City Of New Orleans Property Tax

In the vibrant city of New Orleans, property taxes are an essential aspect of local governance and contribute significantly to the city's economic landscape. This article delves into the intricacies of the New Orleans property tax system, exploring its unique features, rates, and impact on both residents and the city's development.

Understanding the New Orleans Property Tax System

The city of New Orleans, known for its rich cultural heritage and vibrant atmosphere, operates under a comprehensive property tax system that is vital to its financial sustainability and public service provision. This system, while following general property tax principles, also incorporates unique aspects that reflect the city’s distinctive character and historical context.

At its core, the New Orleans property tax system assesses taxes on both real estate and personal property within the city limits. This includes residential, commercial, and industrial properties, as well as various types of personal property such as vehicles, boats, and certain business assets.

The tax rates in New Orleans are determined by a combination of factors, including the assessed value of the property, the type of property, and the specific millage rates set by various taxing authorities. The millage rate, measured in mills (where one mill equals $1 of tax for every $1,000 of assessed property value), is established by local government bodies such as the Orleans Parish School Board, the City of New Orleans, and other special taxing districts.

Assessed Value and Property Appraisals

The assessed value of a property in New Orleans is typically based on its fair market value as determined by the Orleans Parish Tax Assessor’s Office. This office conducts regular property appraisals to ensure that the assessed values are accurate and up-to-date. The assessed value can be influenced by various factors, including recent sales data, improvements made to the property, and the overall real estate market conditions in the city.

| Property Type | Assessed Value |

|---|---|

| Residential (Single-Family Home) | $350,000 |

| Commercial (Office Space) | $700,000 |

| Industrial (Warehouse) | $500,000 |

These assessed values are then used to calculate the property tax liability, which is typically due twice a year. Property owners in New Orleans receive a tax bill that outlines the assessed value, the applicable millage rates, and the total tax amount due.

Millage Rates and Taxing Authorities

The millage rates in New Orleans are set by various taxing authorities, each with its own specific purpose and responsibilities. These authorities include the City of New Orleans, which uses property taxes to fund essential services like police, fire protection, and public works; the Orleans Parish School Board, which is responsible for educating the city’s youth and maintains numerous schools; and other special taxing districts, such as the Sewerage and Water Board, which manages the city’s water and sewerage infrastructure.

| Taxing Authority | Millage Rate (per $1,000 of Assessed Value) |

|---|---|

| City of New Orleans | 55.00 |

| Orleans Parish School Board | 110.00 |

| Sewerage and Water Board | 45.00 |

Each of these authorities has a specific role in the city's governance and development, and their respective millage rates are approved through public processes, often involving public hearings and approval by the Louisiana Tax Commission.

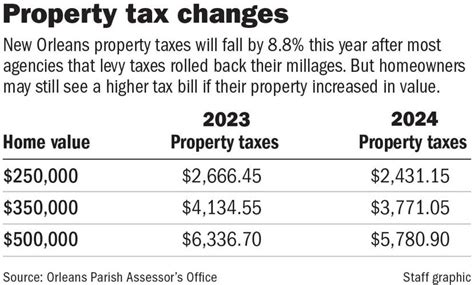

Property Tax Rates and Their Impact

The property tax rates in New Orleans play a crucial role in shaping the city’s economic landscape and influencing the decisions of both residents and businesses. These rates are carefully calibrated to fund essential services, support public infrastructure, and maintain the city’s vibrant culture and heritage.

Residential Property Tax Rates

For residential properties in New Orleans, the tax rates are determined by the combined millage rates of the various taxing authorities. As an example, consider a single-family home with an assessed value of $350,000. Using the millage rates provided earlier, the tax calculation would be as follows:

| Taxing Authority | Millage Rate | Tax Amount |

|---|---|---|

| City of New Orleans | 55.00 mills | $1,925 |

| Orleans Parish School Board | 110.00 mills | $3,850 |

| Sewerage and Water Board | 45.00 mills | $1,575 |

| Total Tax Amount | $7,350 | |

This example illustrates how the combined millage rates of the different taxing authorities contribute to the overall property tax burden for residential properties in New Orleans.

Impact on Homeowners

The property tax rates in New Orleans can significantly impact homeowners’ financial planning and decisions. High property taxes can influence a homeowner’s decision to sell, rent, or maintain their property. For instance, an increase in property taxes could lead to a higher cost of living for residents, potentially impacting their ability to afford other essential services or goods.

Additionally, property taxes can affect the desirability of a neighborhood or area. Areas with consistently high property taxes may see a shift in the demographic makeup of their residents, as those who cannot afford the tax burden may be forced to move to more affordable locations. On the other hand, stable and reasonably priced property taxes can encourage homeownership and long-term residency, fostering a sense of community and continuity.

Commercial and Industrial Property Tax Rates

Commercial and industrial properties in New Orleans face a different tax landscape compared to residential properties. These properties are typically assessed at a higher rate, reflecting their potential for generating higher income and their impact on the local economy.

For example, an office space with an assessed value of $700,000 would have a significantly higher tax burden than a residential property with the same assessed value. The tax calculation for this commercial property would be as follows:

| Taxing Authority | Millage Rate | Tax Amount |

|---|---|---|

| City of New Orleans | 55.00 mills | $3,850 |

| Orleans Parish School Board | 110.00 mills | $7,700 |

| Sewerage and Water Board | 45.00 mills | $3,150 |

| Total Tax Amount | $14,700 | |

As seen in this example, the total tax amount for commercial properties can be substantially higher than that of residential properties, due to both the higher assessed values and the specific millage rates applied to these properties.

Impact on Businesses

High property tax rates for commercial and industrial properties can influence a business’s decision to locate, expand, or maintain operations in New Orleans. While these taxes contribute significantly to the city’s revenue, they can also pose a challenge for businesses, especially small and medium-sized enterprises, as they can increase operational costs and potentially affect profitability.

On the other hand, a stable and predictable property tax system can provide businesses with the certainty needed to plan for the future. It can encourage long-term investment, job creation, and economic growth, all of which are essential for the city's prosperity.

Property Tax Exemptions and Discounts

The New Orleans property tax system recognizes the importance of supporting certain segments of the population and promoting specific community goals. As such, it offers a range of exemptions and discounts that can reduce the tax burden for eligible property owners.

Homestead Exemption

One of the most significant property tax exemptions in New Orleans is the Homestead Exemption. This exemption is designed to provide relief to homeowners who use their property as their primary residence. To qualify for the Homestead Exemption, homeowners must meet certain criteria, including owning and occupying the property as their primary residence and applying for the exemption annually.

The Homestead Exemption reduces the assessed value of the property for tax purposes, effectively lowering the tax bill for eligible homeowners. The exact reduction depends on the specific criteria met by the homeowner, such as age, disability status, or military service. For instance, a homeowner aged 65 or older may qualify for a higher reduction than a younger homeowner.

| Homestead Exemption Criteria | Assessed Value Reduction |

|---|---|

| Age 65 or older | $7,500 |

| Disabled | $7,500 |

| Veteran | $7,500 |

Other Property Tax Exemptions

Beyond the Homestead Exemption, New Orleans offers several other property tax exemptions to support specific community initiatives and groups. These exemptions include:

- Military Exemption: Active-duty military personnel and veterans may be eligible for a partial or full exemption on their property taxes, depending on their service history and other factors.

- Historic Property Exemption: Properties that are designated as historic by the city or state may qualify for a partial exemption, recognizing the importance of preserving the city's rich cultural and architectural heritage.

- Religious and Non-Profit Exemption: Properties owned by religious organizations and certain non-profit entities may be exempt from property taxes, allowing these institutions to focus their resources on their core missions.

Tax Discounts and Programs

In addition to exemptions, New Orleans also offers various tax discount programs to support specific groups and promote economic development. These programs include:

- First-Time Homebuyer Credit: New Orleans provides a tax credit to first-time homebuyers, helping them offset some of the initial costs associated with purchasing a home.

- Senior Citizen Discount: Similar to the Homestead Exemption, this discount provides a reduction in property taxes for homeowners aged 65 and older, helping to ease the financial burden of aging residents.

- Economic Development Incentives: The city may offer tax discounts or abatements to businesses that invest in certain economic development projects, such as job creation or infrastructure improvements.

The Future of New Orleans Property Taxes

The New Orleans property tax system is an evolving landscape, shaped by economic trends, demographic changes, and policy decisions. As the city continues to grow and develop, its property tax system will play a crucial role in shaping its future, influencing investment, development, and the overall quality of life for its residents.

Economic Development and Property Taxes

New Orleans’ property tax system is intricately linked to its economic development goals. The city aims to attract and retain businesses, create jobs, and foster a thriving economy, and its property tax policies play a significant role in achieving these objectives.

As the city continues to recover from past challenges and position itself for future growth, the strategic use of property taxes will be essential. This may involve offering tax incentives to attract new businesses, providing tax relief to support existing businesses, or investing in infrastructure and services to create a more attractive business environment.

Community Engagement and Tax Policy

The future of New Orleans’ property tax system will also be influenced by community engagement and public participation. As residents and stakeholders express their priorities and concerns, the city’s tax policies will need to adapt to address these issues. This could involve increasing tax relief for specific communities, adjusting millage rates to reflect changing economic conditions, or investing tax revenues in community-driven projects.

Sustainable Development and Property Taxes

As the world increasingly focuses on sustainable development and environmental stewardship, New Orleans’ property tax system will need to evolve to support these goals. This may involve offering tax incentives for green building practices, promoting energy efficiency, or investing in sustainable infrastructure projects.

Additionally, as the city continues to rebuild and strengthen its flood protection systems, property taxes may play a role in funding these critical initiatives. This could involve dedicated millage rates or tax assessments specifically earmarked for flood protection and environmental resilience projects.

Conclusion

The New Orleans property tax system is a complex and dynamic entity, reflecting the city’s unique character, economic aspirations, and community priorities. It plays a crucial role in funding essential services, supporting public infrastructure, and promoting economic development.

As New Orleans continues to thrive and evolve, its property tax system will remain a key tool for shaping the city's future. By understanding and effectively managing this system, the city can create a sustainable and prosperous environment for its residents and businesses, ensuring that the vibrant spirit of New Orleans endures for generations to come.

How are property taxes calculated in New Orleans?

+Property taxes in New Orleans are calculated based on the assessed value of the property and the applicable millage rates set by various taxing authorities. The assessed value is determined by the Orleans Parish Tax Assessor’s Office, and the millage rates are established by entities like the City of New Orleans, the Orleans Parish School Board, and special taxing districts.

What is the Homestead Exemption, and how does it work?

+The Homestead Exemption is a property tax exemption designed to provide relief to homeowners who use their property as their primary residence. It reduces the assessed value of the property for tax purposes, resulting in a lower tax bill. Eligibility criteria include owning and occupying the property as a primary residence and applying annually.

Are there any other property tax exemptions or discounts available in New Orleans?

+Yes, New Orleans offers several other property tax exemptions, including those for military personnel, historic properties, and religious and non-profit organizations. Additionally, there are tax discount programs for first-time homebuyers, senior citizens, and businesses involved in economic development initiatives.