Bay County Tax Collector

Welcome to this comprehensive guide on the Bay County Tax Collector, an essential office for residents of Bay County, Florida. The Bay County Tax Collector plays a vital role in the community, providing essential services and handling various financial and administrative tasks. In this article, we will delve into the functions, services, and impact of this important office, shedding light on its significance and the benefits it brings to the local population.

Understanding the Role of the Bay County Tax Collector

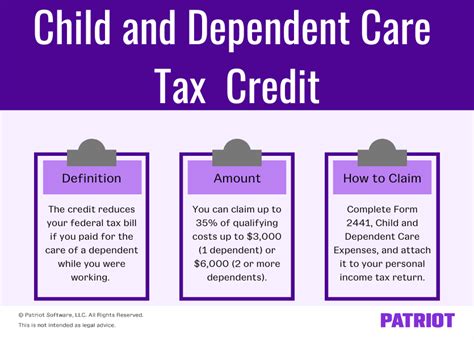

The Bay County Tax Collector’s Office is a government entity responsible for a wide range of tasks, primarily related to the collection and management of taxes, fees, and other financial obligations within the county. It serves as a crucial link between the local government and the residents, offering a convenient and accessible platform for individuals and businesses to fulfill their financial responsibilities.

This office is led by the elected Tax Collector, who serves as a trusted public servant, ensuring the efficient and fair administration of the county's financial affairs. The Tax Collector's role extends beyond tax collection; they are also responsible for various licensing and registration processes, providing essential services that impact the daily lives of Bay County residents.

Services Offered by the Bay County Tax Collector’s Office

The Bay County Tax Collector’s Office provides a comprehensive suite of services, catering to the diverse needs of the community. Here’s an overview of some of the key services offered:

- Vehicle Registration and Titling: Residents can register their vehicles, obtain titles, and renew registrations at the Tax Collector's Office. This service ensures that vehicles are properly registered and licensed, adhering to state regulations.

- Driver License Services: The office offers a range of driver license-related services, including issuing new licenses, renewing existing ones, and processing address changes. This streamlines the process of obtaining or updating driver licenses for Bay County residents.

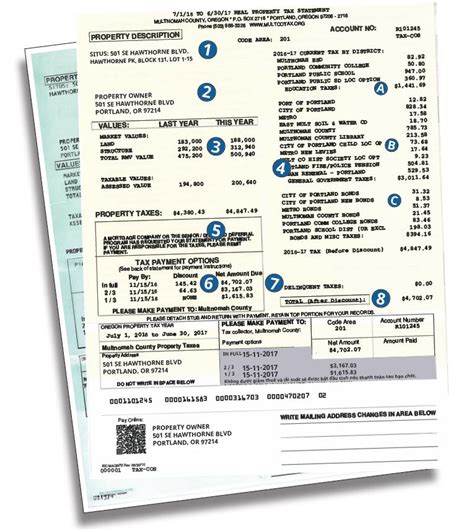

- Property Tax Payment: Property owners can conveniently pay their property taxes at the Tax Collector's Office. The office provides accurate tax information, accepts payments, and ensures timely distribution of funds to the appropriate authorities.

- Business Tax Receipts: Businesses operating within Bay County are required to obtain business tax receipts. The Tax Collector's Office facilitates this process, ensuring compliance with local business regulations.

- Hunting and Fishing Licenses: Outdoor enthusiasts can obtain hunting and fishing licenses through the Tax Collector's Office. This service promotes responsible recreational activities while supporting conservation efforts.

- Vehicle Title Transfers: When buying or selling a vehicle, individuals can visit the Tax Collector's Office to complete the necessary title transfer process, ensuring a smooth and legal transaction.

- Voter Registration: The office also assists residents with voter registration, ensuring their voices are heard in local and national elections. This service plays a crucial role in promoting civic engagement.

| Service Category | Description |

|---|---|

| Vehicle Registration | Registration, titling, and renewal of vehicle registrations |

| Driver Licenses | Issuance, renewal, and updates for driver licenses |

| Property Taxes | Collection and distribution of property taxes |

| Business Taxes | Issuance of business tax receipts and compliance assistance |

| Recreational Licenses | Hunting and fishing licenses for outdoor activities |

| Vehicle Title Transfers | Assistance with vehicle title transfers during buying/selling |

| Voter Registration | Facilitation of voter registration for civic participation |

Impact and Benefits of the Bay County Tax Collector

The Bay County Tax Collector’s Office has a significant impact on the local community, offering numerous benefits that enhance the lives of residents. Here are some key advantages:

Convenience and Accessibility

The Tax Collector’s Office is easily accessible to residents, with multiple locations across the county. This convenience ensures that individuals can easily reach the office, regardless of their location, reducing travel time and effort. The office’s hours of operation are designed to accommodate working individuals, making it convenient for residents to visit during their free time.

Efficient Financial Management

By centralizing various financial transactions, the Tax Collector’s Office streamlines the payment process for residents. Property owners, for instance, can make timely property tax payments, ensuring they meet their financial obligations without the hassle of navigating complex systems. This efficiency reduces the risk of late payments and associated penalties.

Licensing and Registration Compliance

The office plays a crucial role in ensuring that residents and businesses comply with licensing and registration requirements. Whether it’s registering a vehicle, obtaining a driver license, or securing a business tax receipt, the Tax Collector’s Office provides a centralized platform for these essential processes. This compliance not only ensures legal operation but also contributes to the overall safety and well-being of the community.

Civic Engagement and Voter Participation

Through its voter registration services, the Tax Collector’s Office encourages civic engagement and participation in the democratic process. By providing a simple and accessible way to register to vote, the office empowers residents to have a say in local and national elections. This engagement strengthens the democratic fabric of the community and ensures that the voices of Bay County residents are heard.

Support for Conservation and Outdoor Activities

The issuance of hunting and fishing licenses by the Tax Collector’s Office supports responsible outdoor activities and contributes to conservation efforts. These licenses ensure that individuals engage in these activities legally and ethically, promoting sustainable practices and the protection of natural resources. The revenue generated from these licenses also funds conservation initiatives, benefiting the environment and wildlife.

Future Initiatives and Developments

The Bay County Tax Collector’s Office continuously strives to improve its services and adapt to the evolving needs of the community. Here are some potential future initiatives and developments:

- Enhanced Online Services: The office may further develop its online platform, allowing residents to access and complete a wider range of services remotely. This would include secure online payment options, digital document submission, and real-time tracking of transactions.

- Mobile App Integration: To enhance convenience, the Tax Collector's Office could develop a dedicated mobile app. This app would provide residents with easy access to account information, payment history, and notifications, ensuring they stay informed and engaged.

- Community Outreach Programs: The office could initiate community outreach programs to educate residents about tax obligations, licensing requirements, and the importance of compliance. These programs could include workshops, seminars, and interactive sessions, fostering a better understanding of the Tax Collector's role and services.

- Environmental Initiatives: Given the office's role in issuing hunting and fishing licenses, it could collaborate with environmental organizations to promote sustainable practices. This could involve educational campaigns, eco-friendly licensing options, and initiatives to reduce the environmental impact of outdoor activities.

- Expanded Partnership with Local Businesses: The Tax Collector's Office could strengthen its partnerships with local businesses, offering tailored services and support. This could include streamlined processes for business tax receipts, specialized workshops, and collaborative initiatives to support local entrepreneurship.

Conclusion

The Bay County Tax Collector’s Office is an integral part of the local community, providing essential services that impact the daily lives of residents. From vehicle registration to property tax payments, the office ensures compliance, convenience, and efficiency. By offering a comprehensive suite of services, the Tax Collector’s Office simplifies administrative tasks, promotes civic engagement, and contributes to the overall well-being of Bay County.

As the office continues to evolve and adapt, it remains committed to serving the community with integrity, professionalism, and a deep understanding of the county's unique needs. The Bay County Tax Collector's Office stands as a trusted partner, ensuring the financial health and administrative ease of its residents.

What are the office hours of the Bay County Tax Collector’s Office?

+The office hours may vary depending on the location, but typically, the Bay County Tax Collector’s Office is open from 8:00 AM to 5:00 PM, Monday through Friday. Some locations may offer extended hours or Saturday openings to accommodate residents’ schedules.

How can I renew my driver’s license at the Tax Collector’s Office?

+To renew your driver’s license, you can visit the Bay County Tax Collector’s Office with your current license, proof of identity, and proof of residency. The office will guide you through the renewal process, which may involve a vision test and a fee payment. You can also explore online renewal options if eligible.

What is the process for registering a newly purchased vehicle?

+When registering a newly purchased vehicle, you’ll need to bring the vehicle’s title, proof of insurance, and payment for the registration fee to the Bay County Tax Collector’s Office. The office will assist you with the registration process, ensuring your vehicle is properly registered and licensed.

Can I pay my property taxes online through the Tax Collector’s Office?

+Yes, the Bay County Tax Collector’s Office offers an online payment platform for property taxes. You can access the online portal, enter your account information, and make secure payments using a credit/debit card or electronic check. The office provides step-by-step instructions to guide you through the process.

How does the Tax Collector’s Office promote civic engagement through voter registration?

+The Tax Collector’s Office actively promotes voter registration by providing convenient access to the process. Residents can register to vote when visiting the office for other services, such as vehicle registration or driver’s license renewal. The office also participates in community events and outreach programs to encourage voter participation.