South Carolina Income Tax

Welcome to an in-depth exploration of South Carolina's Income Tax, a critical component of the state's revenue system and an essential aspect of its economic landscape. Understanding the intricacies of South Carolina's income tax is vital for individuals, businesses, and investors alike, as it directly impacts financial planning, investment strategies, and the overall economic health of the state.

South Carolina, known for its vibrant culture, thriving industries, and picturesque landscapes, has a unique approach to income taxation that influences the state's financial dynamics and investment opportunities. This article aims to provide a comprehensive guide to South Carolina's income tax, offering insights into its structure, rates, exemptions, and implications for taxpayers.

The Structure of South Carolina’s Income Tax System

South Carolina operates on a graduated income tax system, which means that the tax rate applied to an individual’s income increases as their income level rises. This progressive tax structure aims to ensure that higher-income earners contribute a larger proportion of their income to the state’s revenue.

The state's income tax system is designed to complement the federal income tax system, allowing for a seamless transition between the two. Residents of South Carolina are required to file both federal and state tax returns, with the state tax return reflecting adjustments and deductions made on the federal level.

Tax Rates and Brackets

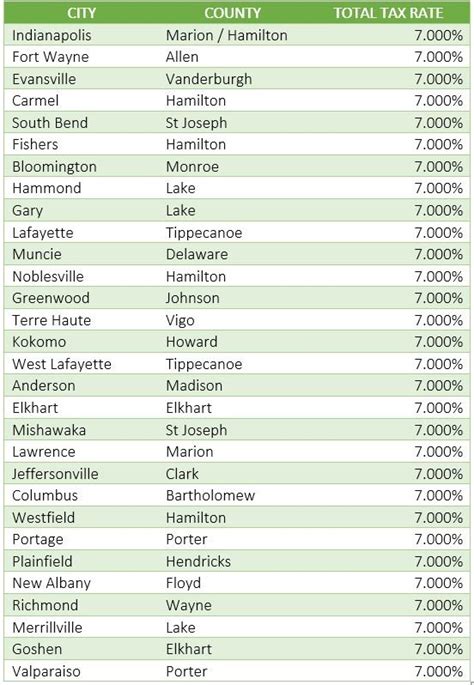

South Carolina’s income tax rates are divided into seven brackets, each corresponding to a specific income range. The tax rates range from 0% to 7%, with the highest rate applying to the highest income brackets. This graduated structure ensures that the tax burden is distributed proportionally across different income levels.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $2,999 | 0% |

| $3,000 - $5,999 | 3% |

| $6,000 - $10,999 | 4% |

| $11,000 - $20,999 | 5% |

| $21,000 - $35,999 | 6% |

| $36,000 - $90,000 | 6.5% |

| Over $90,000 | 7% |

Exemptions and Deductions

South Carolina offers a range of exemptions and deductions to reduce the tax liability of its residents. These include personal exemptions, dependent exemptions, and a standard deduction. Additionally, the state allows for various itemized deductions, such as those for medical expenses, charitable contributions, and certain tax credits.

One notable exemption is the homestead exemption, which provides a tax break for homeowners. This exemption reduces the assessed value of a primary residence, resulting in lower property taxes. Such incentives encourage homeownership and contribute to the stability of the state's real estate market.

Taxable Income and Reporting

South Carolina residents are required to report their total income from all sources, including wages, salaries, bonuses, commissions, and investment income. The state also taxes income from pensions, annuities, and retirement accounts, subject to certain exemptions.

For businesses, South Carolina's tax structure is designed to encourage economic growth and investment. The state offers corporate income tax incentives for businesses operating within its borders, including tax credits for research and development, job creation, and investment in certain industries. These incentives aim to foster a business-friendly environment and attract new investments.

Filing and Payment Deadlines

The deadline for filing South Carolina income tax returns typically aligns with the federal tax deadline, which is usually April 15th of each year. However, in years when April 15th falls on a weekend or a holiday, the deadline may be extended to the next business day. It is essential for taxpayers to be aware of these deadlines to avoid penalties and late fees.

Taxpayers can file their returns electronically or by mail, with the South Carolina Department of Revenue providing a user-friendly online portal for electronic filing. Payment options include direct debit, credit card, and electronic funds transfer, offering convenience and flexibility to taxpayers.

Economic Impact and Investment Opportunities

South Carolina’s income tax system plays a crucial role in the state’s economic landscape, influencing investment decisions and business strategies. The state’s tax structure, combined with its business-friendly environment and diverse industries, makes it an attractive destination for investors and entrepreneurs.

Attracting Business and Investment

The state’s competitive tax rates and incentives for businesses create an environment conducive to economic growth. South Carolina’s approach to income taxation attracts a range of industries, from manufacturing and technology to tourism and healthcare. This diverse economic base contributes to the state’s resilience and long-term sustainability.

Furthermore, South Carolina's income tax system, combined with its favorable business climate, has led to the establishment of numerous successful businesses and startups. The state's tax incentives for research and development, for instance, have fostered innovation and technological advancement, positioning South Carolina as a hub for cutting-edge industries.

Real Estate and Property Investment

South Carolina’s income tax structure, particularly its homestead exemption and property tax incentives, has a significant impact on the real estate market. These incentives encourage homeownership and investment in real estate, contributing to the state’s thriving property market. Investors seeking stable and lucrative property investments often find South Carolina an attractive option.

The state's vibrant tourism industry, coupled with its picturesque coastal regions and historical landmarks, further enhances the appeal of real estate investment. Whether it's beachfront properties, historic downtown condos, or rural land for development, South Carolina offers a diverse range of investment opportunities.

Conclusion: South Carolina’s Income Tax Landscape

South Carolina’s income tax system is a well-structured and carefully designed component of the state’s financial framework. It balances the needs of revenue generation with the goal of encouraging economic growth, business investment, and homeownership. The state’s approach to income taxation is a critical factor in its overall economic success and its ability to attract and retain a diverse range of industries and businesses.

As South Carolina continues to thrive and evolve, its income tax system will play a pivotal role in shaping the state's economic future. Understanding the intricacies of this system is essential for individuals and businesses looking to navigate the state's financial landscape and capitalize on the myriad investment opportunities it offers.

What is the difference between South Carolina’s income tax and federal income tax?

+South Carolina’s income tax is a separate tax from the federal income tax. While both systems operate on a graduated tax structure, the tax rates and brackets differ. Additionally, South Carolina’s tax system offers its own set of exemptions and deductions, which may differ from those available at the federal level.

Are there any tax credits available in South Carolina for specific industries or initiatives?

+Yes, South Carolina offers a range of tax credits to encourage specific industries and initiatives. These include credits for research and development, job creation, investment in certain sectors, and more. These credits are designed to foster economic growth and innovation in targeted areas.

How does South Carolina’s income tax impact the state’s business climate and economic growth?

+South Carolina’s income tax system, combined with its business-friendly policies and incentives, has a positive impact on the state’s business climate and economic growth. The competitive tax rates and incentives attract a diverse range of industries, fostering economic diversification and stability. This, in turn, creates job opportunities and contributes to the state’s overall prosperity.