Washington Estate Tax

The Washington Estate Tax, often referred to as the "Death Tax," is a complex and often controversial aspect of the state's tax system. It is a tax levied on the transfer of an individual's assets upon their death, impacting many residents and their heirs. Understanding the intricacies of this tax is crucial for estate planning and ensuring a smooth transition of assets.

Understanding the Washington Estate Tax

The Washington Estate Tax is a state-level tax, separate from the federal estate tax. It is imposed on the taxable estate of a deceased individual who was a resident of Washington at the time of their death. This tax aims to capture a portion of the wealth transferred during inheritance, contributing to the state’s revenue.

The tax applies to the "taxable estate," which includes all assets owned by the decedent at the time of their death, such as real estate, investments, business interests, and personal property. However, it is important to note that not all assets are subject to the estate tax. Certain exclusions and deductions are available, allowing heirs to minimize the tax burden.

Exclusions and Deductions

Washington offers several exclusions and deductions to reduce the taxable estate and alleviate the tax burden on heirs. The primary exclusion is the unlimited marital deduction, allowing spouses to pass their entire estate to each other without incurring estate tax. This encourages asset transfer between spouses and simplifies estate planning.

Additionally, Washington provides an exemption amount for individuals. Currently, this exemption is set at $2.193 million for deaths occurring in 2022. This means that estates valued below this threshold are not subject to the estate tax. The exemption amount is adjusted annually, often following the federal estate tax exemption.

Other deductions available include the charitable deduction, allowing heirs to reduce the taxable estate by the value of assets donated to qualified charitable organizations. This encourages philanthropy and supports community initiatives.

| Year | Exemption Amount |

|---|---|

| 2022 | $2.193 million |

| 2021 | $2.155 million |

| 2020 | $2.125 million |

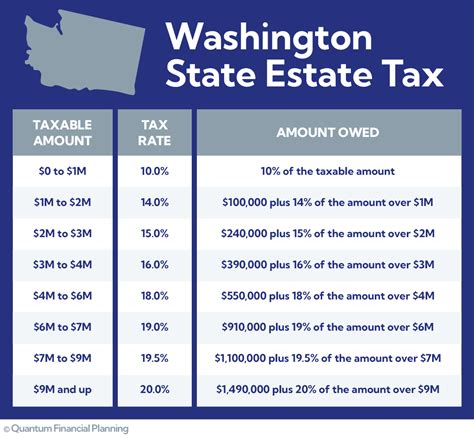

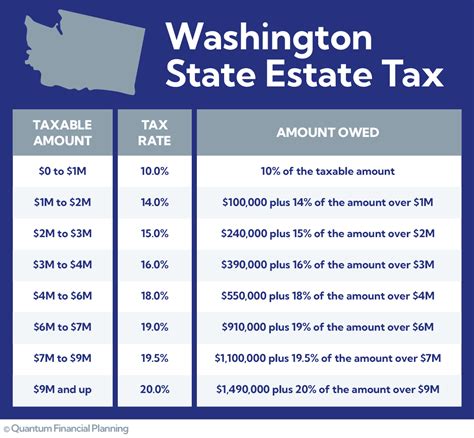

Tax Rates and Calculations

The Washington Estate Tax follows a progressive rate structure, with higher tax rates applied to larger estates. The current tax rates range from 10% to 20%, with the highest rate applicable to estates valued over $11.7 million. This progressive system ensures that larger estates contribute a greater proportion of their value to the state.

To calculate the estate tax, the taxable estate is multiplied by the applicable tax rate. For example, an estate valued at $5 million would be subject to a tax rate of 12%, resulting in an estate tax of $600,000.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $1.2 million | 10% |

| $1.2 million - $2.4 million | 12% |

| $2.4 million - $5.5 million | 14% |

| $5.5 million - $11.7 million | 17% |

| $11.7 million and above | 20% |

Planning and Strategies

Estate planning is crucial to minimize the impact of the Washington Estate Tax and ensure a smooth transition of assets. Here are some strategies to consider:

Gifting and Transfers

Gifting assets during one’s lifetime is a strategy to reduce the taxable estate. Washington allows individuals to gift up to $16,000 per year per recipient without triggering gift taxes. This can help reduce the value of the estate and potentially lower the estate tax liability.

Life Insurance and Trusts

Life insurance proceeds and assets held in certain types of trusts are often excluded from the taxable estate. Establishing an irrevocable life insurance trust (ILIT) can help remove the value of a life insurance policy from the taxable estate, providing funds for heirs while reducing tax obligations.

Charitable Giving

As mentioned earlier, charitable deductions can significantly reduce the taxable estate. Donating assets to qualified charities not only supports worthy causes but also lowers the estate tax burden. This strategy can be particularly beneficial for individuals with substantial assets.

Business Interests and Valuation

The valuation of business interests can greatly impact the taxable estate. Proper valuation and strategic planning can help minimize the tax burden. Consulting with tax professionals and business advisors is crucial to ensure accurate valuation and explore potential tax-saving opportunities.

The Impact and Future of the Washington Estate Tax

The Washington Estate Tax has a significant impact on the state’s revenue and contributes to the funding of various public services and initiatives. It is an important source of income for the state, particularly for education, healthcare, and infrastructure projects.

Looking ahead, the future of the Washington Estate Tax remains uncertain. While the tax has been a stable source of revenue for the state, there have been debates and discussions surrounding its fairness and potential reforms. Some argue for its abolition, citing its impact on small businesses and family farms, while others advocate for maintaining it to support essential state services.

The state legislature regularly reviews and adjusts the estate tax laws, taking into account economic conditions, federal tax reforms, and public sentiment. It is crucial for individuals and businesses to stay informed about any changes to the estate tax laws to ensure effective estate planning and minimize potential tax liabilities.

Conclusion

The Washington Estate Tax is a complex and evolving aspect of the state’s tax system. Understanding its intricacies and staying informed about potential changes is crucial for effective estate planning. By utilizing exclusions, deductions, and strategic planning, individuals can minimize the tax burden and ensure a smoother transition of assets to their heirs.

What is the purpose of the Washington Estate Tax?

+The Washington Estate Tax is a state-level tax imposed on the transfer of assets upon an individual’s death. It aims to capture a portion of the wealth transferred during inheritance, contributing to the state’s revenue and funding public services.

Who is subject to the Washington Estate Tax?

+The Washington Estate Tax applies to the taxable estate of a deceased individual who was a resident of Washington at the time of their death. It includes all assets owned by the decedent, with certain exclusions and deductions available.

How are the tax rates determined in Washington’s Estate Tax?

+Washington’s Estate Tax follows a progressive rate structure, with higher tax rates applied to larger estates. The rates range from 10% to 20%, and the specific rate depends on the value of the taxable estate.

What are some strategies to minimize the Washington Estate Tax burden?

+Strategies to minimize the estate tax burden include gifting assets during one’s lifetime, utilizing life insurance and trusts, making charitable donations, and properly valuing business interests. Consulting with tax professionals is crucial for effective planning.