Hsa Tax Forms

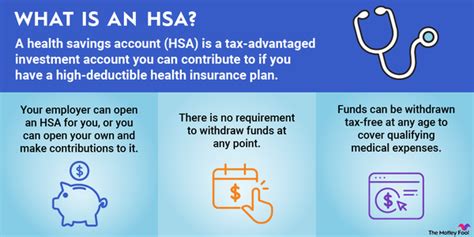

Welcome to a comprehensive guide on HSA tax forms, a critical component of Health Savings Accounts (HSAs) that offer tax benefits to individuals with high-deductible health plans. This article will delve into the intricacies of HSA tax forms, explaining their purpose, usage, and the vital role they play in managing your healthcare finances efficiently.

Understanding the HSA Tax Forms Landscape

Health Savings Accounts have become an essential financial tool for many individuals, offering a tax-efficient way to save for healthcare expenses. The HSA tax forms are the administrative backbone of this system, ensuring compliance and providing a record of your contributions, distributions, and account activity.

The Key Forms in Focus

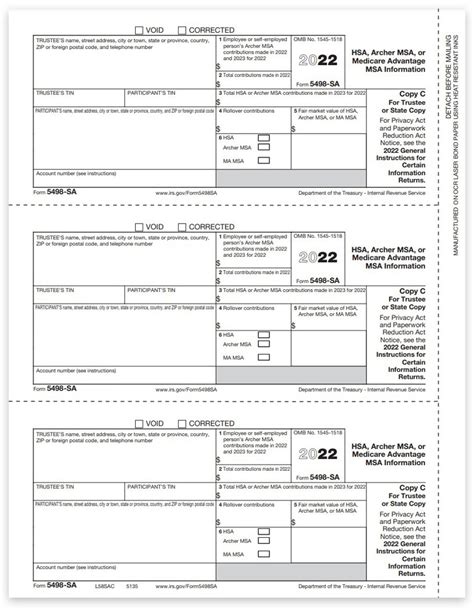

Several forms are integral to the HSA ecosystem, each serving a unique purpose. The IRS Form 8889, known as the Health Savings Accounts (HSAs) Benefits Double-Taxation Relief, is a crucial form that reports HSA contributions, deductions, and distributions. Additionally, the HSA Trustee’s Annual Tax Form provides a comprehensive overview of your HSA activity, including investments and earnings.

When and How to Use These Forms

The Form 8889 is typically filed with your annual tax return. It allows you to claim deductions for HSA contributions and report any distributions made during the tax year. Meanwhile, the HSA Trustee’s Annual Tax Form is usually provided by your HSA custodian or trustee, detailing the account’s activity and financial performance.

Navigating the HSA Contribution and Distribution Process

Understanding how to accurately report contributions and distributions is vital to managing your HSA effectively. This section will guide you through these processes, ensuring you maximize the tax benefits of your HSA.

Maximizing HSA Contributions

HSAs offer triple tax advantages: contributions are tax-deductible, investments grow tax-free, and distributions for qualified medical expenses are tax-free. To maximize these benefits, it’s essential to contribute the maximum allowed amount, which is determined by your age and HSA plan type. These contributions can be made by you, your employer, or both, and they must be reported on the Form 8889 to claim the tax deduction.

Reporting Distributions

Distributions from your HSA must be reported to ensure you comply with the tax regulations. Distributions used for qualified medical expenses are tax-free, but it’s crucial to maintain records of these expenses to substantiate your claims. The Form 8889 provides a space to report distributions, and it’s important to ensure accuracy to avoid penalties.

| Form 8889 Section | Description |

|---|---|

| Part I | Contributions: Reports contributions made to your HSA, including those made by you and your employer. |

| Part II | Deductions: Claims the deduction for HSA contributions made during the tax year. |

| Part III | Distributions: Reports distributions from your HSA, including any penalties if applicable. |

Avoiding Common HSA Tax Form Pitfalls

While HSAs offer significant tax advantages, it’s crucial to understand the potential pitfalls to avoid costly mistakes. This section will highlight common errors and provide strategies to navigate these challenges effectively.

Understanding Qualified Medical Expenses

To ensure your HSA distributions are tax-free, it’s essential to understand what constitutes a qualified medical expense. This includes a wide range of healthcare costs, from doctor’s visits and prescription medications to dental care and vision services. It’s crucial to keep receipts and records to substantiate these expenses, especially if your HSA is audited.

Avoiding Excessive Contribution Penalties

Contributing too much to your HSA can result in penalties. It’s important to understand the contribution limits for your age group and plan type. The Form 8889 includes a section to report excess contributions and any penalties incurred. Being aware of these limits and reporting accurately can help you avoid unnecessary penalties.

The Future of HSA Tax Forms: Simplification and Innovation

As the popularity of HSAs grows, there is a push for simplifying the tax forms and processes associated with these accounts. This section will explore potential future developments and innovations that could streamline HSA tax management.

Potential Form Simplification

Efforts are underway to simplify the Form 8889 and other HSA-related forms. This could involve consolidating multiple forms into one comprehensive document or integrating HSA reporting into existing tax forms. Such simplifications would make it easier for individuals to manage their HSA tax obligations, reducing the risk of errors and increasing compliance.

Digital Innovations in HSA Management

The rise of digital health platforms and mobile apps offers an opportunity to streamline HSA management. These technologies could provide real-time tracking of HSA contributions and distributions, making it easier to report accurately and reducing the need for extensive paperwork. Additionally, digital platforms could offer educational resources and tools to help individuals understand their HSA benefits and obligations.

Conclusion: Navigating the HSA Tax Forms Landscape with Confidence

Understanding and effectively managing HSA tax forms is crucial to maximizing the benefits of your Health Savings Account. By staying informed about the forms, their usage, and potential future developments, you can ensure your HSA works optimally for your healthcare and financial needs. Remember, while this guide provides a comprehensive overview, it’s always recommended to seek professional advice for your specific circumstances.

How often should I contribute to my HSA, and when should I file the Form 8889?

+It’s recommended to contribute to your HSA regularly, especially if you have a high-deductible health plan. You can make contributions throughout the year, and the deadline for filing the Form 8889 is typically aligned with your annual tax return deadline.

Can I use my HSA for over-the-counter medications, and how do I report these expenses?

+Starting in 2011, you can use your HSA for over-the-counter medications with a doctor’s prescription. To report these expenses, keep the prescription and the receipt, and include these details when filing your Form 8889.

What happens if I withdraw funds from my HSA for non-qualified medical expenses?

+Withdrawing funds for non-qualified medical expenses can result in a 20% penalty and the amount withdrawn is subject to income tax. It’s important to understand the qualified medical expenses to avoid these penalties.