How To Find Real Estate Taxes Paid

Determining the real estate taxes paid on a property is an essential step for buyers, sellers, and investors alike. These taxes, often overlooked, can significantly impact the overall cost of owning a property and are crucial to consider when evaluating a potential real estate investment. This guide aims to provide a comprehensive, step-by-step approach to discovering the actual real estate taxes paid on a property, empowering you with the knowledge to make informed decisions.

Understanding Real Estate Taxes

Real estate taxes, also known as property taxes, are a crucial component of owning a property. These taxes are typically levied by local governments and are based on the assessed value of the property. The funds collected through these taxes are often used to support local services and infrastructure, such as schools, roads, and emergency services.

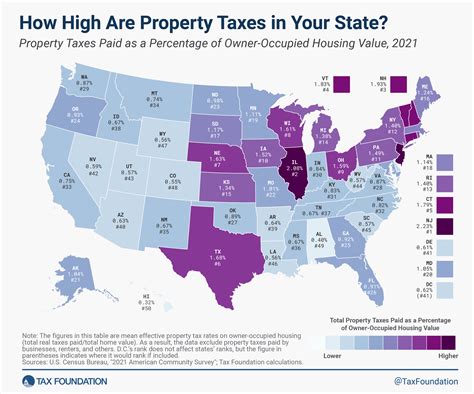

The tax rates and assessment methods can vary widely between different jurisdictions, making it essential to understand the specific rules and regulations in the area of interest. Factors influencing the tax rate include the type of property, its location, and the local tax climate. For instance, residential properties might be taxed at a different rate than commercial properties, and rural areas may have distinct tax rates compared to urban centers.

Locating Real Estate Tax Information

Uncovering the real estate taxes paid on a property involves several steps, each providing a piece of the puzzle. Here’s a detailed guide to help you navigate this process:

Step 1: Check the Property Tax Records

The most straightforward method to access real estate tax information is by examining the property tax records. These records are typically maintained by the local government or the county tax assessor’s office. They provide a wealth of information, including the assessed value of the property, the tax rate, and the actual taxes paid in the previous years.

To access these records, you can either visit the tax assessor's office in person or explore their online portal. Many jurisdictions now offer digital access to these records, making it more convenient for property owners and prospective buyers to retrieve this information. When searching online, ensure you're using the correct keywords and filters to narrow down the results to the specific property of interest.

Step 2: Contact the Property Owner

If you’re unable to locate the tax records through official channels, another option is to reach out to the current property owner. They might be willing to share their recent tax bills or provide insights into the average taxes they’ve been paying. However, it’s important to note that this method relies on the owner’s willingness to share such information and their records might not be entirely accurate or up-to-date.

Step 3: Consult a Real Estate Agent

Real estate agents are often privy to a vast network of resources and can provide valuable insights into the local property market, including tax information. They might have access to proprietary databases or local knowledge that can help in determining the real estate taxes paid on a property. Engaging a local real estate agent can be especially beneficial when researching properties in unfamiliar areas.

Step 4: Analyze Historical Data

Delving into historical data can offer a comprehensive understanding of the property’s tax history. By examining tax records over several years, you can identify any trends or anomalies. This analysis can help in forecasting future tax liabilities and understanding the stability of the tax burden on the property.

Step 5: Consider Tax Exemptions and Deductions

When researching real estate taxes, it’s crucial to account for any tax exemptions or deductions that might apply to the property. These can significantly reduce the overall tax liability and are often specific to the type of property, its use, or the owner’s circumstances. Examples include homestead exemptions for primary residences or agricultural tax exemptions for farms.

| Tax Exemption Type | Description |

|---|---|

| Homestead Exemption | Reduces property taxes for primary residence owners. |

| Agricultural Exemption | Provides tax relief for agricultural lands. |

| Senior Citizen Exemption | Offers reduced taxes for senior homeowners. |

The Impact of Real Estate Taxes

Understanding the real estate taxes paid on a property is not just a matter of compliance but also a strategic consideration. These taxes can significantly influence the financial viability of a property investment. For instance, a property with consistently high taxes might impact the potential rental income or resale value, making it less attractive to investors.

On the other hand, properties with lower taxes might be more affordable to own and operate, offering a competitive advantage in the market. Therefore, researching and understanding the tax landscape is a crucial step in any real estate transaction, whether you're buying, selling, or investing.

Future Implications

As the real estate market continues to evolve, so do the tax policies and assessment methods. Staying informed about potential changes in tax laws and regulations is essential for property owners and investors. These changes can significantly impact the overall tax burden, affecting the financial health of real estate portfolios.

Additionally, advancements in technology and data analytics are transforming the way real estate taxes are assessed and collected. Governments are increasingly adopting digital platforms and data-driven approaches to tax administration, which could lead to more efficient and transparent tax systems. Keeping abreast of these developments can help property owners and investors anticipate and adapt to future changes.

How often do real estate taxes change?

+Real estate tax rates can change annually, typically based on a reassessment of property values. However, some jurisdictions might have longer reassessment cycles, such as every 2-5 years.

Can real estate taxes be negotiated?

+In most cases, real estate taxes are determined by the local government and cannot be negotiated. However, property owners can appeal their assessed value if they believe it is inaccurate, which could lead to a reduction in taxes.

What happens if real estate taxes are not paid on time?

+Late payment of real estate taxes can result in penalties, interest, and potential legal action. In extreme cases, the property might be subject to a tax sale, where the local government sells the property to recover the unpaid taxes.