Durham County Tax

Welcome to this comprehensive guide on the intricacies of Durham County Tax, a vital aspect of the local economy and an essential responsibility for residents and businesses alike. This article aims to provide an in-depth understanding of the tax system, its implications, and its role in shaping the financial landscape of Durham County. With a focus on clarity and expertise, we will navigate through the complex world of taxation, offering valuable insights and practical information for taxpayers.

Unraveling the Durham County Tax System

Durham County, known for its vibrant culture, diverse economy, and thriving communities, has a tax system that reflects its dynamic nature. The county’s tax structure is designed to support essential public services, infrastructure development, and community initiatives, while also encouraging economic growth and sustainability.

At the heart of Durham County's tax system is the ad valorem property tax, which forms a significant portion of the county's revenue. This tax is levied on the assessed value of real property, including residential, commercial, and industrial properties. The assessed value is determined by the Durham County Tax Assessor's Office, which conducts regular evaluations to ensure fair and accurate assessments.

The tax rate in Durham County is expressed as a millage rate, which represents the number of dollars owed per $1,000 of assessed property value. For instance, a millage rate of 100 mills would mean that a property assessed at $100,000 would owe $1,000 in taxes. This rate is set annually by the Durham County Board of Commissioners, taking into consideration the budget needs of various departments and services.

Tax Assessments and Valuations

The process of tax assessment in Durham County involves a comprehensive evaluation of each property’s characteristics, including its size, location, and improvements. The tax assessor’s office employs a team of trained professionals who conduct on-site visits, analyze market trends, and utilize specialized software to ensure accurate valuations. This meticulous approach ensures that taxpayers are assessed fairly and consistently.

Property owners in Durham County receive a Notice of Proposed Taxes each year, detailing the assessed value of their property and the calculated tax amount. This notice provides an opportunity for taxpayers to review the assessment and, if necessary, appeal the valuation. The appeals process is designed to be accessible and transparent, allowing for a fair resolution of any disputes.

Tax Relief Programs

Durham County is committed to providing tax relief to eligible residents and businesses, recognizing the importance of financial support for its community. One notable program is the Homestead Exemption, which reduces the taxable value of a primary residence for eligible homeowners. This exemption provides much-needed relief for homeowners, especially those on fixed incomes or with limited financial means.

Additionally, Durham County offers various tax incentives and abatements to attract and support businesses. These incentives aim to encourage economic development, job creation, and investment in the county. Qualified businesses may be eligible for reduced tax rates, tax credits, or even complete tax exemptions for a specified period, depending on the nature and impact of their operations.

| Tax Relief Program | Description |

|---|---|

| Homestead Exemption | Reduces taxable value of primary residence for eligible homeowners. |

| Business Tax Incentives | Varying tax breaks for businesses to encourage economic growth and investment. |

| Senior Citizen Relief | Provides tax relief for senior citizens based on income and property value. |

Tax Payment Options and Deadlines

Durham County offers a range of convenient payment options for taxpayers, ensuring flexibility and accessibility. Residents and businesses can choose to pay their taxes in full or opt for installment plans, providing a manageable approach to meeting their tax obligations.

The county accepts payments through various methods, including online portals, mobile apps, mail-in checks, and in-person payments at designated locations. These options cater to different preferences and technological capabilities, making the payment process as seamless as possible.

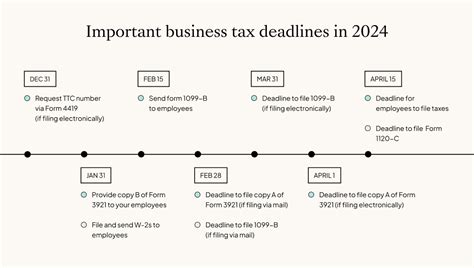

Taxpayers are encouraged to stay informed about the tax payment deadlines, which are typically set annually and publicized through official channels. Late payments may incur penalties and interest, so timely payment is crucial to avoid additional financial burdens.

Tax Lien Sales and Delinquency

In cases of prolonged tax delinquency, Durham County may initiate a tax lien sale, which is a public auction of the delinquent property’s tax lien. This process allows the county to recover the outstanding taxes and associated costs, while also providing an opportunity for investors to purchase these liens. Tax lien sales are governed by strict regulations and procedures, ensuring a fair and transparent process.

Taxpayers facing financial difficulties are advised to communicate with the Durham County Tax Collector's Office early on. The office may offer payment plans or other arrangements to help taxpayers manage their obligations and avoid the consequences of delinquency.

Taxation and Community Development

The revenue generated through Durham County’s tax system plays a pivotal role in the development and improvement of the local community. Tax dollars fund essential services such as education, healthcare, public safety, infrastructure maintenance, and cultural initiatives, contributing to the overall well-being and prosperity of the county’s residents.

Furthermore, the tax system supports economic development by funding initiatives that attract businesses and promote job growth. Investments in infrastructure, such as transportation networks, utilities, and technology, create an environment conducive to business expansion and innovation. This, in turn, generates further tax revenue, creating a positive cycle of economic growth and community enhancement.

Impact on Local Businesses

Local businesses in Durham County benefit from a supportive tax environment that encourages entrepreneurship and economic diversity. The county’s tax structure, coupled with its incentives and abatements, creates a competitive business landscape, attracting both established companies and startups.

Businesses in Durham County can take advantage of various tax benefits, including tax credits for job creation, investment incentives, and property tax abatements. These incentives not only reduce the tax burden for businesses but also foster a climate of innovation and economic opportunity. The result is a thriving business community that contributes to the county's tax base and supports local jobs.

Future Trends and Tax Reform

As Durham County continues to evolve, its tax system is also subject to potential reforms and adaptations. The county’s leaders and tax professionals are continually evaluating the tax structure to ensure it remains equitable, efficient, and aligned with the community’s needs and aspirations.

One area of focus is the fairness and equity of the tax system. Efforts are underway to ensure that the tax burden is distributed equitably across different income levels and property types. This includes exploring options such as income-based tax brackets, progressive tax rates, and reassessing the valuation methods to minimize disparities.

Additionally, the county is exploring technology-driven tax reforms to enhance efficiency and transparency. This includes the implementation of advanced tax collection systems, online platforms for tax management, and data-driven analysis to optimize tax policies. These initiatives aim to streamline processes, reduce administrative burdens, and provide taxpayers with convenient and accessible tools for managing their obligations.

How often are property tax assessments conducted in Durham County?

+Property tax assessments in Durham County are conducted annually. The Durham County Tax Assessor’s Office evaluates each property’s value based on various factors, including market trends and property characteristics. This annual assessment ensures that tax obligations are based on current and accurate valuations.

Are there any tax relief programs for senior citizens in Durham County?

+Yes, Durham County offers a Senior Citizen Tax Relief program. This program provides tax relief to eligible senior citizens based on their income and property value. The aim is to support seniors by reducing their tax burden, allowing them to maintain their financial stability and continue contributing to the community.

How can businesses take advantage of tax incentives in Durham County?

+Businesses in Durham County can access a range of tax incentives by working closely with the county’s economic development offices and tax professionals. These incentives may include tax credits for job creation, investment incentives, and property tax abatements. Consulting with local experts can help businesses navigate the application process and maximize their tax benefits.