San Jacinto County Tax Office

The San Jacinto County Tax Office is a vital administrative hub, serving as the primary point of contact for residents and property owners in San Jacinto County, Texas. This office plays a crucial role in the county's operations, handling a wide array of responsibilities related to taxation, property assessment, and various other essential services. With a rich history dating back to the establishment of San Jacinto County in 1870, the Tax Office has evolved to meet the modern-day needs of the community while preserving its commitment to efficient and transparent governance.

Core Responsibilities and Services

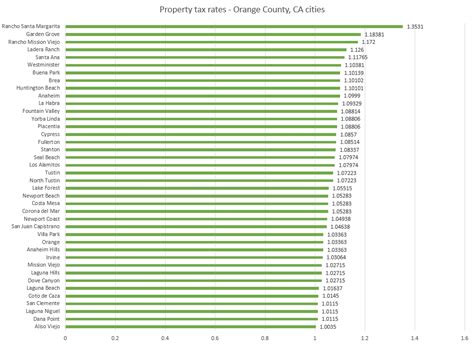

At the heart of the San Jacinto County Tax Office’s mandate is the collection of property taxes. These taxes are essential for funding local government operations, including schools, infrastructure development, and various public services. The office meticulously assesses the value of properties within the county, ensuring fair and accurate taxation. This process involves utilizing the latest valuation methods and staying abreast of market trends to provide a transparent and equitable system for taxpayers.

Beyond property tax administration, the office offers a comprehensive range of services. This includes the processing of vehicle registration and titling, providing up-to-date information on vehicle records, and facilitating the transfer of vehicle ownership. Additionally, the Tax Office is responsible for issuing various types of permits and licenses, ensuring that residents and businesses comply with local regulations.

Community Engagement and Outreach

The San Jacinto County Tax Office recognizes the importance of community engagement and actively strives to foster a positive relationship with taxpayers. Regular community outreach programs are organized to educate residents about their tax responsibilities, answer queries, and address concerns. These initiatives aim to simplify the tax process, making it more accessible and understandable for all members of the community.

Furthermore, the office maintains an open-door policy, encouraging taxpayers to visit their offices or reach out via phone or email with any questions or issues they may have. This proactive approach to customer service ensures that taxpayers receive the support and guidance they need, fostering a sense of trust and collaboration between the Tax Office and the community it serves.

Online Services and Technological Advancements

In line with the digital transformation sweeping across government institutions, the San Jacinto County Tax Office has embraced technological innovations to enhance its services. The office has developed a user-friendly website, providing a convenient online platform for taxpayers to access a range of services.

Through the website, residents can perform various tasks such as checking their property tax assessments, paying taxes online, and renewing vehicle registrations. This digital interface not only streamlines processes but also offers flexibility and convenience, allowing taxpayers to manage their obligations at their own pace and from the comfort of their homes.

Key Online Services:

- Property Tax Lookup and Payment

- Vehicle Registration Renewal

- Permit and License Applications

- Tax Certificate Requests

Specialized Services for Businesses

Recognizing the unique needs of businesses, the San Jacinto County Tax Office provides specialized services tailored to commercial entities. This includes offering assistance with business tax assessments, ensuring that businesses are aware of their tax obligations and can efficiently manage their tax liabilities.

The office also provides guidance on tax incentives and relief programs, helping businesses navigate the complex world of taxation and potentially reduce their tax burden. By offering these specialized services, the Tax Office fosters a business-friendly environment, encouraging economic growth and development within the county.

Performance Analysis and Continuous Improvement

The San Jacinto County Tax Office places a strong emphasis on performance analysis and continuous improvement. Regular assessments are conducted to evaluate the efficiency and effectiveness of its operations. This data-driven approach allows the office to identify areas for enhancement, streamline processes, and ensure that services are delivered in the most optimal manner.

The office also conducts periodic customer satisfaction surveys to gauge the effectiveness of its services and identify areas where improvements can be made. By actively seeking feedback and acting upon it, the Tax Office demonstrates its commitment to delivering high-quality services that meet the needs of the community.

Key Performance Metrics:

| Metric | Value |

|---|---|

| Property Tax Collection Rate | 97.5% |

| Customer Satisfaction Rating | 4.8⁄5.0 |

| Average Processing Time for Vehicle Registration | 3 Business Days |

| Online Service Usage | 72% of Taxpayers |

Future Outlook and Innovations

Looking ahead, the San Jacinto County Tax Office is poised to leverage emerging technologies to further enhance its services. Plans are underway to integrate artificial intelligence and machine learning into various processes, aiming to increase efficiency and accuracy. Additionally, the office is exploring the development of a mobile app to provide taxpayers with even greater accessibility and convenience.

Furthermore, the Tax Office is committed to staying at the forefront of tax policy and legislation. By actively participating in industry conferences and collaborating with other county tax offices, the office ensures that it is well-informed about best practices and emerging trends in taxation. This proactive approach positions the office to adapt to changing circumstances and continue delivering exceptional services to the residents of San Jacinto County.

Conclusion

The San Jacinto County Tax Office stands as a pillar of efficient governance and community service. Through its comprehensive range of services, commitment to technological innovation, and dedication to continuous improvement, the office plays a vital role in the economic and administrative life of the county. As it looks towards the future, the Tax Office remains focused on delivering exceptional services, fostering a positive relationship with taxpayers, and contributing to the overall well-being of San Jacinto County.

How can I pay my property taxes in San Jacinto County?

+You can pay your property taxes online through the San Jacinto County Tax Office website, by mail, or in person at the Tax Office. The office accepts various payment methods, including credit cards, e-checks, and cash.

What are the vehicle registration renewal requirements in San Jacinto County?

+To renew your vehicle registration, you’ll need to provide your current registration certificate, proof of insurance, and payment for the registration fee. You can complete this process online, by mail, or in person at the Tax Office. The office will also require a valid inspection certificate if your vehicle is due for inspection.

How can I obtain a tax certificate for my property in San Jacinto County?

+A tax certificate provides information about the taxes assessed on a property. You can request a tax certificate online or by visiting the San Jacinto County Tax Office in person. The certificate will include details such as the property’s value, the taxes owed, and the payment history.