Savers Tax Credit

The Savers Tax Credit, also known as the Retirement Savings Contributions Credit, is a valuable financial incentive designed to encourage low- and moderate-income individuals to start saving for their retirement. This tax credit, offered by the Internal Revenue Service (IRS), provides a financial boost to eligible taxpayers, helping them build a secure retirement nest egg. In this comprehensive article, we delve into the intricacies of the Savers Tax Credit, exploring its purpose, eligibility criteria, and the benefits it offers to those who qualify.

Understanding the Savers Tax Credit

The Savers Tax Credit is a non-refundable tax credit, which means it directly reduces the amount of tax owed to the IRS. This credit is specifically tailored to encourage retirement savings among those who might otherwise find it challenging to set aside funds for their golden years. By providing a financial incentive, the government aims to promote financial security and independence during retirement, reducing the burden on social welfare programs.

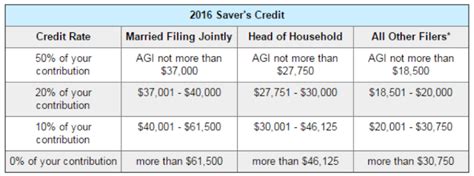

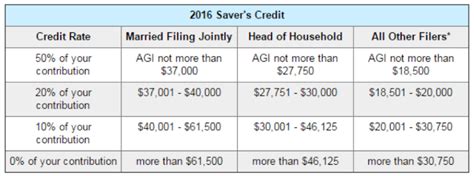

This tax credit can be claimed on Form 8880 and is calculated as a percentage of the contributions made to eligible retirement plans, such as IRAs (Individual Retirement Accounts) and employer-sponsored plans like 401(k)s. The credit percentage varies based on the taxpayer's income level and filing status, offering a higher credit percentage to those with lower incomes.

Eligibility Criteria and Qualifying Contributions

To be eligible for the Savers Tax Credit, taxpayers must meet certain criteria. First and foremost, their adjusted gross income (AGI) must fall within specific limits, which vary based on their filing status: single, married filing jointly, or head of household.

| Filing Status | Maximum AGI for Credit Eligibility |

|---|---|

| Single | $34,000 |

| Married Filing Jointly | $68,000 |

| Head of Household | $51,000 |

Additionally, taxpayers must have made contributions to eligible retirement plans during the tax year. These contributions can include:

- Traditional IRA contributions

- Roth IRA contributions

- Employee contributions to 401(k), 403(b), or similar employer-sponsored plans

- Self-employed retirement plan contributions, such as SEP IRAs or Solo 401(k)s

Calculating the Savers Tax Credit

The Savers Tax Credit is calculated based on the taxpayer's income and the amount contributed to eligible retirement plans. The credit percentage ranges from 10% to 50%, with lower-income taxpayers receiving a higher credit percentage. Here's a simplified calculation:

Credit Percentage = (AGI - $17,500) / $1,250

However, the credit percentage is capped at 50%, so even if the calculation exceeds 50%, the credit percentage will remain at 50%.

Once the credit percentage is determined, it is applied to the retirement contributions made during the tax year. For example, if a taxpayer's AGI is $25,000 and they contribute $2,000 to their IRA, the credit percentage would be 30% (calculated as (25,000 - 17,500) / 1,250), and the Savers Tax Credit would be $600 (30% of $2,000). This credit can be a significant boost to their retirement savings.

Maximizing the Benefits of the Savers Tax Credit

To make the most of the Savers Tax Credit, taxpayers should consider the following strategies:

- Maximizing Contributions: Contribute the maximum allowed to eligible retirement plans, as the credit is calculated based on these contributions.

- Timing Contributions: If possible, time your contributions to ensure they are made within the tax year to qualify for the credit.

- Explore Employer Matches: If eligible for an employer-sponsored plan, take advantage of any matching contributions offered by your employer. This not only increases your retirement savings but also maximizes the credit.

- Rollover IRAs: If you have funds in a previous employer's retirement plan, consider rolling them over to an IRA to potentially qualify for the credit.

The Impact of the Savers Tax Credit on Retirement Planning

The Savers Tax Credit plays a crucial role in encouraging retirement savings among individuals who might otherwise struggle to set aside funds. By providing a financial incentive, it motivates taxpayers to start or continue contributing to their retirement plans. This credit not only helps individuals build a more secure financial future but also promotes financial literacy and long-term financial planning.

Moreover, the Savers Tax Credit can significantly boost the growth of retirement savings over time. By reducing the tax burden, it allows more of the contributions to be invested and grow tax-deferred or tax-free, depending on the type of retirement plan. This compound growth effect can make a substantial difference in the overall retirement savings balance.

Frequently Asked Questions

Can I claim the Savers Tax Credit if I contribute to both a traditional and Roth IRA in the same year?

+Yes, you can claim the Savers Tax Credit for contributions to both types of IRAs. The credit is calculated separately for each type of account, and you can receive the credit for both as long as you meet the eligibility criteria for each.

What if my income exceeds the maximum AGI limit for the Savers Tax Credit eligibility? Can I still claim it?

+Unfortunately, if your income exceeds the maximum AGI limit, you won’t be eligible for the Savers Tax Credit. The credit is designed to target low- and moderate-income taxpayers, so exceeding the income limit disqualifies you from claiming it.

Can I use the Savers Tax Credit to offset other tax liabilities, such as state income tax?

+No, the Savers Tax Credit is a federal tax credit and can only be used to reduce your federal income tax liability. It cannot be used to offset state or local tax liabilities.

Are there any age restrictions for claiming the Savers Tax Credit?

+The Savers Tax Credit is not specifically age-restricted. However, certain retirement plans, like IRAs, have age limits for contributions. For instance, traditional IRA contributions must be made before the age of 70 1⁄2. So, while there’s no direct age limit for the credit, it’s important to consider the contribution requirements of the retirement plans you’re contributing to.

Can I claim the Savers Tax Credit if I’m already receiving Social Security benefits?

+Yes, receiving Social Security benefits does not disqualify you from claiming the Savers Tax Credit. As long as you meet the eligibility criteria and have made eligible contributions to retirement plans, you can claim the credit regardless of your Social Security status.