Maximize Profits with Expert Tips on Tax Lien Properties for Real Estate Investors

Imagine navigating a maze where each turn and dead-end offers an opportunity to uncover hidden treasures—this is akin to how savvy real estate investors approach tax lien properties. These assets, often shrouded in legal and financial complexity, can serve as potent leverage for maximizing returns when understood and managed with strategic precision. At the core of success in this domain lies a deep comprehension of the mechanics, legal frameworks, and market dynamics that underpin tax lien investing. By demystifying these elements through expert insights, investors can transform what appears to be a labyrinth of regulatory obligations into a well-mapped route toward substantial profits, much like a seasoned explorer turning obstacles into opportunities.

Understanding Tax Lien Properties: Foundations of a Hidden Wealth Stream

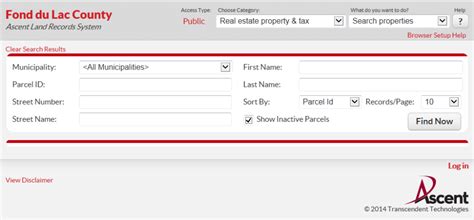

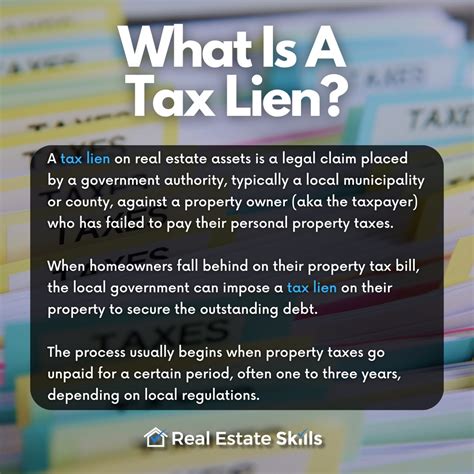

Tax lien properties represent a unique facet of the real estate universe—a system where government authorities impose liens on properties due to unpaid property taxes, which then become auctioned to private investors. For those unfamiliar, think of tax liens as the unpaid tolls on a highway; when these tolls accumulate without payment, the government steps in to recoup owed sums via liens. These liens are not just debt claims but are investment instruments promising interest income and potential property acquisition if the delinquency persists. The essence of successful tax lien investing parallels a bank’s role in lending—providing capital secured by collateral—in this case, the property itself. Investors buy these liens at auction, effectively paying the overdue taxes upfront, with the expectation of earning interest or gaining ownership if the owner defaults.

Historically, tax lien certificates have been a mainstay in the United States since the early 20th century, with nuances that vary across states and municipalities. Their allure lies in offering high-yield opportunities—interest rates often range from 8% to over 25%, depending on jurisdiction—paired with the relative opacity that can deter less experienced investors. Yet, navigating this terrain successfully demands a mastery of legal procedures, local statutes, and market conditions—akin to a chess game requiring foresight, patience, and tactical positioning.

The Legal and Financial Frameworks Governing Tax Liens

Just as a ship needs a sturdy hull to withstand stormy seas, tax lien investors require a robust understanding of the legal environment that governs their ventures. Each jurisdiction establishes its own rules for tax lien sales, foreclosure processes, redemption periods, and interest accrual. For example, some states operate a strict auction system, with redemption rights lasting months to years, while others impose a more lenient process facilitating faster property acquisition. A comprehensive grasp of these nuances enables investors to craft strategies that optimize returns, mitigate risks, and conform to compliance mandates.

Strategies for Maximizing Profits with Tax Lien Investments

Like a seasoned gardener planting seeds for a bountiful harvest, successful tax lien investors employ a variety of strategic approaches tailored to their risk appetite and market conditions. Some focus on high-interest liens in distressed neighborhoods, aiming for quick redemption and interest income. Others adopt a buy-and-hold mentality, acquiring liens with the potential for foreclosure and property ownership—transforming the lien into a real estate asset that can be renovated or sold.

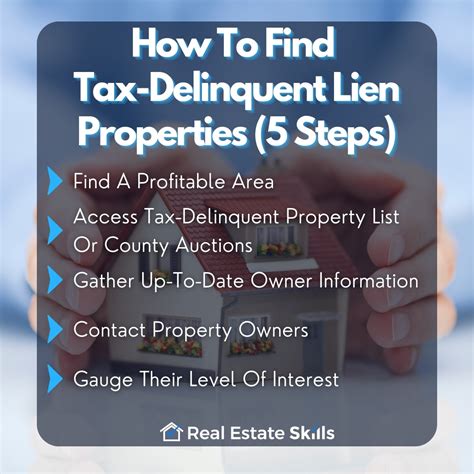

Diversification and Due Diligence

Just as a prudent investor diversifies stock portfolios to mitigate volatility, tax lien investors spread their holdings across multiple jurisdictions and property types. Due diligence is critical—evaluating property values, assessing neighborhood trends, and understanding legal encumbrances. This process is akin to inspecting the foundation before constructing a building; neglect could lead to financial failures or unexpected liabilities.

| Relevant Category | Substantive Data |

|---|---|

| Average Interest Rates | Range from 8% to 25% depending on state, with some localities offering premium rates for specific liens. |

Leveraging Market Trends and Data Analysis

Much like a meteorologist predicting weather patterns to plan an expedition, proficient investors analyze market data to anticipate shifts in property values, delinquency rates, and legal changes. Advanced analytics and real estate valuation tools can reveal opportunities that are not immediately obvious. For instance, rising property taxes in a growing area may signal future value appreciation, which, combined with strategic lien purchases, can amplify profit potential significantly.

Technology and Data-Driven Decisions

Employing platforms that aggregate property records, tax sale results, and economic indicators transforms guesswork into informed investment decisions. Real-time data provides a competitive edge—allowing investors to act quickly before competition saturates lucrative liens. This is akin to using a GPS device rather than haphazardly wandering in unfamiliar territory.

| Related Entity | Data Point |

|---|---|

| Tax Delinquency Rate | Approximately 4.2% nationally, with variations based on economic conditions. |

| Median Home Price Growth | Average annual growth of 3-5%, impacting property valuation post-foreclosure. |

Risks and Limitations in Tax Lien Investing

Just as a tightrope walker balances precariously, investors must be aware of the inherent risks. The primary concern is the possibility of a dormant or bankrupt property owner failing to redeem the lien, leading to foreclosure and property ownership. While this can be lucrative, it also requires capital, legal expertise, and patience—qualities as vital as a climber’s endurance.

Additional risks include fluctuations in property values, legal disputes, or changes in local tax laws that can impact returns or procedures. Market downturns can also leave investors holding liens on properties with declining worth, mirroring the risk of holding a depreciating asset in any investment class.

| Risk Type | Description |

|---|---|

| Owner Non-Redemption | Property owner fails to redeem, leading to foreclosure—potential for acquiring a property or losing initial investment. |

| Legal Challenges | Disputes over lien validity or encumbrances can delay proceedings and reduce profitability. |

| Market Volatility | Declining property values may erode the potential gains from foreclosure. |

Advanced Tactics and Niche Opportunities

In the toolkit of an experienced investor, niche strategies such as purchasing tax liens in emerging markets or targeting properties with known issues—such as environmental hazards—offer compelling opportunities. These tactics demand an even deeper knowledge of local conditions and may involve collaborating with legal or environmental consultants. Think of these approaches as taking a shortcut through a less visible but highly rewarding trail in our wilderness analogy.

Pre-Foreclosure Investment and Property Redevelopment

Once the lien process matures into foreclosure, investors can choose to develop or resell properties or lease them for ongoing income streams. The transition from lienholder to property owner echoes the shift from being a passive investor to an active developer—where judgment, craftsmanship, and market timing are critical. Successful redevelopment hinges on evaluating rehabilitation costs, market demand, and legal clearances, much like a chef perfecting a complex dish.

Key Points

- Expertise in local law is vital for navigating and capitalizing on tax lien sales effectively.

- Diversification reduces risk and enhances exposure to favorable markets.

- Data analysis can preempt market downturns and optimize exit strategies.

- Legal due diligence safeguards against future disputes and liabilities.

- Market timing and understanding foreclosure cycles are central to maximizing profits.

Conclusion: Turning the Maze into a Map of Opportunities

Tax lien properties, when approached with the acumen of an expert navigator, unlock a realm of lucrative possibilities reminiscent of discovering treasure chests hidden behind what initially seems like an intangible legal labyrinth. Success hinges on meticulous research, strategic diversification, and leveraging data insights—transforming uncertainty into opportunity. Just as an explorer excels by understanding the terrain, the savvy investor employs knowledge, patience, and tactical finesse to maximize profits in this niche yet highly rewarding segment of real estate investing. The journey is complex but navigable for those willing to study the map carefully and trust their expertise, turning what may appear as a maze into a corridor of wealth-building potential.

What are the most profitable strategies for tax lien investing?

+Profitable strategies include focusing on high-interest liens with short redemption periods, diversifying across jurisdictions, and pursuing foreclosures on undervalued properties in growing markets. Combining these approaches enhances profitability while managing risks effectively.

How does legal complexity impact tax lien investments?

+Legal complexity dictates the speed and security of investments. Thorough knowledge of local laws ensures compliance and informs strategic decisions, reducing the risk of disputes and enhancing return opportunities.

What role does data analysis play in maximizing profits?

+Data analysis helps identify emerging markets, evaluate property values, and optimize timing for foreclosure or redemption. It provides a strategic edge, much like a seasoned chess player analyzing every move for advantage.

What are the risks involved, and how can they be mitigated?

+Risks include owner non-redemption, legal disputes, and declining market values. Mitigation strategies encompass thorough due diligence, diversification, legal counsel, and timely exit strategies—akin to a pilot navigating through turbulent weather with precision.

Can tax liens lead to property redevelopment opportunities?

+Yes, upon foreclosure, investors can develop or resell properties, especially in emerging markets or distressed areas. This approach requires expertise in property development, permitting, and market analysis.