Houston Property Tax Rate

Welcome to a comprehensive guide on the Houston property tax rate. In this article, we will delve into the intricacies of property taxation in Houston, Texas, providing you with valuable insights and information to understand the system better. Property taxes are an essential aspect of homeownership, and being well-informed can make a significant difference in managing your finances effectively.

Understanding the Houston Property Tax System

The property tax system in Houston, like many other cities in Texas, is a crucial source of revenue for local governments and plays a vital role in funding various public services and infrastructure. It is a complex yet necessary process that ensures the smooth functioning of the city and its amenities.

Property taxes in Houston are determined by the tax appraisal value of your property, which is assessed by the Harris County Appraisal District (HCAD). This value is then multiplied by the tax rate set by the various taxing entities within the city. These entities include the city of Houston itself, the county, school districts, and special districts, each with their own tax rates.

Factors Influencing Property Tax Rates

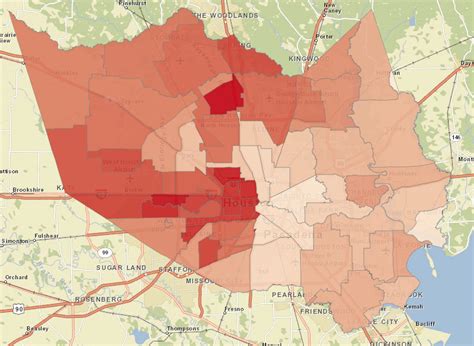

Several factors contribute to the determination of property tax rates in Houston. These include the property’s location, as different taxing entities have varying tax rates, and the property’s appraisal value, which can fluctuate based on market conditions and improvements made to the property.

Additionally, tax rate changes can occur annually, influenced by factors such as the city's budget, the need for additional revenue, or adjustments made by the taxing entities to maintain financial stability.

| Taxing Entity | Tax Rate (Effective Rate per $100 of Appraised Value) |

|---|---|

| City of Houston | 0.600000 |

| Harris County | 0.369000 |

| Houston ISD | 1.332600 |

| Special Districts | Varies |

How Property Taxes Are Calculated in Houston

The calculation of property taxes in Houston involves a series of steps. First, the appraised value of your property is determined by the HCAD. This value is then subject to any applicable exemptions or limitations, such as the Residential Homestead Exemption or the School Tax Limitation.

Once the taxable value is established, it is multiplied by the tax rate of each taxing entity that serves your property's location. The sum of these calculations determines your total property tax liability.

Residential Homestead Exemption

The Residential Homestead Exemption is a valuable tool for Houston homeowners. It allows eligible homeowners to reduce the taxable value of their primary residence by up to $25,000, effectively lowering their property taxes. To qualify, homeowners must meet certain criteria, such as owning and occupying the property as their primary residence.

School Tax Limitation

The School Tax Limitation, also known as the Robin Hood law, is a unique feature of Texas property taxation. It aims to equalize funding across school districts by imposing a tax rate cap on certain school districts. In Houston, this cap is set at 1.5%, ensuring that school districts with higher property values do not benefit disproportionately.

Recent Trends and Changes in Houston Property Tax Rates

Property tax rates in Houston have experienced fluctuations over the years, influenced by various economic and budgetary factors. In recent years, the city has seen a general trend of moderate increases in tax rates to accommodate growing infrastructure needs and public service demands.

For instance, in the 2022 tax year, the City of Houston implemented a 0.0250 increase in its tax rate, bringing it to 0.600000. This change was primarily driven by the need to fund critical city services and infrastructure projects.

Impact of Special Districts

Special districts in Houston, such as municipal utility districts (MUDs) and special utility districts (SUDs), can significantly impact property tax rates. These districts are created to provide specific services or infrastructure to a defined area and have the authority to levy taxes. The tax rates for these districts can vary widely and are often in addition to the regular tax rates.

Strategies for Managing Houston Property Taxes

Managing your property taxes effectively is crucial for maintaining a healthy financial situation. Here are some strategies to consider:

- Understand Your Appraisal Value: Review your property's appraisal value each year to ensure its accuracy. If you believe the value is too high, you can protest the appraisal with the HCAD.

- Apply for Exemptions: Explore the various exemptions available, such as the Residential Homestead Exemption, to reduce your taxable value.

- Stay Informed: Keep track of tax rate changes and understand how they impact your property taxes. Attend local government meetings or follow online resources to stay updated.

- Consider Payment Plans: If you face financial difficulties, many taxing entities offer payment plans to help homeowners manage their property tax obligations.

Professional Assistance

For complex situations or if you require expert guidance, consider seeking assistance from a tax professional or a real estate attorney who specializes in property taxes. They can provide personalized advice and help you navigate the complexities of the Houston property tax system.

Conclusion: Empowering Houston Homeowners

Understanding the Houston property tax rate is a vital aspect of responsible homeownership. By being informed about the system, your property’s appraisal value, and the various exemptions and limitations available, you can effectively manage your property taxes and make well-informed financial decisions. Remember, staying proactive and seeking professional advice when needed can go a long way in ensuring a smooth and stress-free property tax experience.

What is the average property tax rate in Houston, TX?

+The average effective property tax rate in Houston is approximately 2.12%, which is calculated based on the average appraised value of homes in the city. However, it’s important to note that this rate can vary significantly depending on the specific location and taxing entities that serve the property.

Are property taxes in Houston, TX, higher than the national average?

+Yes, Houston’s property tax rates are generally higher than the national average. This is due to a combination of factors, including the city’s robust infrastructure, diverse taxing entities, and the need to fund various public services.

How often do property tax rates change in Houston, TX?

+Property tax rates in Houston can change annually. Taxing entities, such as the city, county, and school districts, may adjust their rates based on budgetary needs and other factors. It’s important for homeowners to stay informed about these changes to understand their potential impact on property taxes.