Pay Broward County Property Taxes

Broward County, located in the sunny state of Florida, is a vibrant and diverse community with a unique culture and a thriving real estate market. As a resident or property owner in this beautiful county, understanding and managing your property taxes is an essential part of financial planning. In this comprehensive guide, we will delve into the process of paying Broward County property taxes, covering everything from the basics to advanced strategies.

Understanding Broward County Property Taxes

Property taxes in Broward County, like in many other counties across the United States, are a significant source of revenue for local governments. These taxes fund essential services such as public schools, road maintenance, emergency services, and more. As a property owner, it is your responsibility to contribute to these vital community resources.

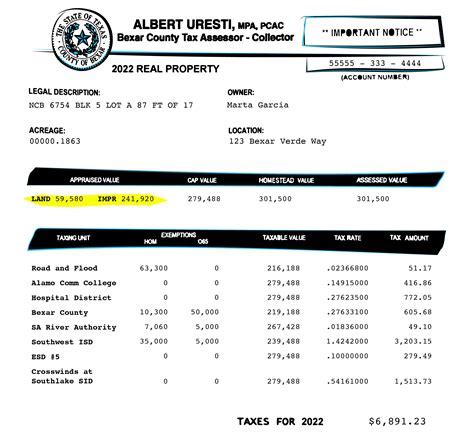

The property tax system in Broward County is based on the assessed value of your property. The property appraiser's office evaluates your property annually to determine its taxable value. This value takes into account factors such as location, size, improvements, and recent sales of similar properties in the area.

The tax rate, known as the millage rate, is set by various taxing authorities within the county, including the county government, municipalities, school districts, and special districts. The millage rate is expressed in mills, where one mill represents $1 of tax for every $1,000 of assessed value. These authorities use the tax revenue to provide essential services to residents.

Calculating Your Property Tax

To calculate your property tax liability, you need to multiply the assessed value of your property by the applicable millage rate. Here’s a simple formula:

Property Tax = Assessed Value × Millage Rate

For example, if your property has an assessed value of $200,000 and the millage rate is 10 mills, your property tax calculation would be:

Property Tax = $200,000 × 0.010 = $2,000

This means you would owe $2,000 in property taxes for that year.

It's important to note that the millage rate can vary from one taxing authority to another within the county. Therefore, your property tax bill may include charges from multiple authorities, each with its own millage rate.

| Taxing Authority | Millage Rate (in mills) |

|---|---|

| Broward County Government | 5.00 |

| City of Fort Lauderdale | 4.50 |

| Broward County School District | 6.00 |

| Special District (e.g., Water Management) | 2.00 |

In the above example, if your property is located within the City of Fort Lauderdale and falls under the jurisdiction of the Broward County School District, your property tax calculation would include charges from these three authorities.

Payment Options and Due Dates

Broward County offers several convenient methods to pay your property taxes. Here are the most common options:

Online Payment

The most popular and efficient way to pay your property taxes is through the Broward County Property Appraiser’s online payment portal. This secure platform allows you to make payments using a credit card, debit card, or electronic check. You can also view your tax bill, check payment status, and access previous years’ tax records.

To make an online payment, follow these steps:

- Visit the Broward County Property Appraiser's website: https://broward.floridapropertytaxes.com

- Click on the "Pay Taxes Online" button.

- Enter your parcel number or property address to access your tax information.

- Review your tax bill details and select your preferred payment method.

- Enter your payment information and complete the transaction.

Mail-in Payment

If you prefer a more traditional method, you can mail your property tax payment to the Broward County Tax Collector’s Office. Ensure that you include your payment voucher or a note with your parcel number and property address to ensure proper processing.

The mailing address is:

Broward County Tax Collector's Office

115 S. Andrews Ave.

Fort Lauderdale, FL 33301

In-Person Payment

You can also pay your property taxes in person at any of the Broward County Tax Collector’s offices. This option is ideal if you prefer a more personal interaction or need assistance with your payment. You can find the locations and operating hours of the tax collector’s offices on their official website.

Due Dates and Penalties

Property taxes in Broward County are due by a specific deadline, typically around November or December of each year. The exact due date may vary slightly depending on the taxing authority. It is crucial to pay your taxes on time to avoid late fees and penalties.

If you miss the payment deadline, you will incur a penalty, which is typically calculated as a percentage of the unpaid tax amount. The penalty rate can vary, so it's essential to check the official guidelines provided by the Broward County Tax Collector's Office.

To avoid any penalties, it is advisable to plan your property tax payments well in advance and consider setting up automatic payments or reminders to ensure timely settlement.

Strategies for Managing Property Taxes

Paying your property taxes is a necessary obligation, but there are strategies you can employ to optimize your tax liability and ensure you’re not overpaying.

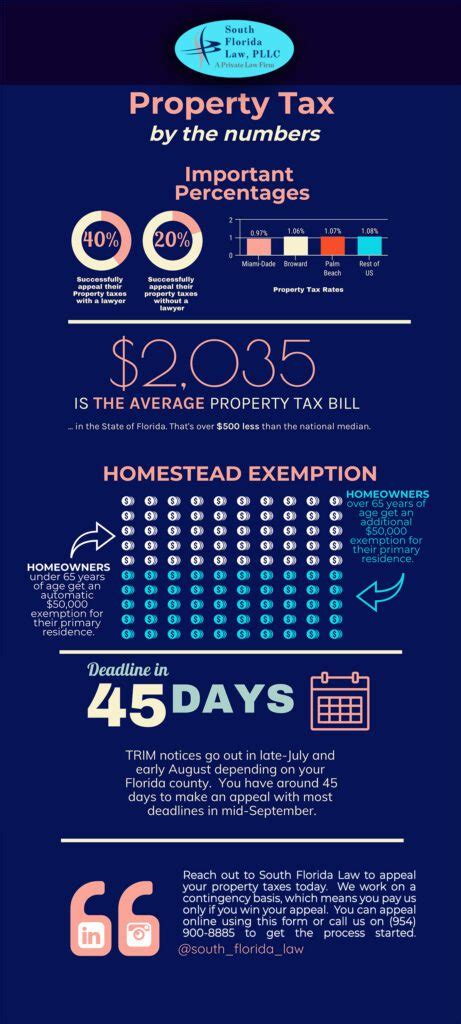

Understanding Tax Exemptions

Broward County, like many other counties, offers various tax exemptions that can reduce your property tax burden. These exemptions are designed to provide relief to specific groups of taxpayers or for specific purposes.

Some common tax exemptions in Broward County include:

- Homestead Exemption: If you own and occupy your property as your primary residence, you may be eligible for a homestead exemption. This exemption reduces the assessed value of your property, resulting in lower property taxes.

- Senior Exemption: Residents who are 65 years or older may qualify for a senior exemption, which provides a reduction in property taxes.

- Veteran's Exemption: Broward County offers exemptions for eligible veterans, reducing their property tax liability.

- Widow/Widower Exemption: Spouses of deceased veterans or first responders may be entitled to an exemption, reducing their property taxes.

It is essential to research and understand the specific exemptions available in Broward County and determine if you meet the eligibility criteria. Consulting with a tax professional or the Broward County Property Appraiser's Office can help you navigate these exemptions effectively.

Appealing Your Property Assessment

If you believe that the assessed value of your property is higher than it should be, you have the right to appeal the assessment. An overassessment can lead to higher property taxes, so it’s important to ensure accuracy.

The process of appealing your property assessment typically involves the following steps:

- Obtain a copy of your property's assessment record from the Broward County Property Appraiser's Office.

- Review the assessment carefully and gather evidence to support your case, such as recent sales of similar properties in the area.

- File an appeal with the Property Appraisal Adjustment Board (PAAB) within the designated timeframe.

- Attend a hearing where you can present your case and argue for a lower assessment.

- If your appeal is successful, your property's assessed value will be adjusted, resulting in a lower property tax liability.

It is advisable to consult with a tax professional or legal expert to guide you through the appeal process and maximize your chances of success.

Optimizing Property Improvements

Strategic improvements to your property can not only enhance its value but also potentially reduce your property taxes. Certain improvements may be exempt from assessment, which means they won’t increase your property’s assessed value for tax purposes.

Examples of improvements that may be exempt from assessment include:

- Solar panels and energy-efficient upgrades

- Disaster mitigation improvements (e.g., hurricane shutters, elevated construction)

- Certain additions or renovations that meet specific criteria

Before making any significant improvements to your property, consult with a tax professional or the Broward County Property Appraiser's Office to understand which improvements are exempt and how they can impact your property taxes.

Conclusion

Paying your Broward County property taxes is a crucial responsibility as a property owner. By understanding the property tax system, calculating your liability, and exploring strategies like tax exemptions and assessment appeals, you can effectively manage your property tax obligations. Remember to stay informed, seek professional advice when needed, and take advantage of the resources provided by the Broward County Property Appraiser’s Office and Tax Collector’s Office to ensure a smooth and efficient tax payment process.

How can I estimate my property tax liability before receiving the official bill?

+To estimate your property tax liability, you can use the online property tax estimator provided by the Broward County Property Appraiser’s Office. This tool allows you to input your property’s assessed value and the applicable millage rate to calculate an estimated tax amount.

Are there any payment plans available for property taxes in Broward County?

+Yes, Broward County offers a convenient payment plan option called the “Property Tax Payment Plan.” This plan allows you to pay your property taxes in installments over a specified period. To enroll, you need to complete an application and meet certain eligibility criteria.

Can I receive a discount for early payment of my property taxes?

+Yes, Broward County offers an early payment discount for property taxes. If you pay your taxes before the early payment deadline, typically a few weeks before the regular due date, you can receive a discount on your tax bill. The discount percentage varies, so it’s advisable to check the official guidelines.

What happens if I fail to pay my property taxes on time?

+If you fail to pay your property taxes by the due date, you will incur late fees and penalties. The penalty amount can vary, and it is essential to pay your taxes promptly to avoid additional costs. If you are facing financial difficulties, consider reaching out to the Broward County Tax Collector’s Office to discuss potential payment arrangements.

Can I dispute my property assessment if I believe it is inaccurate?

+Absolutely! If you believe your property’s assessed value is incorrect, you have the right to appeal the assessment. The process involves submitting an appeal to the Property Appraisal Adjustment Board (PAAB) within a specified timeframe. It is beneficial to gather evidence and consult with a tax professional to increase your chances of a successful appeal.