Greenville County Tax

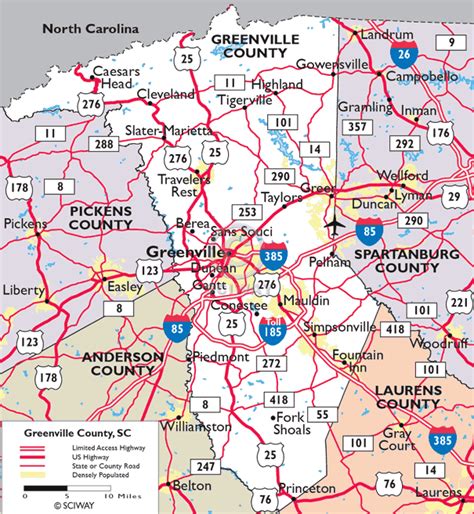

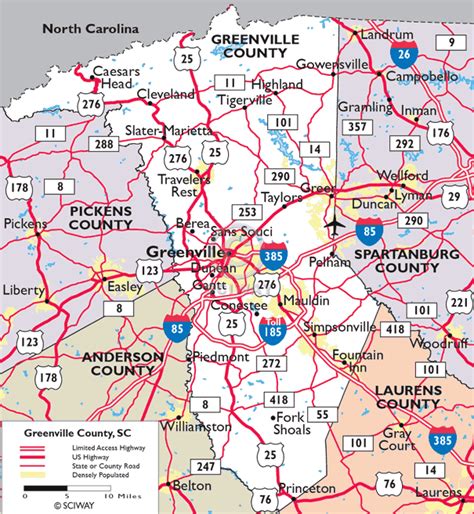

Greenville County, nestled in the heart of South Carolina, is a vibrant community with a rich history and a thriving economy. As a resident or business owner in this dynamic county, understanding the intricacies of Greenville County taxes is essential. From property assessments to sales tax rates, and from local taxes to state-wide regulations, there's a lot to navigate. In this comprehensive guide, we'll delve into the world of Greenville County taxes, providing you with the knowledge and insights needed to make informed decisions.

The Greenville County Tax Landscape

Greenville County’s tax system is a complex yet well-structured framework, designed to support the county’s growth and development while ensuring fairness and compliance. Let’s break down the key components to gain a clearer understanding.

Property Taxes: The Backbone of Greenville County’s Revenue

Property taxes are a significant source of revenue for Greenville County. The process begins with an assessment, where the county’s property tax assessor evaluates each property based on its value. This value, known as the assessed value, is determined by considering factors such as the property’s location, size, improvements, and market conditions.

Once the assessed value is established, it is multiplied by the millage rate, which is set annually by the Greenville County Council. The millage rate represents the tax rate per dollar of assessed value. For instance, if a property has an assessed value of $200,000 and the millage rate is 100 mills, the property tax due would be $2,000 ($200,000 x 0.0100). This calculation ensures that property owners contribute fairly to the county's revenue, based on the value of their holdings.

| Fiscal Year | Residential Millage Rate | Commercial Millage Rate |

|---|---|---|

| 2023-2024 | 101.69 | 121.17 |

| 2022-2023 | 100.53 | 120.01 |

| 2021-2022 | 99.63 | 119.11 |

It's important to note that Greenville County offers various property tax exemptions to eligible residents. These exemptions can significantly reduce the taxable value of a property, providing relief to homeowners. Some common exemptions include the homestead exemption, veterans' exemption, and senior citizen exemption. Understanding these exemptions and applying for them when eligible can result in substantial savings on property taxes.

Sales and Use Taxes: Generating Revenue for Essential Services

Sales and use taxes are another crucial component of Greenville County’s tax landscape. These taxes are imposed on the sale or lease of tangible personal property and certain services within the county. The revenue generated from these taxes funds essential services such as education, public safety, and infrastructure development.

Greenville County follows the state of South Carolina's sales tax structure, with a statewide base sales tax rate of 6%. However, the county also imposes an additional local sales tax rate of 1%, bringing the total sales tax rate within Greenville County to 7%. This rate is applicable to most transactions, with certain exceptions and exemptions for specific goods and services.

| Type of Tax | Rate |

|---|---|

| State Sales Tax | 6% |

| Local Sales Tax (Greenville County) | 1% |

| Total Sales Tax Rate | 7% |

It's worth noting that Greenville County also imposes a use tax, which is similar to a sales tax but applies to goods and services purchased from out-of-state vendors and used within the county. This ensures that all transactions contributing to the local economy are taxed fairly.

Business Taxes: Supporting Economic Growth

Greenville County’s vibrant business community contributes significantly to the local economy, and the county’s tax system is designed to support and encourage this growth. Businesses operating within Greenville County are subject to various taxes, including:

- Income Tax: Businesses with income sourced from Greenville County are required to pay income tax. The rate varies depending on the type of business and its tax classification.

- Franchise Tax: This tax is levied on certain types of businesses, such as corporations and limited liability companies (LLCs), based on their capital stock and surplus.

- Business License Tax: Most businesses operating within Greenville County are required to obtain a business license and pay an associated tax. The rate and requirements vary depending on the type of business and its location within the county.

- Lodging Tax: Hotels, motels, and other lodging establishments within Greenville County are subject to a lodging tax, which contributes to the county's tourism and hospitality initiatives.

Greenville County provides a range of business incentives and tax credits to attract and support businesses. These incentives can significantly reduce the tax burden for eligible businesses, making the county an attractive destination for investment and growth.

Understanding Tax Due Dates and Payment Options

Staying on top of tax due dates is crucial to avoid penalties and maintain a positive relationship with the Greenville County Treasurer’s Office. Here’s a breakdown of the key tax due dates and payment options available to residents and businesses.

Property Tax Due Dates

Property taxes in Greenville County are due in two installments. The first installment is typically due in January, and the second installment is due in June. However, it’s important to note that these due dates can vary slightly from year to year, so it’s advisable to check the specific due dates for the current fiscal year with the Greenville County Treasurer’s Office.

If a property owner fails to pay their property taxes by the due date, a penalty of 1.5% is applied for each month or portion thereof that the taxes remain unpaid. It's crucial to stay informed about these deadlines to avoid unnecessary penalties.

Sales and Use Tax Due Dates

Sales and use tax returns and payments are due on a monthly, quarterly, or annual basis, depending on the business’s tax liability and filing requirements. The specific due dates are determined by the business’s tax registration and reporting period. It’s essential for businesses to stay updated with their tax obligations to avoid late payment penalties and interest charges.

Payment Options

Greenville County offers a range of convenient payment options for residents and businesses to pay their taxes. These include:

- Online Payments: The Greenville County Treasurer's Office provides an online payment portal where taxpayers can pay their property taxes, sales taxes, and other applicable taxes securely and conveniently.

- In-Person Payments: Taxpayers can visit the Greenville County Treasurer's Office during regular business hours to make payments in person. This option is ideal for those who prefer face-to-face transactions and need assistance with their payments.

- Mail-In Payments: Taxpayers can also mail their tax payments to the Greenville County Treasurer's Office. It's important to ensure that the payment is sent well in advance of the due date to allow for processing time.

- Electronic Funds Transfer (EFT): Businesses can set up EFT payments for their sales and use taxes, providing a seamless and efficient way to manage their tax obligations.

The Role of the Greenville County Treasurer’s Office

The Greenville County Treasurer’s Office plays a vital role in the county’s tax system. This office is responsible for administering and collecting various taxes, including property taxes, sales taxes, and business taxes. They ensure that taxpayers comply with their tax obligations and provide support and guidance to residents and businesses.

The Treasurer's Office maintains detailed records of tax assessments, collections, and disbursements. They also handle taxpayer inquiries, provide tax forms and instructions, and offer assistance with tax payment options. Additionally, they ensure that tax revenues are distributed fairly and efficiently to the various county departments and agencies, supporting the delivery of essential services to the community.

Tax Relief and Assistance Programs

Greenville County recognizes the financial challenges that some residents and businesses may face when it comes to paying taxes. To provide support and relief, the county offers a range of tax relief and assistance programs. These programs are designed to ensure that taxpayers who qualify can meet their tax obligations without undue hardship.

Property Tax Relief Programs

Greenville County provides several property tax relief programs to eligible residents. These programs include:

- Homestead Exemption: This exemption reduces the taxable value of a homeowner's primary residence, providing significant savings on property taxes. To qualify, homeowners must meet certain income and residency requirements.

- Senior Citizen Exemption: Greenville County offers a partial exemption on property taxes for senior citizens who meet specific age and income criteria. This exemption helps seniors maintain their financial stability and independence.

- Disabled Veteran Exemption: Qualified disabled veterans are eligible for a property tax exemption, reducing their taxable value and providing financial relief.

Sales Tax Relief Programs

Greenville County also offers sales tax relief programs to eligible residents and businesses. These programs include:

- Food Tax Credit: This credit reduces the sales tax burden on essential food items, making groceries more affordable for low-income residents.

- Sales Tax Holidays: Greenville County occasionally participates in sales tax holidays, during which certain categories of goods are exempt from sales tax for a limited time. These holidays provide an opportunity for residents to save on essential purchases.

Business Tax Relief Programs

Greenville County understands the importance of supporting local businesses, and as such, it offers a range of business tax relief programs. These programs include:

- Business Tax Incentives: The county provides various tax incentives to attract and retain businesses, such as tax abatements, tax credits, and reduced tax rates for specific industries.

- Economic Development Initiatives: Greenville County actively promotes economic growth through various initiatives, offering tax relief and support to businesses that create jobs and contribute to the local economy.

The Future of Greenville County Taxes

As Greenville County continues to thrive and grow, its tax system will play a crucial role in supporting its development and ensuring financial stability. The county’s tax landscape is dynamic, and changes may occur to adapt to evolving economic conditions and community needs.

The Greenville County Council regularly reviews and adjusts tax rates, exemptions, and incentives to strike a balance between generating revenue for essential services and supporting the growth of the local economy. This careful management ensures that Greenville County remains an attractive place to live, work, and invest.

Looking ahead, the county may explore new tax initiatives, such as the implementation of a local option sales tax, which could provide additional revenue for specific projects or services. Additionally, the county may continue to enhance its tax relief programs to ensure that all residents and businesses have access to the support they need.

Stay informed about the latest developments in Greenville County taxes by regularly checking the Greenville County Treasurer's Office website and subscribing to their newsletters. This will ensure you remain up-to-date with any changes or updates that may impact your tax obligations.

Conclusion

Understanding Greenville County taxes is an essential aspect of being a responsible resident or business owner. By navigating the county’s tax system with the insights provided in this guide, you can ensure compliance, take advantage of available tax relief programs, and contribute to the vibrant community that Greenville County has become.

Remember, staying informed, seeking professional advice when needed, and staying up-to-date with tax due dates and payment options are key to a smooth and stress-free tax experience. With a well-structured tax system and a supportive community, Greenville County continues to thrive, and its residents and businesses can look forward to a bright and prosperous future.

What is the average property tax rate in Greenville County?

+The average property tax rate in Greenville County varies depending on the type of property and its location. However, as of the 2023-2024 fiscal year, the residential millage rate is 101.69, and the commercial millage rate is 121.17. These rates are subject to change annually, so it’s advisable to check with the Greenville County Treasurer’s Office for the most current information.

Are there any sales tax exemptions in Greenville County?

+Yes, Greenville County offers certain sales tax exemptions. For example, certain types of food, prescription drugs, and some non-prepared food items are exempt from sales tax. Additionally, certain industries, such as manufacturing, may qualify for specific sales tax exemptions or incentives. It’s important to consult with the Greenville County Treasurer’s Office or a tax professional to understand the specific exemptions and qualifications.

How can I apply for a property tax exemption in Greenville County?

+To apply for a property tax exemption in Greenville County, you’ll need to contact the Greenville County Assessor’s Office. They will provide you with the necessary forms and guidelines for the specific exemption you’re seeking. It’s important to note that eligibility criteria vary depending on the type of exemption, so be sure to review the requirements carefully.

What happens if I miss a tax payment deadline in Greenville County?

+Missing a tax payment deadline in Greenville County can result in penalties and interest charges. The specific penalties and interest rates may vary depending on the type of tax and the amount overdue. It’s crucial to stay informed about tax due dates and make timely payments to avoid these additional costs. If you’re facing financial difficulties, it’s advisable to contact the Greenville County Treasurer’s Office to discuss potential payment plans or relief options.

Are there any online resources available to help me understand Greenville County taxes?

+Yes, the Greenville County Treasurer’s Office provides a wealth of online resources to help residents and businesses understand their tax obligations. Their website offers detailed information on various taxes, including property taxes, sales taxes, and business taxes. You can find tax forms, payment options, due dates, and frequently asked questions. Additionally, they provide contact information for further assistance.