Clay County Tax

Welcome to this in-depth exploration of the world of Clay County Tax, a topic that impacts every resident and business owner within the county. In this comprehensive guide, we will delve into the intricacies of Clay County's tax system, shedding light on its workings, its significance, and its impact on the local economy. From property taxes to sales taxes and everything in between, we aim to provide a clear understanding of this essential aspect of Clay County's financial landscape.

Unraveling the Clay County Tax System

Clay County, with its vibrant communities and diverse economic activities, relies on a well-structured tax system to support its growth and development. The county's tax system is a crucial component of its financial infrastructure, ensuring the provision of essential services and the maintenance of public facilities.

Property Taxes: The Backbone of Clay County's Revenue

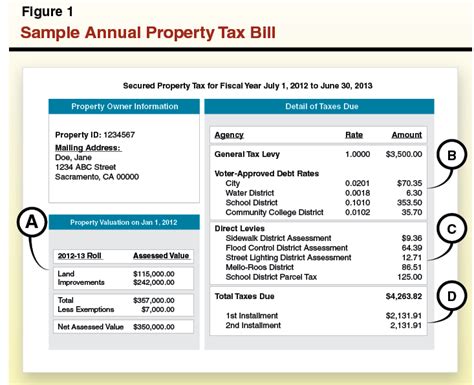

Property taxes form the backbone of Clay County's revenue generation. These taxes are levied on both residential and commercial properties within the county, with rates determined by the assessed value of the property. The assessment process is carried out by the Clay County Property Appraiser's Office, which ensures fairness and accuracy in the valuation process.

The assessed value of a property is determined by a combination of factors, including its location, size, improvements, and the local real estate market. Property owners are notified of their assessed value each year and have the opportunity to review and appeal the assessment if they believe it is inaccurate. This transparency and the opportunity for review contribute to a fair and equitable tax system.

The property tax rates in Clay County are set by the Clay County Commission, taking into consideration the needs of the county's various departments and services. These taxes fund essential services such as public safety, education, infrastructure maintenance, and social programs. By investing in these areas, Clay County aims to create a thriving and sustainable community for its residents.

| Property Type | Tax Rate (Millage) |

|---|---|

| Residential | 5.75% |

| Commercial | 7.25% |

Sales Taxes: Supporting County Commerce

In addition to property taxes, Clay County also collects sales taxes on goods and services sold within its boundaries. These taxes are an important source of revenue, particularly for supporting local businesses and infrastructure projects. The sales tax rate in Clay County is composed of both state and local components.

The state sales tax rate is set by the Florida Department of Revenue and applies uniformly across the state. This rate is currently 6%, and it funds various state-level programs and initiatives. On top of this, Clay County levies an additional 1.5% local option sales tax to support specific county projects and services.

The revenue generated from the local option sales tax is often earmarked for specific purposes, such as road improvements, public transit, or cultural and recreational facilities. This targeted approach ensures that the tax revenue directly benefits the community it is collected from.

Other Tax Streams in Clay County

Beyond property and sales taxes, Clay County utilizes several other tax streams to meet its financial obligations and support its operations. These include:

- Tangible Personal Property Tax: Taxed on the value of tangible personal property owned by businesses and individuals, such as machinery, equipment, and inventory.

- Tourist Development Tax: A tax levied on short-term rentals, hotels, and certain other tourist accommodations. The revenue generated from this tax is used to promote tourism and develop tourism-related infrastructure in Clay County.

- Intangible Personal Property Tax: Taxed on the value of intangible assets, such as stocks, bonds, and certain other financial instruments. This tax is typically paid by individuals and businesses that hold these types of assets.

The Impact of Clay County Taxes

The tax system in Clay County plays a pivotal role in shaping the county's economic landscape and the quality of life for its residents. By investing tax revenue in essential services and infrastructure, the county creates a thriving and attractive environment for businesses and individuals alike.

Supporting Economic Development

The tax revenue generated in Clay County is a key driver of economic development. It funds critical infrastructure projects, such as road improvements, water and sewer upgrades, and the expansion of public facilities. These investments not only enhance the county's overall infrastructure but also make it more attractive to businesses considering relocation or expansion.

Additionally, the revenue from Clay County's taxes supports local businesses by funding initiatives aimed at fostering entrepreneurship and small business growth. This includes providing resources for business development, offering incentives for job creation, and investing in programs that promote economic diversification.

Enhancing Community Services

A significant portion of Clay County's tax revenue is dedicated to enhancing community services and improving the overall quality of life for residents. This includes funding for education, with a focus on maintaining high-quality schools and providing resources for student success.

Tax revenue also supports public safety initiatives, ensuring that the county's residents have access to a robust police force, emergency response teams, and fire protection services. Additionally, the county utilizes tax revenue to maintain and improve its parks, recreational facilities, and cultural centers, promoting a healthy and vibrant community.

Sustainable Finance and Future Planning

Clay County's tax system is designed with long-term sustainability in mind. The county's financial planning and budgeting processes ensure that tax revenue is allocated efficiently and effectively, taking into consideration both current needs and future growth projections. This approach allows the county to invest in projects and initiatives that have a lasting impact on the community.

Moreover, the county's tax system is regularly reviewed and updated to ensure it remains fair, transparent, and responsive to the needs of its residents and businesses. This commitment to continuous improvement ensures that Clay County remains a desirable place to live, work, and invest, with a strong and resilient tax base to support its future growth.

Navigating the Clay County Tax Landscape

Understanding the intricacies of Clay County's tax system is essential for both residents and businesses. It empowers individuals to make informed decisions about their financial obligations and allows businesses to plan their operations with clarity and confidence.

For residents, a thorough understanding of the tax system ensures they can navigate the process of paying their property taxes accurately and efficiently. It also enables them to stay informed about the various tax relief programs and incentives available, ensuring they receive the benefits they are entitled to.

Businesses, on the other hand, benefit from a clear understanding of the tax landscape when making decisions about their operations. This includes considerations such as tax rates, incentives for business expansion, and the potential for tax breaks or credits based on their industry or location within the county.

Clay County provides a range of resources to assist residents and businesses in navigating the tax system. These include online tools for calculating tax obligations, detailed information on tax rates and assessment processes, and dedicated offices and staff to provide personalized assistance and support.

Resources and Support

- Clay County Property Appraiser's Office: Responsible for assessing property values and providing resources to help property owners understand their assessments and appeal if necessary.

- Clay County Tax Collector's Office: Handles the collection of property taxes, sales taxes, and other taxes. They provide resources for tax payment, offer information on tax relief programs, and assist with any tax-related queries.

- Clay County Economic Development Office: Provides information and resources for businesses, including details on tax incentives and programs to support business growth and expansion.

Frequently Asked Questions (FAQ)

What is the current property tax rate in Clay County?

+The current property tax rate in Clay County is 5.75% for residential properties and 7.25% for commercial properties.

How often are property taxes assessed in Clay County?

+Property taxes in Clay County are assessed annually. The assessed value of a property is based on its value as of January 1st of the tax year.

Are there any tax relief programs available for Clay County residents?

+Yes, Clay County offers various tax relief programs, including the Homestead Exemption, which reduces the taxable value of a primary residence, and the Disabled Veterans Exemption, which provides tax relief for qualified veterans. Other programs may be available based on age, income, or other criteria.

How can businesses in Clay County benefit from the tax system?

+Businesses in Clay County can benefit from a range of tax incentives and programs. These may include tax breaks for job creation, investments in research and development, or for locating in designated economic development areas. The Clay County Economic Development Office provides detailed information on these opportunities.

By delving into the complexities of Clay County’s tax system, we hope to have provided a comprehensive understanding of its role and impact. As a vital component of the county’s financial infrastructure, the tax system ensures the provision of essential services, supports economic growth, and enhances the quality of life for all residents. For more information and personalized assistance, residents and businesses are encouraged to reach out to the dedicated offices and resources provided by Clay County.