New Hanover County Tax Department

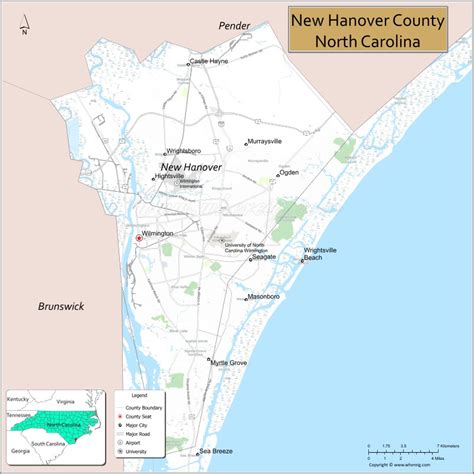

Welcome to a comprehensive guide on the New Hanover County Tax Department, a crucial government entity responsible for the assessment and collection of taxes within the vibrant county of New Hanover, North Carolina. In this article, we will delve into the inner workings of this department, its role in the community, and the services it offers to taxpayers. Get ready to uncover the intricacies of tax administration and discover how this department ensures the smooth functioning of local government through effective tax management.

An Overview of the New Hanover County Tax Department

The New Hanover County Tax Department stands as a cornerstone of the county’s financial framework, tasked with the vital responsibility of assessing and collecting taxes from both residents and businesses. This department plays a pivotal role in sustaining the county’s operations, funding essential services, and contributing to the overall economic stability of the region.

The department's operations are governed by a team of dedicated professionals who possess a wealth of knowledge and experience in tax administration. Their expertise ensures that the tax assessment and collection process is conducted with precision and fairness, adhering to the stringent guidelines set forth by local and state authorities.

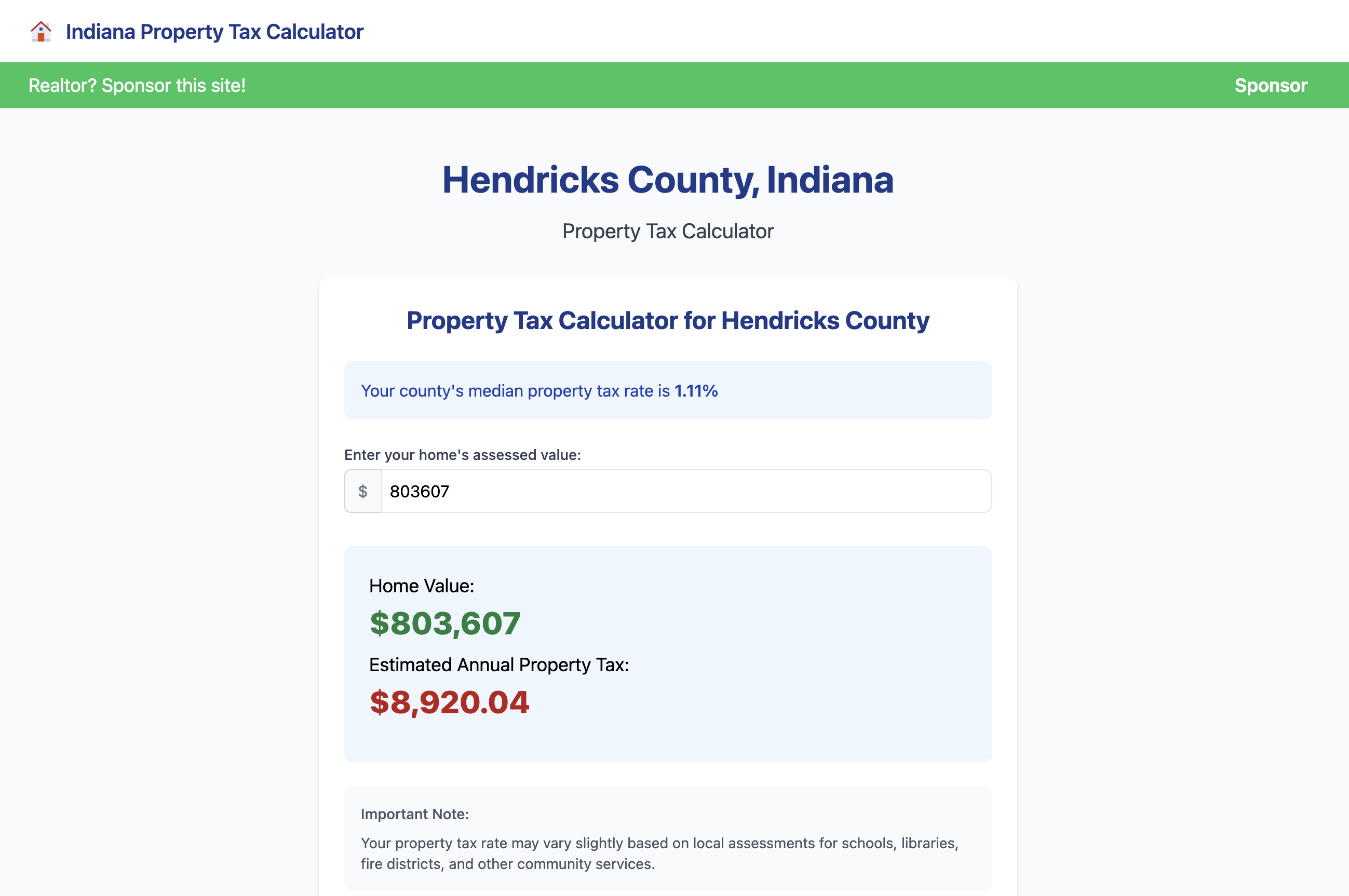

One of the key aspects of the department's work is the valuation of properties within the county. This process involves meticulous assessment of each property's worth, taking into account various factors such as location, size, and market trends. These valuations are then used to determine the property tax liabilities for each taxpayer, ensuring that the tax burden is distributed equitably across the community.

In addition to property taxes, the New Hanover County Tax Department also handles the collection of various other taxes, including sales taxes, business taxes, and special assessments. The department's comprehensive approach to tax administration ensures that all revenue streams are efficiently managed, maximizing the county's financial resources.

Key Services Offered by the New Hanover County Tax Department

The New Hanover County Tax Department provides a range of essential services to taxpayers, making the tax payment process as seamless and accessible as possible. Here are some of the key services offered by the department:

- Online Tax Payment Portal: Taxpayers can conveniently pay their taxes online through a secure and user-friendly portal. This service offers flexibility and efficiency, allowing residents and businesses to make payments at their convenience without the need for physical visits to the department.

- Tax Assessment Information: The department maintains a comprehensive database of tax assessment records, which are accessible to the public. Taxpayers can easily retrieve information about their property's assessed value, tax rates, and any applicable exemptions or deductions. This transparency fosters trust and ensures that taxpayers have the necessary information to understand their tax obligations.

- Tax Payment Plans: Recognizing that tax payments can be a financial burden for some taxpayers, the department offers installment payment plans. These plans allow taxpayers to spread their tax liabilities over a specified period, making it more manageable to meet their obligations. The department works closely with taxpayers to create tailored payment plans that suit individual financial circumstances.

- Taxpayer Assistance: The New Hanover County Tax Department prioritizes taxpayer support and assistance. A dedicated team of professionals is available to provide guidance and clarification on tax-related matters. Whether it's understanding complex tax regulations, resolving discrepancies, or addressing concerns, the department strives to ensure that taxpayers receive the help they need.

By offering these services, the New Hanover County Tax Department demonstrates its commitment to serving the community and fostering a positive taxpayer experience. The department's focus on accessibility, transparency, and support contributes to a more efficient and fair tax system, benefiting both taxpayers and the county as a whole.

Tax Assessment Process: A Comprehensive Breakdown

The tax assessment process undertaken by the New Hanover County Tax Department is a meticulous and detailed endeavor, ensuring that every property within the county is accurately valued for tax purposes. This process is crucial for maintaining fairness and equity in the distribution of tax liabilities among residents and businesses.

At the heart of this process is the property appraisal, where trained professionals conduct on-site inspections and gather extensive data about each property. These appraisers consider a multitude of factors, including the property's physical characteristics, recent improvements, and market trends. By analyzing these elements, they can determine an accurate and fair market value for each property.

Once the appraisal is complete, the assessed value is then applied to the prevailing tax rate, which is determined by the county commissioners based on the budget requirements and the need to maintain essential services. This calculation results in the tax liability for each property owner.

However, the tax assessment process does not end there. The New Hanover County Tax Department understands the importance of transparency and taxpayer rights. As such, it provides avenues for taxpayers to appeal their assessed values if they believe there has been an error or if they disagree with the assessment. This appeal process ensures that taxpayers have a voice and can seek a fair resolution if they feel their property has been overvalued.

The department also takes into account various exemptions and deductions that may apply to certain taxpayers. These exemptions can reduce the taxable value of a property, providing relief to eligible taxpayers. The department's commitment to accuracy and fairness extends to ensuring that these exemptions are properly applied and that no taxpayer is disadvantaged.

Through this comprehensive and meticulous tax assessment process, the New Hanover County Tax Department strives to create a tax system that is not only efficient but also equitable. By valuing each property accurately and providing avenues for taxpayer engagement, the department ensures that the tax burden is shared fairly among the community.

The Impact of Tax Assessments on the Community

Tax assessments conducted by the New Hanover County Tax Department have a profound impact on the community, influencing not only the financial obligations of taxpayers but also shaping the economic landscape of the county.

Accurate tax assessments ensure that the county's revenue stream is stable and predictable. This stability is crucial for funding essential services such as education, public safety, and infrastructure development. By properly valuing properties and assessing taxes, the department contributes to the overall financial health and sustainability of the county.

Furthermore, tax assessments play a vital role in promoting fairness and equity within the community. When properties are assessed accurately, taxpayers are assured that they are paying their fair share, based on the value of their property and the prevailing tax rate. This sense of fairness fosters trust in the tax system and encourages taxpayers to fulfill their obligations voluntarily.

The tax assessment process also has implications for property owners' decision-making. Accurate assessments provide a clear picture of a property's worth, influencing investment decisions, renovation projects, and even the timing of real estate transactions. Property owners can make informed choices based on the assessed value, knowing that it reflects the current market conditions and their potential tax liabilities.

Additionally, the tax assessment data collected by the New Hanover County Tax Department serves as a valuable resource for economic development initiatives. Planners and policymakers can analyze this data to identify growth areas, assess the impact of new developments, and make informed decisions about future investments. This data-driven approach enhances the county's ability to attract businesses, create jobs, and foster economic prosperity.

In summary, the tax assessment process undertaken by the New Hanover County Tax Department is a critical component of the county's economic ecosystem. It ensures financial stability, promotes fairness, and provides valuable insights for community development. By conducting meticulous assessments and maintaining transparency, the department plays a pivotal role in shaping the future of New Hanover County.

Navigating the Tax Payment Process: A Step-by-Step Guide

Paying taxes is an essential responsibility for every resident and business owner in New Hanover County, and the New Hanover County Tax Department has streamlined the process to make it as convenient and user-friendly as possible. Here’s a step-by-step guide to help you navigate the tax payment process smoothly.

Step 1: Understanding Your Tax Bill

Before making a payment, it’s crucial to understand the details of your tax bill. The bill will include information such as your property’s assessed value, the applicable tax rate, and the total amount due. Take the time to review this information carefully to ensure accuracy and identify any potential discrepancies.

If you have any questions or concerns about your tax bill, the New Hanover County Tax Department offers taxpayer assistance services. You can reach out to their dedicated team for clarification and guidance. They are there to ensure that you understand your tax obligations and can address any issues you may have.

Step 2: Choosing Your Payment Method

The New Hanover County Tax Department provides multiple payment methods to accommodate different preferences and needs. Here are some of the options available:

- Online Payment Portal: The department's online payment portal is a secure and efficient way to make your tax payments. You can access the portal through the official website, where you'll be guided through a straightforward process to complete your payment. This method offers convenience and flexibility, allowing you to pay from the comfort of your home or office.

- Mail-In Payments: If you prefer a more traditional approach, you can mail your tax payment to the New Hanover County Tax Department. Simply include your payment, along with your tax bill stub, in a self-addressed envelope and send it to the designated address. Remember to allow sufficient time for mailing and processing to ensure your payment is received on time.

- In-Person Payments: For those who prefer face-to-face interactions, the department offers the option to make payments in person. Visit the New Hanover County Tax Office during their operating hours, and a friendly staff member will assist you in making your payment. This method provides an opportunity to address any immediate concerns or questions you may have.

Step 3: Making Your Payment

Once you’ve chosen your preferred payment method, it’s time to make your tax payment. Whether you’re using the online portal, mailing in your payment, or visiting the tax office in person, ensure that you have the necessary funds available and that your payment is made in a timely manner to avoid any late fees or penalties.

When making your payment, keep a record of the transaction for your records. This could include a confirmation number from the online portal, a copy of the mailed payment, or a receipt from the in-person payment. These records will serve as proof of payment and can be useful in case of any future inquiries.

If you encounter any difficulties or have questions during the payment process, don't hesitate to reach out to the New Hanover County Tax Department for assistance. Their team is committed to providing a positive taxpayer experience and will guide you through any challenges you may face.

Step 4: Managing Your Tax Account

After making your tax payment, it’s essential to stay informed about your tax account status. The New Hanover County Tax Department offers online account management tools that allow you to track your payments, view your account balance, and access important tax-related information.

By regularly monitoring your tax account, you can ensure that your payments are processed correctly and that your tax obligations are up to date. This proactive approach helps you avoid any unexpected surprises and allows you to plan your finances more effectively.

The New Hanover County Tax Department's commitment to transparency and accessibility ensures that taxpayers have the tools and resources they need to manage their tax accounts efficiently. By utilizing these online tools and staying engaged with the department, you can maintain a positive relationship with the tax office and contribute to the smooth functioning of the county's tax system.

The Role of the New Hanover County Tax Department in Economic Development

The New Hanover County Tax Department plays a vital role in the economic development and growth of the county. Beyond its core function of tax assessment and collection, the department serves as a catalyst for stimulating economic activity and attracting investments.

One of the key ways the department contributes to economic development is through its role in maintaining a stable and predictable tax environment. By conducting fair and accurate tax assessments, the department ensures that businesses and investors have clarity and certainty regarding their tax obligations. This predictability fosters an environment conducive to business growth and encourages long-term investments.

Furthermore, the department's commitment to transparency and taxpayer engagement enhances the county's reputation as a desirable place to do business. By providing accessible information, offering assistance, and resolving taxpayer concerns, the department creates a positive perception of the county's tax system. This, in turn, attracts businesses and entrepreneurs who value a supportive and efficient tax administration.

The New Hanover County Tax Department also actively collaborates with other county departments and economic development agencies to promote business growth. Through partnerships and joint initiatives, the department contributes to the development of economic incentives, tax abatements, and other programs aimed at attracting and retaining businesses. These efforts not only enhance the county's economic competitiveness but also create job opportunities and boost the local economy.

Fostering Business Growth and Investment

The New Hanover County Tax Department recognizes the importance of fostering a business-friendly environment to support economic growth. To achieve this, the department offers a range of services and initiatives aimed at easing the tax burden on businesses and encouraging investment.

For instance, the department provides specialized assistance to new businesses, helping them navigate the tax registration process and understand their tax obligations. This support ensures that businesses can focus on their core operations while complying with tax regulations efficiently.

Additionally, the department works closely with business associations and chambers of commerce to address their tax-related concerns and provide tailored solutions. By engaging with the business community, the department gains valuable insights into the challenges faced by local businesses, allowing it to develop targeted initiatives to support their growth.

The New Hanover County Tax Department also offers tax incentives and credits to eligible businesses. These incentives, such as tax abatements or tax credits for job creation, provide financial relief to businesses and encourage them to invest in the county. By attracting and retaining businesses, the department contributes to the diversification of the local economy and enhances the county's economic resilience.

In summary, the New Hanover County Tax Department's dedication to economic development extends beyond its tax administration duties. Through its efforts to create a stable tax environment, foster business growth, and collaborate with economic development stakeholders, the department plays a crucial role in shaping the county's economic future. By supporting businesses and attracting investments, the department contributes to the prosperity and well-being of the entire New Hanover County community.

Future Outlook: The New Hanover County Tax Department’s Vision

As the New Hanover County Tax Department looks to the future, it is committed to continuous improvement and innovation to enhance its services and better serve the needs of the community. With a focus on technology, efficiency, and taxpayer satisfaction, the department is poised to meet the challenges and opportunities that lie ahead.

Embracing Technology for Enhanced Services

The New Hanover County Tax Department recognizes the transformative power of technology in modern tax administration. As such, it is investing in digital solutions to streamline processes, improve accuracy, and provide taxpayers with more convenient and accessible services.

One area of focus is the development of a comprehensive online platform that integrates various tax-related services. This platform will enable taxpayers to access their tax information, make payments, and manage their accounts from a single, user-friendly interface. By consolidating services online, the department aims to reduce administrative burdens and provide a more efficient experience for taxpayers.

Additionally, the department is exploring the use of advanced data analytics to optimize tax assessments and enhance taxpayer engagement. By leveraging data-driven insights, the department can identify trends, detect anomalies, and make more informed decisions. This approach not only improves the accuracy of tax assessments but also allows for more targeted taxpayer outreach and support.

Efficient Operations and Taxpayer Satisfaction

The New Hanover County Tax Department understands that efficiency is key to delivering exceptional taxpayer services. To this end, the department is implementing process improvements and staff training initiatives to enhance productivity and reduce response times.

By streamlining internal workflows and adopting best practices, the department aims to minimize wait times and improve overall efficiency. This focus on operational excellence ensures that taxpayers receive timely responses to their inquiries and that their tax obligations can be fulfilled with minimal hassle.

Furthermore, the department is dedicated to fostering a culture of taxpayer satisfaction. It strives to create a positive and supportive environment where taxpayers feel heard and valued. Through proactive outreach, personalized assistance, and continuous feedback mechanisms, the department aims to build strong relationships with taxpayers and address their needs effectively.

Collaborative Partnerships for Community Development

Recognizing that effective tax administration is interconnected with community development, the New Hanover County Tax Department is committed to building strong partnerships with local organizations and stakeholders.

By collaborating with community groups, businesses, and government agencies, the department can better understand the unique needs and challenges of the county. This collaborative approach allows for the development of tailored solutions and initiatives that address specific community concerns. Whether it's supporting local businesses, promoting affordable housing, or enhancing public services, the department aims to contribute to the overall well-being and prosperity of New Hanover County.

In conclusion, the New Hanover County Tax Department is committed to a vision of continuous improvement and innovation. By embracing technology, prioritizing efficiency, and fostering collaborative partnerships, the department is well-positioned to navigate the future with confidence and provide exceptional services to the community it serves.

Frequently Asked Questions (FAQ)

How often does the New Hanover County Tax Department reassess property values?

+

The New Hanover County Tax Department typically conducts reassessments of property values every 8 years, or as mandated by state law. However, certain circumstances, such as significant property improvements or market fluctuations, may trigger an earlier reassessment.