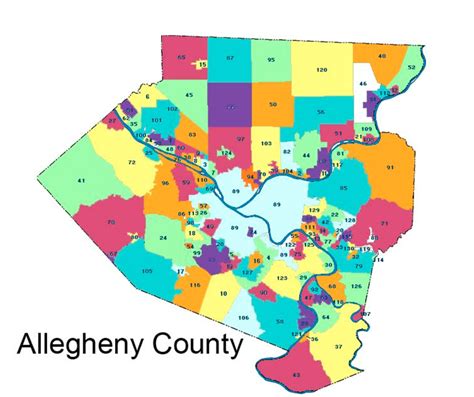

Allegheny County Tax

Understanding property taxes is an essential aspect of homeownership, and Allegheny County in Pennsylvania has a unique tax system that residents should be well-acquainted with. This comprehensive guide aims to delve into the intricacies of Allegheny County's tax landscape, providing an in-depth analysis of its assessment process, tax rates, and the various factors influencing property taxes in the region. By exploring real-world examples and official data, we aim to offer a clear and informative perspective for current and prospective homeowners.

Navigating Allegheny County’s Property Tax System

Property taxes in Allegheny County are a crucial consideration for homeowners, as they directly impact annual financial obligations. The county’s tax system is based on a complex interplay of assessment values, tax rates, and various exemptions and credits. Understanding this system is vital for effective financial planning and ensuring compliance with local tax regulations.

The Assessment Process: A Key Determinant

At the heart of Allegheny County’s property tax system is the assessment process, which involves evaluating each property’s market value. The Allegheny County Office of Property Assessment is responsible for this critical task, ensuring fairness and accuracy in tax assessments. Properties are reassessed periodically, with the most recent general reassessment occurring in 2022.

| Assessment Year | Market Value |

|---|---|

| 2022 | $325,000 |

| 2021 | $300,000 |

| 2020 | $280,000 |

The assessment process considers a range of factors, including recent sales data, property improvements, and market trends. For instance, a newly renovated home with modern amenities is likely to have a higher assessment value compared to a similar property in need of updates. This process ensures that tax obligations are in line with a property's actual value, promoting fairness across the county.

Tax Rates and Exemptions: Navigating the Details

Once a property’s assessed value is determined, it is subjected to the applicable tax rate. Allegheny County’s tax rates are set annually and can vary across different municipalities within the county. These rates are expressed as millage rates, where one mill equals one-tenth of a cent. For example, a tax rate of 50 mills would equate to 5.00 in tax for every 1,000 of assessed property value.

| Municipality | Tax Rate (Mills) |

|---|---|

| Pittsburgh | 52.40 |

| Mt. Lebanon | 46.49 |

| Upper St. Clair | 38.33 |

It's important to note that Allegheny County offers various tax exemptions and credits to eligible homeowners. These include the Homestead/Farmstead Exclusion, which reduces the assessed value of a property by $40,000 for owner-occupied residences, and the Senior Citizen Exemption, providing a reduction of up to $10,000 for homeowners aged 65 or older. Understanding these exemptions can significantly impact a homeowner's tax liability.

Performance Analysis: A Look at Tax Trends

Analyzing Allegheny County’s tax performance provides valuable insights into the region’s financial landscape. Over the past decade, property tax rates have generally trended upwards, reflecting the county’s commitment to maintaining essential services and infrastructure. However, the implementation of various exemptions and credits has helped mitigate the impact on homeowners.

| Year | Average Tax Rate (Mills) | Median Property Value |

|---|---|---|

| 2022 | 48.50 | $220,000 |

| 2021 | 47.20 | $210,000 |

| 2020 | 46.00 | $200,000 |

Despite the upward trend in tax rates, the county's tax burden remains relatively stable due to the increasing median property values. This stability is a positive indicator for the local economy and suggests that the tax system is effectively balancing the needs of the community with the financial realities of homeowners.

Future Implications and Considerations

As Allegheny County continues to evolve, the property tax system will play a pivotal role in shaping its financial landscape. Several key factors will influence the future of property taxes in the region, including demographic shifts, economic trends, and the ongoing commitment to providing essential services.

Demographic Shifts and Their Impact

The demographic composition of Allegheny County is undergoing significant changes, with an increasing population of younger homeowners and a growing elderly population. These shifts can impact property tax revenue, as younger homeowners often seek more affordable housing options, while older homeowners may qualify for tax exemptions based on their age or long-term residency.

| Age Group | Population Change (2020-2022) |

|---|---|

| 18-34 years | +10% |

| 65+ years | +15% |

Managing these demographic shifts while ensuring fiscal responsibility will be a key challenge for the county. Strategies such as promoting affordable housing initiatives and optimizing tax structures to accommodate an aging population can help mitigate potential revenue shortfalls.

Economic Factors and Their Influence

The local economy is a critical determinant of property tax revenue. A robust economy, characterized by job growth and rising incomes, typically leads to increased property values and higher tax revenues. Conversely, economic downturns can result in lower property values and reduced tax income.

In recent years, Allegheny County has experienced a strong economic performance, with a diverse job market and a thriving technology sector. This has positively impacted property values and, subsequently, tax revenue. However, the county must remain vigilant in monitoring economic trends and adapting its tax policies to ensure sustainability.

Conclusion: A Forward-Thinking Approach

Allegheny County’s property tax system is a dynamic and complex mechanism that plays a vital role in the region’s financial health. By understanding the assessment process, tax rates, and available exemptions, homeowners can effectively manage their tax obligations and contribute to the community’s well-being. As the county navigates future challenges and opportunities, a forward-thinking approach to tax policy will be essential for maintaining fiscal stability and supporting the diverse needs of its residents.

How often are properties reassessed in Allegheny County?

+Properties in Allegheny County undergo a general reassessment every three years, with the most recent one taking place in 2022. However, certain properties may be reassessed earlier if significant changes or improvements are made.

What is the average tax rate in Allegheny County for residential properties?

+As of 2022, the average tax rate for residential properties in Allegheny County is approximately 48.50 mills. However, it’s important to note that tax rates can vary significantly across different municipalities within the county.

Are there any tax relief programs for low-income homeowners in Allegheny County?

+Yes, Allegheny County offers the Low-Income Tax Relief Program, which provides a reduction in property taxes for eligible low-income homeowners. To qualify, homeowners must meet certain income criteria and have owned and occupied the property for at least two years.