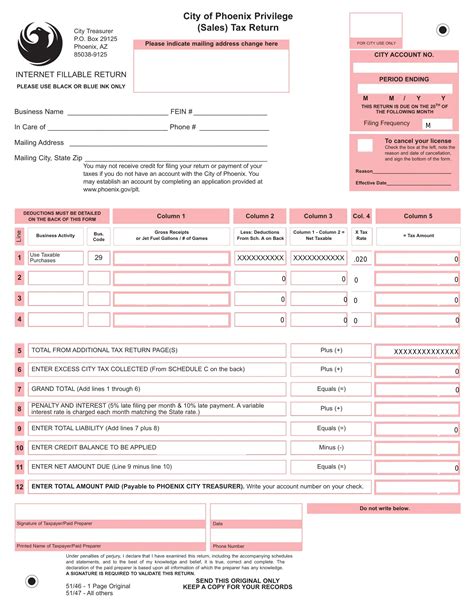

Phoenix Az Sales Tax

The sales tax in Phoenix, Arizona, is an essential aspect of the city's economy and business landscape. It plays a significant role in generating revenue for the state and local governments, funding public services, and influencing consumer behavior. This article aims to delve into the intricacies of Phoenix's sales tax, exploring its rates, applicability, and impact on various industries and consumers.

Understanding the Phoenix Sales Tax

The sales tax in Phoenix, like in many other U.S. cities, is a consumption tax levied on the sale of goods and services. It is a percentage-based tax, where a certain rate is applied to the purchase price of an item or service. The collected tax funds are then allocated to support public infrastructure, education, and other vital government functions.

In Phoenix, the sales tax system is a combination of state, county, and municipal taxes. This multi-level taxation structure means that the total sales tax rate varies depending on the specific location within the city and the nature of the transaction.

State Sales Tax

Arizona, like many U.S. states, imposes a state sales tax. As of [Date], the state sales tax rate in Arizona is 5.6%. This rate is applied uniformly across the state, including Phoenix and its surrounding areas.

County Sales Tax

Maricopa County, where Phoenix is located, adds an additional sales tax to the state rate. The county sales tax rate in Phoenix is currently 1.35%, bringing the total county and state sales tax to 7.0%.

Municipal Sales Tax

The city of Phoenix itself imposes a municipal sales tax to fund its operations and projects. As of [Date], the municipal sales tax rate in Phoenix is 2.0%, making the total sales tax rate in the city 9.6% when combined with the state and county taxes.

| Tax Level | Rate |

|---|---|

| State Sales Tax | 5.6% |

| County Sales Tax (Maricopa) | 1.35% |

| Municipal Sales Tax (Phoenix) | 2.0% |

| Total Sales Tax in Phoenix | 9.6% |

Sales Tax Exemptions and Special Cases

While the sales tax in Phoenix generally applies to most goods and services, there are certain exemptions and special cases to consider. These exceptions can significantly impact businesses and consumers, offering tax advantages in specific scenarios.

Food and Groceries

In Phoenix, like in many other places, certain food items are exempt from sales tax. This exemption applies to unprepared food items, such as fresh produce, meats, dairy products, and staples like bread and eggs. However, prepared foods and meals, including restaurant meals, are subject to the full sales tax rate.

Clothing and Footwear

Clothing and footwear purchases in Phoenix are also exempt from sales tax up to a certain value. As of [Date], clothing and footwear items priced below $100 per item are tax-free. However, if the purchase price exceeds $100, the tax is calculated on the portion above that threshold.

Pharmaceuticals and Medical Supplies

Pharmaceuticals and certain medical supplies are exempt from sales tax in Phoenix. This exemption includes prescription medications, over-the-counter drugs, and durable medical equipment. However, it's important to note that non-medical items sold in pharmacies, such as cosmetics or personal care products, are subject to the full sales tax rate.

Construction Materials

Sales tax on construction materials can be complex, as it often depends on the intended use of the materials. For residential construction, certain materials may be exempt from sales tax. However, for commercial construction projects, the sales tax typically applies.

Impact on Businesses and Industries

The sales tax in Phoenix has a significant influence on the local business environment and various industries. It affects pricing strategies, consumer behavior, and the overall competitiveness of businesses in the region.

Retail Sector

Retail businesses in Phoenix must incorporate the sales tax into their pricing models. This can impact their profit margins and competitiveness. To remain attractive to consumers, retailers often absorb a portion of the tax or offer promotional discounts to offset the tax burden.

Hospitality and Tourism

The hospitality industry, including hotels, restaurants, and entertainment venues, is significantly affected by sales tax. With a relatively high tax rate in Phoenix, businesses in this sector must carefully consider their pricing strategies to remain competitive and attract tourists and locals alike.

E-commerce and Online Sales

E-commerce businesses operating in Phoenix must navigate the complexities of sales tax laws. They must accurately collect and remit sales tax on online transactions, considering the varying tax rates across different locations within the city. Failure to comply with these regulations can lead to legal and financial consequences.

Consumer Perspective

For consumers in Phoenix, understanding the sales tax is crucial for making informed purchasing decisions. The tax can significantly impact the overall cost of goods and services, especially for large or frequent purchases.

Cost of Living

The sales tax in Phoenix contributes to the overall cost of living in the city. While it may not be the sole factor, it influences the affordability of various goods and services, from groceries and clothing to dining out and entertainment.

Comparison with Other Cities

Comparing Phoenix's sales tax rate with other major U.S. cities can provide valuable insights. While some cities may have lower rates, others may have higher taxes to fund specific initiatives or projects. This comparison can help consumers and businesses assess the relative affordability and competitiveness of Phoenix's market.

Future Outlook and Potential Changes

The sales tax landscape in Phoenix, like in any city, is subject to change and evolution. As economic conditions, political priorities, and consumer trends shift, the tax rates and exemptions may be adjusted to meet the changing needs of the city and its residents.

Here are some potential future implications and considerations:

- Economic Growth and Development: As Phoenix continues to grow and attract new businesses and residents, the sales tax revenue can play a vital role in funding infrastructure improvements, public transportation, and other initiatives to support the city's development.

- Tax Reform and Simplification: There have been ongoing discussions about simplifying the sales tax system in Arizona. Reform efforts could aim to reduce complexities, harmonize rates across counties, and streamline tax collection processes for businesses.

- Impact on Tourism: Phoenix's tourism industry is a significant contributor to the local economy. The sales tax rate can influence the attractiveness of the city to visitors. A balanced approach to taxation can ensure that the city remains competitive as a tourist destination.

- Online Sales and E-commerce: With the continued growth of e-commerce, the sales tax collection on online transactions is an area of focus for state and local governments. Ensuring fair and efficient tax collection from online retailers can be a challenge and an opportunity for revenue generation.

Staying informed about these potential changes and their impact on businesses and consumers is crucial for navigating the evolving sales tax landscape in Phoenix.

Frequently Asked Questions

What is the total sales tax rate in Phoenix, AZ, as of the latest update?

+As of our last update, the total sales tax rate in Phoenix is 9.6%. This includes the state sales tax rate of 5.6%, the county sales tax rate of 1.35% (Maricopa County), and the municipal sales tax rate of 2.0% (Phoenix City).

Are there any sales tax holidays in Phoenix, and when do they occur?

+Yes, Arizona, including Phoenix, observes sales tax holidays. These holidays typically occur around back-to-school season and allow consumers to purchase certain items, such as clothing and school supplies, tax-free for a limited time. The specific dates and eligible items vary annually, so it’s advisable to check the official state website for the most recent information.

How does Phoenix’s sales tax compare to other major U.S. cities?

+Phoenix’s total sales tax rate of 9.6% is relatively high compared to some other major U.S. cities. For example, New York City has a combined state and city sales tax rate of 8.875%, while Los Angeles has a rate of 9.5%. However, it’s important to consider that sales tax rates can vary significantly across states and cities, and other factors like cost of living and business incentives should be taken into account when comparing locations.

Are there any plans to reform or change the sales tax structure in Phoenix in the near future?

+While specific plans may change over time, there have been ongoing discussions and proposals to simplify and reform the sales tax structure in Arizona, including Phoenix. These efforts aim to reduce complexities, harmonize rates, and improve compliance. However, any significant changes would likely require legislative action and public support. It’s advisable to stay informed through local news and government updates to track potential developments.