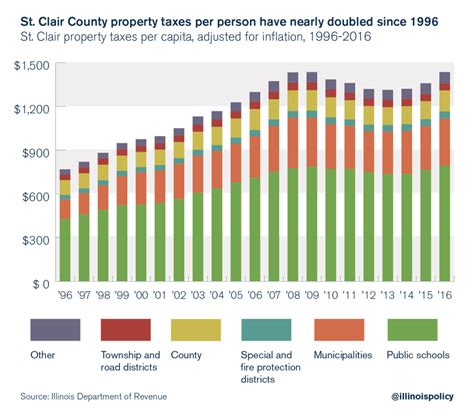

St Clair County Real Estate Taxes

St. Clair County, located in the heart of Michigan's thriving real estate market, is a region that has long captivated investors, homeowners, and businesses alike. The county's vibrant economy, coupled with its diverse landscapes and rich cultural heritage, makes it an attractive proposition for those seeking property. A critical aspect of any real estate investment or purchase is understanding the tax landscape, and St. Clair County's real estate tax system is a key component of this equation.

Unraveling the Complexity of St. Clair County’s Real Estate Taxes

The real estate tax system in St. Clair County is intricate, reflecting the diverse needs and characteristics of the county’s municipalities and townships. It is designed to fund essential public services, infrastructure, and community initiatives, ensuring the county’s continued growth and prosperity.

At its core, real estate taxes in St. Clair County are levied on the assessed value of properties, with rates varying across the county's numerous jurisdictions. These rates are determined by local governing bodies, taking into account the specific needs and financial realities of each community.

The Assessment Process: Unveiling Property Values

The journey towards understanding St. Clair County’s real estate taxes begins with the assessment process. This is where the County’s Equalization Department steps in, tasked with ensuring that all properties are assessed fairly and accurately.

The assessment process involves a meticulous evaluation of each property's characteristics, including its size, location, condition, and any recent improvements. These factors contribute to determining the property's taxable value, which forms the basis for calculating the real estate tax liability.

To maintain transparency and fairness, the County Equalization Department conducts periodic assessments, often every few years. These assessments help ensure that property values remain current and reflect market realities.

| Municipality | Tax Rate (Mills) |

|---|---|

| China Township | 20.75 |

| Clyde Township | 17.00 |

| Columbus Township | 15.00 |

| Cottrellville Township | 19.00 |

| East China Township | 19.75 |

Tax Rates and Levy: A Complex Web

St. Clair County’s real estate tax system is characterized by a complex web of tax rates and levies. These rates are determined by local authorities, with each municipality or township setting its own tax rate, known as “mills.”

A mill is a unit of measure equal to one-tenth of a cent. Therefore, when you see a tax rate expressed in mills, it represents the amount of tax per $1,000 of assessed property value. For instance, a tax rate of 20 mills means that for every $1,000 of assessed value, you would pay $20 in taxes.

The actual tax amount you pay is calculated by multiplying your property's assessed value by the applicable tax rate. This means that properties with higher assessed values will generally pay more in taxes, reflecting the principle of "ability to pay."

The tax rates can vary significantly across the county, with some municipalities opting for higher rates to fund specific projects or initiatives, while others maintain lower rates to attract businesses and residents.

Special Assessments: Beyond the Standard Tax

In addition to the standard real estate tax, St. Clair County residents may encounter special assessments. These are additional charges levied on properties to fund specific public improvements or services that directly benefit the property.

Special assessments can cover a wide range of projects, from road improvements and sidewalk installations to the construction of public parks or the provision of essential services like water and sewerage. These assessments are typically levied on properties within a defined district or area that directly benefits from the improvement.

The amount of a special assessment is calculated based on the property's proximity to and direct benefit from the improvement. It is important to note that special assessments are distinct from regular real estate taxes and are often paid separately.

Understanding Your Tax Bill: A Breakdown

Your real estate tax bill in St. Clair County is a comprehensive document that provides a detailed breakdown of your tax obligations. It typically includes the following key components:

- Property Address: The exact location of your property.

- Assessed Value: The value of your property as determined by the County Equalization Department.

- Taxable Value: The value used to calculate your real estate tax, often lower than the assessed value due to Michigan's Headlee Amendment.

- Tax Rates: The applicable tax rates for your property, including any special assessment rates.

- Tax Amount: The total amount of real estate tax you owe for the year.

- Payment Due Dates: The deadlines for paying your real estate taxes.

It is crucial to carefully review your tax bill to ensure its accuracy. If you have any concerns or questions, you can contact the St. Clair County Treasurer's Office, which is responsible for collecting and distributing real estate taxes.

Appealing Your Assessment: Ensuring Fairness

If you believe your property’s assessed value is incorrect or unfair, you have the right to appeal. St. Clair County provides a formal process for property owners to challenge their assessments. This process typically involves:

- Informal Review: Contacting the County Equalization Department to discuss your concerns and potentially resolve the issue.

- Board of Review: If the informal review doesn't lead to a satisfactory resolution, you can file a formal appeal with the Board of Review, a panel of elected officials who review assessment appeals.

- Circuit Court: If you're still dissatisfied, you can take your appeal to the Circuit Court, which has the authority to adjust assessments.

Payment Options and Penalties: Managing Your Obligations

St. Clair County offers several payment options for real estate taxes, providing flexibility to taxpayers. These options include:

- Online Payments: You can pay your taxes securely online through the County's official website.

- Mail-in Payments: Send your payment, along with the remittance slip from your tax bill, to the St. Clair County Treasurer's Office.

- In-Person Payments: Visit the County Treasurer's Office to make your payment in person.

- Installment Plans: If you're facing financial challenges, you may be eligible for an installment plan, allowing you to pay your taxes in multiple payments throughout the year.

It's crucial to meet the payment deadlines to avoid late fees and penalties. St. Clair County imposes penalties for late payments, which can accumulate over time. These penalties are designed to encourage timely payment and ensure the county's revenue stream remains stable.

Future Outlook: Navigating Tax Changes

The real estate tax landscape in St. Clair County is subject to change, influenced by various factors such as economic trends, community needs, and legislative decisions. As a property owner or investor, staying informed about potential tax changes is crucial for effective financial planning.

St. Clair County, like many other jurisdictions, periodically reviews its tax policies and rates. These reviews can lead to adjustments in tax rates, the implementation of new taxes, or the modification of existing ones. Staying engaged with local government initiatives and attending public meetings can provide valuable insights into potential tax changes.

Additionally, economic factors, such as fluctuations in the real estate market or changes in state or federal tax policies, can indirectly impact local tax structures. For instance, a slowdown in the real estate market might lead to a decrease in property values, which could, in turn, affect tax revenues and assessment processes.

By staying informed and proactive, property owners and investors can better navigate the dynamic nature of real estate taxes in St. Clair County, ensuring they are prepared for any changes that may arise.

How often are real estate taxes levied in St. Clair County?

+Real estate taxes in St. Clair County are typically levied annually. Property owners receive a tax bill once a year, and they are responsible for paying their taxes by the due date to avoid penalties.

Can I pay my real estate taxes in installments?

+Yes, St. Clair County offers installment plans for real estate taxes. This option allows property owners to spread their tax payments over multiple installments, making it more manageable for those facing financial challenges.

What happens if I don’t pay my real estate taxes on time?

+Failure to pay your real estate taxes on time can result in late fees and penalties. If the taxes remain unpaid for an extended period, the county may initiate legal action, including a tax foreclosure process.

How can I appeal my property’s assessed value in St. Clair County?

+To appeal your property’s assessed value, you can follow the formal process outlined by St. Clair County. This typically involves an informal review with the County Equalization Department, followed by an appeal to the Board of Review if necessary.

Are there any tax exemptions or credits available in St. Clair County for real estate taxes?

+Yes, St. Clair County offers various tax exemptions and credits to eligible property owners. These can include homestead exemptions, senior citizen exemptions, and tax credits for certain improvements or energy-efficient upgrades. It’s advisable to consult with the County Treasurer’s Office or a tax professional to determine your eligibility.