New York City Real Estate Taxes

In the bustling metropolis of New York City, real estate is a dynamic and ever-evolving landscape. As one of the most sought-after urban centers globally, understanding the intricacies of its real estate market, including the complex web of taxes, is crucial for investors, homeowners, and businesses alike. This comprehensive guide aims to unravel the specifics of New York City real estate taxes, offering a detailed insight into the various levies, their implications, and strategies to navigate this complex system.

Understanding New York City Real Estate Taxes

The taxation system in New York City is intricate, reflecting the city’s diverse real estate market, which encompasses everything from historic brownstones in Brooklyn to modern skyscrapers in Manhattan. Property owners in the city are subject to a range of taxes, each serving a specific purpose and contributing to the city’s overall financial health.

Property Taxes

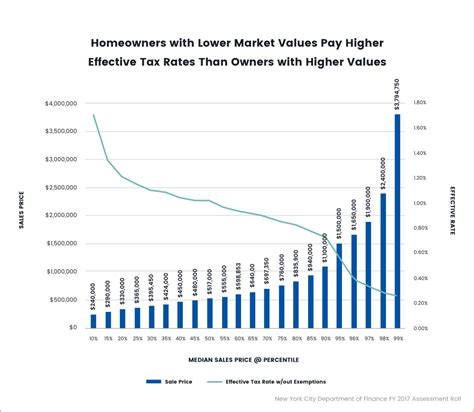

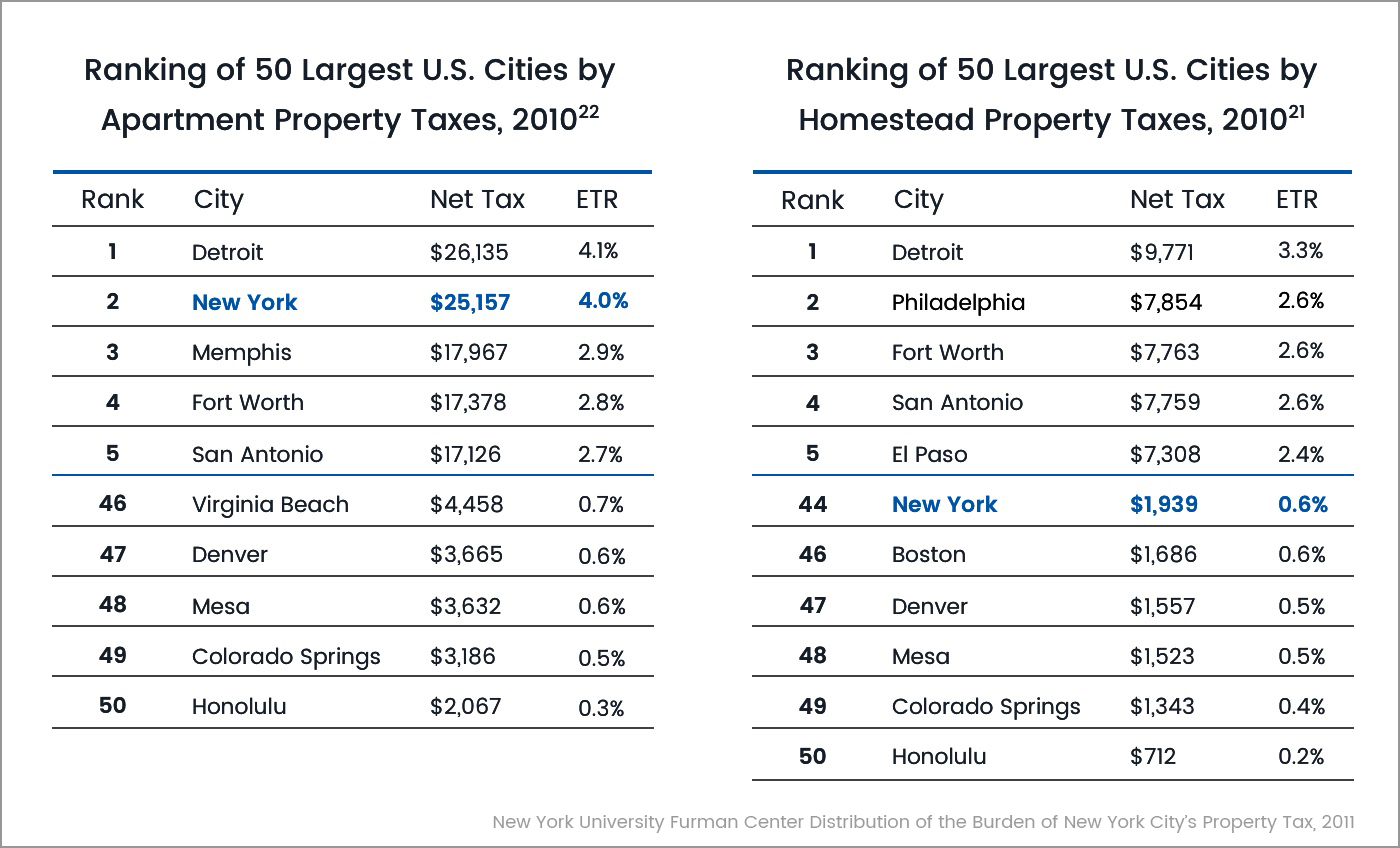

At the heart of the taxation system lies the property tax, a levy imposed on real estate based on its assessed value. The Department of Finance is responsible for assessing property values, a process that considers various factors such as the property’s location, size, and recent sales data. Property taxes in New York City are known for their relatively high rates, with the average effective property tax rate standing at 0.83%, which is above the national average of 0.79%.

| Property Type | Average Effective Tax Rate |

|---|---|

| Residential | 0.85% |

| Commercial | 0.78% |

The city's property tax system also includes various exemptions and abatements designed to ease the tax burden on certain properties or individuals. For instance, the Senior Citizen Rent and Property Tax Relief Program offers benefits to senior citizens who own their homes, and the J-51 Abatement Program provides tax incentives for developers who renovate older buildings.

Transfer Taxes

When real estate changes hands, whether through a sale or transfer, New York City imposes a transfer tax. This tax is designed to capture a portion of the value of the transaction, with the revenue generated contributing to the city’s general fund. The rate of the transfer tax depends on the type of property and the transaction value.

| Property Type | Tax Rate |

|---|---|

| Residential Properties (up to $1 million) | 0.4% |

| Residential Properties (over $1 million) | 0.92% |

| Commercial Properties | 2.625% |

It's important to note that transfer taxes are not only levied by the city but also by the state. The New York State Real Estate Transfer Tax applies to all real estate transfers within the state, with rates varying based on the transaction value.

Mansion Tax

New York City’s unique tax landscape includes the Mansion Tax, a tax on the purchase of residential properties priced at $1 million or more. This tax, which is levied on the buyer, is a progressive tax, meaning the rate increases as the property price increases. The Mansion Tax is designed to generate revenue for the city while also discouraging the purchase of high-end properties by foreign investors.

| Property Price | Mansion Tax Rate |

|---|---|

| $1 million - $2 million | 1% |

| $2 million - $5 million | 1.25% |

| Over $5 million | 1.488% |

Strategies for Navigating New York City Real Estate Taxes

Given the complexity of the tax system, property owners and investors in New York City must employ strategic tax planning to minimize their tax liabilities while remaining compliant with the law. Here are some key strategies:

Exemptions and Abatements

As mentioned earlier, New York City offers a range of exemptions and abatements that can significantly reduce tax liabilities. Property owners should carefully review their eligibility for these programs, such as the Senior Citizen Rent and Property Tax Relief Program or the J-51 Abatement Program, and ensure they are taking advantage of any applicable benefits.

Tax Deductions and Credits

New York City residents and businesses can also benefit from various tax deductions and credits. For instance, homeowners can deduct mortgage interest and property taxes from their federal tax returns, while businesses can take advantage of incentives such as the Commercial Rent Tax Credit or the New York State Empire Zones Program, which offers tax credits and other benefits to businesses located in designated zones.

Estate Planning

For high-net-worth individuals and families, estate planning becomes crucial in managing real estate taxes. Strategies such as gifting property to heirs, establishing trusts, or utilizing life insurance policies can help minimize estate taxes and ensure the smooth transfer of real estate assets.

Tax-Efficient Transactions

When buying or selling real estate in New York City, it’s essential to consider the tax implications of the transaction. Buyers should factor in the Mansion Tax and transfer taxes when budgeting for a property purchase, while sellers should carefully plan their transaction timing to minimize capital gains taxes. Working with experienced real estate professionals and tax advisors can help navigate these complexities.

The Future of New York City Real Estate Taxes

As the real estate market in New York City continues to evolve, so too will the city’s tax policies. The city’s leaders are constantly evaluating the tax system to ensure it remains fair, sustainable, and effective in generating revenue. While specific changes are difficult to predict, some potential future developments include:

- Reassessment of property values to ensure fairness and accuracy.

- Adjustment of tax rates to align with market trends and city revenue needs.

- Expansion or revision of existing tax incentives and programs to encourage specific types of development or support certain demographics.

- Implementation of new taxes or levies to address emerging issues or revenue shortfalls.

Conclusion

Navigating the tax landscape of New York City’s real estate market is a complex but crucial task. By understanding the various taxes, exemptions, and strategies, property owners and investors can make informed decisions that minimize their tax liabilities and maximize their financial returns. As the city continues to thrive and evolve, its tax system will remain a key component in shaping the real estate market and the city’s future.

What is the average property tax rate in New York City?

+The average effective property tax rate in New York City is 0.83%, which is above the national average. This rate can vary based on the type of property and its location within the city.

Are there any tax incentives for renovating older buildings in New York City?

+Yes, the J-51 Abatement Program provides tax incentives for developers who renovate older buildings. This program aims to encourage the renovation and preservation of older structures, contributing to the city’s architectural heritage.

How does the Mansion Tax work in New York City?

+The Mansion Tax is a progressive tax on the purchase of residential properties priced at $1 million or more. The rate increases as the property price increases, with rates ranging from 1% to 1.488%. It is designed to generate revenue for the city and discourage foreign investment in high-end properties.