Ky State Taxes

Welcome to our comprehensive guide on Kentucky State Taxes, a crucial aspect of financial planning for individuals and businesses alike. Understanding the intricacies of state tax laws is essential for effective tax management and strategic financial decision-making. In this article, we delve into the specific tax landscape of Kentucky, providing an in-depth analysis of its tax structure, rates, and unique considerations. By exploring real-world examples and offering expert insights, we aim to equip you with the knowledge needed to navigate the Kentucky tax system with confidence.

Unraveling the Kentucky Tax System

The Commonwealth of Kentucky employs a diverse tax system that encompasses various revenue streams to fund its operations and public services. At the core of this system is the individual income tax, a critical component for residents and non-residents alike. Kentucky’s income tax structure is progressive, with rates ranging from 2% to 6% based on taxable income.

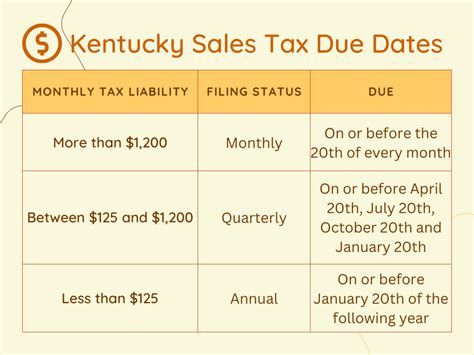

Beyond individual income tax, Kentucky levies a corporate income tax on business profits. The state's corporate tax rate stands at 6%, applying to both domestic and foreign corporations doing business within its borders. Additionally, Kentucky imposes a sales and use tax on the sale or lease of tangible personal property, with a standard rate of 6%. This tax is applicable to a wide range of goods and services, contributing significantly to the state's revenue stream.

For property owners, Kentucky implements a property tax, assessed and collected at the local level. The tax rate varies across counties and is influenced by factors such as the type of property, its location, and its assessed value. This decentralization of property tax administration ensures a tailored approach to local needs and circumstances.

Key Tax Rates and Examples

Let’s illustrate these tax rates with some real-world scenarios. For an individual earning 50,000 annually in Kentucky, the income tax liability would be calculated as follows: the first 3,220 is taxed at 2%, the next 3,220 at 3%, and the remaining 43,560 at 5%, resulting in a total income tax of 2,154. Similarly, a corporation with profits of 1 million would owe $60,000 in corporate income tax.

| Tax Type | Rate | Example |

|---|---|---|

| Individual Income Tax | 2% - 6% | An individual earning $50,000 pays $2,154 in income tax. |

| Corporate Income Tax | 6% | A corporation with $1 million in profits pays $60,000 in corporate tax. |

| Sales and Use Tax | 6% | A $100 purchase results in a $6 tax liability. |

| Property Tax | Varies by county | A home assessed at $200,000 in County A might have a tax rate of 0.8%, resulting in $1,600 in property taxes. |

Tax Incentives and Credits

Kentucky is proactive in offering various tax incentives and credits to attract businesses and support economic development. These incentives are designed to encourage investment, job creation, and innovation within the state.

Kentucky Business Investment Program

The Kentucky Business Investment (KBI) Program is a notable incentive, offering tax credits to businesses that make substantial capital investments and create new jobs. To qualify, businesses must meet specific investment and job creation thresholds. For instance, a manufacturing company investing $10 million and creating 50 new jobs could be eligible for substantial tax credits over a period of 10 years.

Research and Development Tax Credits

Kentucky promotes research and development (R&D) activities by providing tax credits to businesses engaged in qualified R&D projects. These credits can be applied against corporate income tax liabilities, offering a financial incentive for innovation and technological advancement. A technology company conducting advanced R&D on renewable energy solutions could leverage these credits to offset a significant portion of its tax liability.

Historic Preservation Tax Credits

The state also incentivizes the preservation and rehabilitation of historic properties through the Historic Preservation Tax Credit Program. This program offers tax credits to offset the costs of rehabilitating historic structures, encouraging the restoration and preservation of Kentucky’s rich architectural heritage. A developer restoring a historic building in downtown Louisville could utilize these credits to make the project more financially feasible.

Tax Filing and Compliance

Navigating the tax filing process is a critical aspect of managing Kentucky state taxes. The Kentucky Department of Revenue provides a comprehensive online platform for taxpayers to file their returns, make payments, and access various resources. This platform offers convenience and efficiency, allowing taxpayers to manage their obligations digitally.

Individual Tax Filing

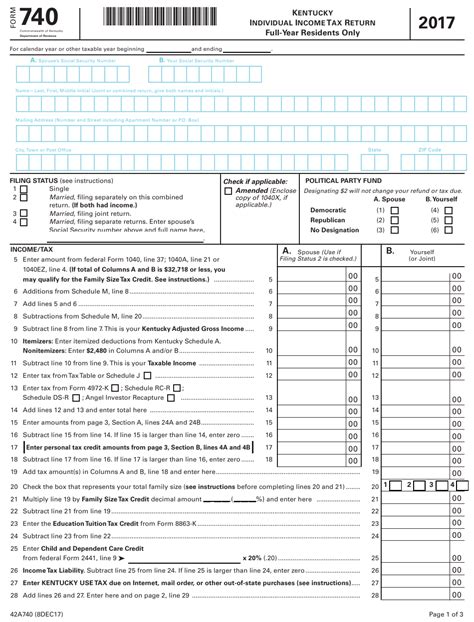

For individual taxpayers, the filing process involves completing Form 740, the Kentucky Individual Income Tax Return. This form captures income, deductions, and credits to determine the tax liability. The due date for filing is typically April 15th, aligning with the federal tax deadline.

Business Tax Filing

Businesses operating in Kentucky are required to file various tax forms depending on their structure and activities. This includes Form 765, the Kentucky Corporate Income Tax Return, for C-corporations, and Form 760, the Kentucky Partnership Return, for partnerships. The due dates for these returns vary based on the business’s fiscal year.

Tax Compliance and Penalties

Compliance with Kentucky’s tax laws is essential to avoid penalties and interest charges. Late filing or non-filing of tax returns can result in significant penalties, which escalate over time. Additionally, underreporting or failure to pay taxes can lead to further legal consequences. It is crucial for taxpayers to stay informed about their obligations and seek professional guidance when needed.

Future Outlook and Considerations

The Kentucky tax landscape is dynamic and influenced by economic trends, legislative changes, and societal needs. As the state continues to evolve, several key considerations emerge for taxpayers and stakeholders.

Economic Growth and Tax Policy

Kentucky’s focus on economic growth and job creation is likely to drive ongoing discussions around tax policy. The state may explore strategies to further incentivize business investment and innovation, potentially through expanded tax credits or targeted tax reforms. These initiatives could attract new businesses and industries, fostering economic prosperity.

Budgetary Constraints and Tax Reform

Balancing budgetary needs with tax policy can be a delicate task. As the state navigates fiscal challenges, it may consider tax reforms to enhance revenue streams and address budgetary gaps. This could involve adjustments to tax rates, the introduction of new taxes, or the modification of existing tax incentives. Taxpayers should stay informed about these potential changes to effectively plan their financial strategies.

Impact of Federal Tax Reforms

Federal tax reforms can have a ripple effect on state tax systems. Changes to federal tax laws, such as the Tax Cuts and Jobs Act of 2017, can influence state tax structures and compliance requirements. Kentucky taxpayers should monitor federal tax developments to understand how they might impact their state tax obligations.

Conclusion

Kentucky’s tax system is a complex yet essential component of the state’s financial landscape. By understanding the nuances of its tax rates, incentives, and compliance requirements, individuals and businesses can make informed decisions to optimize their financial positions. This guide provides a comprehensive overview, but it is crucial to stay updated with the latest developments and seek professional advice when navigating the intricacies of Kentucky state taxes.

What is the Kentucky state income tax rate for 2023?

+The state income tax rate in Kentucky for 2023 remains at a progressive scale, ranging from 2% to 6% based on taxable income. This structure ensures a fair distribution of tax liabilities across different income levels.

Are there any tax incentives for renewable energy projects in Kentucky?

+Yes, Kentucky offers tax incentives for renewable energy projects through its Renewable Energy Production Tax Credit. This credit provides a financial boost to businesses investing in renewable energy generation, promoting a greener and more sustainable energy landscape.

How can I stay updated with the latest tax laws and changes in Kentucky?

+To stay informed about Kentucky’s tax laws and updates, you can regularly visit the Kentucky Department of Revenue’s website, which provides the latest information on tax changes, deadlines, and resources. Additionally, subscribing to tax newsletters or consulting tax professionals can ensure you remain up-to-date with any developments.