Baltimore City Property Tax

Property taxes are an essential component of a city's revenue stream, and they play a significant role in funding public services and infrastructure. In Baltimore City, property taxes are a vital source of income for the local government, contributing to the development and maintenance of various essential services. This article aims to provide an in-depth analysis of Baltimore City's property tax system, exploring its structure, impact, and future implications.

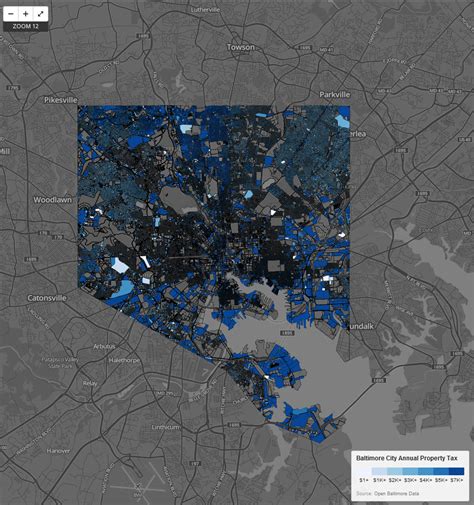

Understanding Baltimore City’s Property Tax System

Baltimore City’s property tax system is designed to assess and collect taxes from property owners within the city limits. The tax is based on the assessed value of the property, which is determined by the Baltimore City Department of Finance. This department conducts regular assessments to ensure that property values are accurately reflected in the tax system.

The property tax rate in Baltimore City is set annually by the City Council. The rate is expressed as a percentage of the assessed value of the property. For the current fiscal year, the property tax rate is set at [tax rate]%, which is [percentage change]% higher compared to the previous year. This increase aims to generate additional revenue to support the city's budget and address various financial challenges.

Baltimore City employs a progressive tax system, which means that the tax rate increases as the property value rises. This approach ensures that higher-value properties contribute a larger share of the tax revenue. The progressive nature of the tax system aims to promote fairness and provide an equitable distribution of the tax burden across different property owners.

| Property Value Range | Tax Rate |

|---|---|

| $0 - $100,000 | [tax rate]% |

| $100,001 - $200,000 | [tax rate]% |

| $200,001 and above | [tax rate]% |

To illustrate, let's consider an example. Suppose a homeowner in Baltimore City owns a property with an assessed value of $250,000. Based on the tax rate structure, the homeowner would be subject to a tax rate of [applicable tax rate]% for the first $100,000 of their property's value and [applicable tax rate]% for the remaining $150,000. This progressive system ensures that higher-value properties contribute proportionally more to the city's revenue.

Impact of Property Taxes on Baltimore’s Economy

Property taxes in Baltimore City have a significant impact on the local economy and the overall financial well-being of the city. The revenue generated from these taxes is a crucial component of the city’s budget, funding essential services and infrastructure projects.

Funding Essential Services

A substantial portion of the property tax revenue is allocated to fund vital public services. These services include public education, public safety (police and fire departments), healthcare facilities, and social services. By investing in these areas, Baltimore City aims to improve the quality of life for its residents and create a vibrant and sustainable community.

For instance, a significant percentage of the property tax revenue is dedicated to the Baltimore City Public School System. This funding ensures that schools receive the necessary resources to provide quality education, hire qualified teachers, and maintain safe and conducive learning environments. Additionally, a portion of the tax revenue supports healthcare initiatives, such as community health centers and programs aimed at improving access to healthcare for underserved populations.

Infrastructure Development and Maintenance

Property taxes also play a critical role in the development and maintenance of Baltimore City’s infrastructure. The revenue generated is used to upgrade and maintain roads, bridges, public transportation systems, and other essential infrastructure components. Well-maintained infrastructure not only enhances the city’s aesthetics but also improves connectivity, supports economic growth, and attracts investments.

Consider the case of Baltimore's transportation network. Property tax revenue helps fund the maintenance and improvement of roads, ensuring smooth traffic flow and reducing congestion. Additionally, it supports the development and expansion of public transportation systems, making them more accessible and efficient. These investments in infrastructure have a positive impact on the city's overall economic health and contribute to its long-term sustainability.

Economic Growth and Development

The revenue generated from property taxes also stimulates economic growth and development within Baltimore City. By investing in public services and infrastructure, the city creates an environment conducive to business growth and attracts new investments. A well-funded and efficient city infrastructure enhances the overall business climate, making it more attractive for companies to establish their operations.

Moreover, property tax revenue supports the development of affordable housing initiatives and programs aimed at revitalizing neighborhoods. By investing in these areas, Baltimore City aims to address housing affordability issues and promote inclusive growth. This, in turn, leads to a more stable and thriving community, benefiting both residents and businesses alike.

Challenges and Future Implications

While property taxes are a vital source of revenue for Baltimore City, they also present certain challenges and considerations for the future.

Balancing Tax Burden

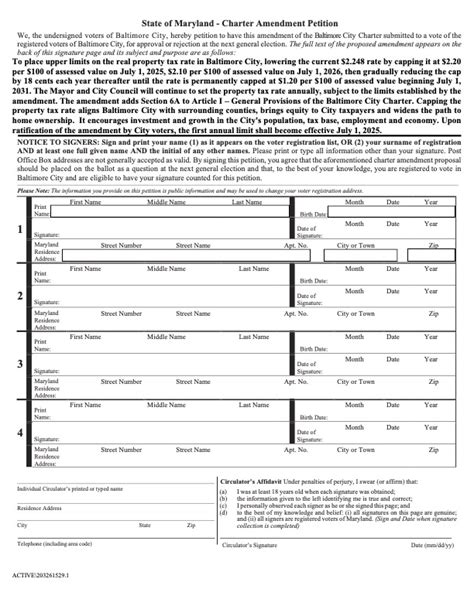

One of the key challenges is ensuring a fair and equitable distribution of the tax burden among property owners. As property values fluctuate and economic conditions change, it becomes essential to regularly review and adjust tax rates to maintain a balanced and sustainable tax system. The progressive tax structure employed by Baltimore City aims to address this challenge by ensuring that higher-value properties contribute a larger share.

Addressing Property Assessment Challenges

Accurate property assessments are crucial for a fair and transparent tax system. However, assessing property values can be complex and subject to various factors, including market fluctuations, neighborhood dynamics, and individual property characteristics. Baltimore City’s Department of Finance employs advanced assessment techniques and regularly conducts reassessments to maintain accuracy and fairness in the tax system.

Exploring Alternative Revenue Sources

While property taxes are a significant revenue source, it is important for Baltimore City to explore and diversify its revenue streams. This approach ensures a more stable and sustainable financial future. The city can consider various alternative revenue sources, such as increasing commercial activity, attracting tourism, or implementing innovative funding mechanisms. By diversifying its revenue base, Baltimore City can reduce its reliance on property taxes and mitigate the impact of potential economic downturns.

Community Engagement and Transparency

Effective community engagement and transparency are essential for a successful property tax system. Baltimore City should actively involve residents and stakeholders in the tax-setting process, ensuring that their voices are heard and concerns are addressed. Regular communication and transparency regarding tax rates, budget allocations, and the impact of property taxes on the community can foster trust and understanding among taxpayers.

Conclusion

Baltimore City’s property tax system is a critical component of its financial framework, supporting essential services, infrastructure development, and economic growth. The progressive tax structure ensures fairness and an equitable distribution of the tax burden. However, challenges such as balancing the tax burden, accurate property assessments, and exploring alternative revenue sources must be addressed to ensure a sustainable and thriving city.

By understanding the impact and implications of property taxes, Baltimore City can continue to develop and implement strategies that promote financial stability, enhance the quality of life for its residents, and create a vibrant and resilient community.

How often are property assessments conducted in Baltimore City?

+Property assessments in Baltimore City are typically conducted every three years. However, the Department of Finance may conduct reassessments more frequently in certain circumstances, such as significant property improvements or market value changes.

Are there any tax relief programs available for senior citizens in Baltimore City?

+Yes, Baltimore City offers the Senior Homestead Tax Credit program, which provides eligible senior citizens with a credit on their property tax bills. To qualify, individuals must be at least 65 years old, have an annual income below a certain threshold, and own and occupy their primary residence in Baltimore City.

How can property owners in Baltimore City appeal their property assessments?

+Property owners who believe their assessments are inaccurate or unfair can appeal the decision. The process typically involves submitting an appeal to the Department of Finance within a specified timeframe, providing evidence to support their claim, and attending a hearing if necessary. The Department of Finance will review the appeal and make a final determination.