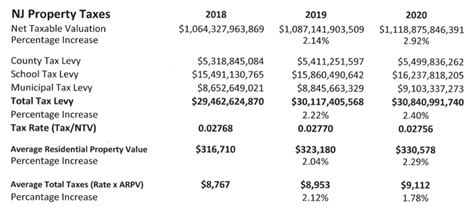

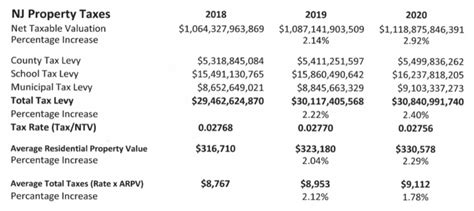

Nj Property Taxes

Property taxes in New Jersey are a complex and often contentious topic, impacting homeowners, renters, and businesses alike. With one of the highest property tax rates in the nation, understanding the intricacies of the New Jersey property tax system is crucial for residents and investors alike. This comprehensive guide aims to delve into the specifics, shedding light on the factors that influence property tax assessments and payments in the Garden State.

Understanding New Jersey’s Property Tax Landscape

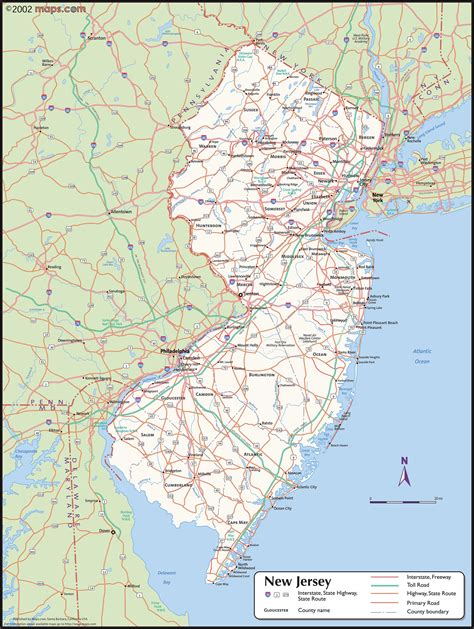

New Jersey’s property tax system is renowned for its complexity, influenced by a myriad of factors that vary across the state’s 21 counties and 565 municipalities. At its core, the system revolves around the assessment of real estate value, which serves as the basis for calculating property taxes. This value assessment is a crucial determinant of the tax burden borne by property owners.

The property tax in New Jersey is primarily a local tax, with each municipality responsible for setting its tax rate. This local control often results in significant variations in tax rates and assessments, creating a complex and diverse landscape. Additionally, the state's school funding mechanism, which relies heavily on property taxes, further complicates the system, as it can lead to disparities in educational resources across districts.

Key Factors Influencing Property Taxes in New Jersey

Several critical factors play a role in determining property taxes in the state:

- Property Value: The assessed value of a property is a key determinant. Higher-valued properties typically attract higher taxes.

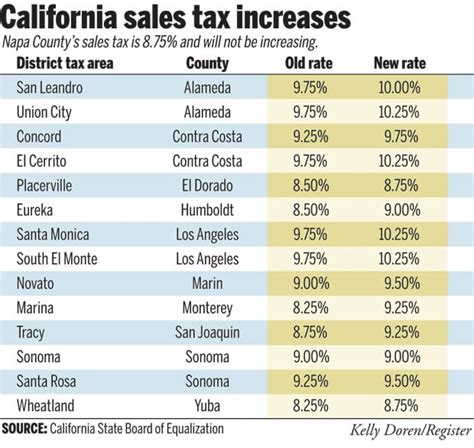

- Local Tax Rates: Each municipality sets its tax rate, which can vary widely. This rate is applied to the assessed value to calculate the tax bill.

- School Funding: Property taxes are a significant source of funding for public schools. Areas with higher educational expenditures may have higher tax rates.

- Equalization: New Jersey employs an equalization process to ensure fairness. This involves adjusting assessed values to more accurately reflect market values.

- Tax Appeals: Property owners have the right to appeal their assessments. Successful appeals can lead to reduced tax bills.

| County | Average Effective Tax Rate | Median Home Value |

|---|---|---|

| Union | 2.49% | $385,000 |

| Bergen | 2.26% | $450,000 |

| Essex | 2.25% | $330,000 |

The Property Tax Assessment Process

The assessment process is a critical component of New Jersey’s property tax system. It involves a detailed evaluation of a property’s value, taking into account various factors such as location, size, condition, and recent sales of comparable properties.

Assessment Methods

New Jersey utilizes two primary methods for assessing property values:

- Market Value Assessment: This method considers the property's value based on recent sales of similar properties in the area. It aims to reflect the property's fair market value.

- Income Approach: Used primarily for commercial properties, this method assesses value based on the property's income-generating potential.

The state also employs a reassessment process, typically conducted every six years, to ensure that property values remain up-to-date and fair.

Assessment Appeal Process

Property owners have the right to appeal their assessments if they believe the value assigned to their property is inaccurate or unfair. The appeal process involves a review by a local board of taxation or a county tax board. Successful appeals can lead to a reduction in the assessed value, resulting in lower property taxes.

To initiate an appeal, property owners must gather evidence, such as recent sales data or appraisals, to support their case. The process can be complex, so it's often beneficial to seek professional guidance or representation.

Tax Rates and Calculations

Property tax rates in New Jersey are set at the local level, with each municipality determining its rate based on the budget it needs to cover expenses, including schools, infrastructure, and other services.

Understanding Tax Rates

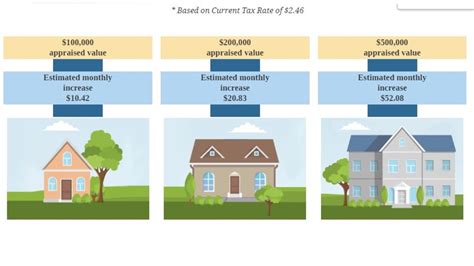

Tax rates are typically expressed as a millage rate, which is the amount of tax per 1,000 of assessed value. For instance, a millage rate of 2.5 means that for every 1,000 of assessed value, the property owner will pay $2.50 in property taxes.

It's important to note that tax rates can vary significantly between municipalities, with some areas having much higher rates than others.

Calculating Property Taxes

To calculate the property tax bill, the assessed value of the property is multiplied by the tax rate. For example, if a property has an assessed value of $300,000 and the tax rate is 2.5 mills, the annual property tax bill would be:

$300,000 x 0.0025 = $750

This means the property owner would pay $750 in annual property taxes.

Reducing Property Taxes

For homeowners and businesses, reducing property taxes is often a key concern. While the tax system in New Jersey can be challenging to navigate, there are strategies and programs in place to help alleviate the burden.

Tax Relief Programs

New Jersey offers several tax relief programs aimed at assisting homeowners, particularly those with limited incomes or disabilities. These programs include:

- Senior Freeze Program (also known as the Property Tax Reimbursement Program): This program provides reimbursement for property tax increases to eligible seniors and disabled individuals.

- Homestead Rebate Program: Offers rebates to homeowners based on their income and property tax payments.

- Property Tax Deductions: Homeowners can deduct certain expenses, such as mortgage interest and property taxes, from their federal and state income taxes.

Tax Appeal Strategies

As mentioned earlier, appealing a property assessment is a viable strategy to reduce tax obligations. By gathering evidence and presenting a strong case, property owners can potentially lower their assessed value, resulting in lower taxes.

It's crucial to stay informed about the assessment process and be proactive in reviewing and challenging assessments when necessary.

The Impact of Property Taxes on Homeownership

Property taxes have a significant impact on the affordability and desirability of homeownership in New Jersey. With some of the highest taxes in the nation, the state’s tax burden can influence decisions around purchasing, selling, and maintaining properties.

Affordability Considerations

High property taxes can make homeownership less affordable, particularly for those on fixed incomes or with limited financial means. This can lead to challenges in attracting and retaining residents, especially in areas with already high living costs.

Real-World Examples

Let’s consider a hypothetical scenario. A homeowner in a suburban town with a median home value of $400,000 and a tax rate of 2.7 mills would pay:

$400,000 x 0.0027 = $1,080

This means an annual property tax bill of $1,080. Over time, these taxes can add up significantly, influencing the homeowner's financial decisions and overall quality of life.

The Future of Property Taxes in New Jersey

As New Jersey continues to grapple with budgetary challenges and the need for equitable school funding, the future of property taxes remains a topic of debate and policy reform.

Potential Reforms

Proposed reforms often focus on addressing the disparities in tax rates and assessments across the state. These may include:

- Statewide Assessment Reform: Implementing a more standardized and uniform assessment process to reduce variations.

- Revenue Sharing: Redistributing tax revenues to ensure that areas with lower tax bases can still provide essential services and maintain quality schools.

- Tax Cap Proposals: Implementing caps on property tax increases to provide relief for homeowners.

Policy Implications

The impact of these reforms could be significant. For instance, a statewide assessment reform could lead to more consistent tax rates, making it easier for homeowners to understand and manage their tax obligations. Revenue sharing could ensure that all areas have access to quality public services, regardless of their tax base.

However, such reforms often face political and logistical challenges, requiring careful planning and consideration.

Conclusion

New Jersey’s property tax system is a complex and multifaceted topic, influencing the lives and finances of residents across the state. From understanding assessment processes to exploring relief options, this guide aims to provide a comprehensive understanding of the challenges and opportunities presented by the state’s tax landscape.

As the state continues to navigate budgetary and policy challenges, staying informed about property taxes and their implications is crucial for homeowners, investors, and policymakers alike.

How often are property values reassessed in New Jersey?

+Property values are typically reassessed every six years, although some municipalities may conduct reassessments more frequently.

Can I appeal my property assessment if I think it’s inaccurate?

+Yes, property owners have the right to appeal their assessments. It’s important to gather evidence and present a strong case to support your appeal.

What are the tax rates in my municipality?

+Tax rates vary widely across municipalities. You can find the tax rate for your municipality on your local tax assessor’s website or by contacting your local tax office.

Are there any tax relief programs available for homeowners in New Jersey?

+Yes, New Jersey offers several tax relief programs, including the Senior Freeze Program and the Homestead Rebate Program. Eligibility and application requirements vary, so it’s important to review the specific programs and their guidelines.

How can I reduce my property taxes in New Jersey?

+You can explore options such as appealing your assessment, taking advantage of tax relief programs, and staying informed about potential reforms and changes to the tax system.