Sales Tax Iowa

Sales tax is an essential component of the tax system in the United States, and Iowa, like many other states, has its own set of sales tax regulations. Understanding the sales tax landscape in Iowa is crucial for businesses and consumers alike, as it directly impacts their financial obligations and decisions. In this comprehensive guide, we will delve into the intricacies of Iowa's sales tax, exploring its rates, applicability, exemptions, and the implications it has on various industries and transactions.

The Iowa Sales Tax: A Comprehensive Overview

Iowa’s sales tax system is designed to generate revenue for the state government, municipalities, and various special taxing districts. It is a consumption tax, meaning it is applied to the sale of goods and certain services. The state of Iowa, along with its local jurisdictions, has implemented a comprehensive sales tax framework to ensure a fair and efficient tax collection process.

Sales Tax Rates in Iowa

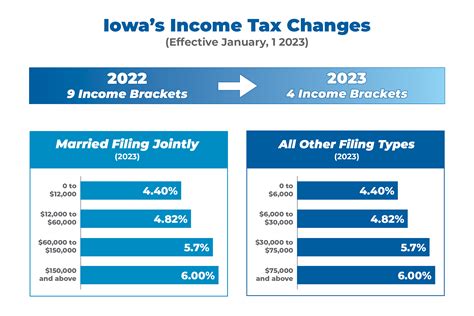

Iowa operates with a state-wide sales tax rate, which serves as a base for the tax calculation. As of my last update in January 2023, the statewide sales tax rate in Iowa stands at 6%. This rate is consistent across the state and applies to most tangible personal property and certain services.

However, it's important to note that Iowa allows for local option sales tax rates, which can be imposed by cities and counties. These local rates are added on top of the state rate, resulting in a combined sales tax rate that varies depending on the location of the transaction. Local option sales tax rates can range from 0% to 2%, bringing the total sales tax rate in certain areas to a maximum of 8%. It is crucial for businesses and consumers to be aware of these variations when making purchases.

To illustrate the impact of these rates, let's consider an example. If you purchase a television in a county with a local option sales tax rate of 1%, the sales tax calculation would be as follows:

| Sales Tax Calculation |

|---|

| State Sales Tax Rate: 6% |

| Local Option Sales Tax Rate: 1% |

| Total Sales Tax: 7% |

In this case, the consumer would pay a total sales tax of 7% on the television purchase, which includes both the state and local option sales tax rates.

Sales Tax Exemptions in Iowa

While Iowa’s sales tax is applicable to a wide range of goods and services, there are certain exemptions and exceptions that businesses and consumers should be aware of. These exemptions are designed to promote specific economic activities or provide relief to certain sectors.

One notable exemption in Iowa is for groceries and food products. Sales tax is generally not applicable to items intended for human consumption, such as groceries, produce, and prepared foods. This exemption is aimed at reducing the tax burden on essential food items and making them more affordable for consumers.

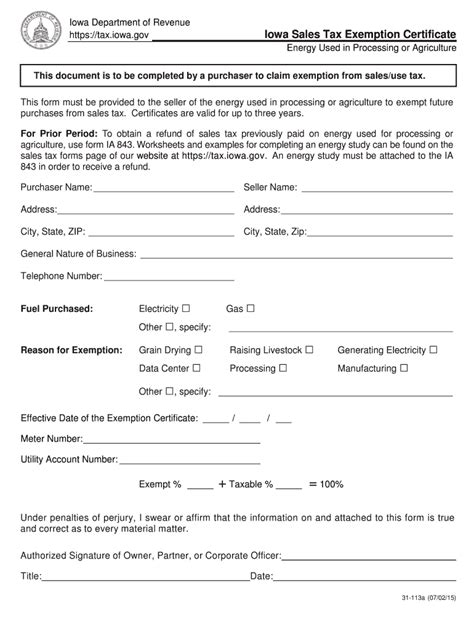

Additionally, Iowa offers exemptions for specific industries, such as manufacturing and agriculture. These exemptions are intended to encourage economic growth and support the state's key industries. For instance, the sale of manufacturing machinery and equipment is often exempt from sales tax, allowing businesses to invest in their operations without facing a significant tax liability.

Sales Tax Registration and Compliance

For businesses operating in Iowa, sales tax registration and compliance are crucial aspects of their financial obligations. Businesses that engage in taxable sales or provide taxable services must register with the Iowa Department of Revenue and obtain a sales tax permit. This permit authorizes the business to collect and remit sales tax to the state.

Sales tax registration typically involves providing detailed information about the business, including its legal structure, contact information, and the nature of its operations. The registration process ensures that the business is properly identified and categorized for tax purposes. Once registered, businesses are required to comply with sales tax regulations, which include accurate record-keeping, timely filing of tax returns, and remittance of collected sales tax to the state.

Failing to register or comply with sales tax regulations can result in penalties and interest charges. It is essential for businesses to stay informed about their sales tax obligations and seek professional guidance when necessary to ensure they meet all legal requirements.

The Impact of Iowa’s Sales Tax on Businesses and Consumers

Iowa’s sales tax has a significant impact on both businesses and consumers, influencing their financial decisions and overall economic behavior. Let’s explore some of the key implications:

Impact on Business Operations

For businesses operating in Iowa, sales tax considerations play a crucial role in their financial planning and strategy. Here are some key impacts:

- Pricing Strategy: Businesses must factor in the sales tax rate when setting their prices. The sales tax rate directly affects the final cost of goods and services, influencing the pricing decisions of businesses.

- Cash Flow Management: Collecting and remitting sales tax can impact a business's cash flow. Proper cash flow management is essential to ensure timely payment of sales tax obligations without compromising other operational expenses.

- Competitive Advantage: Understanding the sales tax landscape can provide businesses with a competitive edge. Businesses that offer tax-exempt products or services may have an advantage over competitors, especially in industries with thin profit margins.

- Compliance and Record-Keeping: Sales tax compliance requires meticulous record-keeping. Businesses must maintain accurate records of taxable sales, exemptions, and remittances to avoid penalties and ensure compliance with Iowa's sales tax regulations.

Impact on Consumer Behavior

Sales tax directly affects consumers’ purchasing decisions and spending habits. Here’s how:

- Budgeting and Affordability: Consumers must consider sales tax when budgeting for purchases. The addition of sales tax to the purchase price can impact a consumer's ability to afford certain goods or services, especially for those with limited budgets.

- Price Sensitivity: Sales tax can make consumers more price-sensitive. When faced with higher sales tax rates, consumers may opt for cheaper alternatives or postpone non-essential purchases, impacting the sales and revenue of businesses.

- Cross-Border Shopping: Consumers may engage in cross-border shopping to avoid sales tax. If sales tax rates differ significantly between states, consumers may choose to make purchases in neighboring states with lower tax rates, impacting the local economy and businesses in their home state.

The Future of Sales Tax in Iowa

As Iowa’s economy continues to evolve, so does its sales tax system. The state government regularly reviews and updates its tax policies to align with changing economic conditions and emerging trends. Here are some potential future implications and developments:

- Online Sales Tax Collection: With the rise of e-commerce, Iowa, like many other states, is likely to focus on implementing effective online sales tax collection mechanisms. This ensures that online retailers, both in-state and out-of-state, contribute to the state's tax revenue, creating a level playing field for local businesses.

- Sales Tax Simplification: Iowa may explore initiatives to simplify its sales tax system, making it more efficient and easier for businesses to comply. This could involve streamlining registration processes, offering more user-friendly tax software, and providing clearer guidelines for businesses.

- Exemption and Incentive Reviews: The state may periodically review its sales tax exemptions and incentives to ensure they align with its economic development goals. This could lead to the expansion or reduction of certain exemptions, impacting businesses and consumers alike.

- Local Option Sales Tax Changes: Local governments may propose changes to their local option sales tax rates to address specific community needs or infrastructure projects. These changes can impact the total sales tax rate in certain areas, influencing consumer behavior and business operations.

Conclusion

Iowa’s sales tax system is a complex yet essential component of the state’s tax framework. It plays a significant role in generating revenue for the state and local governments, while also influencing the financial decisions of businesses and consumers. Understanding the intricacies of Iowa’s sales tax, including its rates, exemptions, and compliance requirements, is crucial for anyone operating within the state’s economy.

As Iowa continues to evolve, its sales tax system will adapt to meet the changing needs of its economy and citizens. By staying informed about sales tax regulations and their potential future developments, businesses and consumers can make more informed financial decisions and navigate the tax landscape with confidence.

What is the current state sales tax rate in Iowa?

+As of my last update in January 2023, the state sales tax rate in Iowa is 6%.

Are there any local option sales tax rates in Iowa?

+Yes, Iowa allows for local option sales tax rates, which can be imposed by cities and counties. These rates are added on top of the state rate, resulting in a combined sales tax rate that varies by location.

What are some common sales tax exemptions in Iowa?

+Iowa offers exemptions for groceries and food products, as well as specific industries such as manufacturing and agriculture. These exemptions are designed to promote economic growth and support key sectors.

How can businesses register for sales tax in Iowa?

+Businesses must register with the Iowa Department of Revenue by providing detailed information about their operations. This process ensures proper identification and categorization for tax purposes.

What are the potential future developments for Iowa’s sales tax system?

+Iowa may focus on online sales tax collection, sales tax simplification, and periodic reviews of exemptions and incentives. Local governments may also propose changes to their local option sales tax rates.