Washington Car Sales Tax

The car sales tax in Washington state is an important aspect of vehicle purchasing and ownership, with implications for both consumers and businesses. This comprehensive guide will delve into the intricacies of Washington's car sales tax, providing an in-depth analysis of its structure, rates, exemptions, and impact on the automotive market.

Understanding Washington’s Car Sales Tax

Washington state levies a sales and use tax on the purchase of motor vehicles, including cars, trucks, motorcycles, and certain types of recreational vehicles. This tax is applied to the total sale price or lease price of the vehicle and is a critical revenue source for the state, supporting various public services and infrastructure projects.

The car sales tax in Washington is administered by the Washington State Department of Revenue, which outlines specific guidelines and regulations for taxpayers and businesses. It is important to note that the tax structure and rates can vary based on several factors, including the type of vehicle, its purchase price, and the location of the sale or lease.

Tax Rates and Calculations

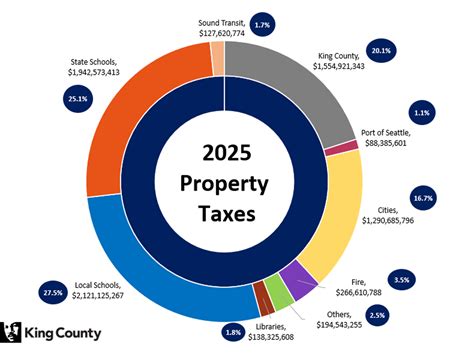

Washington’s car sales tax rate is generally 6.5% of the vehicle’s total sale price. However, this rate can be subject to additional local taxes, known as combined rates, which may vary by county. For instance, in King County, the combined sales tax rate for vehicle purchases is 9.5%, consisting of the state tax rate of 6.5% and a local tax rate of 3%.

The sales tax calculation is straightforward: the tax is applied to the total purchase price of the vehicle, including any additional costs like accessories, delivery fees, and extended warranties. For example, if a car is purchased for $25,000, the sales tax would be calculated as follows:

| Total Purchase Price | $25,000 |

|---|---|

| Sales Tax Rate | 6.5% |

| Sales Tax Amount | $1,625 |

Therefore, the total cost of the vehicle, including sales tax, would be $26,625.

Exemptions and Special Considerations

Washington state offers several exemptions and special provisions related to car sales tax. These include:

- Trade-Ins: When trading in a vehicle as part of a new purchase, the sales tax is calculated based on the difference between the trade-in value and the new vehicle's price. For instance, if a trade-in vehicle is valued at $10,000 and the new vehicle costs $25,000, the sales tax is applied to the $15,000 difference.

- Lease Agreements: For vehicle leases, the sales tax is calculated as a percentage of the lease payments. The tax is typically included in the monthly payment, making it more convenient for leaseholders.

- Exempt Vehicles: Certain vehicles are exempt from sales tax, including some types of agricultural equipment, military vehicles, and vehicles used exclusively for public transportation. It is important to consult the Department of Revenue's guidelines for a complete list of exempt vehicles.

- Out-of-State Purchases: If a vehicle is purchased out of state and brought into Washington, the owner must pay a use tax, which is similar to sales tax. The use tax rate is based on the vehicle's purchase price and is calculated at the time of registration.

Impact on Automotive Market

Washington’s car sales tax has a significant influence on the state’s automotive market, affecting consumer behavior, dealer operations, and the overall economic landscape.

Consumer Considerations

For consumers, the car sales tax is a critical factor in vehicle purchasing decisions. The tax adds a substantial cost to the overall purchase price, which can impact affordability and budget planning. As a result, consumers often strategize their vehicle purchases to minimize tax impact. This may involve timing purchases to take advantage of tax-free holidays, negotiating prices to reduce the tax amount, or exploring financing options to spread out the tax payment.

Dealer Operations and Strategies

Car dealerships in Washington must carefully navigate the sales tax regulations to ensure compliance and maintain profitability. Dealers often incorporate sales tax into their pricing strategies, either by including it in the advertised price or by negotiating the tax amount as part of the overall deal. Additionally, dealerships may offer incentives or discounts to attract buyers and offset the tax burden.

From an operational perspective, dealerships must maintain accurate records of vehicle sales and tax payments to comply with state regulations. This includes reporting sales to the Department of Revenue, collecting and remitting sales tax, and ensuring proper documentation for all transactions.

Economic Impact

Washington’s car sales tax contributes significantly to the state’s revenue stream, supporting various public services and infrastructure projects. The tax revenue is used to fund transportation initiatives, education, healthcare, and other essential state functions. Additionally, the tax provides a steady source of income for local governments, allowing them to invest in community development and services.

Future Outlook and Considerations

The future of Washington’s car sales tax is subject to ongoing discussions and potential policy changes. As the automotive industry evolves, with advancements in electric and autonomous vehicles, the tax structure may need to adapt to accommodate these changes.

One potential consideration is the introduction of a mileage-based tax, which would shift the tax burden from vehicle purchase to usage. This approach, already implemented in some states, could encourage more sustainable driving practices and reduce the impact of car sales tax on consumers.

Furthermore, as the state's economic landscape evolves, there may be discussions around tax reform, including potential rate adjustments or the introduction of incentives to promote certain vehicle types, such as electric or hybrid cars.

Conclusion

Washington’s car sales tax is a complex yet critical component of the state’s automotive market. It impacts consumers, dealerships, and the overall economy, shaping purchasing decisions, dealer strategies, and public services. As the automotive industry continues to evolve, Washington’s tax structure will likely adapt to meet the changing needs and dynamics of the market.

How often are car sales tax rates updated in Washington state?

+Car sales tax rates in Washington are typically updated annually to reflect any changes in local tax rates. The Department of Revenue announces these updates before the start of each fiscal year, which begins on July 1st.

Are there any tax incentives for purchasing electric vehicles in Washington?

+Yes, Washington state offers tax incentives for the purchase of electric vehicles (EVs). These incentives can take the form of tax credits or exemptions, which reduce the overall sales tax burden for EV buyers. It is important to consult the Department of Revenue’s guidelines for the most up-to-date information on EV tax incentives.

Can I negotiate the sales tax amount when purchasing a car in Washington?

+While the sales tax rate is set by law and cannot be negotiated, dealerships may offer incentives or discounts that effectively reduce the tax burden. It is common for dealerships to include these incentives in the overall price negotiation, allowing buyers to minimize their tax payment indirectly.