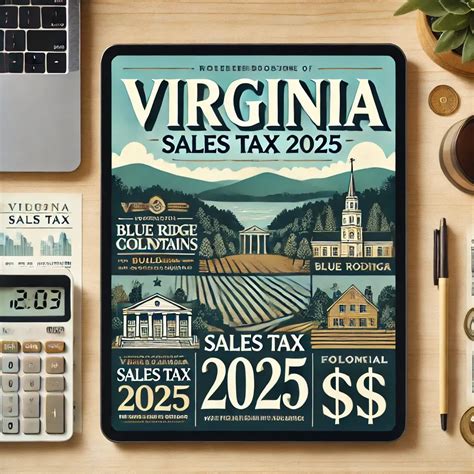

Sales Tax Richmond Va

Sales tax is an essential component of any economy, and it plays a crucial role in generating revenue for state and local governments. In Richmond, Virginia, sales tax is a significant source of funding for various public services and infrastructure development. This article delves into the intricacies of sales tax in Richmond, providing an in-depth analysis of its rates, exemptions, and impact on businesses and consumers.

Understanding Sales Tax in Richmond, VA

Richmond, the capital of Virginia, has a robust economy with a diverse range of industries. The city's sales tax system is designed to ensure a fair and efficient revenue collection process. Let's explore the key aspects of sales tax in Richmond.

Sales Tax Rates

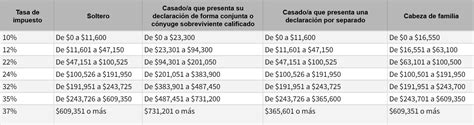

The sales tax in Richmond is comprised of both state and local taxes. As of the latest information, the state sales tax rate in Virginia is 4.3%, which is applied uniformly across the state. However, local governments, including cities like Richmond, have the authority to impose additional sales taxes to meet their specific revenue needs.

Richmond, along with other localities in Virginia, has implemented a local sales tax rate of 1%. This local tax is often used to fund local initiatives, such as transportation projects or community development programs. Thus, the combined sales tax rate in Richmond is 5.3%, which includes both the state and local components.

It's important to note that sales tax rates can change periodically, so staying updated with the latest information is crucial for businesses and consumers alike. The Virginia Department of Taxation regularly publishes updates on its website, ensuring transparency and accessibility for all stakeholders.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 4.3% |

| Local Sales Tax (Richmond) | 1% |

| Total Sales Tax in Richmond | 5.3% |

Sales Tax Exemptions

While most goods and services are subject to sales tax, Virginia, including Richmond, offers certain exemptions to promote specific economic or social goals. Here are some notable sales tax exemptions in the city:

- Groceries and Food Items: Essential groceries and food products are generally exempt from sales tax in Richmond. This exemption ensures that basic necessities remain more affordable for residents.

- Prescription Medications: Sales tax is not applicable to prescription drugs and certain medical devices, providing relief to individuals with healthcare needs.

- Manufacturing Equipment: To support the growth of the manufacturing sector, sales tax is often waived on purchases of machinery and equipment used directly in manufacturing processes.

- Educational Materials: Books, school supplies, and certain educational resources are exempt from sales tax, encouraging investment in education.

- Agricultural Products: Farmers and agricultural businesses benefit from sales tax exemptions on various farming equipment and agricultural products.

These exemptions, along with others outlined in the Virginia Tax Code, contribute to a more targeted and strategic approach to revenue collection, fostering economic growth and social welfare.

Impact on Businesses

Sales tax has a direct influence on businesses operating within Richmond. Here's how it affects various aspects of business operations:

Revenue Generation

For businesses, sales tax represents a significant source of revenue. By collecting sales tax on eligible transactions, companies contribute to the local and state economies. This revenue is vital for funding public services, infrastructure projects, and government operations.

Compliance and Administration

Staying compliant with sales tax regulations is crucial for businesses. It involves accurate record-keeping, proper tax calculation, and timely remittance to the relevant tax authorities. Failure to comply can lead to penalties and legal consequences. Businesses often invest in accounting software or tax professionals to ensure accurate compliance.

Pricing Strategies

Sales tax rates influence pricing strategies. Businesses may choose to absorb the tax or pass it on to consumers. Clear communication of tax-inclusive prices is essential to maintain transparency and avoid customer confusion.

Competitive Advantage

In a competitive market, businesses must consider the impact of sales tax on their pricing and overall competitiveness. Some businesses may choose to offer tax-free promotions or discounts to attract customers, especially during peak shopping seasons.

Impact on Consumers

Consumers in Richmond are directly affected by sales tax, as it influences their purchasing power and overall spending habits. Let's explore some key aspects of sales tax from a consumer perspective.

Price Transparency

Consumers value price transparency. When sales tax is included in the displayed price, it provides a clear understanding of the total cost. This transparency helps consumers make informed purchasing decisions and compare prices effectively.

Budgeting and Affordability

Sales tax can impact consumers' budgeting and affordability, especially for essential items. Exemptions on groceries and necessities can provide much-needed relief, ensuring that basic needs remain accessible.

Tax Burden Perception

The perception of tax burden varies among consumers. Some may view sales tax as a necessary contribution to public services, while others may perceive it as a financial burden. Clear communication about the purpose and benefits of sales tax can help shape public opinion and build trust.

Online Shopping

With the rise of e-commerce, consumers often compare prices online, including sales tax rates. Richmond's sales tax rate may influence consumers' purchasing decisions, especially when comparing prices with other states or online retailers.

Sales Tax Collection and Administration

The efficient collection and administration of sales tax are crucial for the city's fiscal health. Here's an overview of the sales tax collection process in Richmond:

Registration and Remittance

Businesses operating in Richmond are required to register with the Virginia Department of Taxation. They must collect sales tax on eligible transactions and remit the tax to the department on a regular basis, typically monthly or quarterly.

Audit and Compliance

The Department of Taxation conducts audits to ensure compliance with sales tax regulations. These audits verify the accuracy of tax calculations, proper exemption applications, and timely remittance. Businesses should maintain detailed records to facilitate the audit process.

Sales Tax Holidays

To encourage spending and provide temporary relief, Virginia occasionally declares sales tax holidays. During these periods, certain categories of goods, such as clothing or school supplies, are exempt from sales tax. These holidays often generate increased sales and provide a boost to the local economy.

Future Implications and Trends

Sales tax in Richmond is subject to ongoing changes and developments. Here are some key trends and potential future implications:

Online Sales Tax

With the growing popularity of e-commerce, the collection of sales tax on online transactions is a significant focus. Richmond, like many other cities, may explore ways to streamline the collection process for online sales, ensuring a level playing field for both brick-and-mortar and online retailers.

Sales Tax Simplification

Efforts to simplify sales tax regulations and procedures are underway to reduce the administrative burden on businesses. This includes standardized tax rates, simplified exemption rules, and enhanced digital tools for compliance.

Economic Development Initiatives

Sales tax revenue often plays a critical role in funding economic development initiatives. Richmond may utilize sales tax revenue to attract new businesses, support entrepreneurship, and promote job creation, thereby boosting the local economy.

Public Services and Infrastructure

Sales tax revenue is essential for funding public services, including education, healthcare, and transportation. As Richmond's population grows, the demand for these services increases, highlighting the importance of sustainable sales tax revenue.

Frequently Asked Questions (FAQ)

What is the current sales tax rate in Richmond, VA?

+

The current sales tax rate in Richmond, VA, is 5.3%, which includes the state sales tax rate of 4.3% and the local sales tax rate of 1%.

Are there any sales tax exemptions in Richmond, VA?

+

Yes, Richmond, VA, offers sales tax exemptions on certain items such as groceries, prescription medications, manufacturing equipment, educational materials, and agricultural products.

How often do sales tax rates change in Richmond, VA?

+

Sales tax rates in Richmond, VA, can change periodically. It is essential to stay updated with the latest information, as any changes are typically announced by the Virginia Department of Taxation.

How does sales tax impact businesses in Richmond, VA?

+

Sales tax impacts businesses in Richmond, VA, by generating revenue, influencing pricing strategies, and requiring compliance with tax regulations. It affects revenue generation, compliance administration, and overall competitiveness.

What is the role of sales tax in funding public services in Richmond, VA?

+

Sales tax revenue in Richmond, VA, plays a crucial role in funding public services such as education, healthcare, transportation, and infrastructure development, contributing to the overall well-being of the community.