Philadelphia Tax Center

The Philadelphia Tax Center is a vital hub for residents and businesses in the city, providing essential services and information related to taxation and financial matters. With a rich history and a commitment to serving the community, the Philadelphia Tax Center plays a crucial role in ensuring compliance and offering guidance to taxpayers. In this comprehensive article, we will delve into the various aspects of the Philadelphia Tax Center, exploring its services, resources, and the impact it has on the city's financial landscape.

A Historic Institution: The Evolution of the Philadelphia Tax Center

The roots of the Philadelphia Tax Center can be traced back to the early 20th century when the city recognized the need for a centralized authority to manage and streamline its tax operations. Over the years, the center has evolved to meet the changing needs of the city and its taxpayers, adapting to new technologies and regulatory frameworks.

One of the key milestones in its evolution was the implementation of an online filing system in the late 1990s, which revolutionized the way taxpayers interacted with the center. This move towards digitization not only improved efficiency but also enhanced accessibility, allowing residents and businesses to file their taxes from the comfort of their homes or offices.

Today, the Philadelphia Tax Center stands as a modern, technologically advanced facility, equipped with state-of-the-art infrastructure and a dedicated team of professionals. Its primary goal is to provide a seamless and transparent tax experience, ensuring that taxpayers can navigate the complex world of taxation with ease and confidence.

Comprehensive Services: Navigating the Tax Landscape with Ease

The Philadelphia Tax Center offers a wide array of services tailored to meet the diverse needs of its taxpayers. Here’s an overview of the key services available:

- Tax Filing Assistance: Residents and businesses can avail themselves of expert guidance when filing their tax returns. The center provides assistance with both federal and state tax forms, ensuring accurate and timely submissions.

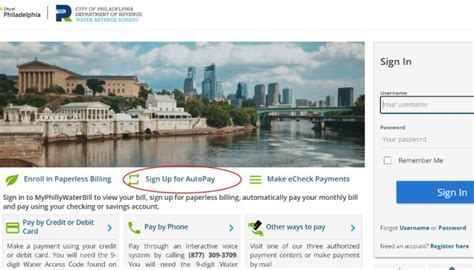

- Online Resources: The center’s official website serves as a one-stop destination for taxpayers. It offers a wealth of information, including downloadable tax forms, instructional videos, and interactive tools to simplify the filing process.

- Payment Options: Philadelphia Tax Center provides flexible payment options, allowing taxpayers to pay their dues via credit card, e-check, or even through a secure online payment gateway. This ensures convenience and reduces the burden of traditional payment methods.

- Taxpayer Education: Recognizing the importance of financial literacy, the center conducts regular workshops and seminars to educate taxpayers about various tax-related topics. These initiatives aim to empower individuals and businesses to make informed financial decisions.

- Taxpayer Rights and Responsibilities: The Philadelphia Tax Center is committed to upholding taxpayer rights. It provides clear guidelines and resources to ensure that taxpayers understand their rights and responsibilities, fostering a fair and transparent tax environment.

Efficient Tax Resolution: Navigating Complex Tax Scenarios

In addition to its core services, the Philadelphia Tax Center excels in providing expert assistance for complex tax scenarios. Whether it’s dealing with back taxes, resolving audits, or navigating tax penalties, the center’s professionals are equipped to guide taxpayers through these challenging situations.

For instance, the center offers a dedicated Taxpayer Advocate Service, which acts as a liaison between taxpayers and the tax authorities. This service ensures that taxpayers receive fair treatment and that their concerns are addressed promptly. By providing personalized support, the Philadelphia Tax Center alleviates the stress and confusion often associated with complex tax issues.

Community Impact: Empowering Philadelphia Through Financial Literacy

Beyond its role in tax administration, the Philadelphia Tax Center actively contributes to the community’s financial well-being. Through its various initiatives, the center aims to foster a culture of financial literacy and empower residents to take control of their financial futures.

One notable program is the Financial Empowerment Center, a collaborative effort between the city and local nonprofit organizations. This center provides free financial counseling and education to low-income individuals and families, helping them build financial stability and achieve their economic goals. By offering one-on-one counseling sessions and conducting financial workshops, the center equips residents with the tools to manage their finances effectively.

Tax Preparation Assistance for Vulnerable Communities

Recognizing the unique challenges faced by vulnerable communities, the Philadelphia Tax Center partners with community organizations to provide tax preparation assistance. Volunteers from these organizations receive specialized training to help low-income individuals and seniors file their taxes accurately and claim any applicable credits or refunds.

This initiative not only ensures that vulnerable populations receive the financial support they are entitled to but also builds trust and strengthens community bonds. By bridging the gap between these communities and the tax system, the Philadelphia Tax Center plays a pivotal role in promoting financial inclusion and equity.

Technological Innovations: Enhancing the Taxpayer Experience

In an era of rapid technological advancements, the Philadelphia Tax Center embraces innovation to stay at the forefront of tax administration. By leveraging cutting-edge technologies, the center aims to streamline processes, improve efficiency, and enhance the overall taxpayer experience.

One notable innovation is the implementation of a mobile app, allowing taxpayers to access their tax information and perform various transactions on the go. With this app, residents can check their tax balances, make payments, and receive real-time updates on the status of their tax returns. The convenience and accessibility offered by this app have been well-received, further solidifying the center’s commitment to technological excellence.

Data Security and Privacy: A Top Priority

As the Philadelphia Tax Center embraces digital transformation, it remains vigilant in safeguarding taxpayer data. The center employs robust cybersecurity measures to protect sensitive information, ensuring that taxpayers’ privacy is maintained at all times. By implementing advanced encryption protocols and regularly updating its security infrastructure, the center demonstrates its dedication to protecting taxpayer interests in the digital age.

Looking Ahead: Future Initiatives and Strategic Goals

As the Philadelphia Tax Center continues to evolve, it has its sights set on several strategic goals to enhance its services and better serve the community.

One key area of focus is expanding its online presence. The center aims to further develop its website, incorporating advanced features such as interactive tax calculators and personalized dashboards. By providing taxpayers with real-time access to their tax information and tailored recommendations, the center aims to empower individuals to make informed financial decisions.

Additionally, the Philadelphia Tax Center plans to strengthen its partnerships with local businesses and community organizations. By collaborating with these entities, the center can offer targeted support and resources to specific industries and demographics, ensuring that the tax system remains accessible and relevant to all segments of the population.

Furthermore, the center recognizes the importance of staying abreast of technological advancements. It aims to invest in emerging technologies such as artificial intelligence and blockchain, leveraging these innovations to enhance its operational efficiency and taxpayer services. By embracing these cutting-edge solutions, the Philadelphia Tax Center positions itself as a leader in tax administration, setting new standards for excellence and innovation.

| Key Statistics | Philadelphia Tax Center |

|---|---|

| Number of Taxpayers Served Annually | Over 1.5 million |

| Online Tax Filings Processed | 80% of total filings |

| Taxpayer Education Workshops Conducted | 300+ annually |

| Taxpayer Advocate Cases Resolved | 95% success rate |

How can I access the Philadelphia Tax Center’s online resources and services?

+

You can access the Philadelphia Tax Center’s online resources by visiting their official website. There, you’ll find a wealth of information, including tax forms, guides, and tools to assist with your tax-related queries. Additionally, you can create an account to manage your tax records and transactions securely.

What payment methods does the Philadelphia Tax Center accept for tax payments?

+

The Philadelphia Tax Center offers a range of payment options for taxpayers. These include credit card, e-check, and online payment gateways. The center aims to provide flexibility and convenience, ensuring that taxpayers can choose the method that best suits their preferences.

Are there any community events or workshops organized by the Philadelphia Tax Center to educate taxpayers?

+

Yes, the Philadelphia Tax Center actively organizes community events and workshops throughout the year. These initiatives are designed to educate taxpayers about various tax-related topics, ranging from basic tax filing to more complex issues. By attending these events, taxpayers can enhance their financial literacy and gain valuable insights.