Understanding the Financial Impact of Bridgeport CT Taxes on Residents

Bridgeport, Connecticut, stands as a multifaceted urban hub in New England, balancing its rich industrial history with modern economic ambitions. Its tax policies serve as a vital lever that influences the economic wellbeing of its residents, impacting everything from disposable income to local business vitality. Comprehensive understanding of these fiscal mechanisms requires not only a grasp of local statutes but also an appreciation of broader economic patterns, demographic shifts, and historical tax evolutions. As a city with a diverse socioeconomic fabric, the implications of Bridgeport’s tax structure resonate deeply within its community, making its analysis a necessity for policymakers, residents, and economic analysts alike.

Decoding Bridgeport’s Tax Framework: Foundations and Components

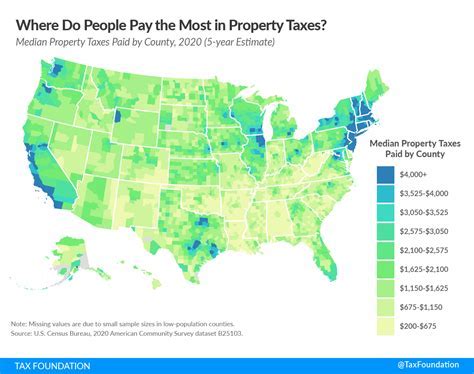

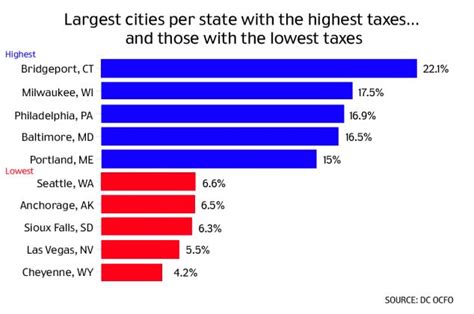

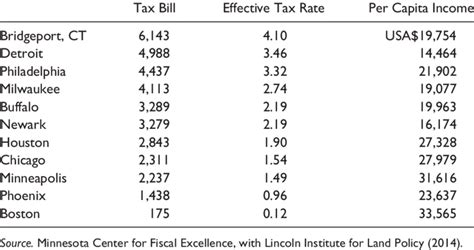

At the core of Bridgeport’s financial landscape lies its property, income, and sales taxes—each uniquely shaping residents’ fiscal realities. Property taxes, assessed primarily on real estate holdings, form the backbone of city revenue, directly influencing property values and investment. Income taxes, though limited at city levels given Connecticut’s state fiscal structure, still influence disposable income and consumption patterns. Meanwhile, sales taxes, applied to goods and services, serve as a consumptive lever that can both stimulate and dampen economic activity.

The complexity of Bridgeport’s tax system is accentuated by intergovernmental transfers, state-mandated assessments, and local levies, creating a dynamic environment where fiscal policy decisions ripple across socioeconomic strata. Notably, the local tax rate, set annually via city council legislation, directly correlates with municipal services quality, including schools, infrastructure, and public safety initiatives—elements critical to residents’ economic stability and quality of life.

Historical context of tax policies in Bridgeport

Historically, Bridgeport’s tax policies have evolved in tandem with its industrial cycles. During the early 20th century, property taxes burgeoned as manufacturing flourished, fueling city growth but also creating disparities in wealth distribution. Post-industrial declines in the late 20th century prompted fiscal adjustments aimed at stabilizing revenue streams amid shrinking tax bases. Recent decades have seen an effort to balance tax rates with economic incentives to attract new residents and business ventures, though debates over tax equity persist within local political arenas.

| Relevant Category | Substantive Data |

|---|---|

| Property tax rate | Approximate rate of 40 mills (4%) in 2023, compared to Connecticut average of 20 mills |

| Average property value | $280,000, with variance across districts impacting tax bills |

| Median household income | $52,000, exposing disparities in tax burden relative to income |

| Sales tax rate | Current rate of 6.35%, including local add-on |

| Tax revenue contribution | Property taxes account for roughly 65% of municipal income |

Economic Consequences of Bridgeport’s Tax Policies on Residents

Understanding the comprehensive impact of taxes involves unpacking their influence on individual households and the broader local economy. Taxes can be a double-edged sword—funding essential services but possibly hindering economic mobility and retention of residents if rates are perceived as excessive. In Bridgeport, this tension manifests vividly, especially among vulnerable populations.

Property tax burden and housing affordability

High property taxes in Bridgeport pose a significant challenge for homeowners, particularly first-time buyers and senior residents on fixed incomes. Elevated property tax bills can diminish affordable housing stock, incentivize residents to move to neighboring municipalities with lower rates, or lead to increased mortgage defaults. Recent assessments indicate that property owners in certain districts pay effectively 4% of their home value annually in taxes, which can represent upwards of 20% of median household income—an untenable burden for many.

| Relevant Category | Substantive Data |

|---|---|

| Average annual property tax bill | Approximately $11,200 for median-value homes |

| Tax delinquency rate | Roughly 3.2%, indicating affordability stress |

These figures underscore how tax burdens can inadvertently exacerbate socioeconomic disparities, influencing housing stability and community demographics.

Impact on small businesses and employment

Business taxes—particularly property and gross receipts taxes—also shape the local economic environment. Elevated corporate tax levels, coupled with higher operational costs, may deter small business startups or even prompt relocations. Conversely, strategic tax incentives have been employed to stimulate growth and employment opportunities, recognizing that a vibrant business ecosystem supports residential prosperity. In Bridgeport, recent initiatives have attempted to balance tax competitiveness with long-term fiscal sustainability, yet debates over tax fairness remain central to policy discussions.

| Relevant Category | Substantive Data |

|---|---|

| Business tax rate | Effective rates vary but average around 8% for gross receipts |

| Number of small businesses | Approximately 5,500 registered in 2023, with a 2% annual growth |

| Local employment rate | Approximately 88%, with small businesses accounting for 40% of job creation |

Socioeconomic Disparities and the Taxation Equity in Bridgeport

Tax policy equity becomes especially poignant in Bridgeport, where income inequality persists as a defining characteristic. The city’s Gini coefficient, a measure of income disparity, hovers around 0.48—significantly above the national average—indicating unequal wealth distribution. Such disparities influence how tax burdens fall across socioeconomic groups and highlight potential policy shortcomings.

Progressive versus flat tax structures in practice

While Connecticut employs a progressive state income tax system, local property taxes tend to be regressive in effect, placing a larger relative burden on low-income households. Bridgeport’s reliance on property taxes inadvertently amplifies inequalities, placing disproportionate fiscal pressure on the less affluent—an aspect that can lead to socio-economic segmentation and community destabilization.

| Relevant Category | Substantive Data |

|---|---|

| Tax burden distribution | Top 20% of income earners pay approximately 50% of property taxes |

| Tax delinquencies by income group | Higher delinquency rates (4.1%) among households earning below $30,000 annually |

Addressing these disparities necessitates exploring alternative tax relief measures or income-based assessments to foster neighborhood stability and social cohesion.

Policy Recommendations and Future Fiscal Strategies for Bridgeport

Achieving a balanced, equitable, and sustainable tax environment in Bridgeport depends on strategic policy reform informed by data, community engagement, and regional economic insights. Some key pathways forward include:

Implementing progressive property tax reforms

Adjusting property tax assessments to incorporate income-based variables could ease burdens on low- and middle-income households. This would involve complex valuation models but could significantly improve affordability and community stability.

Expanding tax incentives for revitalization

Targeted incentives designed to attract small businesses and developers could catalyze economic activity, creating employment while diversifying revenue streams. Such measures might include abatements, enterprise zones, or tiered corporate taxes aligned with community goals.

Enhancing transparency and community involvement

Transparency around tax allocation and decision-making processes fosters trust and facilitates community buy-in. Public forums, participatory budgeting, and clear reporting mechanisms are tools that can democratize fiscal policymaking.

| Strategic Considerations | Implications |

|---|---|

| Fiscal sustainability | Requires balancing reforms with stable revenue streams |

| Equity and inclusion | Must prioritize reduced disparities to sustain social fabric |

| Economic competitiveness | Incentives should foster growth without undermining fiscal health |

Conclusion: Navigating the Fiscal Future in Bridgeport

Bridgeport’s tax landscape is a complex tapestry woven through history, socioeconomic realities, and policy choices. Its residents’ prosperity hinges on crafting a fiscal environment that is fair, sustainable, and conducive to economic growth. Strategic adjustments—grounded in detailed data and inclusive policymaking—offer pathways toward a more equitable tax system that supports community development while ensuring fiscal health. In this balancing act, continuous evaluation, adaptive reforms, and participatory governance emerge as vital tools for shaping Bridgeport’s economic destiny.

How do property taxes in Bridgeport compare to other Connecticut cities?

+Bridgeport’s property tax rate of approximately 40 mills is nearly double the Connecticut average of around 20 mills, making it one of the higher rates in the state. This disparity reflects differing municipal priorities and tax bases, directly influencing housing affordability and investment attractiveness.

What measures could reduce tax burdens for low-income residents in Bridgeport?

+Possible measures include implementing income-based property tax assessments, expanding property tax relief programs, or providing targeted exemptions and credits. These approaches aim to reduce regressive impacts and promote fiscal fairness across socioeconomic groups.

How is revenue from taxes utilized in Bridgeport?

+Tax revenue primarily funds municipal services such as education, public safety, infrastructure, and community development programs. Effective allocation ensures that residents receive quality services, which in turn supports overall economic stability.

Are there upcoming tax reforms anticipated in Bridgeport?

+While specific reforms are under discussion, proposals include property tax reassessment adjustments, increased transparency measures, and targeted incentives for economic development. These initiatives aim to make taxes more equitable and sustainable.