Vermont Dept Of Taxes

Welcome to a comprehensive guide exploring the inner workings of the Vermont Department of Taxes. This state agency plays a crucial role in ensuring the efficient and fair administration of taxes in Vermont, contributing significantly to the state's economic landscape and the well-being of its residents. With a rich history and a commitment to transparency and service, the Vermont Department of Taxes offers a range of essential services and resources to individuals and businesses alike.

An Overview of the Vermont Department of Taxes

The Vermont Department of Taxes, often referred to as VTDT, is a state government entity responsible for the collection, management, and enforcement of various taxes within the state. Established with the primary goal of maintaining a robust tax system, VTDT ensures that Vermont’s tax laws are effectively administered, contributing to the state’s economic stability and growth.

Headquartered in the vibrant city of Montpelier, VTDT serves as a vital hub for tax-related activities, offering a range of services and resources to taxpayers across the state. The department's dedicated team of professionals works tirelessly to ensure that the tax system is fair, efficient, and accessible to all Vermonters, fostering an environment conducive to economic prosperity and community development.

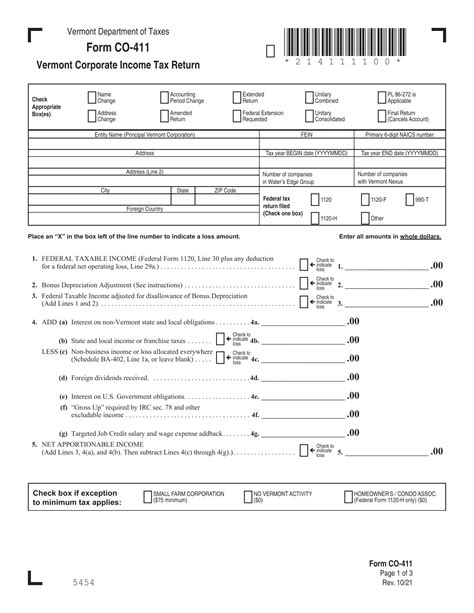

VTDT's scope of work encompasses a wide range of tax types, including income tax, sales and use tax, meals and rooms tax, property tax, and various other specialized taxes. By effectively managing these tax categories, the department plays a pivotal role in supporting state initiatives, funding public services, and contributing to the overall economic health of Vermont.

The department's commitment to transparency and accountability is evident in its robust website, VermontTax.gov, which serves as a comprehensive resource for taxpayers. This online platform provides a wealth of information, including tax forms, guidelines, payment options, and valuable tools to assist taxpayers in navigating the complex world of taxes. VTDT's website is designed to be user-friendly, ensuring that taxpayers can access the information they need quickly and efficiently.

Services and Resources for Individuals

For individuals, the Vermont Department of Taxes offers a range of services tailored to meet their unique tax needs. Whether it’s filing income tax returns, understanding tax credits and deductions, or navigating the complexities of property tax assessments, VTDT provides the necessary resources and guidance.

Income Tax Filing

Vermont residents are required to file annual income tax returns, and VTDT ensures that this process is as streamlined as possible. The department provides clear guidelines and resources, including tax forms and instructions, to assist individuals in accurately reporting their income and calculating their tax liability. Additionally, VTDT offers online filing options, making the process more convenient and efficient for taxpayers.

Tax Credits and Deductions

Vermont offers a variety of tax credits and deductions to support its residents, and VTDT plays a crucial role in educating taxpayers about these benefits. From the Earned Income Tax Credit (EITC) to deductions for child care expenses and higher education, the department ensures that eligible individuals can take advantage of these incentives, reducing their tax burden and promoting financial stability.

Property Tax Assessments

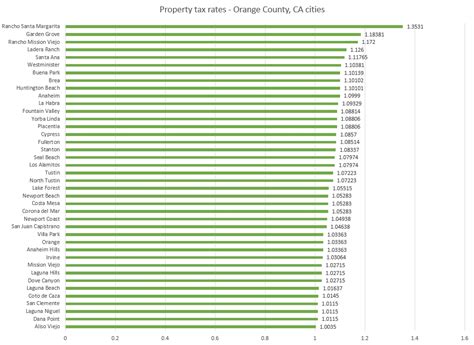

Property taxes are an essential component of Vermont’s tax system, and VTDT works closely with local municipalities to ensure fair and accurate assessments. The department provides resources and guidance to help homeowners understand their property tax obligations, including information on assessment appeals and the factors that influence property tax rates.

Support for Businesses

Vermont’s business community is a vital driver of the state’s economy, and the Vermont Department of Taxes recognizes the unique tax needs and challenges faced by businesses. The department offers a range of services and resources to support businesses in their tax obligations, fostering an environment that encourages growth and investment.

Business Tax Registration and Filing

Businesses operating in Vermont are required to register with the Department of Taxes and meet their tax filing obligations. VTDT provides a straightforward process for business registration, offering online platforms and step-by-step guides to ensure that businesses can easily navigate the registration process. Once registered, businesses can access a range of resources to assist with tax filing, including forms, payment options, and guidance on tax compliance.

Sales and Use Tax

The Sales and Use Tax is a significant source of revenue for Vermont, and VTDT ensures that businesses understand their obligations under this tax. The department provides clear guidelines and resources to help businesses accurately collect and remit sales tax, including information on tax rates, exemptions, and filing requirements. Additionally, VTDT offers support to businesses in navigating the complexities of use tax, ensuring compliance with state regulations.

Tax Incentives for Businesses

Vermont recognizes the importance of supporting business growth and development, and VTDT plays a key role in promoting tax incentives for businesses. The department offers guidance on a range of tax incentives, including tax credits for research and development, job creation, and investments in renewable energy. By providing businesses with access to these incentives, VTDT contributes to the state’s economic growth and fosters a business-friendly environment.

Enforcement and Compliance

While the Vermont Department of Taxes strives to provide a supportive and accessible environment for taxpayers, it also plays a critical role in enforcing tax laws and ensuring compliance. The department’s enforcement efforts are designed to protect the integrity of the tax system and ensure that all taxpayers meet their obligations.

Audit Processes

VTDT conducts audits to verify the accuracy of tax returns and ensure compliance with tax laws. The audit process is designed to be fair and transparent, with taxpayers given the opportunity to provide additional information and documentation to support their tax filings. By conducting audits, the department ensures that the tax system remains equitable and that all taxpayers contribute their fair share.

Collection of Unpaid Taxes

In cases where taxpayers fail to meet their tax obligations, VTDT has processes in place to collect unpaid taxes. The department works with taxpayers to develop payment plans and explore options for resolving tax liabilities. In situations where taxpayers are unable or unwilling to cooperate, VTDT has the authority to pursue legal action to enforce tax compliance.

Penalties and Interest

Vermont’s tax laws stipulate penalties and interest for taxpayers who fail to meet their obligations in a timely manner. VTDT enforces these penalties, ensuring that taxpayers understand the consequences of non-compliance. By imposing penalties, the department encourages taxpayers to meet their obligations promptly and discourages deliberate attempts to evade taxes.

Technology and Innovation

The Vermont Department of Taxes recognizes the importance of leveraging technology to enhance its services and improve the taxpayer experience. The department continuously invests in innovative solutions to streamline processes, increase efficiency, and provide a more user-friendly interface for taxpayers.

Online Services

VTDT offers a range of online services, including electronic filing of tax returns, payment options, and account management. These online services provide taxpayers with convenience and flexibility, allowing them to manage their tax obligations from the comfort of their homes or offices. The department regularly updates and improves these online platforms to ensure they remain secure, user-friendly, and accessible to all Vermonters.

Data Analytics and Insights

VTDT utilizes data analytics to gain valuable insights into tax trends, identify potential issues, and enhance its services. By analyzing taxpayer data, the department can make informed decisions, improve tax policies, and develop targeted initiatives to support taxpayers. Additionally, data analytics help the department identify potential instances of non-compliance, enabling it to focus its enforcement efforts effectively.

Continuous Improvement

The Vermont Department of Taxes is committed to continuous improvement and regularly seeks feedback from taxpayers and stakeholders to enhance its services. The department values transparency and accountability, ensuring that its processes are fair, efficient, and responsive to the needs of Vermonters. By incorporating feedback and staying abreast of technological advancements, VTDT strives to provide a world-class tax administration system.

Community Engagement and Outreach

VTDT understands the importance of engaging with the community and providing outreach programs to educate taxpayers and promote tax awareness. The department actively participates in community events, hosts workshops and seminars, and provides resources to ensure that taxpayers have the knowledge and tools they need to meet their tax obligations.

Taxpayer Education Programs

VTDT offers a range of educational programs and resources to help taxpayers understand their rights and responsibilities under Vermont’s tax laws. These programs cover a wide range of topics, from basic tax concepts to more complex issues, ensuring that taxpayers are well-informed and confident in their tax dealings. The department’s educational initiatives contribute to a culture of tax compliance and awareness, fostering a sense of civic responsibility among Vermonters.

Community Partnerships

VTDT collaborates with community organizations, non-profits, and local governments to extend its reach and provide tax assistance to underserved communities. These partnerships enable the department to offer targeted support and resources to individuals and businesses that may face unique challenges in meeting their tax obligations. By working together, VTDT and community partners can ensure that all Vermonters have access to the information and services they need to navigate the tax system successfully.

Volunteer Tax Assistance Programs

Recognizing that some taxpayers may require additional support, VTDT partners with volunteer organizations to provide free tax preparation assistance. These programs, often offered through community centers and libraries, provide a helping hand to low-income individuals, the elderly, and those with limited access to tax resources. By leveraging the power of volunteers, VTDT ensures that no Vermonter is left behind in the tax process, fostering a sense of community and support.

The Future of Tax Administration in Vermont

As technology continues to advance and tax landscapes evolve, the Vermont Department of Taxes remains committed to staying at the forefront of innovation. The department recognizes the need to adapt to changing times and is dedicated to continuously improving its services to meet the needs of a modern and diverse taxpayer base.

Digital Transformation

VTDT is undergoing a digital transformation, leveraging cutting-edge technologies to enhance its services and improve taxpayer experiences. The department is exploring innovative solutions, such as blockchain and artificial intelligence, to streamline processes, enhance data security, and provide more efficient and effective tax administration. By embracing digital transformation, VTDT aims to reduce administrative burdens, increase transparency, and create a more user-centric tax system.

Tax Policy Reforms

Vermont’s tax policies are subject to ongoing review and evaluation, and VTDT plays a pivotal role in recommending and implementing reforms. The department works closely with policymakers and stakeholders to identify areas where tax policies can be improved, ensuring that the tax system remains fair, efficient, and responsive to the needs of Vermonters. By staying engaged in the policy discourse, VTDT contributes to a dynamic and progressive tax landscape that supports the state’s economic growth and community development.

International Tax Cooperation

In an increasingly globalized world, international tax cooperation is essential to ensure fair taxation and prevent tax evasion. VTDT actively engages with international tax authorities and participates in global initiatives to combat tax avoidance and promote transparency. By collaborating with other jurisdictions, the department contributes to a more equitable tax system, protecting Vermont’s interests and fostering a fair global tax environment.

How can I register my business with the Vermont Department of Taxes?

+To register your business with the Vermont Department of Taxes, you can visit their official website, VermontTax.gov. The website provides a straightforward online registration process, guiding you through the necessary steps to register your business and obtain the required tax identification numbers. You will need to provide basic information about your business, including its legal name, address, and the type of business activity it engages in. Once registered, you will receive the necessary forms and instructions to meet your tax obligations.

What tax credits and deductions are available to Vermont residents?

+Vermont offers a range of tax credits and deductions to support its residents. Some of the notable credits include the Earned Income Tax Credit (EITC), the Vermont Property Tax Circuit Breaker Program, and the Child and Dependent Care Credit. Deductions are available for expenses such as medical and dental costs, state and local taxes paid, and higher education expenses. The Vermont Department of Taxes provides detailed information on these credits and deductions on its website, ensuring that residents can take advantage of these incentives and reduce their tax liability.

How can I check the status of my tax refund in Vermont?

+To check the status of your tax refund in Vermont, you can visit the Vermont Department of Taxes’ official website, VermontTax.gov. The website provides a convenient online tool where you can enter your personal information and check the status of your refund. You will need to provide your Social Security Number or Individual Taxpayer Identification Number, as well as your refund amount and the tax year for which you filed. This online service ensures that you can track your refund conveniently and efficiently.

What are the tax rates for businesses in Vermont?

+The tax rates for businesses in Vermont vary depending on the type of business and its revenue. Generally, Vermont has a flat corporate income tax rate of 6% for C corporations and S corporations. Additionally, businesses are subject to the Sales and Use Tax, with a base rate of 6%. However, certain goods and services may be subject to different tax rates or exemptions. It’s important for businesses to consult the Vermont Department of Taxes’ website or seek professional advice to understand their specific tax obligations.

How can I reach the Vermont Department of Taxes for assistance or inquiries?

+The Vermont Department of Taxes provides various channels for taxpayers to seek assistance and address their inquiries. You can visit their official website, VermontTax.gov, which offers a comprehensive help section with frequently asked questions and detailed information on various tax topics. Additionally, you can contact the department directly by phone or email. The website provides contact information for different departments and services, ensuring that taxpayers can receive timely assistance and accurate information.