South Dakota Sales Tax

In the realm of state finances, sales tax stands as a pivotal revenue source, funding essential public services and infrastructure. This article delves into the intricacies of South Dakota's sales tax system, exploring its rates, applicability, and impact on businesses and consumers. Through a detailed analysis, we aim to provide a comprehensive understanding of this vital economic mechanism, offering insights into its role within the state's fiscal landscape.

Understanding South Dakota Sales Tax

South Dakota, akin to many other states, imposes a sales tax on the retail sale of tangible personal property and certain services. This tax, levied at various rates, contributes significantly to the state’s revenue stream, funding a range of critical public initiatives. The state’s sales tax system, while relatively straightforward, encompasses a diverse array of goods and services, each subject to specific tax rates and regulations.

Sales Tax Rates and Exemptions

South Dakota operates with a uniform state sales tax rate of 4.5%, which is applied to most retail transactions. However, the state’s sales tax landscape is far from monolithic, with additional local taxes often layered on top of the state rate, resulting in a combined sales tax rate that can vary across different regions. For instance, certain cities and counties levy their own local sales taxes, pushing the overall rate upwards. In Sioux Falls, for example, the combined sales tax rate stands at 6.5%, while Rapid City residents encounter a 7% rate.

In contrast to many other states, South Dakota's sales tax regime does not extend to all goods and services. Notably, the state does not levy sales tax on groceries, a decision that stands in contrast to most other states. This exemption, while benefiting consumers, also limits the state's revenue stream from sales tax. Other exemptions include prescription drugs and medical supplies, as well as certain manufacturing equipment and agricultural products.

| Category | Tax Rate |

|---|---|

| State Sales Tax | 4.5% |

| Local Sales Tax (Average) | Varies (Up to 2.5%) |

| Total Average Sales Tax | 7% |

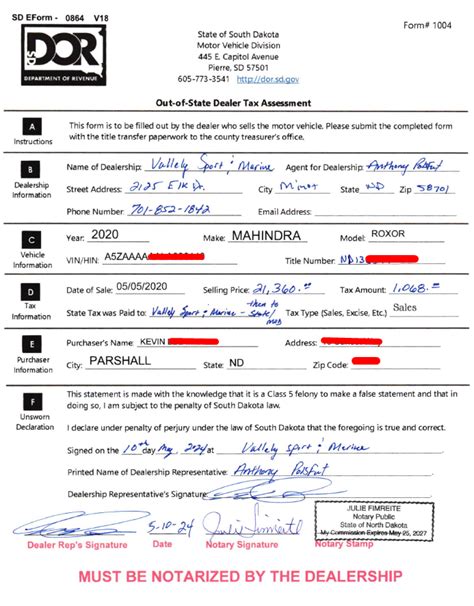

Collection and Remittance

The responsibility for collecting and remitting sales tax in South Dakota falls squarely on the shoulders of the seller. This duty entails the calculation of applicable tax rates, the inclusion of these rates in the sale price, and the subsequent remittance of the collected tax to the South Dakota Department of Revenue. This process, while straightforward in concept, can become complex when dealing with multiple tax rates and jurisdictions, particularly for businesses with operations across different parts of the state.

Impact on Businesses and Consumers

South Dakota’s sales tax system has a dual impact on both businesses and consumers. For businesses, particularly those in the retail sector, sales tax represents a significant operational consideration. The need to understand and adhere to the state’s tax regulations, including the collection and remittance process, adds a layer of complexity to daily operations. Additionally, the varying tax rates across the state can present challenges in price standardization and inventory management.

From the consumer's perspective, South Dakota's sales tax system influences purchasing decisions and overall financial planning. While the state's relatively low average sales tax rate can be viewed as a benefit, the absence of a sales tax on groceries and other essential items further enhances the state's appeal. However, it's important to note that this benefit is not uniform across all regions, with local tax rates potentially offsetting the state's favorable rate in certain areas.

Special Considerations and Future Outlook

South Dakota’s sales tax system, while robust, is not without its unique considerations and potential areas of improvement. One notable aspect is the state’s reliance on sales tax as a primary revenue source, which, while common among states, can lead to challenges during economic downturns when consumer spending decreases. To address this, some states have diversified their revenue streams, incorporating other forms of taxation, such as income or corporate taxes, to provide a more stable financial foundation.

Online Sales and Remote Sellers

The rise of e-commerce and the proliferation of remote sellers have presented new challenges for South Dakota’s sales tax system. While the state has implemented measures to address this issue, such as requiring remote sellers to collect and remit sales tax on transactions with South Dakota consumers, the evolving nature of e-commerce continues to present new complexities. As online sales continue to grow, the state will need to adapt its tax policies and enforcement mechanisms to ensure compliance and maintain revenue streams.

Sales Tax Fairness and Equity

The issue of sales tax fairness and equity is a complex and often controversial topic. South Dakota’s current system, with its exemptions and varying local tax rates, has led to discussions about tax fairness and the potential for a more uniform approach. Some argue for a simplified, flat tax rate across the state, while others advocate for a more nuanced system that takes into account the specific needs and priorities of different regions. Striking the right balance between uniformity and regional flexibility is a delicate task that requires careful consideration of the state’s diverse economic landscape.

Potential for Reform and Innovation

As South Dakota’s economy continues to evolve, so too must its tax system. The state has the opportunity to explore innovative approaches to sales taxation, drawing on best practices from other states and countries. This could involve the implementation of new technologies for tax collection and enforcement, the introduction of incentives to encourage compliance, or the exploration of alternative tax structures that better align with the state’s economic realities and future growth objectives.

How often are sales tax rates updated in South Dakota?

+Sales tax rates in South Dakota are subject to periodic updates, typically driven by legislative changes or local tax adjustments. While the state sales tax rate has remained stable at 4.5% since 2013, local tax rates can fluctuate more frequently, with cities and counties adjusting their rates to meet specific budgetary needs.

Are there any plans to change the state’s sales tax structure in the near future?

+Currently, there are no immediate plans for a significant overhaul of South Dakota’s sales tax structure. However, as with any tax system, ongoing discussions and proposals are a regular part of the legislative process. The state’s leadership continually evaluates the effectiveness and fairness of the tax system, considering potential changes to ensure it remains responsive to the needs of the state’s economy and its citizens.

What steps does South Dakota take to ensure compliance with sales tax regulations?

+South Dakota employs a range of strategies to promote compliance with sales tax regulations. This includes educational initiatives to inform businesses and consumers about their tax obligations, regular audits of businesses to ensure compliance, and the implementation of penalty systems for non-compliance. The state also leverages technology to streamline the tax collection and reporting process, making it more efficient and accessible for taxpayers.