Galveston County Property Tax

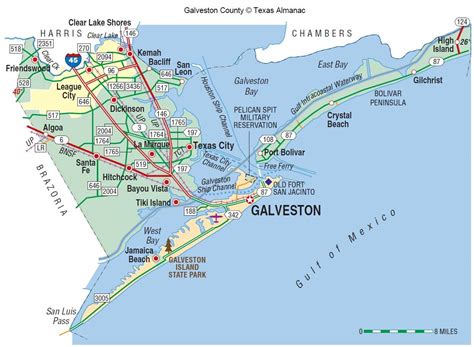

Property taxes are a significant aspect of the real estate landscape, and understanding their workings is crucial for homeowners and investors alike. In the United States, property taxes are typically levied by local governments, and their rates and collection processes can vary widely from state to state and even county to county. This article delves into the specifics of property taxes in Galveston County, Texas, offering a comprehensive guide to how they are calculated, when they are due, and what options are available for homeowners to manage their property tax obligations.

Understanding Galveston County Property Taxes

Galveston County, situated along the Gulf Coast of Texas, is known for its vibrant coastal communities, rich history, and diverse real estate market. Property taxes in this county are an essential source of revenue for local governments, which use the funds to support various public services, including schools, infrastructure, and emergency services.

The property tax system in Galveston County, like many other counties in Texas, is based on the value of the property. This value is determined by the Galveston County Appraisal District (GCAD), an independent entity responsible for appraising properties within the county. The appraised value serves as the basis for calculating property taxes, which are then collected by the Galveston County Tax Assessor-Collector's Office.

The Property Appraisal Process

The GCAD conducts property appraisals annually, aiming to determine the market value of each property. This value is not a mere estimate but is derived from a comprehensive analysis of the property’s characteristics, including its location, size, improvements, and any recent sales of similar properties in the area. The appraised value can fluctuate based on market conditions and improvements made to the property.

Property owners in Galveston County have the right to review their property's appraised value and can file a protest if they believe the value is incorrect. The Appraisal Review Board (ARB) is an independent body that hears and decides on property value protests. If a property owner is not satisfied with the ARB's decision, they can appeal to the State Office of Administrative Hearings (SOAH) or the district court.

| Property Type | Appraisal Process |

|---|---|

| Residential | The GCAD conducts drive-by inspections and interior inspections on a rotating basis to assess property value accurately. |

| Commercial | Commercial properties are appraised based on their income potential, market value, and replacement cost. |

| Agricultural | Agricultural land is appraised based on its productivity and potential use, with specific exemptions for timberland and wildlife management areas. |

Property Tax Rates and Calculation

The property tax rate, also known as the tax rate, is the rate at which a property’s appraised value is taxed. In Galveston County, the tax rate is determined by the local taxing units, which include the county, cities, school districts, and special districts. Each taxing unit sets its own rate, and the combined rates of all these units determine the total tax rate for a particular property.

To calculate the property tax bill, the appraised value is multiplied by the tax rate. For instance, if a property has an appraised value of $200,000 and the combined tax rate is 2%, the property tax bill would be $4,000.

| Taxing Unit | 2023 Tax Rate (per $100 of appraised value) |

|---|---|

| Galveston County | $0.3592 |

| City of Galveston | $0.4489 |

| Galveston Independent School District | $1.5255 |

| Special Districts (varies by location) | Up to $0.3500 |

| Total Combined Rate | $2.6836 |

Please note that these tax rates are subject to change annually and may vary based on the specific location within Galveston County.

Payment Due Dates and Options

Property taxes in Galveston County are due in two installments. The first installment is typically due by January 31, while the second installment is due by July 31. Homeowners have the option to pay their taxes in full by the first due date or choose to pay in two installments. Late payments are subject to penalties and interest.

The Galveston County Tax Assessor-Collector's Office offers several payment methods, including online payments, by mail, in person, or through third-party payment processors. Homeowners can also opt for an escrow account, where their property taxes are paid by their mortgage lender as part of their monthly mortgage payments.

Managing Property Taxes in Galveston County

While property taxes are a necessary obligation for homeowners, there are strategies and programs available to help manage and reduce these expenses.

Homestead Exemptions

Galveston County offers several homestead exemptions, which reduce the appraised value of a property for taxation purposes. These exemptions are available to homeowners who use the property as their primary residence. The most common homestead exemption is the General Homestead Exemption, which exempts the first $25,000 of a property’s value from taxation. Other available exemptions include the Over-65 Homestead Exemption, which offers additional exemptions for homeowners aged 65 and older, and the Disabled Veteran’s Homestead Exemption, which provides exemptions for qualified veterans.

| Homestead Exemption | Description |

|---|---|

| General Homestead Exemption | Exempts the first $25,000 of a property's value from taxation. |

| Over-65 Homestead Exemption | Provides additional exemptions for homeowners aged 65 and older, reducing their taxable value further. |

| Disabled Veteran's Homestead Exemption | Offers exemptions for qualified veterans, reducing their taxable value based on the degree of disability. |

Protest and Appeal Process

If a homeowner believes their property’s appraised value is incorrect or too high, they have the right to protest. The protest process is managed by the GCAD’s Appraisal Review Board (ARB). Homeowners can file a protest online, by mail, or in person. The ARB will schedule a hearing to review the protest, and homeowners have the opportunity to present their case. If the ARB reduces the appraised value, it can result in a lower property tax bill.

Payment Plans and Hardship Options

For homeowners facing financial difficulties, the Galveston County Tax Assessor-Collector’s Office offers payment plans and hardship options. Homeowners can apply for a Deferred Payment Plan, which allows them to pay their property taxes in installments over a longer period. Additionally, the Hardship Deferral Program provides relief for homeowners who meet certain financial criteria, allowing them to defer their property taxes for a period of time.

Conclusion: Navigating Galveston County Property Taxes

Understanding the intricacies of property taxes in Galveston County is essential for homeowners to effectively manage their financial obligations. From the appraisal process to the availability of exemptions and protest options, this guide provides a comprehensive overview. By staying informed and utilizing the resources and programs available, homeowners can navigate the property tax landscape with confidence and ensure they are treated fairly and accurately.

When is the deadline for paying property taxes in Galveston County?

+Property taxes in Galveston County are due in two installments. The first installment is typically due by January 31, and the second installment is due by July 31. However, it’s essential to check with the Galveston County Tax Assessor-Collector’s Office for any changes or updates to these due dates.

How can I protest my property’s appraised value?

+If you believe your property’s appraised value is incorrect, you can protest by filing a notice of protest with the Galveston County Appraisal District (GCAD). This can be done online, by mail, or in person. The GCAD’s Appraisal Review Board (ARB) will review your protest and schedule a hearing. It’s important to provide evidence and support for your protest to increase the chances of a successful appeal.

Are there any exemptions available for property taxes in Galveston County?

+Yes, Galveston County offers several homestead exemptions to reduce the appraised value of a property for taxation purposes. These include the General Homestead Exemption, Over-65 Homestead Exemption, and Disabled Veteran’s Homestead Exemption. Each exemption has specific criteria and application processes, so it’s advisable to consult the GCAD or a tax professional for detailed information.

What happens if I don’t pay my property taxes on time in Galveston County?

+Late payment of property taxes in Galveston County can result in penalties and interest. If taxes remain unpaid, the taxing units may place a tax lien on the property, and in extreme cases, the property could be subject to a tax foreclosure sale. It’s crucial to stay informed about payment deadlines and explore options such as payment plans or hardship deferrals if needed.