New Orleans Tax

Welcome to an in-depth exploration of the intricate world of taxation in New Orleans, Louisiana. This vibrant city, known for its rich cultural heritage, vibrant music scene, and unique cuisine, also boasts a complex tax landscape that impacts both residents and businesses. In this comprehensive guide, we will delve into the specifics of New Orleans taxes, shedding light on the various taxes levied, their rates, and how they influence the local economy.

Understanding the New Orleans Tax Landscape

New Orleans, like many other cities, operates within a multi-layered tax system that includes federal, state, and local taxes. This diverse tax structure reflects the city’s unique position within the broader Louisiana tax framework. Let’s break down the key components of New Orleans taxation.

Federal Taxes

New Orleans residents and businesses are subject to the standard federal tax system, which includes income taxes, payroll taxes, and various other federal levies. The Internal Revenue Service (IRS) oversees federal tax collection, and compliance with federal tax laws is mandatory for all U.S. citizens and businesses.

For individuals, federal income tax rates are progressive, meaning that higher income levels are taxed at higher rates. The specific tax bracket an individual falls into depends on their taxable income and filing status. Similarly, businesses are taxed based on their revenue and profit, with various deductions and credits available to reduce their tax liability.

State Taxes in Louisiana

Louisiana, the state in which New Orleans is located, imposes its own set of taxes. These taxes contribute to the state’s revenue and support various public services and infrastructure projects.

One notable state tax in Louisiana is the state income tax. The state has a progressive income tax system, similar to the federal government, with five tax brackets ranging from 2% to 6%. The tax rate an individual pays depends on their taxable income, and there are also deductions and credits available to reduce the tax burden.

Additionally, Louisiana imposes a state sales tax, which is applied to most goods and services purchased within the state. The standard state sales tax rate is 4.45%, but this can vary depending on local ordinances and special taxes. Some items, such as groceries and prescription drugs, are exempt from sales tax.

Local Taxes in New Orleans

New Orleans, as a city, has its own unique set of local taxes that contribute to the city’s revenue and help fund local services and initiatives.

One of the primary local taxes in New Orleans is the City Sales Tax. This tax is levied on top of the state sales tax and is applied to most retail transactions within the city limits. The current City Sales Tax rate is 5%, making the combined sales tax rate in New Orleans 9.45% (including state and local taxes). This tax generates significant revenue for the city and supports various municipal projects.

New Orleans also imposes a Hotel Occupancy Tax, which is charged to guests staying in hotels, motels, and other lodging facilities within the city. The tax rate is 15.45%, which includes both state and local taxes. This tax is a significant source of revenue for the city, particularly in the tourism-focused economy of New Orleans.

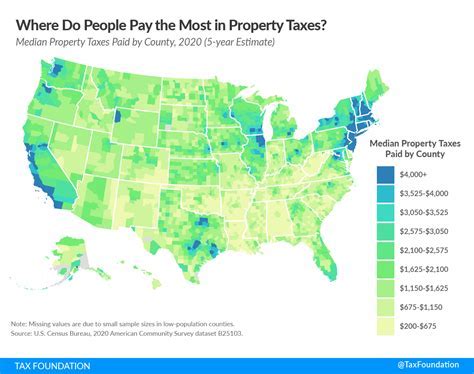

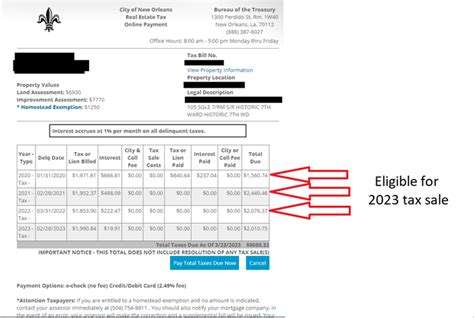

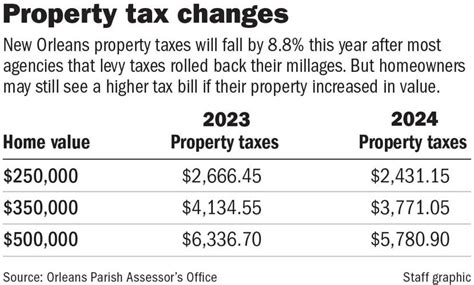

Furthermore, New Orleans has a Property Tax system in place. Property taxes are levied on both residential and commercial properties based on their assessed value. The property tax rate in New Orleans is 0.53%, which is relatively low compared to some other cities in the region. However, the actual tax liability can vary significantly depending on the property's assessed value and any applicable exemptions.

Another notable local tax in New Orleans is the Food and Beverage Tax, which is applied to the sale of prepared food and beverages within the city. This tax rate is 10%, and it helps fund the city's cultural and tourism initiatives. New Orleans is renowned for its culinary scene, and this tax plays a vital role in supporting the city's vibrant food industry.

Lastly, New Orleans has a Special Assessment Tax, which is levied on certain properties within designated special assessment districts. These districts are established to fund specific public improvements or services, such as street lighting, security patrols, or infrastructure upgrades. The tax rate and applicability vary depending on the specific district and the nature of the improvements.

| Tax Type | Rate | Description |

|---|---|---|

| City Sales Tax | 5% | Applied to retail transactions within the city limits. |

| Hotel Occupancy Tax | 15.45% | Charged to guests staying in lodging facilities. |

| Property Tax | 0.53% | Levied on residential and commercial properties based on assessed value. |

| Food and Beverage Tax | 10% | Applied to the sale of prepared food and beverages. |

| Special Assessment Tax | Varies | Levied on properties within special assessment districts to fund public improvements. |

Tax Implications for Residents and Businesses

The diverse tax landscape in New Orleans has significant implications for both residents and businesses operating within the city.

Residents’ Perspective

For individuals living in New Orleans, the tax structure can impact their overall cost of living. The combination of state and local taxes, particularly the sales tax and property tax, can influence financial planning and budgeting. Additionally, the progressive income tax system means that higher-income earners may face a higher tax burden.

Residents also benefit from various tax incentives and credits offered by the state and city. For example, Louisiana provides tax credits for certain expenses, such as educational expenses and certain home improvements. These credits can help reduce the overall tax liability for residents.

Businesses’ Perspective

Businesses operating in New Orleans face a unique set of tax considerations. The city’s tax structure, particularly the sales tax and hotel occupancy tax, can impact pricing strategies and profitability. Businesses must also navigate the complexities of federal and state tax laws, ensuring compliance with all applicable regulations.

However, New Orleans offers a range of tax incentives to attract and support businesses. The state of Louisiana provides tax credits and incentives for businesses that invest in certain industries, create jobs, or undertake specific projects. These incentives can significantly reduce a business's tax liability and contribute to its overall success in the city.

Furthermore, New Orleans has initiatives aimed at supporting small businesses and startups. The city offers resources and programs to help businesses navigate the tax landscape, providing guidance on tax registration, compliance, and potential tax savings opportunities.

The Impact on the New Orleans Economy

The tax system in New Orleans plays a crucial role in shaping the city’s economy. The revenue generated from taxes is essential for funding public services, infrastructure projects, and initiatives that drive economic growth.

The sales tax, in particular, is a significant contributor to the city's revenue. It supports essential services such as education, public safety, and transportation. The hotel occupancy tax, being a major source of revenue for the city, plays a vital role in funding tourism-related initiatives and infrastructure improvements that enhance the visitor experience.

Additionally, the property tax system ensures that residential and commercial property owners contribute to the city's fiscal health. This tax revenue is used to maintain and improve public facilities, such as parks, libraries, and community centers, enhancing the overall quality of life for residents.

The tax incentives and credits offered by the state and city also have a positive impact on the economy. By attracting businesses and encouraging investment, these incentives contribute to job creation, economic growth, and a more vibrant business landscape in New Orleans.

Conclusion: Navigating the New Orleans Tax Landscape

Understanding the tax system in New Orleans is essential for both residents and businesses operating in the city. The diverse tax structure, including federal, state, and local taxes, shapes the fiscal landscape and influences economic decisions.

From the progressive income tax system to the various local taxes, such as the sales tax and hotel occupancy tax, New Orleans residents and businesses must navigate a complex tax environment. However, the city's tax incentives and credits provide opportunities for tax savings and contribute to the overall economic vitality of the region.

By staying informed about the tax landscape and utilizing available resources, individuals and businesses can make informed financial decisions and contribute to the continued growth and prosperity of New Orleans.

How does New Orleans compare to other cities in terms of tax rates?

+New Orleans’ tax rates, particularly its sales tax and property tax, are relatively competitive compared to other major cities in the region. The city’s efforts to provide a balanced tax structure have resulted in rates that are generally considered reasonable for businesses and residents.

Are there any tax breaks or incentives for homeowners in New Orleans?

+Yes, Louisiana offers several tax breaks and incentives for homeowners. These include homestead exemptions, which reduce the taxable value of a primary residence, and tax credits for certain home improvements, such as energy-efficient upgrades.

How does the New Orleans tax system support local businesses?

+New Orleans provides a range of tax incentives and support programs for local businesses. These initiatives aim to attract new businesses, encourage job creation, and promote economic development within the city. The city’s Small Business Resource Center offers resources and guidance to help businesses navigate the tax landscape.

What are the tax filing requirements for individuals in New Orleans?

+Individuals in New Orleans must file federal and state tax returns annually. The filing deadline is typically April 15th each year. Residents may also need to file local tax returns, depending on their income and property ownership. It’s important to consult with a tax professional or refer to official tax guidelines for specific requirements.

How can businesses ensure tax compliance in New Orleans?

+Businesses operating in New Orleans should register with the appropriate tax authorities, obtain necessary licenses and permits, and maintain accurate records of income and expenses. Staying informed about tax regulations and seeking professional advice can help businesses stay compliant and avoid penalties.