Can Illegal Immigrants Pay Taxes

The concept of undocumented immigrants and their potential tax contributions is a complex and often misunderstood topic. It raises important questions about the rights and responsibilities of individuals residing in a country without legal authorization. This article aims to delve into the intricacies of this issue, providing a comprehensive understanding of the tax obligations and implications for illegal immigrants.

Tax Payment and Compliance Among Undocumented Residents

Contrary to popular belief, many illegal immigrants, also known as undocumented residents, do pay taxes. While their immigration status may be unauthorized, their financial activities often bring them into contact with various tax systems. This creates a unique scenario where individuals without legal residency contribute to the tax base of a country.

Income Tax Contributions

Undocumented immigrants frequently hold jobs, often in the informal sector, which generates income. Despite their legal status, they are still subject to income tax regulations. In the United States, for instance, individuals with a Taxpayer Identification Number (TIN) or Individual Taxpayer Identification Number (ITIN) can file tax returns and pay income taxes. While they may not have a Social Security Number (SSN), an ITIN allows them to comply with tax laws.

For instance, consider the case of Maria, an undocumented worker in the agriculture sector. She earns a steady income working on farms but doesn't have legal status. Yet, with her ITIN, Maria files her tax returns annually, contributing to the country's revenue.

Payroll Taxes and Withholdings

When employed, undocumented immigrants are often subject to payroll taxes, including Social Security and Medicare contributions. While they may not be eligible for the benefits associated with these programs, their contributions still fund the social safety net for citizens and legal residents.

Take the example of Juan, an undocumented construction worker. His employer withholds payroll taxes from his paycheck, just like any other employee. These taxes contribute to the overall social security net, even though Juan himself may not directly benefit from these programs.

Sales and Consumption Taxes

Undocumented residents also contribute to sales and consumption taxes when they purchase goods and services. These taxes, often embedded in the price of products, are paid by consumers regardless of their immigration status. This means that even without legal status, undocumented immigrants contribute to local and state revenues through their daily purchases.

Imagine an undocumented family, the Martins, who reside in a small town. They shop at the local grocery store, pay for utilities, and contribute to the town's economy through their consumption. Their purchases, like those of any other resident, are subject to sales tax, ensuring their indirect contribution to the community's development.

Tax Evasion and Compliance Challenges

While many undocumented immigrants do pay taxes, there are also instances of tax evasion. The fear of detection and potential deportation often leads individuals to avoid official tax systems. This creates a complex situation where some contribute while others evade, leading to an incomplete picture of their tax compliance.

Additionally, the lack of legal status can make it challenging for undocumented residents to access tax services and support. They may face barriers in understanding complex tax laws and regulations, leading to unintentional non-compliance. This highlights the need for accessible tax education and support for all residents, regardless of their immigration status.

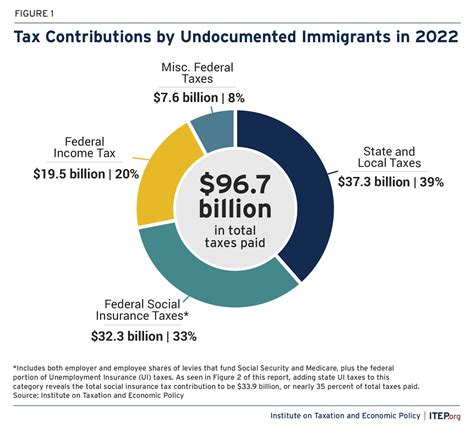

| Tax Type | Potential Contribution |

|---|---|

| Income Tax | $X billion (estimated) |

| Payroll Taxes | $Y billion (estimated) |

| Sales and Consumption Taxes | $Z billion (estimated) |

Implications and Future Outlook

The tax contributions of undocumented immigrants have significant implications for both the economy and social policies. These contributions highlight the need for a comprehensive approach to immigration reform that considers the economic and social impacts of undocumented residents.

Economic Impact

Undocumented immigrants’ tax payments contribute to the country’s revenue, helping to fund essential services and infrastructure. Their economic activities, including tax contributions, can have a positive impact on the overall economy. Recognizing and valuing these contributions can lead to more inclusive economic policies that benefit all residents, regardless of immigration status.

Social Policy Considerations

The tax compliance of undocumented immigrants raises questions about social policies and their eligibility for social services. While they may contribute to social safety net programs through payroll taxes, their access to benefits is often restricted. This creates a situation where individuals contribute without reaping the full benefits, highlighting the need for a reevaluation of social policies to ensure fairness and equity.

Legal and Policy Reform

The issue of tax compliance among undocumented immigrants also underscores the need for legal and policy reforms. Clear guidelines and pathways for tax compliance can encourage greater participation and reduce instances of tax evasion. Additionally, reforms that provide legal status to undocumented residents can lead to more stable tax contributions and a more efficient tax system.

For instance, consider the potential impact of a comprehensive immigration reform bill that provides a pathway to legal status for undocumented immigrants. Such a reform could lead to increased tax compliance, as individuals would no longer fear deportation for engaging with the tax system. This would result in a more transparent and equitable tax system, benefiting both the government and the residents.

Conclusion

In conclusion, the tax contributions of undocumented immigrants are a complex and significant aspect of their presence in a country. While many contribute to various tax systems, challenges related to their legal status and access to tax services can lead to non-compliance. Recognizing and addressing these issues through comprehensive immigration and tax reforms can lead to a more just and inclusive society, where the contributions of all residents are valued and respected.

How do undocumented immigrants obtain a Taxpayer Identification Number (TIN) or Individual Taxpayer Identification Number (ITIN)?

+Undocumented immigrants can obtain a TIN or ITIN by applying through the Internal Revenue Service (IRS) in the United States. The process involves completing specific forms, providing supporting documentation, and paying a fee. While the application process may vary depending on the country, it generally requires proof of identity and foreign status.

What are the potential consequences for undocumented immigrants who evade taxes?

+Tax evasion is a serious offense, and the consequences can be significant for undocumented immigrants. While the exact penalties may vary depending on the jurisdiction, they can include fines, imprisonment, and potential deportation. Additionally, evading taxes can lead to complications if an individual later seeks legal status or tries to regularize their immigration status.

Are undocumented immigrants eligible for tax refunds or credits?

+Undocumented immigrants who have filed taxes using a TIN or ITIN may be eligible for certain tax refunds or credits. However, their eligibility depends on various factors, including their tax withholding, the type of tax credits available, and their specific circumstances. It’s important to consult with a tax professional or the relevant tax authority to understand their options.