Nj Tax Brackets

In the state of New Jersey, understanding the tax brackets is crucial for individuals and businesses to navigate their financial obligations effectively. The tax system in New Jersey is progressive, meaning that as your income increases, so does the tax rate you pay. This article aims to provide a comprehensive guide to the New Jersey tax brackets, covering the latest rates, income thresholds, and the potential impact on your finances.

The New Jersey Tax System: An Overview

New Jersey operates a state income tax system, in addition to the federal income tax, which is levied by the Internal Revenue Service (IRS). The state income tax is collected by the New Jersey Division of Taxation and is used to fund various public services and infrastructure projects. The tax revenue plays a vital role in supporting the state’s economy and its residents.

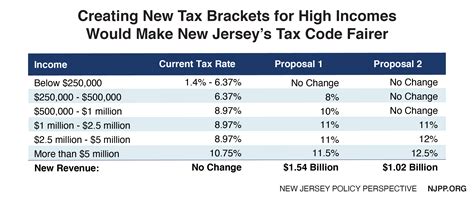

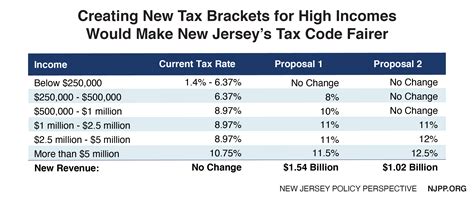

The tax system in New Jersey is designed to ensure that those with higher incomes contribute a larger proportion of their earnings towards state funding. This progressive structure aims to promote fairness and maintain a balanced economy. The state's tax rates are subject to change annually, depending on budgetary requirements and economic conditions.

New Jersey Income Tax Brackets for 2023

As of 2023, New Jersey has five income tax brackets, each with its own tax rate. These brackets are adjusted annually to account for inflation and changing economic circumstances. Here is a breakdown of the current tax brackets and their corresponding tax rates:

| Income Bracket | Tax Rate |

|---|---|

| Up to $20,000 | 1.4% |

| $20,001 - $35,000 | 3.5% |

| $35,001 - $40,000 | 5.525% |

| $40,001 - $150,000 | 6.37% |

| Over $150,000 | 8.97% |

It's important to note that these tax rates apply to taxable income, which is calculated after various deductions and exemptions. The state of New Jersey offers several tax credits and deductions that can reduce your taxable income, potentially placing you in a lower tax bracket.

Examples of Taxable Income and Bracket Placement

To illustrate how these tax brackets work, let’s consider a few examples. For simplicity, we will assume no deductions or credits are applied, focusing solely on taxable income.

- An individual with an annual taxable income of $18,000 would fall into the first bracket, paying a tax rate of 1.4% on their income.

- Someone earning $32,000 annually would be placed in the second bracket, with a tax rate of 3.5%.

- A taxpayer with a taxable income of $45,000 would be taxed at 5.525% for the portion of their income between $35,001 and $40,000, and 6.37% for the remaining income.

- High earners, such as those with a taxable income of $200,000, would be taxed at 6.37% for the first $150,000 and 8.97% for the income above $150,000.

These examples demonstrate how the progressive tax system in New Jersey ensures that higher incomes are taxed at a higher rate.

Taxable Income and Deductions

Taxable income in New Jersey is calculated by taking your total income and subtracting any applicable deductions and exemptions. The state offers a standard deduction, which is adjusted annually, as well as various other deductions and credits. These deductions can significantly impact your taxable income and, consequently, your tax bracket placement.

Standard Deduction and Personal Exemptions

As of 2023, the standard deduction in New Jersey is 1,000 for single filers and 2,000 for married couples filing jointly. Additionally, there is a personal exemption of $1,000 for each dependent, which can further reduce your taxable income. These deductions can be particularly beneficial for individuals with lower incomes, as they may reduce their taxable income to the point where they no longer owe state income tax.

Other Deductions and Credits

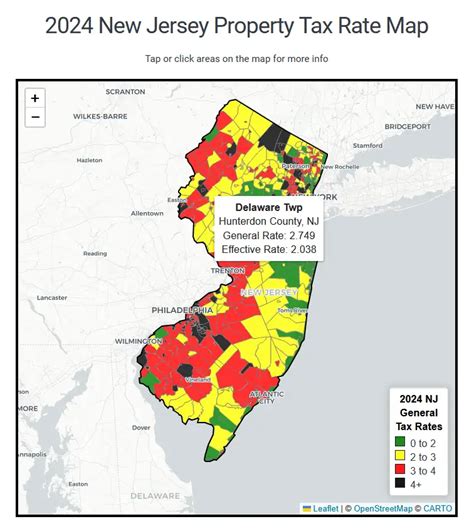

New Jersey offers a range of other deductions and credits that can further reduce your taxable income. These include deductions for medical expenses, property taxes, charitable contributions, and certain business expenses. Additionally, the state provides credits for low-income earners, senior citizens, and individuals with disabilities.

It's crucial to explore all available deductions and credits to ensure you're maximizing your tax savings. Consulting with a tax professional or using reliable tax preparation software can help you navigate these options effectively.

The Impact of Tax Brackets on Your Finances

Understanding your tax bracket is essential for effective financial planning. It allows you to estimate your tax liability and make informed decisions about your income, investments, and savings. For instance, if you’re aware that your income places you in a higher tax bracket, you may consider strategies to reduce your taxable income, such as maximizing deductions or contributing to tax-advantaged retirement accounts.

Additionally, knowledge of the tax brackets can help you evaluate the financial implications of career choices, business ventures, or significant life changes. For example, if you're considering a job offer with a higher salary, understanding the tax bracket shifts can provide valuable insights into the net increase in your take-home pay.

Strategies for Tax Efficiency

To optimize your tax situation, consider the following strategies:

- Maximize Deductions: Take advantage of all applicable deductions and credits to reduce your taxable income and potentially lower your tax bracket.

- Review Investment Strategies: Consider tax-efficient investment options, such as tax-free municipal bonds or retirement accounts like 401(k)s and IRAs, which can offer tax advantages and reduce your overall tax liability.

- Plan for Education Expenses: If you're saving for education expenses, explore tax-advantaged options like 529 plans, which offer tax benefits for college savings.

- Seek Professional Advice: Consulting a tax professional or financial advisor can provide tailored strategies to optimize your tax situation and ensure compliance with state and federal regulations.

By understanding the tax brackets and implementing tax-efficient strategies, you can maximize your financial resources and achieve your financial goals.

Conclusion

The New Jersey tax brackets are an essential component of the state’s tax system, providing a progressive structure that ensures fairness and supports public services. By understanding your tax bracket and exploring tax-saving strategies, you can make informed financial decisions and optimize your financial situation. Remember to stay up-to-date with any changes to the tax brackets and consult professionals when needed to ensure compliance and financial success.

What is the difference between state and federal income tax brackets?

+State income tax brackets are set by individual states and determine the tax rate you pay on your state income. Federal income tax brackets, on the other hand, are set by the federal government and apply to your federal taxable income. While both systems are progressive, the tax rates and brackets may differ significantly between states and the federal government.

Are New Jersey’s tax brackets progressive?

+Yes, New Jersey’s tax brackets are progressive, meaning that as your income increases, so does the tax rate you pay. This progressive structure ensures that higher incomes contribute a larger proportion of their earnings towards state funding.

How often are New Jersey’s tax brackets updated?

+New Jersey’s tax brackets are typically updated annually to account for inflation and changing economic circumstances. These updates are made by the New Jersey Division of Taxation and are announced before the start of the new tax year.

Can I calculate my tax liability using the tax brackets?

+While the tax brackets provide a useful guide, it’s important to remember that they only represent the tax rates applied to different income levels. To calculate your exact tax liability, you’ll need to consider your total income, deductions, credits, and any other applicable factors. Using tax preparation software or consulting a tax professional can help ensure an accurate calculation.