State Of Ohio Tax Refund Status

Are you eagerly awaiting your tax refund from the State of Ohio? The Ohio Department of Taxation understands that receiving your refund promptly is important, and they have implemented a user-friendly system to check the status of your refund online. This article will guide you through the process, providing you with all the necessary information and tips to ensure a smooth and efficient experience. Let's dive in and explore how you can easily track the progress of your State of Ohio tax refund.

Checking Your Ohio Tax Refund Status

The State of Ohio offers a convenient online tool, the Tax Refund Status Lookup, which allows taxpayers to check the status of their refunds in real-time. This service is accessible through the Ohio Department of Taxation's official website and provides a quick and secure way to obtain the latest information about your refund.

By utilizing this online platform, you can avoid the hassle of making repeated calls or visiting physical offices, as the Tax Refund Status Lookup provides up-to-date and accurate details about your refund. Whether you filed your taxes electronically or via mail, this tool caters to all taxpayers, making the refund tracking process seamless and efficient.

Step-by-Step Guide to Checking Your Refund Status

-

Visit the Official Website: Begin by navigating to the Ohio Department of Taxation's official website. This is the trusted source for all tax-related information and services provided by the state.

-

Access the Refund Status Lookup: On the homepage, look for the "Check Your Refund Status" section or use the website's search feature to locate the Tax Refund Status Lookup tool. This tool is designed to be easily accessible and user-friendly.

-

Enter Your Information: You will be prompted to enter specific details to access your refund status. This typically includes your Social Security Number, Filing Status, and the Amount of Your Expected Refund. Ensure that you enter the exact information as it appears on your tax return to avoid any discrepancies.

-

Submit Your Request: After providing the necessary information, click on the "Submit" or "Check Status" button. The system will process your request and display the current status of your refund.

-

Review the Refund Status: The Tax Refund Status Lookup will provide you with the most recent update on your refund. It may display one of the following messages:

- Refund Sent: This indicates that your refund has been processed and sent out. You can expect to receive it soon, either by direct deposit or mail, depending on your preferred method.

- In Process: If your refund is still being processed, this message will appear. The Ohio Department of Taxation is working on your refund, and you will receive an update once it is ready for disbursement.

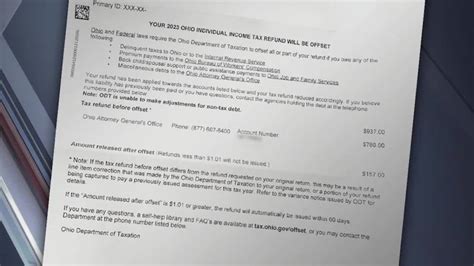

- Additional Information Required: In some cases, the department may need further documentation or clarification from you before processing your refund. If this message appears, it is important to respond promptly with the requested information.

Tip: Keep in mind that the Tax Refund Status Lookup is updated periodically, so you may need to check back if you don't see an immediate update. However, the system is designed to provide accurate and timely information, ensuring that you stay informed about the progress of your refund.

Estimated Refund Timelines

The State of Ohio aims to process tax refunds promptly, and the timeline for receiving your refund depends on several factors, including the method of filing and payment.

| Filing Method | Estimated Refund Timeline |

|---|---|

| E-file with Direct Deposit | Refunds are typically issued within 7-14 business days after the department receives your return. |

| Paper Return with Direct Deposit | The refund process may take approximately 4-6 weeks from the date of receipt. |

| Any Method with Refund by Check | If you opt for a refund by check, allow an additional 2-3 weeks for the processing and mailing of your refund. |

Note: These timelines are estimates and may vary based on individual circumstances and the volume of tax returns being processed. It is always a good practice to plan accordingly and manage your expectations during the tax season.

Contacting the Ohio Department of Taxation

While the Tax Refund Status Lookup provides a convenient way to track your refund, there may be instances where you require further assistance. The Ohio Department of Taxation offers various channels to reach out and seek help.

| Contact Method | Details |

|---|---|

| Telephone | Call the Taxpayer Services Call Center at (800) 282-1780 for general tax inquiries. The call center operates Monday through Friday, 8:00 a.m. to 5:00 p.m. (EST), except on state holidays. |

| For non-urgent matters, you can send an email to tax.questions@tax.ohio.gov. Please allow 3-5 business days for a response. | |

| In-Person | Visit one of the department's district offices. Appointments are recommended and can be scheduled online. Check the official website for the nearest office location and hours of operation. |

When contacting the department, ensure that you have your tax return information readily available to provide accurate and efficient assistance.

Frequently Asked Questions (FAQ)

How long does it typically take to receive my Ohio tax refund after filing electronically with direct deposit?

+On average, it takes about 7-14 business days for the Ohio Department of Taxation to process and issue refunds for e-filed returns with direct deposit. However, factors like the volume of returns and any additional documentation required can influence the timeline.

What should I do if I receive a message stating that additional information is needed for my refund to be processed?

+If you receive a notification that additional information is required, it is crucial to respond promptly. Review the message carefully to understand the specific documentation or clarification needed. Gather the requested information and submit it to the department as soon as possible to avoid further delays in processing your refund.

Can I check my refund status if I filed my Ohio taxes jointly with my spouse?

+Yes, you can check the refund status for a joint tax return. When accessing the Tax Refund Status Lookup, ensure that you have the necessary details for both spouses, including their Social Security Numbers and the expected refund amount. The system will provide an update on the status of your joint refund.

Is it possible to receive my Ohio tax refund by check instead of direct deposit?

+Absolutely! When filing your Ohio tax return, you can indicate your preference for a refund by check. Keep in mind that opting for a refund by check may extend the processing time, as the department needs to print and mail the refund check. Allow for an additional 2-3 weeks for this process.

Remember, staying informed about the status of your State of Ohio tax refund is essential to manage your finances effectively. By utilizing the Tax Refund Status Lookup and understanding the estimated timelines, you can navigate the refund process with ease. Should you have any further questions or require additional assistance, the Ohio Department of Taxation is ready to provide the support you need.