Cook County Il Property Tax

In the vast landscape of Cook County, Illinois, property taxes play a significant role in the economic and social fabric of the community. This article aims to provide an in-depth analysis of the Cook County property tax system, its impact on residents, and the various factors that contribute to its complexity. From assessment methods to payment options, we will explore the intricacies of this essential aspect of local governance.

Understanding the Cook County Property Tax Landscape

The Cook County property tax system is a crucial component of the county’s fiscal infrastructure, providing a substantial portion of the revenue required to fund various public services and initiatives. The tax is levied on both residential and commercial properties within the county, with rates varying based on several factors.

Assessment Methodology

Property assessments in Cook County are conducted by the Cook County Assessor’s Office, which employs a combination of market analysis and physical inspection methods. The primary goal is to determine the fair market value of each property, which serves as the basis for taxation. This value is then used to calculate the property’s equalized assessed value (EAV), which is the amount on which the tax is actually levied.

The EAV is calculated by multiplying the property's fair market value by an equalization factor, which is set by the Illinois Department of Revenue to ensure uniformity across the state. This factor can vary from year to year and is designed to account for fluctuations in the real estate market.

| Property Type | Assessment Frequency |

|---|---|

| Residential | Every 3 years |

| Commercial | Every year |

The assessment process involves a detailed examination of the property's characteristics, including its size, location, condition, and any recent improvements. The Assessor's Office may also consider recent sales of similar properties in the area to ensure an accurate valuation.

Tax Rates and Levies

Cook County property taxes are determined by a combination of the EAV and the tax rate set by various taxing bodies within the county. These bodies include the county government, local municipalities, school districts, and special taxing districts. Each entity has the authority to set its own tax rate, which is expressed as a percentage of the EAV.

The tax rate is typically determined through a budget process, where the taxing body outlines its revenue needs for the upcoming fiscal year. The rate is then calculated by dividing the required revenue by the total EAV within the jurisdiction. This means that the tax rate can vary significantly across different areas of Cook County, even within the same municipality.

For instance, let's consider a hypothetical scenario where two neighboring municipalities, Northtown and Southtown, have different tax rates. Northtown, with a tax rate of 5.5%, levies a tax of $5,500 on a property with an EAV of $100,000. In contrast, Southtown, with a tax rate of 6.25%, levies a tax of $6,250 on the same property.

| Municipality | Tax Rate (%) | Tax Levy on $100,000 EAV |

|---|---|---|

| Northtown | 5.5 | $5,500 |

| Southtown | 6.25 | $6,250 |

It's important to note that the tax rate is just one component of the property tax calculation. The EAV, which is determined by the Assessor's Office, also plays a significant role in determining the final tax bill.

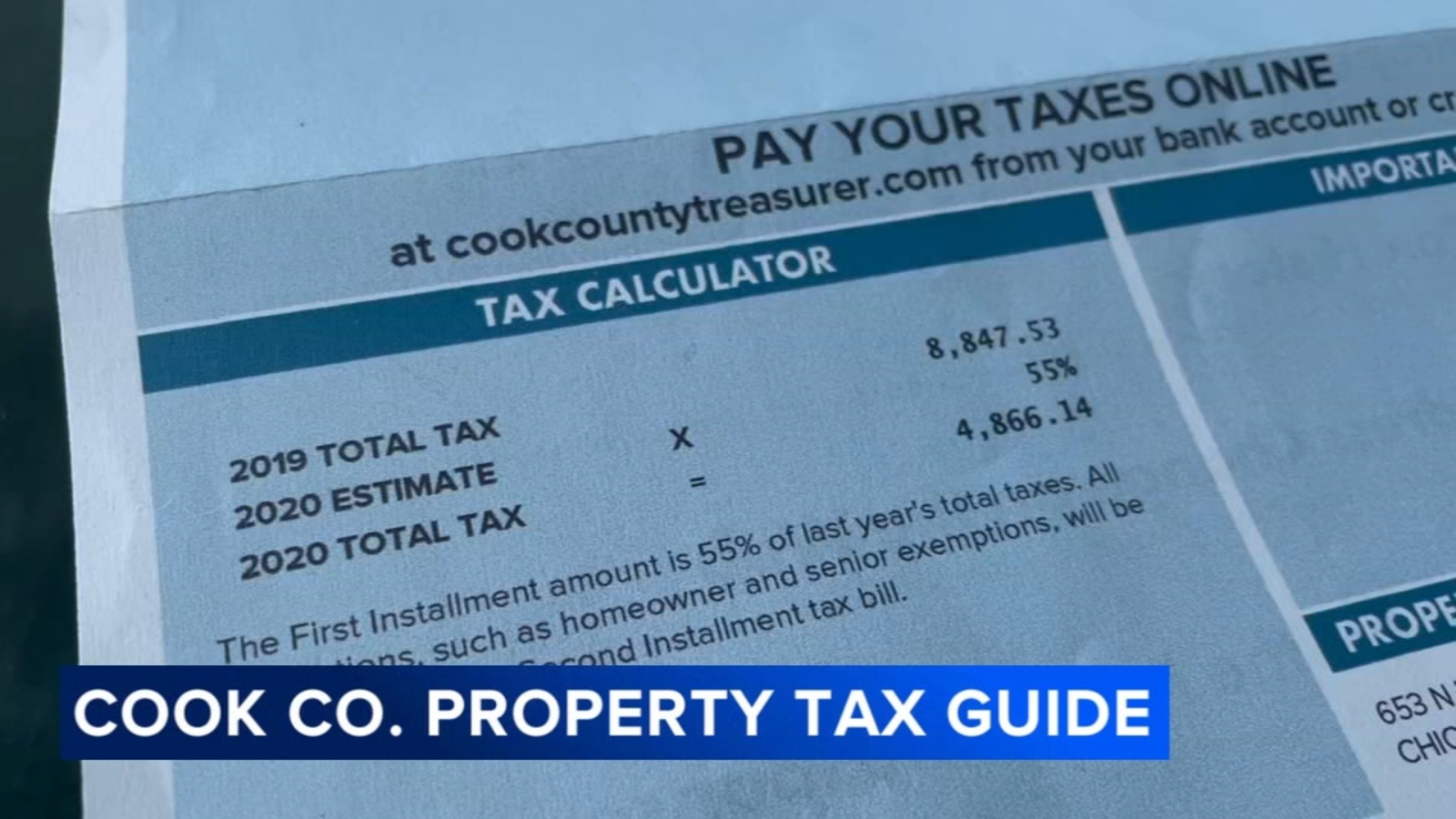

Payment Options and Due Dates

Cook County offers several payment options to accommodate the diverse needs of its residents. Property owners can choose to pay their taxes in full by the first installment due date, which is typically in March, or they can opt for a two-installment plan, with the first payment due in March and the second in July. For those who prefer a more flexible approach, a 10-month installment plan is available, allowing for smaller, more frequent payments.

The county also provides an online payment portal, which offers a convenient way to pay taxes using a credit or debit card. However, it's important to note that a convenience fee is applied to online payments, making the total amount slightly higher than traditional payment methods.

Property owners should be aware of the late payment penalties, which are imposed if the taxes are not paid by the due date. These penalties can accumulate over time, making it crucial for residents to stay informed about payment deadlines.

Challenges and Reforms in the Cook County Property Tax System

The Cook County property tax system, while comprehensive, faces several challenges that impact its efficiency and fairness. These challenges have prompted ongoing discussions and proposed reforms aimed at improving the system for the benefit of all residents.

Assessment Accuracy and Appeals

One of the primary concerns surrounding the Cook County property tax system is the accuracy of property assessments. While the Assessor’s Office strives for precision, discrepancies can occur, leading to potential over- or under-assessment of properties. This can result in unfair tax burdens for some property owners.

To address this issue, the county provides a property tax appeal process, allowing residents to challenge their assessed values if they believe them to be inaccurate. The appeal process involves a review by the Cook County Board of Review, which has the authority to adjust assessments based on the presented evidence.

However, the appeal process can be complex and time-consuming, requiring property owners to gather substantial documentation to support their case. As a result, many residents may opt not to appeal, even if they believe their assessment is incorrect.

Tax Rate Variability and Equity

The variability of tax rates across Cook County has been a subject of debate, particularly in relation to equity. With different taxing bodies setting their own rates, some areas may experience significantly higher tax burdens than others, despite having similar property values.

This variability can lead to a sense of inequity among residents, especially in neighborhoods that are close geographically but have vastly different tax rates. To address this issue, proposals for a uniform tax rate have been put forth, suggesting that a single rate be applied across the entire county to ensure fairness.

However, implementing a uniform tax rate would require significant changes to the current system and may face opposition from municipalities and taxing bodies that rely on their autonomy to set tax rates.

Impact of Economic Factors

Economic factors, such as the state of the real estate market and local economic conditions, can significantly influence property tax revenue in Cook County. During periods of economic prosperity, property values may rise, leading to increased tax revenue. Conversely, economic downturns can result in decreased property values and, subsequently, reduced tax revenue.

This volatility can create challenges for the county's fiscal planning, as it may need to adjust its budget and services based on the fluctuations in tax revenue. Moreover, economic downturns can also lead to an increase in property tax appeals, as residents may seek to reduce their tax burdens during difficult financial times.

Future Implications and Potential Solutions

Looking ahead, the Cook County property tax system faces both challenges and opportunities for improvement. Addressing these issues is crucial to ensuring a fair and efficient taxation system that benefits all residents.

Enhanced Assessment Technology

Advancements in technology offer the potential to improve the accuracy and efficiency of property assessments. Implementing advanced data analytics and geospatial technologies could enable the Assessor’s Office to more precisely determine property values, reducing the likelihood of over- or under-assessment.

For instance, using high-resolution satellite imagery and machine learning algorithms, the Assessor's Office could automatically detect and analyze property features, such as additions or improvements, which would aid in more accurate assessments.

Streamlined Appeal Process

To address the complexity and time-consuming nature of the current appeal process, a streamlined system could be implemented. This might involve a more user-friendly online platform, where property owners can easily submit their appeal documentation and track the progress of their case.

Additionally, providing clear guidelines and educational resources on the appeal process could empower residents to take an active role in ensuring the accuracy of their assessments.

Tax Rate Reform and Equity

Achieving equity in tax rates across Cook County is a complex but crucial goal. While a uniform tax rate may be an ideal solution, it is essential to carefully consider the impact on the autonomy of local governments and the potential loss of revenue for certain taxing bodies.

An alternative approach could involve a regional tax rate, where neighboring municipalities collaborate to set a common tax rate, ensuring a more equitable distribution of tax burdens while maintaining some level of local control.

Community Engagement and Transparency

Engaging the community in discussions about property taxes and their impact is vital to fostering understanding and trust. The Cook County government could implement initiatives to increase transparency around the tax system, including hosting public forums and providing educational resources on property assessments and tax rates.

Furthermore, by actively listening to resident concerns and feedback, the county can better understand the challenges faced by its diverse population and work towards implementing equitable solutions.

How often are property assessments conducted in Cook County?

+Residential properties are assessed every three years, while commercial properties are assessed annually.

What is the role of the equalization factor in property tax calculations?

+The equalization factor, set by the Illinois Department of Revenue, ensures uniformity in property tax assessments across the state. It accounts for fluctuations in the real estate market and is applied to the fair market value of a property to calculate its equalized assessed value (EAV), which is the basis for taxation.

How can I appeal my property assessment if I believe it is inaccurate?

+You can initiate the appeal process by contacting the Cook County Board of Review. They will guide you through the necessary steps, which typically involve providing evidence to support your claim. It’s important to gather relevant documentation, such as recent property sales data or appraisals, to strengthen your case.