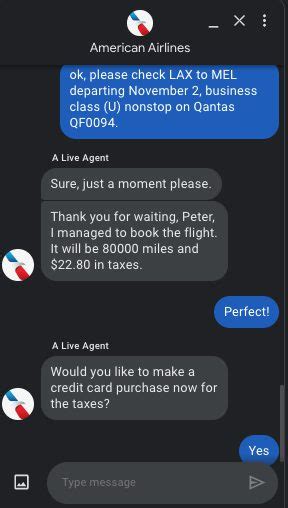

Hidalgo County Tax Appraisal

Welcome to the comprehensive guide on Hidalgo County Tax Appraisal, a critical process that shapes the financial landscape of this vibrant community. In this in-depth exploration, we will delve into the intricacies of property taxation in Hidalgo County, Texas, providing a clear understanding of the assessment process, its impact on residents, and the strategies employed to ensure fair and accurate evaluations.

The Significance of Hidalgo County Tax Appraisal

Hidalgo County, situated in the Rio Grande Valley, is a dynamic region known for its thriving agriculture, vibrant culture, and steady economic growth. The tax appraisal process plays a pivotal role in this landscape, influencing property values, tax revenues, and ultimately, the county’s development and prosperity.

Each year, the Hidalgo County Appraisal District (HCAD) undertakes the crucial task of assessing the value of properties within the county. This valuation determines the property taxes that residents and businesses will pay, making it a vital aspect of the local economy and community life.

Understanding the Appraisal Process

The Hidalgo County Tax Appraisal process is a meticulous and systematic endeavor. It begins with data collection, where the HCAD gathers information on all taxable properties in the county. This includes residential, commercial, and agricultural properties, each subject to unique valuation methods.

Residential Property Appraisal

For residential properties, the appraisal district employs a market-based approach. This involves analyzing recent sales of comparable properties, considering factors such as location, size, age, and any recent improvements. By studying these sales, the HCAD can estimate the fair market value of a property, which serves as the basis for taxation.

| Property Type | Average Market Value |

|---|---|

| Single-Family Homes | $210,000 |

| Condominiums | $185,000 |

| Multi-Family Units | $350,000 |

In recent years, Hidalgo County has seen a surge in property values, particularly in the residential sector. This is largely attributed to the region's economic growth and the increasing demand for housing. As a result, the HCAD has had to adapt its appraisal methods to ensure accurate valuations.

Commercial Property Appraisal

Commercial properties, including offices, retail spaces, and industrial sites, are appraised based on their income-generating potential. The HCAD analyzes the property’s rental income, operating expenses, and market trends to determine its fair value. This approach, known as the income capitalization method, is essential for ensuring that businesses pay their fair share of taxes.

| Property Type | Average Market Value |

|---|---|

| Office Buildings | $550,000 |

| Retail Spaces | $420,000 |

| Industrial Warehouses | $700,000 |

The commercial sector in Hidalgo County has witnessed significant development, with new businesses and industries flocking to the area. The HCAD's appraisal methods have had to evolve to accommodate these changes, ensuring that the county's economic growth is reflected in the tax assessments.

Agricultural Property Appraisal

Agricultural lands in Hidalgo County are a vital part of the local economy. The HCAD employs a unique approach to appraising these properties, considering factors such as soil quality, irrigation availability, and the productivity of the land. This ensures that farmers and ranchers pay taxes based on the true value of their land, taking into account the specific challenges and opportunities of agricultural production.

| Crop Type | Average Acreage Value |

|---|---|

| Citrus Groves | $15,000 per acre |

| Vegetable Fields | $12,000 per acre |

| Grain Fields | $8,000 per acre |

Hidalgo County's agricultural sector is diverse, ranging from citrus orchards to vegetable farms and grain fields. The HCAD's appraisal methods are tailored to this diversity, recognizing the unique value of each crop and the challenges faced by farmers in the region.

Ensuring Fairness and Accuracy

The Hidalgo County Appraisal District is committed to maintaining fairness and accuracy in its tax appraisal process. To achieve this, the HCAD employs a team of highly trained appraisers who are well-versed in the latest valuation methods and local market trends.

Appraiser Training and Expertise

HCAD appraisers undergo rigorous training to ensure they are equipped with the skills and knowledge needed to perform accurate appraisals. This includes staying updated on industry best practices, attending workshops and conferences, and participating in continuous professional development programs.

The HCAD's appraisers are also well-versed in the unique challenges and opportunities of the Hidalgo County market. They understand the local economy, the impact of seasonal fluctuations, and the influence of external factors on property values. This expertise is crucial in ensuring that appraisals are not only accurate but also fair and reflective of the local context.

Appeals Process

Recognizing that mistakes can occur or that property owners may have valid concerns about their appraised values, the HCAD has established a robust appeals process. Property owners who believe their property has been overvalued can file an appeal, providing evidence and arguments to support their case.

The appeals process is designed to be fair and transparent. It involves a review by an independent panel, ensuring that the decision is unbiased. Property owners are given the opportunity to present their case, and the HCAD works to resolve any disputes in a timely and efficient manner.

The Impact on the Community

The Hidalgo County Tax Appraisal process has a profound impact on the community, shaping the financial landscape and influencing the county’s development.

Funding Essential Services

Property taxes are a primary source of revenue for Hidalgo County, funding essential services such as education, healthcare, infrastructure, and public safety. Accurate tax appraisals ensure that these services are adequately funded, allowing the county to invest in the community’s well-being and future.

Encouraging Economic Development

A fair and efficient tax appraisal process is crucial for attracting new businesses and investments to Hidalgo County. By ensuring that property taxes are based on accurate valuations, the HCAD creates an environment that is attractive to investors and businesses, fostering economic growth and job creation.

Community Engagement

The HCAD actively engages with the community, providing resources and information to help property owners understand the appraisal process and their rights. This includes hosting public meetings, providing educational materials, and offering one-on-one assistance to address any concerns or questions.

Looking Ahead: Future Implications

As Hidalgo County continues to grow and evolve, the tax appraisal process will play a pivotal role in shaping its future. The HCAD is poised to adapt and innovate, ensuring that its appraisal methods remain fair, accurate, and reflective of the dynamic nature of the local market.

Technological Advancements

The HCAD is exploring the use of advanced technologies, such as geographic information systems (GIS) and remote sensing, to enhance the accuracy and efficiency of property appraisals. These tools can provide real-time data on property characteristics and market trends, aiding in the appraisal process.

Market Fluctuations

Hidalgo County’s economy is subject to market fluctuations, influenced by factors such as global trends, natural disasters, and policy changes. The HCAD will need to remain agile, adapting its appraisal methods to account for these fluctuations and ensuring that property values are accurately reflected in the tax assessments.

Community Development Initiatives

The HCAD recognizes the importance of community development and is committed to supporting initiatives that enhance the quality of life in Hidalgo County. This includes collaborating with local governments and organizations to promote sustainable development, affordable housing, and economic opportunities.

Conclusion

The Hidalgo County Tax Appraisal process is a complex yet crucial endeavor, shaping the financial landscape of this vibrant community. Through its commitment to accuracy, fairness, and community engagement, the Hidalgo County Appraisal District ensures that property taxes are a fair reflection of property values, contributing to the county’s prosperity and growth.

How often does the Hidalgo County Appraisal District update property values?

+The HCAD updates property values annually to reflect changes in the market and property characteristics. This ensures that tax assessments remain current and accurate.

Can property owners dispute their appraised value?

+Yes, property owners have the right to appeal their appraised value if they believe it is inaccurate or unfair. The HCAD provides a transparent and fair appeals process to address such concerns.

How does the HCAD determine the market value of a property?

+The HCAD employs various methods, including analyzing recent sales of comparable properties, considering income-generating potential for commercial properties, and assessing the productivity of agricultural lands. These methods ensure that property values are accurately determined.

What resources does the HCAD provide to help property owners understand the appraisal process?

+The HCAD offers a range of resources, including public meetings, educational materials, and one-on-one assistance. Property owners can access these resources to gain a better understanding of the appraisal process and their rights.