Indiana State Tax Return Status

Are you eagerly awaiting the status of your Indiana state tax return? In this comprehensive guide, we'll delve into the world of Indiana tax return processing, exploring the steps, timelines, and factors that influence the process. From understanding the unique aspects of Indiana's tax system to tracking your return's progress, we've got you covered. Whether you're a resident or a non-resident, a business owner, or an individual filer, this article will provide you with the insights and tools you need to navigate the Indiana tax landscape confidently.

The Indiana Tax Return Process: An Overview

The Indiana Department of Revenue handles the processing of state tax returns, ensuring compliance with state tax laws and regulations. Understanding the Indiana tax return process is crucial for both individuals and businesses, as it impacts timely filing, potential refunds, and accurate reporting. Let’s break down the key stages of this process:

Step 1: Tax Filing Period

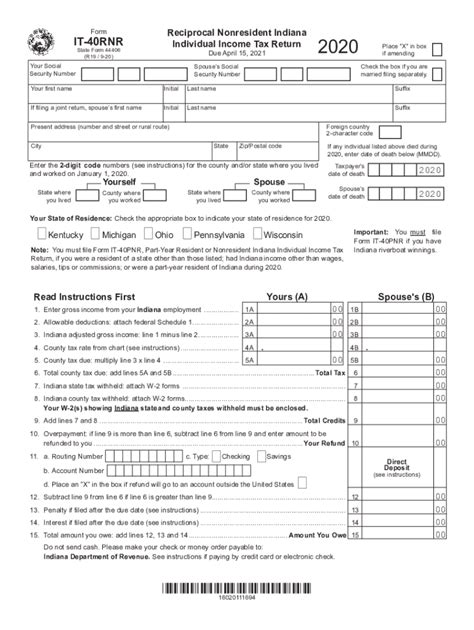

The tax filing period in Indiana typically spans from January to April each year, mirroring the federal tax filing season. However, it’s important to note that specific filing deadlines may vary based on the type of tax return and the taxpayer’s circumstances. For instance, individual taxpayers generally have until April 15th to file their returns, while business taxpayers may have different deadlines depending on their legal structure.

During this period, taxpayers are required to gather relevant financial documents, such as W-2 forms, 1099 forms, and receipts, to ensure accurate reporting. The Indiana Department of Revenue provides comprehensive guidelines and resources to assist taxpayers in navigating the filing process, including online filing options and the necessary forms.

Step 2: Return Processing

Once the tax return is filed, the Indiana Department of Revenue initiates the processing phase. This stage involves a thorough review of the submitted information to ensure compliance with state tax laws. The processing time can vary based on several factors, including the complexity of the return, the accuracy of the submitted information, and the volume of returns received by the department.

During the processing stage, taxpayers may receive correspondence from the Indiana Department of Revenue regarding any discrepancies or additional information required. It's crucial for taxpayers to respond promptly to such requests to avoid delays in the processing of their returns.

Step 3: Refund Processing (if applicable)

For taxpayers who are eligible for a refund, the Indiana Department of Revenue will initiate the refund processing stage. The timeline for refund issuance can vary, depending on the method of filing and the taxpayer’s circumstances. Generally, taxpayers can expect to receive their refunds within a few weeks to a couple of months after their returns have been processed.

The Indiana Department of Revenue offers various refund options, including direct deposit and check payments. Taxpayers can choose their preferred refund method when filing their returns, ensuring a more efficient and convenient process.

Factors Influencing Indiana State Tax Return Status

The processing and status of Indiana state tax returns can be influenced by several factors, each playing a crucial role in the overall timeline. By understanding these factors, taxpayers can better anticipate the status of their returns and take necessary actions if delays occur.

Complexity of the Return

The complexity of a tax return is one of the primary factors affecting its processing time. Returns that involve multiple sources of income, various deductions, or business-related expenses often require more time for thorough review and analysis. Complex returns may include situations such as:

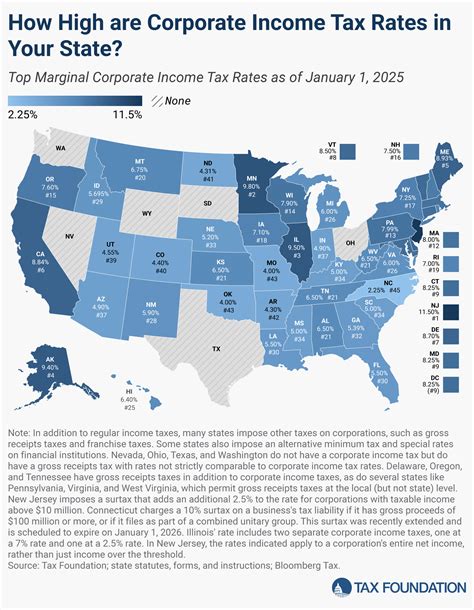

- Multiple state tax returns due to residing in or conducting business across different states.

- Taxpayers with significant investment income, requiring careful calculation of capital gains or losses.

- Business taxpayers with complex financial structures or extensive employee benefits.

Accuracy of Information

Accurate reporting is essential for a smooth tax return process. Errors or discrepancies in the submitted information can lead to delays in processing. The Indiana Department of Revenue may need to contact taxpayers to resolve these issues, extending the overall processing time.

Volume of Returns

The volume of tax returns received by the Indiana Department of Revenue can also impact the processing timeline. During peak filing seasons, such as the traditional April deadline, the department experiences a surge in returns, which may lead to increased processing times. Taxpayers should be mindful of these peak periods and plan their filing accordingly.

Additional Review or Audits

In certain cases, the Indiana Department of Revenue may require additional review or even conduct audits on specific tax returns. This can occur when there are significant discrepancies, potential errors, or suspicious activities identified during the initial processing stage. Audits can lead to extended processing times, as they involve a more detailed examination of the taxpayer’s financial records and may require additional documentation.

Tracking Your Indiana State Tax Return Status

Staying informed about the status of your Indiana state tax return is crucial for effective financial planning and timely decision-making. The Indiana Department of Revenue provides several resources and tools to help taxpayers track the progress of their returns, ensuring transparency and peace of mind.

Online Status Check

The Indiana Department of Revenue offers an online status check feature, accessible through their official website. Taxpayers can log in to their individual or business accounts to view the current status of their returns. This feature provides real-time updates, allowing taxpayers to monitor the progress of their returns from the comfort of their homes.

Email or Text Notifications

To stay updated on the status of their returns, taxpayers can opt to receive email or text notifications from the Indiana Department of Revenue. These notifications provide timely alerts regarding important milestones in the return processing journey, such as the receipt of the return, the initiation of processing, and the issuance of refunds.

Phone Support

For taxpayers who prefer a more personalized approach, the Indiana Department of Revenue offers phone support. Trained representatives are available to provide assistance and answer inquiries regarding the status of tax returns. This option is particularly beneficial for taxpayers who may have complex return situations or require additional guidance.

Future Implications and Trends in Indiana Tax Returns

The world of tax returns is ever-evolving, and Indiana is no exception. As technology advances and tax laws undergo revisions, the processing of Indiana state tax returns is likely to experience significant transformations in the coming years. Let’s explore some of the key future implications and trends that taxpayers should be aware of.

Digital Transformation

The Indiana Department of Revenue is actively embracing digital transformation to enhance the tax return process. The department is investing in modern technologies, such as cloud computing and artificial intelligence, to streamline the processing of tax returns and improve overall efficiency. This shift towards digital tax administration is expected to result in faster processing times, reduced errors, and a more seamless experience for taxpayers.

Tax Law Updates

Tax laws are subject to change, and taxpayers in Indiana should stay informed about any updates or revisions. The Indiana General Assembly periodically revisits tax laws, introducing new regulations, deductions, or credits that may impact the filing process. Staying abreast of these changes is crucial for accurate reporting and compliance.

Enhanced Security Measures

With the increasing prevalence of cyber threats and identity theft, the Indiana Department of Revenue is prioritizing the enhancement of security measures to protect taxpayer information. This includes implementing robust encryption protocols, multi-factor authentication, and other advanced security technologies to safeguard sensitive data during the tax return process.

Tax Reform Initiatives

Indiana, like many other states, is exploring tax reform initiatives to simplify the tax system and improve fairness. These initiatives may involve restructuring tax brackets, revising tax rates, or introducing new tax credits and deductions. Taxpayers should stay tuned for any significant tax reform announcements, as these changes can have a direct impact on their tax liabilities and return processing.

Frequently Asked Questions

How long does it typically take to process an Indiana state tax return?

+The processing time for an Indiana state tax return can vary, but on average, it takes around 4 to 6 weeks from the date of filing. However, factors such as the complexity of the return, accuracy of information, and the volume of returns received by the Indiana Department of Revenue can influence the processing timeline.

What happens if my Indiana state tax return is selected for an audit?

+If your Indiana state tax return is selected for an audit, you will receive a notification from the Indiana Department of Revenue. An audit is a detailed review of your financial records and tax return to ensure accuracy and compliance. It’s important to cooperate with the audit process and provide the necessary documentation as requested. You may also consider seeking professional assistance to guide you through the audit.

How can I check the status of my Indiana state tax refund?

+You can check the status of your Indiana state tax refund by logging into your online account on the Indiana Department of Revenue’s website. Alternatively, you can call the department’s customer service hotline and provide your tax identification number to receive an update on your refund status.

Are there any penalties for late filing of Indiana state tax returns?

+Yes, Indiana imposes penalties for late filing of state tax returns. The penalty is typically calculated as a percentage of the tax due, with additional interest accruing over time. It’s important to file your Indiana state tax return by the due date to avoid these penalties and potential interest charges.

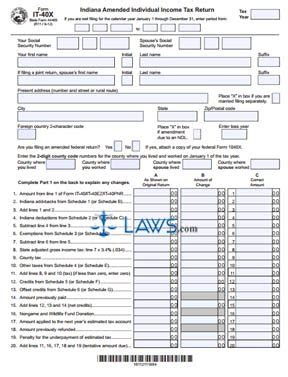

Can I file an amended Indiana state tax return if I made a mistake?

+Yes, you can file an amended Indiana state tax return if you discover a mistake or need to make changes to your original return. You will need to complete Form IT-1040X, the Amended Indiana Individual Income Tax Return, and submit it along with any supporting documentation. It’s important to follow the instructions provided by the Indiana Department of Revenue for amending tax returns.