How Can Tax Identity Theft Occur

Tax identity theft is a serious and growing concern, impacting individuals and businesses alike. It occurs when a fraudster uses someone else's personal information, often obtained illegally, to file a tax return in their name and claim a refund. This can result in significant financial losses, legal complications, and a damaged credit reputation for the victim. In this comprehensive guide, we will delve into the various ways tax identity theft can occur, providing valuable insights to help you protect yourself and your business.

Understanding Tax Identity Theft

Tax identity theft is a form of financial fraud where thieves exploit personal and financial information to gain access to an individual’s tax records. By obtaining sensitive data such as Social Security numbers, dates of birth, and tax-related documents, criminals can impersonate their victims and file fraudulent tax returns. This deceptive practice allows them to claim refunds or credits that rightfully belong to the actual taxpayers.

The impact of tax identity theft can be devastating. Victims may face difficulties in obtaining their rightful tax refunds, encounter legal challenges, and experience long-lasting financial consequences. Moreover, repairing the damage caused by tax identity theft can be a lengthy and complex process, requiring extensive documentation and cooperation with tax authorities.

Methods of Tax Identity Theft

Tax identity thieves employ various sophisticated techniques to carry out their fraudulent activities. Understanding these methods is crucial in order to prevent falling victim to such scams. Here are some common ways tax identity theft can occur:

Phishing Scams

Phishing is a prevalent tactic used by cybercriminals to trick individuals into revealing their personal information. Fraudsters often pose as legitimate entities, such as tax authorities or financial institutions, and send deceptive emails, text messages, or create fake websites. These messages may appear urgent and official, requesting sensitive information like Social Security numbers or tax details. Unsuspecting individuals who fall for these scams unknowingly provide their personal data, enabling tax identity thieves to commit fraud.

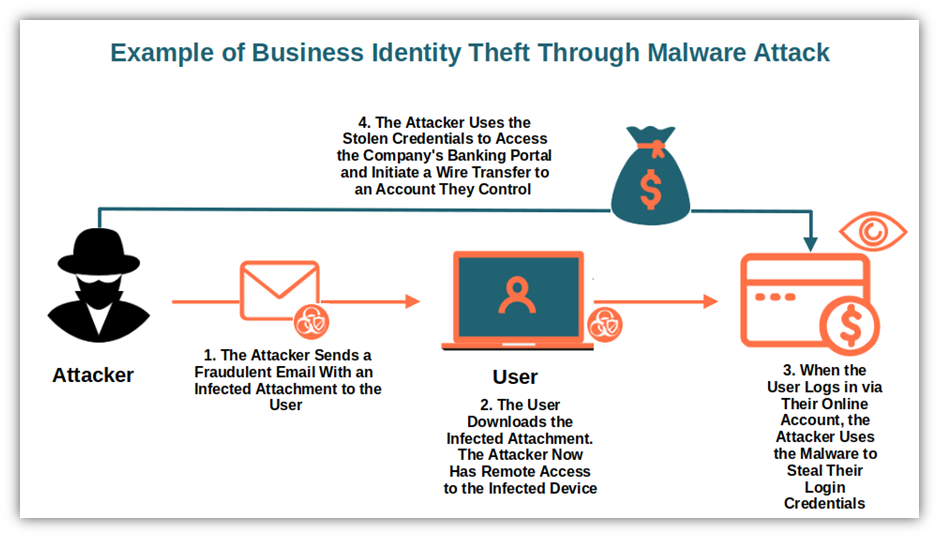

Data Breaches and Cybersecurity Attacks

In today’s digital age, data breaches and cybersecurity attacks have become increasingly common. Criminals target businesses, government agencies, and even individuals to gain access to sensitive information. By exploiting vulnerabilities in computer systems or using malicious software, hackers can steal large volumes of personal data, including tax-related information. This stolen data is then sold on the dark web or used by fraudsters to commit tax identity theft.

Identity Theft Through Public Records

Public records, such as birth certificates, marriage licenses, and property records, contain valuable personal information that can be exploited by identity thieves. These records are often publicly accessible, making it easier for criminals to gather key details about individuals. By combining information from various public sources, fraudsters can piece together a person’s identity and use it for tax-related scams.

Social Engineering and Impersonation

Social engineering is a manipulative technique used by criminals to gain trust and deceive individuals into providing sensitive information. Fraudsters may pose as tax professionals, government officials, or even family members, using persuasive tactics to convince victims to share their personal data. Through phone calls, emails, or in-person interactions, they exploit the trust of unsuspecting individuals, enabling them to commit tax identity theft.

Stolen W-2 and Tax Forms

Criminals often target businesses and payroll departments to gain access to W-2 forms and other tax-related documents. By stealing these forms, which contain valuable personal and financial information, they can file fraudulent tax returns in the names of employees. This type of tax identity theft can affect multiple individuals associated with a single organization, causing widespread financial harm.

Unsecured Data Disposal

Improper disposal of sensitive documents or electronic data can leave individuals vulnerable to tax identity theft. When individuals or businesses fail to securely destroy old tax records, bank statements, or other financial documents, they risk exposing their personal information to identity thieves. Fraudsters can rummage through trash bins or access unsecured digital storage devices to obtain valuable data.

Protecting Yourself and Your Business

Given the various methods used by tax identity thieves, it is essential to take proactive measures to safeguard your personal and business information. Here are some practical steps you can take to reduce the risk of falling victim to tax identity theft:

- Secure Your Personal Information: Be cautious when sharing personal data, especially online. Avoid clicking on suspicious links or providing sensitive information to unknown sources. Regularly review your credit reports and tax records for any signs of unauthorized activity.

- Use Strong Passwords and Two-Factor Authentication: Implement strong, unique passwords for all your online accounts, including tax-related portals. Enable two-factor authentication whenever possible to add an extra layer of security.

- Stay Informed and Educate Others: Stay updated on the latest tax scams and fraud techniques. Share this knowledge with your family, friends, and colleagues to create awareness and help prevent tax identity theft.

- Protect Your Business Data: As a business owner, ensure that your payroll and tax-related data is securely stored and accessed only by authorized individuals. Regularly train your employees on data security best practices to minimize the risk of internal data breaches.

- Utilize Secure File Sharing and Storage: When sharing sensitive tax documents or information, use secure file-sharing platforms or encrypted storage solutions. Avoid sending sensitive data via unencrypted email or storing it on unsecured devices.

- Monitor Your Tax Refunds: Keep track of your tax refunds and expect them within a reasonable timeframe. If you notice any delays or unexpected changes in your refund status, contact the tax authorities immediately to investigate.

The Future of Tax Identity Theft Prevention

As technology advances, so do the methods employed by tax identity thieves. However, there is hope on the horizon as tax authorities and technology companies are developing innovative solutions to combat this growing problem. Here are some potential future developments in the fight against tax identity theft:

- Enhanced Authentication Measures: Tax authorities and financial institutions are exploring more advanced authentication methods, such as biometric identification and behavioral analytics, to verify the identity of taxpayers.

- Artificial Intelligence and Machine Learning: These technologies can be leveraged to detect suspicious patterns and anomalies in tax returns, helping to identify potential fraud cases more efficiently.

- Blockchain Technology: Blockchain offers a secure and transparent way to store and verify sensitive data. Implementing blockchain solutions in tax systems could enhance data security and prevent unauthorized access.

- Real-Time Data Sharing and Analysis: By establishing secure data-sharing platforms, tax authorities and financial institutions can collaborate to identify and address tax identity theft in real-time, minimizing the impact on victims.

- Education and Awareness Campaigns: Continued efforts to educate individuals and businesses about tax identity theft and its prevention strategies will play a vital role in reducing the success of fraudsters.

Conclusion

Tax identity theft is a serious issue that requires constant vigilance and proactive measures. By understanding the various methods used by fraudsters and implementing robust security practices, individuals and businesses can significantly reduce the risk of falling victim to tax identity theft. Stay informed, protect your personal information, and contribute to a safer tax environment for everyone.

How can I report tax identity theft if I become a victim?

+If you suspect you have become a victim of tax identity theft, it is crucial to act promptly. Contact the tax authorities in your country or region and report the incident. They will guide you through the necessary steps to resolve the issue and protect your rights. Additionally, file a report with your local law enforcement agency and consider freezing your credit to prevent further damage.

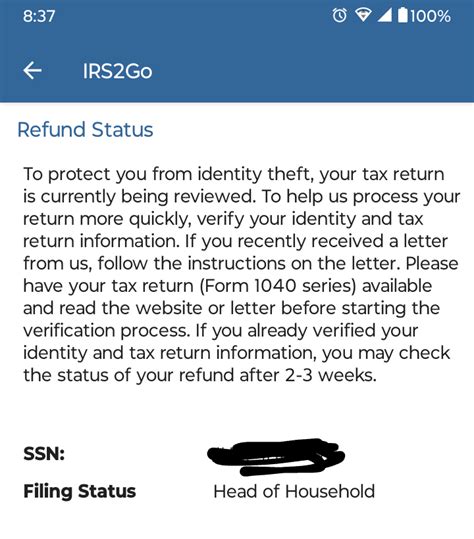

What are the signs that my tax return has been compromised?

+There are several signs that may indicate your tax return has been compromised. These include receiving notices from the tax authorities about errors or discrepancies in your return, being notified that your tax refund has been delayed or redirected, or discovering unauthorized changes in your tax records. It is essential to regularly monitor your tax accounts and stay vigilant for any unusual activities.

Can I protect my business from tax identity theft?

+Absolutely! As a business owner, you have a responsibility to protect your employees’ personal information and your business data. Implement robust security measures, train your employees on data protection, and regularly review your payroll and tax processes. By taking these steps, you can significantly reduce the risk of tax identity theft affecting your business.