Portland Property Tax

Property taxes in Portland, Oregon, play a significant role in funding various public services and infrastructure. These taxes are an essential source of revenue for local governments, schools, and other public entities. Understanding the intricacies of Portland's property tax system is crucial for homeowners, businesses, and anyone interested in real estate within the city.

The Mechanics of Portland Property Taxes

Portland’s property tax system is a complex yet well-regulated process that determines the amount of tax homeowners and property owners pay annually. The tax is primarily based on the assessed value of the property and the tax rates set by different taxing districts within the city.

Assessed Value

The assessed value of a property is determined by the Multnomah County Assessor’s Office. This value is not necessarily the same as the market value. Instead, it is a legally defined value that considers factors like the property’s location, improvements, and other specific characteristics.

| Property Type | Assessment Ratio |

|---|---|

| Residential | 100% |

| Agricultural | 15% |

| Commercial/Industrial | 100% |

Tax Rates

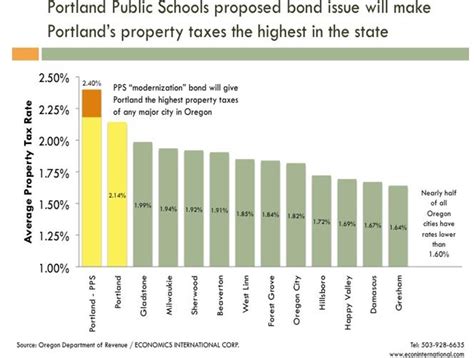

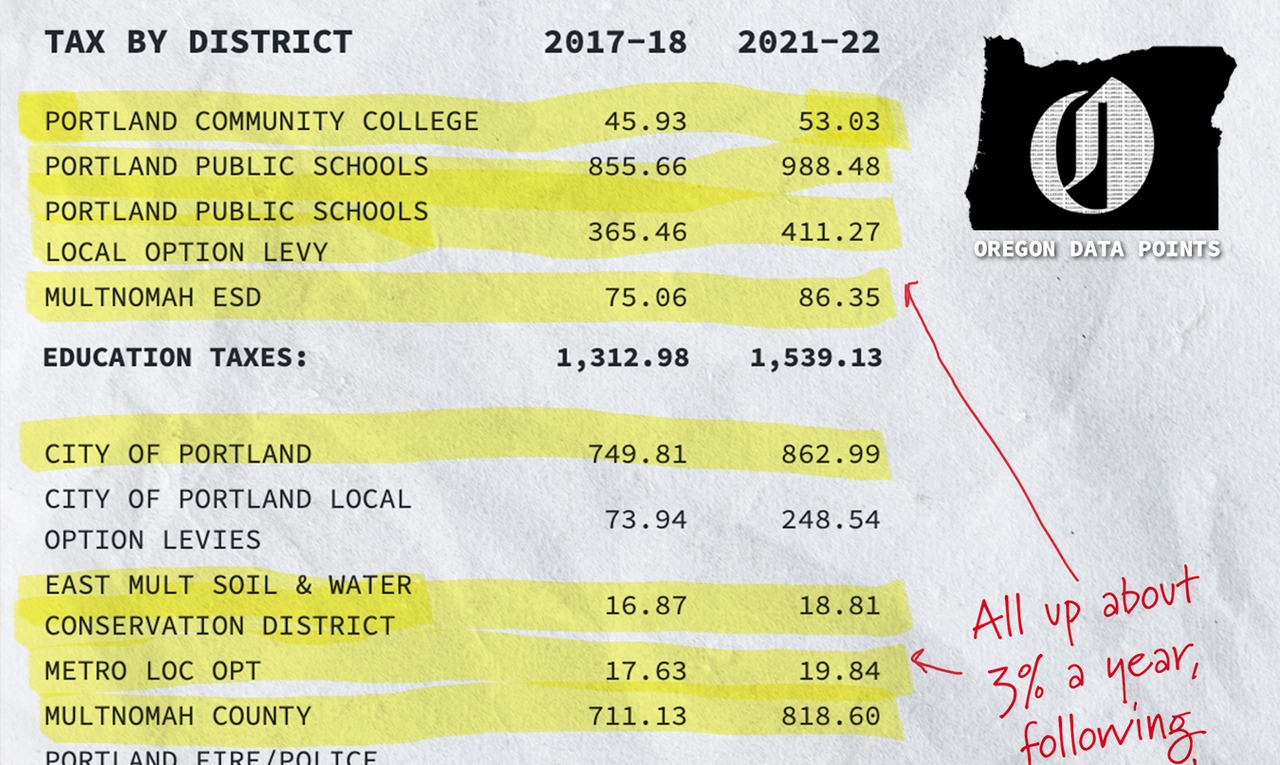

Tax rates in Portland are established by various taxing districts, including the city, county, school districts, and special districts. These rates are expressed in dollars per 1,000 of assessed value. For instance, a tax rate of 20 per 1,000 means that for every 1,000 of assessed value, the property owner pays $20 in taxes.

The actual tax rate can vary significantly depending on the location of the property and the services it receives. For example, properties within the boundaries of a specific school district may have a higher tax rate to support local education.

Calculating Property Taxes

The formula for calculating property taxes in Portland is straightforward: Taxable Value x Tax Rate = Property Tax.

Here's a simple example: If a residential property has an assessed value of $300,000 and the applicable tax rate is $20 per $1,000, the calculation would be as follows: $300,000 x $20 / $1,000 = $6,000 in annual property taxes.

Property Tax Exemptions and Deferrals

Portland offers several exemptions and deferrals to reduce the tax burden on certain property owners. These programs are designed to support specific groups, such as seniors, veterans, and low-income individuals.

Senior and Disabled Property Tax Deferral Program

This program allows eligible seniors and disabled individuals to defer their property taxes. The deferred taxes, along with interest, become a lien on the property and are repaid when the property is sold or the owner no longer meets the program’s requirements.

Property Tax Exemption for Veterans

Veterans with service-connected disabilities may be eligible for a property tax exemption. This exemption reduces the assessed value of the property, resulting in lower taxes. The amount of the exemption depends on the veteran’s disability rating.

Low-Income Property Tax Deferral

Low-income homeowners may qualify for a property tax deferral. This program allows eligible individuals to defer their property taxes, which are then repaid with interest when the property is sold or the homeowner no longer meets the income criteria.

The Impact of Property Taxes on Real Estate Transactions

Property taxes are a significant consideration for buyers and sellers in Portland’s real estate market. They can influence a property’s market value and the overall affordability of homeownership.

Property Tax Considerations for Buyers

When purchasing a property in Portland, buyers should carefully review the property tax information. This includes understanding the current tax rate, the assessed value, and any potential changes in the future. High property taxes can impact a buyer’s decision-making process and their ability to afford the property.

Property Tax Appeals

If a homeowner believes their property’s assessed value is too high, they can file an appeal with the Multnomah County Board of Property Tax Appeals. This process allows homeowners to challenge the assessed value and potentially reduce their property taxes.

Property Tax Considerations for Sellers

Sellers should be transparent about the property taxes when listing their home. High property taxes may deter potential buyers or lead to lower offers. On the other hand, lower taxes can be a selling point, making the property more attractive to buyers.

Portland’s Property Tax System: Future Outlook

The future of Portland’s property tax system is closely tied to the city’s economic growth, real estate market trends, and public service needs. As the city continues to develop and attract new residents, the demand for public services and infrastructure is likely to increase.

To accommodate these needs, the city may explore strategies to ensure a sustainable tax base. This could include adjustments to tax rates, reassessments, or the implementation of new tax policies. It's crucial for property owners and residents to stay informed about these potential changes and their implications.

Potential Changes and Challenges

One of the challenges Portland faces is the need to balance the tax burden fairly across different property types and locations. As the city grows, ensuring that all residents contribute equitably to public services will be a key focus.

Additionally, the city must navigate the delicate balance between generating sufficient revenue through property taxes and maintaining the affordability of homeownership. This is especially important in a market like Portland, which has experienced rapid growth and rising housing costs.

Conclusion

Portland’s property tax system is a vital component of the city’s financial framework, funding essential public services and infrastructure. Understanding this system is crucial for property owners, buyers, and sellers, as it directly impacts their financial obligations and real estate decisions.

As Portland continues to evolve, the property tax landscape will likely undergo changes to adapt to the city's growing needs. Staying informed about these changes and actively engaging with the local government and community can help ensure that the tax system remains fair, sustainable, and supportive of the city's future development.

How often are property taxes assessed in Portland?

+Property taxes in Portland are assessed annually. The assessment is based on the property’s value as of January 1st of each year. This means that any improvements or changes to the property made after this date will not be reflected in the current year’s assessment.

Are there any property tax breaks or incentives for green homes or energy-efficient upgrades in Portland?

+Yes, Portland offers a property tax exemption for properties that meet specific energy efficiency standards. The Energy Trust of Oregon provides a Residential Energy Tax Credit, which can reduce property taxes for homeowners who install energy-efficient upgrades. This includes measures like solar panels, high-efficiency heating systems, and insulation.

How can I estimate my property taxes before purchasing a home in Portland?

+You can estimate your property taxes by multiplying the assessed value of the property by the applicable tax rate. You can find the assessed value on the property listing or by contacting the Multnomah County Assessor’s Office. The tax rate can be obtained from the local taxing districts or through online resources.