Multnomah County Property Tax

Property taxes are an essential component of a county's revenue stream, and understanding the system is crucial for both property owners and residents. In Multnomah County, Oregon, the property tax landscape is unique and plays a significant role in funding various public services and infrastructure. This comprehensive guide aims to delve into the intricacies of Multnomah County's property tax system, shedding light on its calculation, assessment, and impact on the community.

Understanding the Multnomah County Property Tax Structure

Multnomah County’s property tax system is designed to ensure a fair and equitable distribution of tax obligations among property owners. The county’s tax structure is a complex interplay of various factors, including property value, tax rates, and exemptions, all of which contribute to the final tax liability.

At its core, the property tax system in Multnomah County is based on the principle of ad valorem taxation, which means that the tax amount is directly proportional to the value of the property. This value is assessed by the county's Assessor's Office, which employs a team of professionals to evaluate properties based on a multitude of factors.

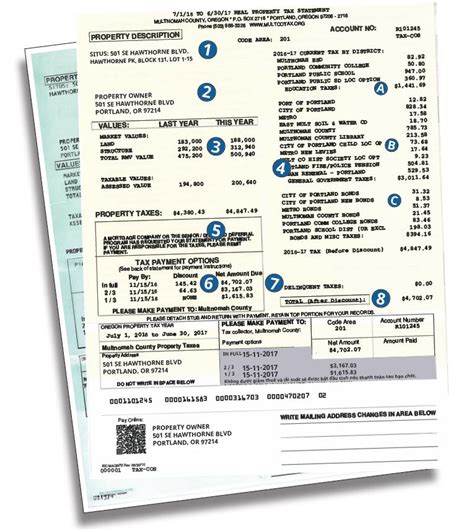

The assessment process takes into account the property's physical characteristics, such as size, location, and any improvements made. It also considers the market conditions and recent sales data to determine the property's fair market value. This value, known as the Assessed Value, forms the basis for calculating the property tax.

Once the Assessed Value is determined, it is multiplied by the Tax Rate to arrive at the tax liability. The Tax Rate is established by various taxing districts within the county, including the county government itself, cities, school districts, and special districts like fire protection or water authorities. Each district sets its own rate, which is then applied to the Assessed Value to determine the tax owed to that specific district.

Tax Rate Composition

The Tax Rate in Multnomah County is typically expressed as a millage rate, which represents the amount of tax per 1,000 of Assessed Value. For instance, a millage rate of 5.00 would mean that for every 1,000 of Assessed Value, the property owner would owe $5 in taxes. These rates can vary significantly between different districts, leading to a diverse range of tax obligations across the county.

To illustrate, let's consider a hypothetical property in Portland with an Assessed Value of $400,000. If the combined millage rate for all taxing districts is 8.00, the property owner would owe $3,200 in property taxes ($400,000 x 8.00 mills = $3,200). This tax amount would then be distributed among the various districts based on their individual millage rates.

| Taxing District | Millage Rate | Tax Amount |

|---|---|---|

| Multnomah County | 2.00 | $800 |

| City of Portland | 2.50 | $1,000 |

| Portland School District | 1.75 | $700 |

| Fire Protection District | 1.75 | $700 |

Assessing Property Value: The Role of the Assessor’s Office

The Assessor’s Office in Multnomah County is tasked with the critical responsibility of evaluating the value of all taxable properties within the county. This assessment process is a meticulous endeavor, requiring a deep understanding of the local real estate market and property characteristics.

Mass Appraisal Techniques

The Assessor’s Office employs a range of mass appraisal techniques to ensure an accurate and fair assessment. These techniques include:

- Sales Comparison Approach: Properties are compared to similar ones that have recently sold, taking into account factors like location, size, and features. This approach is particularly useful for single-family homes and residential properties.

- Cost Approach: This method estimates the cost of rebuilding the property, minus depreciation, to determine its value. It is often used for unique or specialized properties.

- Income Approach: Applicable to income-producing properties like rental units or commercial spaces, this approach considers the potential income generated by the property and the associated expenses.

By utilizing these techniques, the Assessor's Office aims to provide a comprehensive and unbiased valuation of each property, ensuring that the tax burden is distributed equitably among property owners.

Property Tax Exemptions

Multnomah County offers a range of exemptions to certain property owners, reducing their tax liability. These exemptions are designed to provide relief to specific groups and encourage particular types of development.

- Senior Citizen Exemption: Property owners who are 62 years or older and meet certain income requirements may qualify for a reduction in their property taxes. This exemption aims to support seniors who are on a fixed income.

- Veteran's Exemption: Veterans who have served in the U.S. military and meet specific criteria may be eligible for a property tax exemption. This exemption is a token of appreciation for their service.

- Green Space Exemption: Property owners who dedicate a portion of their land to open space or conservation may qualify for this exemption. It encourages the preservation of natural areas and reduces development pressure.

- Historic Property Exemption: Owners of properties that are listed on the National Register of Historic Places may be eligible for a partial exemption. This exemption promotes the preservation of historic buildings and encourages their adaptive reuse.

The Impact of Property Taxes on Multnomah County

Property taxes play a pivotal role in funding essential services and infrastructure projects in Multnomah County. The revenue generated from these taxes supports a wide range of initiatives, from education and healthcare to transportation and public safety.

Funding Education

One of the most significant beneficiaries of property tax revenue is the education sector. In Multnomah County, property taxes contribute to funding public schools, ensuring that students receive a quality education. This includes supporting teachers’ salaries, purchasing educational resources, and maintaining school facilities.

Investing in Infrastructure

Property taxes also drive the development and maintenance of critical infrastructure in the county. This encompasses road repairs, bridge maintenance, and the construction of new public facilities like libraries and community centers. By investing in infrastructure, the county aims to improve the quality of life for its residents and attract businesses.

Supporting Public Safety

A portion of the property tax revenue is allocated to public safety initiatives, including law enforcement, fire protection, and emergency response services. This funding ensures that the county can provide adequate resources to keep its residents safe and respond effectively to emergencies.

Addressing Social Services

Multnomah County’s property taxes also contribute to a range of social services, such as healthcare, housing assistance, and support for vulnerable populations. These services aim to address social inequalities and provide a safety net for those in need.

Conclusion

The property tax system in Multnomah County is a complex yet vital component of the local economy and community. It ensures that property owners contribute fairly to the funding of essential services and infrastructure, while also providing exemptions to support specific groups and initiatives. By understanding this system, property owners can better appreciate the role their taxes play in shaping the county’s future.

When are property taxes due in Multnomah County?

+

Property taxes in Multnomah County are due in two installments: the first by October 15th and the second by May 15th of the following year. Failure to pay by the due date may result in penalties and interest charges.

How can I contest my property’s assessed value?

+

If you believe your property’s assessed value is incorrect, you have the right to appeal. The process involves submitting an appeal to the Board of Property Tax Appeals within a specified timeframe. You will need to provide evidence to support your claim, such as recent sales data of comparable properties.

Are there any online tools to estimate my property tax?

+

Yes, the Multnomah County website provides an online Property Tax Estimator tool. This tool allows you to input your property’s details and estimated value to calculate a rough estimate of your annual property tax liability. It’s a useful resource for budgeting and planning.

How often are property values reassessed in Multnomah County?

+

Property values in Multnomah County are reassessed every two years. This ensures that the assessed values remain up-to-date and reflect any changes in the property or the local real estate market.