeals process, allowing homeowners to present evidence supporting a lower valuation.

Another strategy is to take advantage of available exemptions and credits. For instance, the Homestead Tax Credit can provide significant savings for homeowners who use their property as their primary residence. Similarly, senior citizens may qualify for additional credits or reduced tax rates.

Staying informed about local tax initiatives and special tax districts is also crucial. These entities can influence tax rates and may offer unique opportunities for tax savings or incentives. For example, some special districts provide tax breaks for certain types of development or for properties that meet specific environmental standards.

The Impact of Property Taxes on the Local Economy

Property taxes play a pivotal role in funding essential services and infrastructure in Montgomery County. These taxes contribute significantly to the county’s revenue, enabling investments in education, public safety, and community development. As such, understanding and managing property taxes is not just a personal financial concern but also a responsibility that contributes to the well-being of the entire community.

The intricate nature of Montgomery County's property tax system underscores the importance of informed decision-making for both homeowners and investors. By understanding the factors that influence tax rates and the assessment process, individuals can make more strategic choices about their property ownership and potentially reduce their tax burden. Moreover, by actively participating in the local tax landscape, residents can ensure that their contributions support the continued growth and prosperity of their community.

How often are property taxes assessed in Montgomery County?

+Property taxes in Montgomery County are assessed annually. The assessment process takes into account changes in property value and market conditions to determine the tax bill for the upcoming year.

What is the typical tax rate range in Montgomery County?

+The tax rate in Montgomery County can vary depending on the location within the county and the specific tax district. As of [date], the county tax rate is [rate], while additional city or town tax rates may apply, ranging from [range]. Special tax districts can further impact the overall rate.

Are there any exemptions or credits available for homeowners in Montgomery County?

+Yes, Montgomery County offers several exemptions and credits to eligible homeowners. These include the Homestead Tax Credit, which provides a reduction for primary residences, and credits for senior citizens and certain income-based criteria. It’s advisable to consult with the Department of Finance to determine eligibility for these benefits.