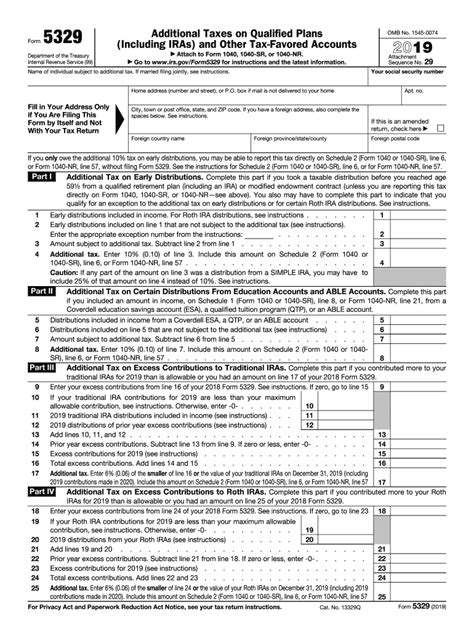

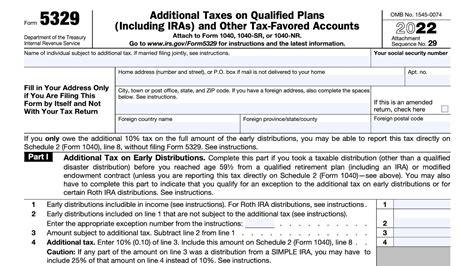

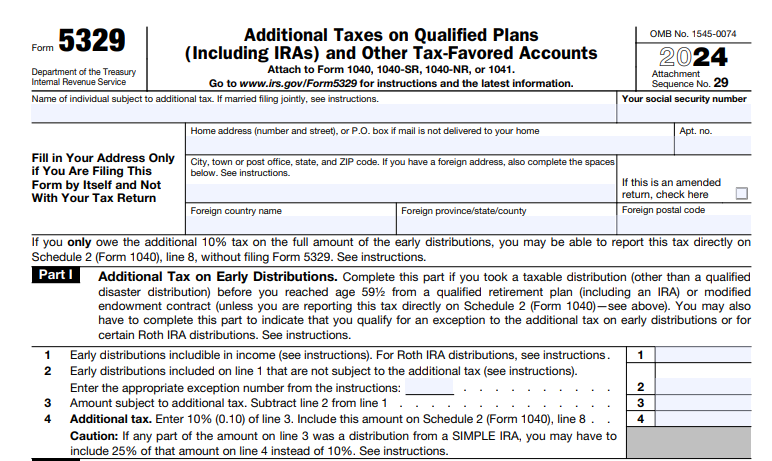

Tax Form 5329

When it comes to taxes and financial planning, one often encounters various forms and regulations that can be daunting. Among these is IRS Form 5329, a tax document that plays a crucial role in certain specific scenarios. This article aims to demystify Form 5329, providing an in-depth exploration of its purpose, applicability, and implications for taxpayers.

Understanding the Purpose of Form 5329

IRS Form 5329, titled “Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts”, is a specialized tax form used to report and calculate additional taxes that may be owed on certain types of retirement accounts and education savings plans.

This form serves as a crucial tool for taxpayers to comply with specific tax regulations, particularly those related to early distributions, excess contributions, and certain penalties. By using Form 5329, taxpayers can ensure they are accurately reporting and paying the correct taxes on these specialized accounts.

Key Scenarios Where Form 5329 is Applicable

Form 5329 is primarily utilized in the following situations:

- Early Distributions: When an individual withdraws funds from a qualified retirement plan or IRA before reaching the age of 59½, they may be subject to an additional 10% early withdrawal penalty. Form 5329 is used to report and calculate this penalty.

- Excess Contributions: If an individual contributes more than the allowed annual limit to certain retirement plans, such as IRAs or Health Savings Accounts (HSAs), they may need to report and correct these excess contributions using Form 5329.

- Education Savings Plans: This form is also used to report and calculate the additional tax on distributions from education savings plans, such as Coverdell Education Savings Accounts (ESAs), if the distributions are not used for qualified education expenses.

- Qualified Education Loans: In certain cases, taxpayers can use Form 5329 to claim an exclusion from income for loan forgiveness, cancellation, or discharge of a qualified education loan.

Navigating the Form 5329 Process

Filling out Form 5329 can be complex due to the specialized nature of the scenarios it addresses. Here’s a simplified guide to help taxpayers navigate the process:

Step 1: Determine Your Eligibility

First, determine if you are eligible to use Form 5329. This typically involves assessing whether you have made early withdrawals, excess contributions, or need to report specific distributions from education savings plans.

For instance, if you withdrew funds from your IRA before turning 59½, you would need to complete Part I of Form 5329 to calculate the early withdrawal penalty. Similarly, if you contributed more than the allowed limit to your IRA, you would use Part II to report and correct these excess contributions.

Step 2: Gather Necessary Information

Collect all the required information, including the amount of early withdrawals, excess contributions, or distributions from education savings plans. You will also need to know the applicable tax rates and any relevant exemptions or exclusions.

Step 3: Calculate Taxes and Penalties

Using the information gathered, calculate the additional taxes and penalties using the formulas and instructions provided on Form 5329. This step requires careful attention to detail to ensure accurate calculations.

Step 4: Report and Pay Taxes

Once you have calculated the additional taxes and penalties, report them on Form 5329 and include the form with your tax return. Pay the calculated amount along with your regular tax liability.

It's important to note that Form 5329 is often used in conjunction with other tax forms, such as Form 1040 or Form 1040-SR. Ensure that you follow the instructions provided by the IRS for filing these forms together.

Tips and Considerations for Taxpayers

When dealing with Form 5329, taxpayers should keep the following tips in mind:

- Avoid Penalties: Understand the penalties associated with early withdrawals or excess contributions and strive to avoid them. Proper planning and staying within the contribution limits can help prevent unnecessary taxes and penalties.

- Utilize Exemptions: Certain situations may qualify for exemptions or reduced penalties. For example, early withdrawals from IRAs due to disability or medical expenses may be exempt from the 10% penalty. Research and understand these exemptions to take advantage of them when applicable.

- Seek Professional Advice: The tax rules surrounding Form 5329 can be complex. If you are unsure about any aspect of the form or have unique circumstances, consider consulting a tax professional or financial advisor for personalized guidance.

- Keep Records: Maintain detailed records of all transactions related to your retirement or education savings plans. These records will be invaluable when completing Form 5329 and can help support your calculations and claims.

Real-World Example: Calculating Early Withdrawal Penalties

Let’s consider a real-life scenario to illustrate the use of Form 5329. Imagine John, a 35-year-old individual, who recently withdrew $10,000 from his IRA to cover unexpected medical expenses. As this withdrawal was made before John turned 59½, he is subject to the 10% early withdrawal penalty.

| Early Withdrawal Amount | $10,000 |

|---|---|

| Applicable Penalty Rate | 10% |

| Early Withdrawal Penalty | $1,000 |

In this case, John would need to complete Part I of Form 5329 to report the early withdrawal and calculate the penalty. He would then include this penalty amount with his regular tax liability when filing his tax return.

Form 5329: A Tool for Tax Compliance

Form 5329 serves as a critical tool for taxpayers to maintain compliance with specific tax regulations related to retirement and education savings plans. While it may seem daunting, understanding the purpose and applicability of this form can empower taxpayers to navigate these complex scenarios with confidence.

By following the guidelines provided by the IRS and utilizing resources such as tax preparation software or professional advice, taxpayers can ensure they are accurately reporting and paying the correct taxes, thereby avoiding potential penalties and maintaining their financial well-being.

Frequently Asked Questions

What is the purpose of Form 5329?

+

Form 5329 is used to report and calculate additional taxes on qualified plans, including IRAs, and other tax-favored accounts. It is primarily utilized for early withdrawals, excess contributions, and certain distributions from education savings plans.

How do I determine if I need to use Form 5329?

+

You need to use Form 5329 if you have made early withdrawals from retirement plans or IRAs before the age of 59½, contributed excess amounts to certain retirement plans, or have distributions from education savings plans that are not used for qualified education expenses.

Can I avoid the early withdrawal penalty on my IRA?

+

Yes, you can avoid the early withdrawal penalty by meeting certain exemptions, such as disability, medical expenses, or first-time home purchase. Additionally, planning your withdrawals carefully and staying within the contribution limits can help you avoid this penalty.

Are there any situations where Form 5329 is not required?

+

Form 5329 is generally required when there are early withdrawals, excess contributions, or certain distributions from education savings plans. However, if you meet the requirements for a qualified exception, such as a rollover or a trustee-to-trustee transfer, you may not need to use Form 5329.