Cook County Real Estate Tax Bill

The Cook County Real Estate Tax Bill is a crucial financial obligation for property owners in the Cook County area. This annual tax bill plays a significant role in the region's economy and property management. Understanding the intricacies of this tax bill is essential for both homeowners and investors alike. In this comprehensive guide, we will delve into the details of the Cook County Real Estate Tax Bill, exploring its components, calculation methods, and strategies for effective management.

Understanding the Cook County Real Estate Tax Bill

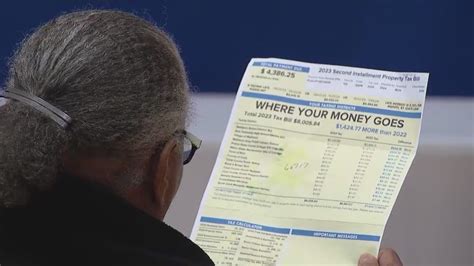

The Cook County Real Estate Tax Bill is an annual assessment sent to property owners within the county. It is a mandatory payment that contributes to the overall funding of various public services and infrastructure projects. The tax bill is calculated based on the assessed value of the property and the tax rates set by local governing bodies.

The Cook County Assessor's Office plays a pivotal role in determining the assessed value of properties. This value is influenced by factors such as property type, location, improvements, and market conditions. The assessor's office conducts regular assessments to ensure fair and accurate valuations, which form the basis for the tax bill calculations.

Components of the Tax Bill

The Cook County Real Estate Tax Bill consists of several components, each contributing to the overall tax liability. These components include:

- Assessed Value: The assessed value of the property, determined by the Cook County Assessor, is the starting point for tax calculations. It represents a percentage of the property's fair market value.

- Tax Rates: Tax rates are established by various taxing bodies, such as the county, municipalities, school districts, and special taxing districts. These rates are applied to the assessed value to calculate the tax liability.

- Tax Exemptions: Property owners may be eligible for certain tax exemptions, which can reduce their overall tax burden. Common exemptions include homestead exemptions, senior citizen exemptions, and veterans' exemptions.

- Special Assessments: In some cases, property owners may receive special assessments for specific improvements or services provided by the local government. These assessments are typically added to the tax bill and are tied to the property.

- Late Payment Penalties: It is crucial to pay the Cook County Real Estate Tax Bill on time to avoid late payment penalties. These penalties can accumulate quickly and increase the overall cost of the tax liability.

Calculation and Payment Process

The calculation of the Cook County Real Estate Tax Bill involves a series of steps. First, the assessed value of the property is determined, taking into account any applicable exemptions. Then, the appropriate tax rates are applied to the assessed value to calculate the tax liability. The resulting amount is the total tax bill for the property owner.

Property owners receive their tax bills by mail, typically in the spring or early summer. The bill includes detailed information about the assessed value, tax rates, and the total amount due. It is essential to review the bill carefully to ensure accuracy and identify any potential errors.

Payment options for the Cook County Real Estate Tax Bill include online payments, mail-in payments, and in-person payments at designated locations. Property owners should be aware of the due dates and any associated fees or discounts for early payment.

Strategies for Effective Tax Bill Management

Managing the Cook County Real Estate Tax Bill efficiently is essential for property owners to maintain their financial well-being. Here are some strategies to consider:

Stay Informed and Organized

Keep track of important dates, such as assessment deadlines, tax bill issuance, and payment due dates. Stay updated on any changes in tax rates or exemptions to ensure you are prepared for the upcoming tax bill.

Review and Appeal the Assessed Value

If you believe your property’s assessed value is inaccurate, you have the right to appeal. The Cook County Assessor’s Office provides a process for property owners to challenge their assessments. By reviewing your assessment and gathering supporting evidence, you may be able to reduce your assessed value, resulting in lower tax bills.

Explore Tax Exemptions and Credits

Research and understand the various tax exemptions and credits available to property owners in Cook County. Take advantage of these opportunities to reduce your tax liability. For example, the homestead exemption provides a reduction in the assessed value of your primary residence.

Consider Payment Options and Discounts

Explore different payment options offered by the Cook County Treasurer’s Office. Some options may provide discounts or incentives for early payment. Additionally, consider setting up automatic payments to ensure timely payment and avoid late fees.

Seek Professional Guidance

If you have complex tax situations or require expert advice, consider consulting a tax professional or accountant. They can provide personalized guidance and help you navigate the intricacies of the Cook County Real Estate Tax Bill.

Real-World Examples and Case Studies

Let’s take a look at some real-world examples to better understand the impact of the Cook County Real Estate Tax Bill on property owners.

Case Study: Residential Property Owner

Imagine a homeowner, Mr. Johnson, who recently purchased a single-family home in Cook County. His assessed value for the first year is 300,000, and the combined tax rate is 2.5%. Mr. Johnson's tax bill amounts to 7,500. By staying informed and exploring tax exemptions, he is able to reduce his tax liability by 500, resulting in a final tax bill of 7,000.

Case Study: Commercial Property Investor

Now, let’s consider Ms. Smith, an investor who owns a commercial property in downtown Chicago. Her property has an assessed value of 2 million, and the tax rate is 3.2%. Ms. Smith's tax bill comes out to 64,000. By appealing her assessment and providing evidence of a recent decline in commercial property values, she successfully reduces her assessed value by 10%, leading to a substantial savings of $6,400 on her tax bill.

Future Implications and Potential Changes

The Cook County Real Estate Tax Bill is subject to potential changes and reforms in the future. As the county’s economy evolves and public needs shift, governing bodies may adjust tax rates and assessment processes. Staying informed about any proposed changes and engaging in public discussions can help property owners understand the potential impact on their tax obligations.

Additionally, advancements in technology and data analytics may play a role in future tax assessments. The Cook County Assessor's Office may leverage innovative tools to enhance the accuracy and efficiency of property valuations. These changes could impact the calculation of tax bills and provide opportunities for more equitable assessments.

Key Takeaways and Expert Insights

💡 Understanding the Cook County Real Estate Tax Bill is crucial for property owners to manage their financial obligations effectively. By staying informed, reviewing assessments, and exploring tax exemptions, property owners can optimize their tax liability. Additionally, seeking professional guidance and staying engaged in discussions about potential reforms can help navigate the evolving landscape of real estate taxation in Cook County.

Conclusion

The Cook County Real Estate Tax Bill is a vital component of property ownership and investment in the region. By delving into its components, calculation methods, and management strategies, property owners can make informed decisions and effectively navigate their tax obligations. Remember, staying proactive, informed, and organized is key to ensuring a smooth and financially beneficial experience with the Cook County Real Estate Tax Bill.

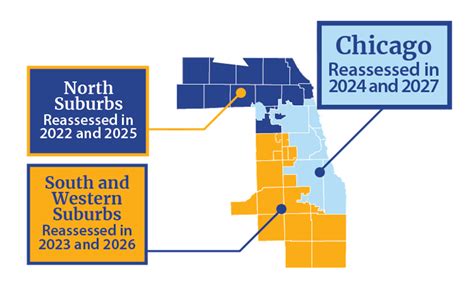

How often are property assessments conducted in Cook County?

+Property assessments in Cook County are typically conducted every three years. However, there may be instances where reassessments are triggered by significant changes to the property or market conditions.

What happens if I miss the deadline to pay my Cook County Real Estate Tax Bill?

+If you miss the deadline to pay your tax bill, late payment penalties will be applied. It is important to stay informed about the due dates and make timely payments to avoid additional costs.

Can I appeal my property’s assessed value if I disagree with it?

+Yes, property owners have the right to appeal their assessed value. The Cook County Assessor’s Office provides a process for filing an appeal. It is advisable to gather evidence and supporting documentation to strengthen your case.