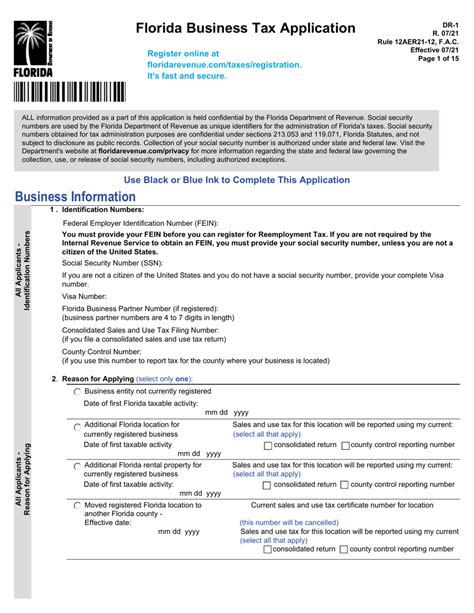

Florida Business Tax Application

Understanding the Florida Business Tax Application: A Comprehensive Guide

For entrepreneurs and business owners in the Sunshine State, navigating the world of taxes is an essential step in establishing a successful venture. The Florida Business Tax Application process is a critical component of setting up a business, and understanding its intricacies is key to ensuring compliance and avoiding potential pitfalls.

In this comprehensive guide, we'll delve into the Florida Business Tax Application, exploring its purpose, requirements, and the steps involved. By the end, you'll have a clear understanding of what's needed to register your business and fulfill your tax obligations, setting the foundation for a thriving enterprise in Florida.

The Purpose of the Florida Business Tax Application

The Florida Business Tax Application is a mandatory registration process for businesses operating within the state. It serves as the official notification to the Florida Department of Revenue (DOR) that a business entity is conducting operations and is, therefore, subject to various taxes and fees.

By registering through the application process, businesses gain the legal authority to operate and are assigned the necessary tax identification numbers and permits. This registration is crucial for compliance with state laws and ensures that businesses contribute to the economic growth and development of Florida.

Key Requirements for the Florida Business Tax Application

The requirements for the Florida Business Tax Application vary based on the type of business, its legal structure, and the specific activities it engages in. Here are some of the key considerations:

Business Entity Type

Florida recognizes various business entities, including sole proprietorships, partnerships, corporations, limited liability companies (LLCs), and more. Each entity type has its own set of tax obligations and requirements. For instance, corporations may need to register for corporate income tax, while sole proprietors may be subject to self-employment tax.

Industry and Business Activities

The nature of your business and the activities it performs play a significant role in determining the applicable taxes. For example, businesses involved in retail sales are required to collect and remit sales tax, while those providing services may be subject to additional taxes or licensing requirements.

Location and Presence

The physical presence of your business in Florida is a crucial factor. If your business has a physical location, such as an office or retail store, you’ll need to register for local taxes and may be subject to property taxes. Even if your business operates remotely, you may still have tax obligations if you have employees or customers in Florida.

Tax Registration and Identification

As part of the application process, businesses must obtain specific tax registrations and identification numbers. These include the Federal Employer Identification Number (FEIN), which is required for businesses with employees, and the Florida Sales and Use Tax Permit for businesses involved in retail sales.

Step-by-Step Guide to the Florida Business Tax Application

Now that we’ve covered the key requirements, let’s walk through the steps involved in completing the Florida Business Tax Application.

Step 1: Determine Your Business Structure

The first step is to choose the legal structure of your business. This decision will impact your tax obligations and liability protection. Common business structures in Florida include:

- Sole Proprietorship: A simple structure for single-owner businesses, where the owner and business are considered one entity for tax purposes.

- Partnership: Suitable for businesses with multiple owners, offering flexibility and shared responsibilities.

- Corporation: A separate legal entity with limited liability protection, often chosen for larger businesses.

- Limited Liability Company (LLC): Provides flexibility and limited liability, making it a popular choice for small businesses.

Step 2: Obtain Necessary Licenses and Permits

Depending on your business activities and location, you may need to obtain specific licenses and permits. This could include:

- Professional or occupational licenses for certain industries (e.g., real estate, healthcare, etc.)

- Local business licenses or permits required by your city or county

- Environmental permits for businesses that may impact the environment

- Health and safety permits for specific business types

Step 3: Register for Federal and State Tax Identification

All businesses, regardless of structure, must obtain a Federal Employer Identification Number (FEIN) from the Internal Revenue Service (IRS). This unique identifier is used for various tax purposes, including filing tax returns and hiring employees.

Additionally, businesses involved in retail sales must register for a Florida Sales and Use Tax Permit. This permit allows you to collect and remit sales tax on behalf of the state.

Step 4: Complete the Florida Business Tax Application

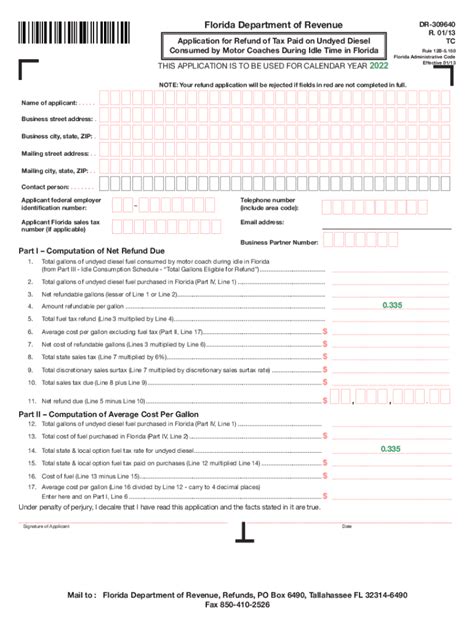

The Florida Business Tax Application can be completed online through the Florida Department of Revenue’s website. Here’s a breakdown of the key sections:

- Business Information: Provide details about your business, including name, address, and contact information.

- Tax Registration: Select the applicable taxes based on your business activities. This could include sales tax, corporate income tax, or other specific taxes.

- Estimated Tax Liability: Estimate your expected tax liability for the upcoming year. This information is used to determine your initial tax deposit requirements.

- Sign and Submit: Review and sign the application, ensuring all information is accurate and complete. Once submitted, you'll receive a confirmation number and your tax registration certificates.

Additional Considerations for Florida Business Taxes

Beyond the initial registration, there are several ongoing considerations to ensure compliance with Florida’s tax laws.

Sales and Use Tax

If your business is involved in retail sales, you must collect and remit sales tax to the state. This includes online sales, where applicable. Failure to collect and remit sales tax can result in significant penalties.

Corporate Income Tax

Corporations doing business in Florida are subject to corporate income tax. The tax rate varies based on the corporation’s taxable income, and returns must be filed annually.

Franchise Tax

Florida imposes a franchise tax on certain business entities, including corporations and LLCs. The tax is calculated based on the entity’s capital, surplus, and undivided profits. Franchise tax returns must be filed annually.

Employment Taxes

Businesses with employees have additional tax obligations, including federal and state income tax withholding, Social Security and Medicare taxes, and unemployment taxes. It’s crucial to stay compliant with these requirements to avoid penalties and maintain a positive relationship with your employees.

Staying Informed and Seeking Professional Guidance

The world of business taxes can be complex, and staying informed is essential to ensuring compliance. The Florida Department of Revenue provides extensive resources and guidance on its website, including tax forms, publications, and frequently asked questions.

💡 Expert Insight: Consider consulting with a tax professional or accountant who specializes in Florida business taxes. They can provide tailored advice based on your specific business situation and help you navigate the complexities of the tax code.

Additionally, staying updated on tax law changes is crucial. Florida's tax laws are subject to periodic updates and amendments, and staying informed can help you avoid surprises and ensure you're taking advantage of any available tax benefits.

Conclusion

Navigating the Florida Business Tax Application process is a crucial step in establishing a successful business in the Sunshine State. By understanding the requirements, completing the necessary registrations, and staying informed about ongoing tax obligations, you can ensure compliance and focus on growing your venture.

Remember, while this guide provides a comprehensive overview, it's always advisable to seek professional guidance to address your specific business needs. With the right knowledge and support, you can confidently navigate the world of Florida business taxes and contribute to the vibrant business landscape of the state.

What are the penalties for failing to register my business in Florida?

+Failing to register your business in Florida can result in significant penalties, including fines and potential criminal charges. It’s crucial to register your business promptly to avoid legal complications.

Are there any tax incentives or benefits for starting a business in Florida?

+Yes, Florida offers various tax incentives and benefits to encourage business growth. These include tax credits for research and development, job creation, and investment in specific industries. It’s worth exploring these incentives to reduce your tax liability.

How often do I need to renew my business tax registrations in Florida?

+The renewal frequency for business tax registrations in Florida varies based on the type of tax. For example, sales tax permits are typically renewed annually, while franchise tax returns are due annually as well. It’s essential to keep track of renewal dates to maintain compliance.