Tax Holiday Florida

Florida, the Sunshine State, is renowned for its vibrant tourism industry, lush beaches, and favorable business environment. One of the key incentives that have attracted numerous businesses to the state is its Tax Holiday program. This initiative offers a unique opportunity for businesses and individuals to save on taxes, providing a significant boost to the local economy. In this comprehensive guide, we will delve into the intricacies of the Tax Holiday in Florida, exploring its benefits, eligibility criteria, and the impact it has on the state's business landscape.

Unraveling the Tax Holiday Concept

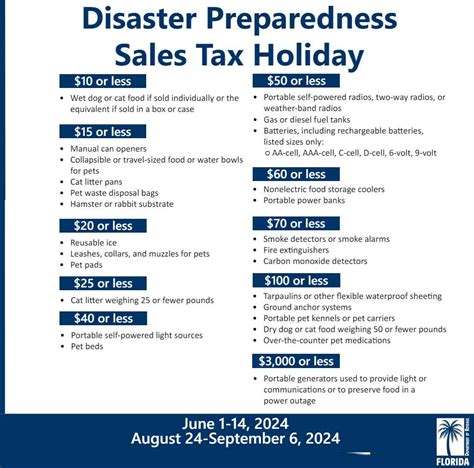

The Tax Holiday, a strategic move by the Florida government, is a designated period during which specific goods or services are exempt from certain taxes. This initiative is designed to stimulate economic activity, encourage consumer spending, and provide a competitive edge to businesses operating within the state. By suspending or reducing taxes on select items, Florida aims to create a vibrant market environment and promote economic growth.

The Tax Holiday in Florida is not a one-size-fits-all approach. Instead, it is tailored to cater to various sectors of the economy, addressing the unique needs of different industries. From retail to manufacturing, and from technology to healthcare, the state has implemented targeted tax breaks to support business growth and innovation.

Benefits of the Tax Holiday

The advantages of the Tax Holiday program are manifold, benefiting both consumers and businesses alike. For consumers, it translates to substantial savings on essential goods and services, making them more affordable and accessible. This not only boosts purchasing power but also encourages consumers to make larger purchases, thus contributing to the overall economic growth of the state.

From a business perspective, the Tax Holiday is a strategic opportunity to attract new customers, boost sales, and enhance their market position. By offering tax-free products or services, businesses can create a unique selling proposition, drawing in more customers and increasing their market share. Moreover, the increased consumer spending during the Tax Holiday period can help businesses build their inventory, improve cash flow, and invest in business expansion or innovation.

Additionally, the Tax Holiday can foster a sense of community and loyalty among consumers. By providing tax breaks on essential items, Florida demonstrates its commitment to the well-being of its residents, creating a positive image of the state and its businesses. This, in turn, can lead to increased consumer trust and loyalty, benefiting businesses in the long run.

Eligibility and Qualifying Criteria

Understanding the eligibility criteria for the Tax Holiday is crucial for businesses and consumers alike. While the specific guidelines may vary depending on the type of tax holiday, there are some common factors that businesses should consider.

Business Eligibility

Generally, businesses operating within the state of Florida are eligible to participate in the Tax Holiday program. This includes retail stores, online retailers, manufacturers, and other service providers. However, it is important to note that certain restrictions may apply based on the type of business and the goods or services offered.

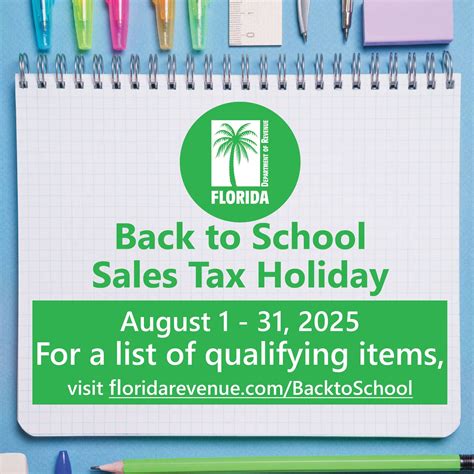

For instance, some tax holidays may be limited to specific industries, such as back-to-school supplies or energy-efficient appliances. In such cases, businesses must ensure that their products align with the designated categories to qualify for the tax exemption.

Additionally, businesses should be aware of any sales thresholds or volume limits that may apply during the Tax Holiday period. These limits are designed to prevent excessive profiteering and ensure a level playing field for all participating businesses.

Consumer Eligibility

Consumers also play a vital role in the success of the Tax Holiday program. While there are no specific eligibility criteria for consumers, it is important for them to understand the terms and conditions of the tax exemption. This includes being aware of the designated tax holiday period, the qualifying items, and any purchase limits that may be in place.

For instance, during a back-to-school tax holiday, consumers may be limited to purchasing a certain quantity of school supplies to qualify for the tax exemption. Being informed about these details can help consumers make the most of the Tax Holiday and maximize their savings.

Impact on Florida’s Economy

The Tax Holiday program has had a significant impact on Florida’s economy, driving growth and development across various sectors. By stimulating consumer spending and encouraging business investment, the initiative has contributed to job creation, increased tax revenues, and a thriving business environment.

Job Creation and Economic Growth

The Tax Holiday period often sees a surge in consumer activity, leading to increased demand for goods and services. This, in turn, creates a ripple effect throughout the economy, with businesses requiring additional staff to meet the heightened demand. As a result, the Tax Holiday has been instrumental in creating job opportunities, particularly in the retail and service sectors.

Furthermore, the increased economic activity during the Tax Holiday period provides a boost to local businesses, encouraging them to expand their operations and create more jobs. This positive cycle of growth and investment strengthens the state's economy and contributes to its overall prosperity.

Tax Revenue and Government Support

While the Tax Holiday involves a temporary suspension of certain taxes, it has not had a detrimental effect on Florida’s tax revenue. In fact, the initiative has proven to be a strategic move that ultimately benefits the state’s finances. By stimulating economic activity and encouraging consumer spending, the Tax Holiday generates increased tax revenue in the long run.

The additional revenue generated during the Tax Holiday period can be utilized by the government to support various public services, infrastructure development, and economic initiatives. This ensures that the state's resources are allocated efficiently, benefiting the community as a whole.

Community Engagement and Awareness

The Tax Holiday program has also fostered a sense of community engagement and awareness among Floridians. By promoting the initiative through various channels, including local media, social media, and community events, the state has successfully raised awareness about the benefits of the program.

This increased awareness has led to a higher level of participation during the Tax Holiday periods, with consumers actively seeking out tax-free products and services. This not only boosts the state's economy but also creates a positive feedback loop, encouraging businesses to continue participating in future Tax Holiday programs.

Real-World Success Stories

The impact of the Tax Holiday program in Florida can be witnessed through numerous success stories across various industries. Let’s explore some real-world examples that highlight the benefits and potential of this initiative.

Retail Sector: A Boost in Sales and Customer Satisfaction

During the annual back-to-school Tax Holiday, a leading retail chain in Florida saw a significant increase in sales. By offering tax-free school supplies and clothing, the store attracted a large number of customers, many of whom were first-time visitors. This not only boosted the store’s revenue but also enhanced its reputation as a consumer-friendly destination.

The success of this Tax Holiday period led to a higher customer retention rate, as many families returned to the store throughout the year, citing the positive experience they had during the tax-free period. This demonstrated the power of the Tax Holiday in building customer loyalty and fostering a positive brand image.

Manufacturing Industry: Increased Production and Market Presence

A Florida-based manufacturing company specializing in energy-efficient appliances experienced a surge in demand during the state’s Energy Tax Holiday. By offering tax exemptions on their energy-saving products, the company attracted both residential and commercial customers, many of whom were previously unaware of the benefits of energy-efficient appliances.

The increased sales during the Tax Holiday period allowed the company to expand its production capacity, hire additional staff, and invest in research and development. This not only strengthened their market presence but also contributed to the state's goal of promoting energy-efficient practices and reducing carbon emissions.

Healthcare Sector: Affordable Access to Medical Supplies

The Tax Holiday program in Florida has also extended its benefits to the healthcare sector. During a designated tax holiday for medical supplies, a local pharmacy saw a significant increase in sales of essential healthcare products. This provided much-needed relief to consumers, especially those with limited budgets, as they could access these products at a reduced cost.

The pharmacy, in turn, benefited from increased foot traffic and customer loyalty. Many customers expressed their appreciation for the tax exemption, recognizing the positive impact it had on their healthcare expenses. This success story highlights how the Tax Holiday can improve access to essential goods and services, benefiting both consumers and businesses.

FAQs: Demystifying the Tax Holiday

When does the Tax Holiday period typically occur in Florida?

+The Tax Holiday period in Florida varies depending on the type of tax holiday. For instance, the back-to-school tax holiday usually occurs in late July or early August, while the energy tax holiday is often held in the spring. It’s essential to stay updated with the specific dates for each tax holiday to make the most of these opportunities.

Are there any limitations on the quantity of items I can purchase during the Tax Holiday?

+Yes, some tax holidays in Florida may have purchase limits to prevent excessive profiteering. For example, during the back-to-school tax holiday, there may be a limit on the number of items or the total amount of school supplies that can be purchased tax-free. It’s important to check the specific guidelines for each tax holiday to ensure compliance.

Can businesses offer discounts or promotions in addition to the Tax Holiday savings?

+Absolutely! Many businesses take the opportunity of the Tax Holiday to offer additional discounts or promotions to attract even more customers. This can include special sales events, loyalty programs, or bundle deals. By combining the tax savings with additional discounts, businesses can create a compelling offer for consumers.

How can consumers stay informed about upcoming Tax Holiday periods and eligible items?

+There are several ways consumers can stay informed about the Tax Holiday program. The Florida Department of Revenue provides detailed information on its website, including the dates, eligible items, and any specific guidelines. Additionally, local media outlets, social media pages, and community organizations often promote the Tax Holiday, ensuring that consumers are aware of the upcoming opportunities.

The Tax Holiday program in Florida is a powerful tool that has transformed the state's business landscape, offering numerous benefits to both businesses and consumers. By understanding the eligibility criteria, leveraging the advantages, and staying informed about the upcoming tax holidays, businesses and consumers can maximize their participation and contribute to the thriving economy of the Sunshine State.