Florida State Sales Tax Rate

Welcome to an in-depth exploration of the Florida State Sales Tax Rate, a crucial component of the state's revenue system. Understanding the intricacies of sales tax is essential for both businesses and consumers, as it directly impacts the cost of goods and services. This article aims to provide a comprehensive guide to the current Florida sales tax rate, its variations across counties, and its impact on the state's economy.

The Florida Sales Tax: An Overview

The Florida sales tax is a state-level consumption tax levied on the sale of goods and certain services within the state. It is an important source of revenue for the state government, contributing significantly to the funding of public services, infrastructure development, and various state programs. The tax is imposed at both the state and local levels, creating a unique tax structure that varies across the state’s 67 counties.

As of my last update in January 2023, the Florida state sales tax rate stands at 6%. This rate is uniform across the state and is applicable to most tangible personal property and certain services. However, it's important to note that in addition to the state sales tax, there are also local sales tax rates that vary by county, creating a complex yet fascinating tax landscape.

Florida’s County-Level Sales Tax Variations

Florida’s sales tax system is notable for its county-specific rates, which add a layer of complexity to the tax structure. While the state sales tax rate remains consistent at 6%, local governments are authorized to levy additional sales taxes to support their local projects and initiatives.

As of 2023, the highest county sales tax rate in Florida is 8.5%, found in Monroe County. This rate includes the state sales tax of 6% and an additional 2.5% local option tax. On the other end of the spectrum, Hillsborough County has one of the lowest sales tax rates at 7%, consisting of the state tax and an additional 1% local tax. These variations are a result of the unique needs and fiscal policies of each county.

The following table provides a snapshot of sales tax rates in some of Florida's major counties:

| County | Total Sales Tax Rate | State Tax | Local Tax |

|---|---|---|---|

| Miami-Dade | 7.5% | 6% | 1.5% |

| Broward | 7% | 6% | 1% |

| Palm Beach | 7% | 6% | 1% |

| Orange | 7% | 6% | 1% |

| Hillsborough | 7% | 6% | 1% |

Local Option Taxes

The additional local sales taxes, often referred to as local option taxes, are authorized by the state to fund specific local projects. These projects can range from infrastructure improvements to tourism development and public safety initiatives. For instance, a local option tax might be used to fund a new road construction project or support local law enforcement.

It's worth noting that local option taxes are not uniform and can vary significantly between counties and even within a county. This variation is due to the unique needs and priorities of each community. As a result, businesses operating in multiple counties in Florida must be well-versed in the specific sales tax rates applicable to each location.

Impact on Businesses and Consumers

The Florida sales tax rate has a significant impact on both businesses and consumers. For businesses, the tax rate directly influences their pricing strategies and cost of doing business. A higher sales tax rate can increase the cost of goods and services for consumers, impacting their purchasing decisions and overall spending habits.

From a consumer perspective, understanding the sales tax rate is crucial for budget planning and financial management. It's especially important for residents who shop across county lines, as they may encounter different sales tax rates depending on their location. Additionally, tourists and visitors to Florida need to be aware of the sales tax rates to factor them into their travel budgets.

Sales Tax and Tourism

Florida’s sales tax structure plays a significant role in the state’s tourism industry. The state’s warm climate, vibrant cities, and world-class attractions attract millions of visitors each year. The sales tax revenue generated from tourism contributes significantly to the state’s economy, funding public services and infrastructure that benefit both residents and visitors alike.

However, it's important to strike a balance. A high sales tax rate can make Florida's attractions and goods less competitive compared to other destinations. Therefore, the state carefully considers the impact of sales tax rates on tourism, aiming to strike a balance between revenue generation and maintaining a competitive market position.

Compliance and Administration

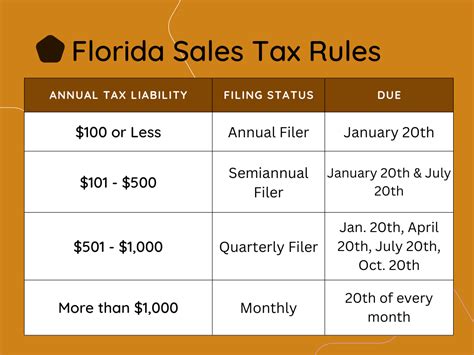

The administration and compliance with Florida’s sales tax system are overseen by the Florida Department of Revenue. The department provides resources and guidance to businesses on sales tax registration, collection, and remittance processes. It also enforces sales tax laws and regulations, ensuring that businesses comply with the state’s tax obligations.

For businesses, understanding and complying with the sales tax regulations is crucial to avoid penalties and legal issues. The Florida Department of Revenue offers various resources, including online tools and guides, to assist businesses in navigating the complex sales tax landscape.

Sales Tax Exemptions and Special Considerations

While the sales tax is applicable to most goods and services, there are certain exemptions and special considerations in Florida. These include:

- Sales tax holidays: Florida occasionally offers sales tax holidays, during which specific items are exempt from sales tax. These holidays often target back-to-school shopping and hurricane preparedness items.

- Food and grocery items: Most unprepared food items are exempt from sales tax in Florida, making groceries more affordable for residents.

- Manufacturing and wholesale businesses: These businesses often have different tax obligations and may be subject to different tax rates or exemptions.

- Remote sellers: Online retailers with no physical presence in Florida are subject to certain sales tax collection requirements based on their sales volume in the state.

Future Outlook and Potential Changes

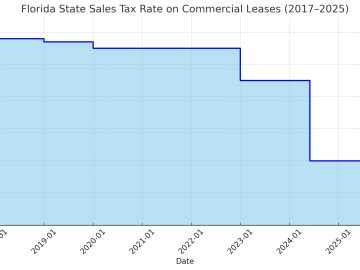

The Florida sales tax rate and its structure are subject to change, influenced by various economic, political, and social factors. While the state sales tax rate has remained stable in recent years, local option taxes have seen fluctuations as counties adjust their fiscal strategies.

Looking ahead, the future of Florida's sales tax rate is tied to the state's economic growth, consumer spending patterns, and the evolving needs of local communities. As the state continues to develop and attract new businesses and residents, the sales tax system will likely adapt to meet these changing dynamics.

Additionally, the ongoing debate surrounding sales tax fairness and uniformity is likely to shape future tax policies. While county-level sales taxes provide much-needed revenue for local projects, they also create a complex tax landscape for businesses and consumers. Balancing the needs of local communities with the desire for a simpler, more uniform tax system will be a key challenge for policymakers in the coming years.

Conclusion

The Florida sales tax rate is a critical component of the state’s revenue system, impacting businesses, consumers, and the overall economy. With its unique county-level variations, the sales tax structure in Florida offers a fascinating insight into the complex relationship between state and local governments in managing public finances.

As we've explored in this article, the sales tax rate influences pricing strategies, consumer spending, and the state's tourism industry. Understanding these dynamics is essential for businesses operating in Florida and for residents and visitors alike. By staying informed about the sales tax landscape, individuals and businesses can make more informed financial decisions and contribute to the state's vibrant economy.

What is the current Florida state sales tax rate as of 2023?

+The current Florida state sales tax rate is 6% as of my last update in January 2023.

Are there any sales tax holidays in Florida?

+Yes, Florida occasionally offers sales tax holidays for specific items like back-to-school supplies and hurricane preparedness items.

How do local option taxes impact the overall sales tax rate in Florida?

+Local option taxes, levied by counties, can add to the state sales tax rate, creating variations in sales tax rates across Florida. These taxes fund specific local projects and initiatives.

Are there any sales tax exemptions in Florida?

+Yes, Florida exempts unprepared food items, certain manufacturing processes, and has special considerations for remote sellers based on their sales volume.